Bet_Noire

I am bullish on US equities — and I am very happy to having been so since late 2022, first as a function of valuation, then as a function of AI speculation. Over the months, I expect the S&P 500 (SP500) will move gradually higher, to about ~4,500, a ~18x FWD P/E by year end. However, following the recent debt ceiling agreement, which has been signed into law on June 3rd, I must admit that the next few weeks/ months may be somewhat volatile as the AI mania is fighting a trillion-dollar liquidity drain. In other words, the long/-mid-term price appreciation could be interrupted by a short term ~5% drop.

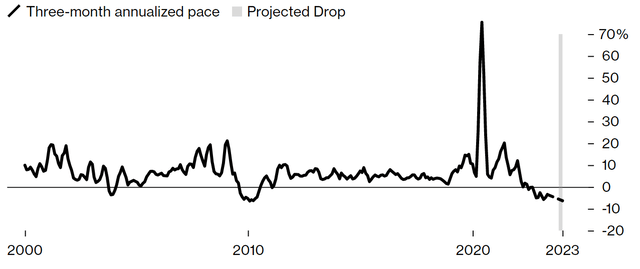

The argument is quite simple: With the U.S. Treasury having been restricted to sell additional debt, the government was drawing down the Treasury General Account (TGA), which can be considered liquidity accreditive on a macro level, as the TGA balance fell by approximately $400 billion from February to mid-April (notably, equity markets appreciated in value during that time).

Now, however, the U.S. government is allowed to sell new liabilities, and concerns are arising regarding potential financial strains as the Treasury office will rush to replenish its cash reserves by issuing debt (while simplified, one may think of TGA draw down as quantitative easing, and build up as quantitative tightening). According to some analysts (JPMorgan, Deutsche Bank, Citigroup), it is expected that the Treasury may sell between $750-1,000 billion worth of bills over the next three to six months in order to restore a healthy balance at the Treasury General Account.

According to J.P. Morgan estimates, the TGA build-up may reduce the aggregate US money supply by about $1.1 trillion.

JPMorgan research; Bloomberg data mapping

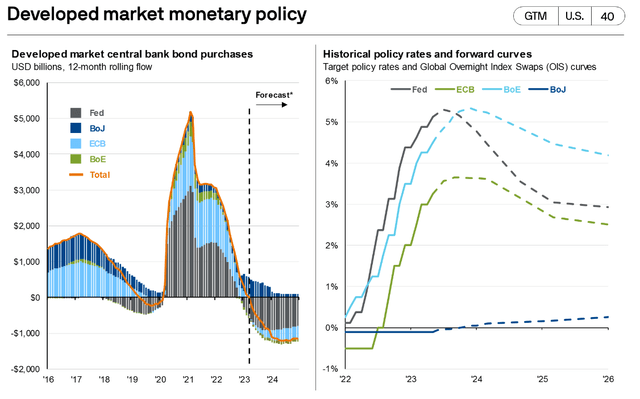

The event of the U.S. Treasury selling large amounts of debt is quite unique in recent history. Investors should consider that since the financial crisis, the Federal Reserve, and central banks across the western world, have bought more than 100% of the new debt issuance of governments. Since 2022, however, central banks have pushed quantitative tightening in an effort to wind down their balance sheets.

JPMorgan Research

And with the largest net-buyer of government debt out of the game, who will step in to fill the void?

Countries like China and Japan have traditionally been major purchasers of US Treasuries, given their large foreign exchange reserves. But with the BoJ fighting currency depreciation, and China being rejected by politics, it is unlikely that support can be found in the east. And in general, the YTD dollar weakness may cause foreign investors to be somewhat more cautious in buying US dollar denominated financial assets.

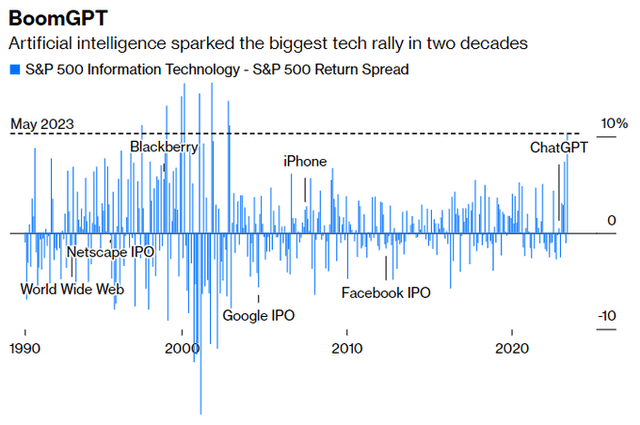

Meanwhile, BigTech — including names such as Nvidia (NVDA), Meta (META), Microsoft (MSFT), Apple (AAPL) and Google (GOOG) (GOOGL) — is soaking up capital on the backdrop of the AI speculation/ mania.

Bloomberg

To be fair, it is in my opinion unlikely that the AI rally will be starved of capital, because the decision to invest in Nvidia et al. is likely not (primarily) based on a rational capital allocation argument. Accordingly, I believe that the TGA-induced liquidity drain will likely pressure the stock prices of ‘value’ names such as Exxon Mobil (XOM) or AT&T (T), stocks who are currently not protected by any bullish glamour.

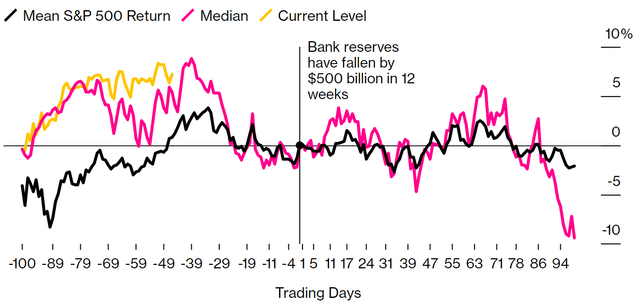

According to a research conclusion from Citigroup strategist Dirk Willer, the supply of new Treasuries will likely result in a ~5.5% drop for the S&P 500 over a two-months period. To arrive at this estimate, Citi modelled historical periods of an approximate $500 billion drop in money supply (taking bank reserves as a proxy) versus the S&P 500’s performance over the following twelve weeks.

Citigroup Research

Interestingly, JPMorgan Chase & Co. strategist Nikolaos Panigirtzoglou, modelled a similar estimate, seeing a 5% decline in the S&P 500 as likely.

Concluding, the U.S. Treasury is expected to sell about $750-1,000 billion in the next three to six months (with the first sale scheduled for Monday 5th June), which could prompt a massive liquidity shock for markets in the short term — interrupting the long-/mid-term price appreciation of the equities market.

That said, I continue to be bullish on the S&P 500 through 2023. And I do not advise to sell stock based on the information and hypotheses presented in this article. However, if the S&P 500 indeed sells of by ~5% within the next few weeks, it might be very valuable to have the correct perspective on what is happening — likely only a break, not a reversal.

Credit: Source link