LunaKate

There is no avoiding the pain of being wrong. It hurts to have a thesis explode in your face, but life provides valuable opportunities to learn from your missteps. A prime example would be the “Sell” rating that we assigned to Alerian MLP ETF (NYSEARCA:AMLP) in December 2021. While it is better to miss out on an opportunity than watch your hard-earned capital evaporate in front of your eyes, “Fear Of Missing Out” or “FOMO” is as painful as a broken heart.

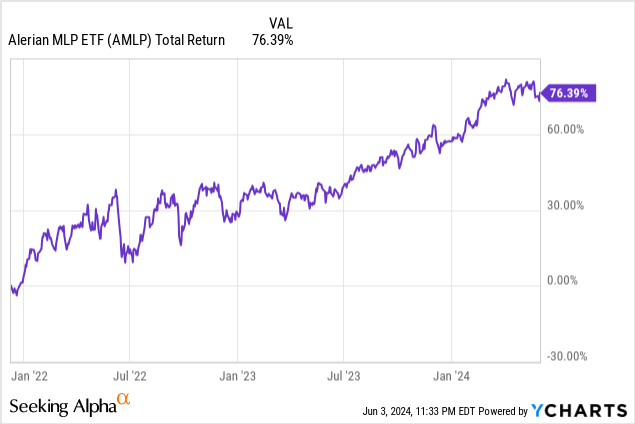

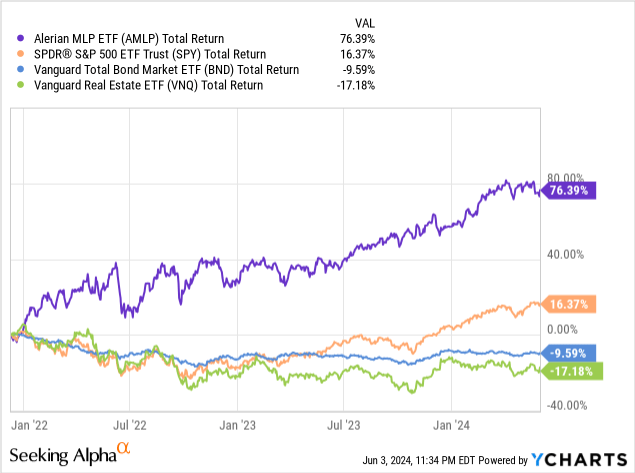

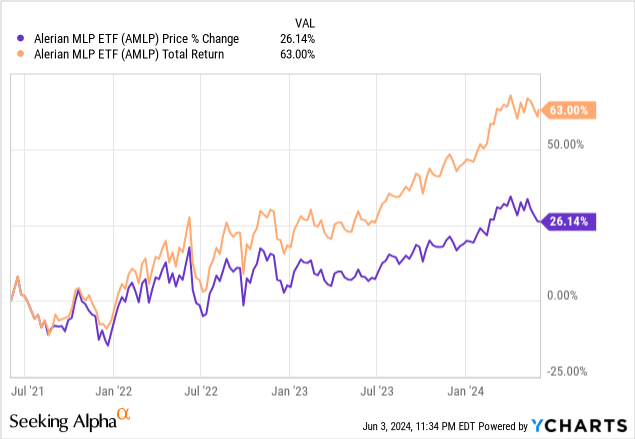

On December 10, 2021, we assigned a “Sell” rating to AMLP based on a variety of factors including long-term trends of oil prices and the post-pandemic rebound. Since, AMLP has returned over 76% including significant dividend appreciation.

Today, we will revisit AMLP and explore how factors including rampant inflation and geopolitical instability caused our thesis to unravel. We’ll explore the shortfalls of our thought process and explain why AMLP may continue to perform well.

Fund Overview

AMLP is an exchange-traded fund focused on master limited partnerships or MLPs. These are infrastructure and resource companies responsible for producing and transporting oil and natural gas. MLPs are complex investments which some investors might find unsuitable in isolation. For example, the distribution of K-1s is a reality that drives some investors away from the category entirely. MLPs are pass-through entities which pass through their earnings as distributions to members of the partnership.

AMLP Fact Card

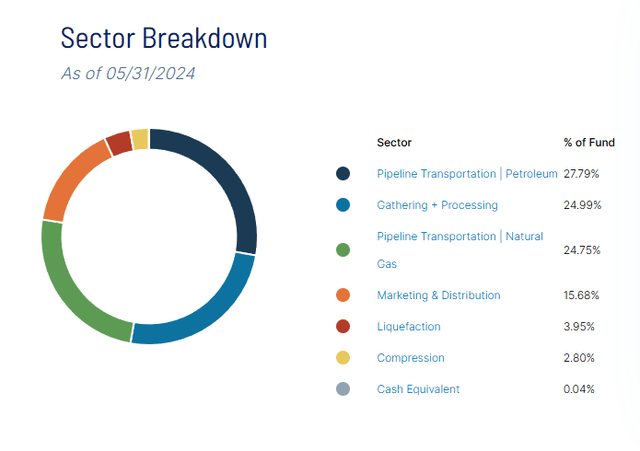

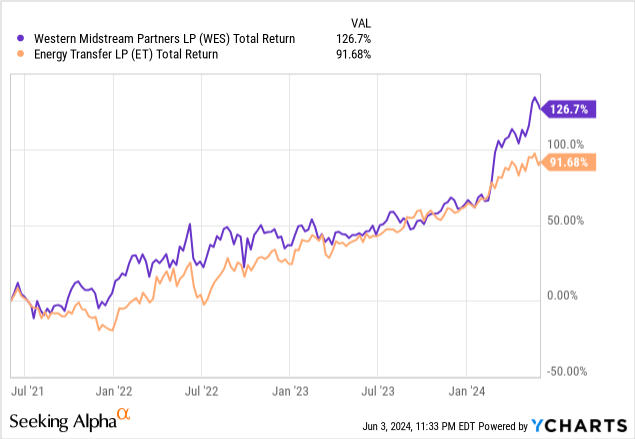

AMLP tracks the Alerian MLP Infrastructure Index (AMZI), a capitalization weighted index of midstream MLPs. The index is concentrated, comprised of just 14 total positions. Most of the portfolio is comprised of midstream MLPs, which transport oil and natural gas through pipelines. A minority of the portfolio is allocated to producers and other similar entities. The fund’s top two positions are Western Midstream Partners LP (WES) and Energy Transfer (ET), which account for over 25% of the portfolio when combined.

One of the most attractive parts of AMLP is that the ETF wrapper eliminates the distribution of K-1’s to investors. Instead, AMLP reports on a 1099-DIV simplifying tax season.

AMLP pays a generous dividend on a quarterly basis. The fund’s dividend is correlated to oil prices due to the commodity-based nature of MLPs. Over the past three years, AMLP’s dividend has appreciated due to a variety of factors causing oil prices to rise. As the underlying commodity appreciated, AMLP’s dividend rose at a compound annual growth rate of 7.8% over the past three years. For AMLP shareholders, this meant a generous yield that grew faster than inflation over that time period.

AMLP is relatively expensive for an index ETF, charging a management fee of 85 basis points. The fund is expensive relative to competitors including the Global X MLP ETF (MLPA) which charges 45 basis points.

Performance Review

Since our previous coverage, AMLP returned 71% outperforming other asset classes including equities, fixed income, and real estate. While other sectors underperformed due to rising interest rates and inflation, MLPs emerged as a clear winning amongst the turmoil of the past several years.

Typically, investors pursue AMLP for the dividend yield. While high in isolation, the yield is also tax efficient, capturing the tax benefits associated with investing in MLPs.

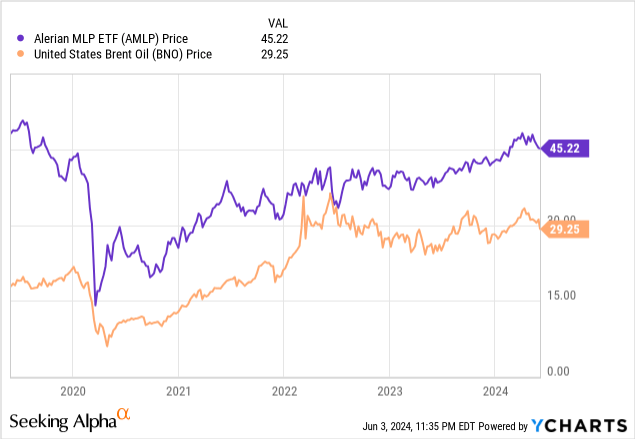

Performance over the past several years has marked a reversal of long-term trends around the MLP sector. Prior to the pandemic, MLPs were on a downward slide, with analysts questioning how a market recovery could materialize. A variety of factors had suppressed the price of oil over a long period, causing MLP performance to slide.

Many analysts didn’t foresee a reversal of these trends. Personally, I believed the pandemic recovery had been realized and AMLP was fully valued following a significant run-up from pandemic lows. At the time, I felt AMLP had met what could be the long term stabilizing price for commodities, including oil and natural gas.

I was wrong for two big reasons.

Reason #1: Geopolitical Instability Favored U.S. Oil Production

Our previous coverage around AMLP was published in December 2021. Two months later, Russia launched an invasion into Ukraine, perpetrating the most significant destabilizing event in decades. The ripple effects of the conflict have been profound, including sanctions, elevated sales of sophisticated weapons, and the formation of new strategic partnerships around the globe.

The energy industry has been profoundly impacted by the conflict. Prior to the invasion, Russian oil and gas became an increasingly significant component of the Western energy trade. Western Europe was becoming increasingly dependent on Russian natural gas for heating and electricity. For decades, the increasing trade was viewed favorably as a mending of ties between the East and West.

The invasion of Ukraine in February 2022 resulted in the unraveling of relations between Russia and the West. Beyond the pen and paper, the transforming landscape is best represented by the sabotage of the Nord Steam gas pipeline, which was constructed by Russia’s Gazprom and supplied a significant portion of Europe’s energy. Prior to its destruction, the pipelines supplied 110 billion cubic meters of natural gas to Germany.

While other nations have still been willing to trade with Russia, Europe’s reliance on Russian gas has declined considerably. According to research from Elcano, Russia previously accounted for 42% of European gas imports prior to the invasion. By the end of 2023, this number had fallen to 14%. Closing the door to Russian gas opens opportunity for competing nations around the world, including LNG from the United States.

For AMLP, the conflict resulted in a rare demand driver which supported rising commodity prices. In addition to geopolitical conflict, a secondary driver pushed AMLP’s performance over the past two years.

Reason #2: Inflation Was Extraordinary

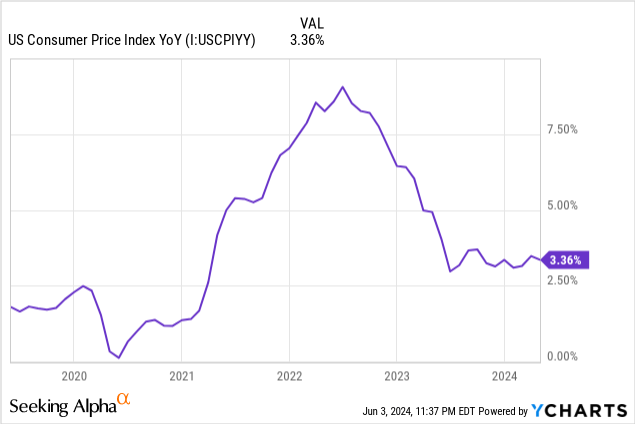

At the end of 2021, inflation began to accelerate. While the economy was still recovering from the pandemic, the Federal Reserve’s aggressive monetary policy pushed inflation higher and higher. As the recovery turned to mania, inflation turned rampant, with year over year CPI peaking above 8% in July 2022.

With a commodity-based business, inflation and rising energy prices act as a significant performance tailwind for MLPs and similar businesses. With inflation outweighing the impacts of rising interest rates, AMLP benefitted strongly from rising oil and gas prices.

Looking prior to 2022, inflation was thought to have peaked. With the pandemic largely over and the Federal Reserve taking the foot off the gas pedal, inflation was expected to decelerate. Instead, the economy accelerated and inflation remained over 6% for the duration of 2022. This was an extraordinary driver for MLP performance during this period, and AMLP’s holdings benefited accordingly.

Benefitting shareholders of AMLP, the fund’s dividend appreciated considerably over this time frame, even surpassing the rate of inflation. The appreciation of oil and gas prices served as a tailwind for MLP investors who capitalized on inflation.

Outlook

While the economy has cooled and geopolitical stability is inching towards a new normal, both issues remain critical to the performance of AMLP. The Russian Invasion of Ukraine continues to rage on, with both sides sustaining heavy human and economic casualties. While the fighting on the ground remains intense, international relations are changing. Importantly, Russia is strengthening relations with nations including China to secure the necessary economic support to survive.

The primary goals of these relations are also to reestablish economic and investment ties, including energy trade, which can help support a long-term disconnection from the West. Should Western European nations continue to turn away from Russia, the United States would continue to benefit as one of the world’s largest producers of oil and natural gas.

The long-term isolation of Russia could act as a benefit for domestic oil producers. Meanwhile, a normalization of relations would result in a supply increase that could negatively impact oil prices.

Inflation remains stubborn, causing the Federal Reserve to keep interest rates elevated. While the Federal Reserve continues to call for a stabilized 2% rate of inflation, CPI appears to be stuck north of 3%. This has resulted in no changes to interest rates over the course of six months.

Even still, inflation has normalized from a peak above 8% in 2022. With inflation returning to the 3% range, this presents a normalization which kills the tailwinds of 2022. This likely means slowing growth of oil and gas prices, independent of ongoing geopolitical instability. For AMLP, this means the best has likely come and gone, but healthy inflation means stability.

Conclusion

It’s impossible to predict the future. As investors, we do the best we can with the information available. Even still, sometimes circumstances change dramatically, shaking the foundation of a thesis. A big enough Earthquake can cause the entire building to collapse. For the thesis we build around AMLP in 2022, this meant outperforming expectations by a significant margin.

The unraveling of our thesis was caused by two key issues. First and foremost, the Russian Invasion of Ukraine destabilized the energy trade, causing prices to rise due to decreased supply. Over the course of two years, this meant increasing oil and gas prices and an open door for U.S. based market participants to fill a gap. Second, domestic inflation caused prices to rise across assets, benefitting commodity-based businesses like MLPs.

These two factors combined to produce extraordinary tailwinds for AMLP’s portfolio. With dividends and share prices appreciating, MLPs emerged as a clear winning over the past two years. AMLP is a solid ETF, giving investors access to a portfolio of MLPs without the headache of K-1 reporting. For those seeking exposure as the sector stabilized, AMLP is a viable option.

Credit: Source link