JHVEPhoto/iStock Editorial via Getty Images

Investment Thesis

With recent Q1 ’23 results out, and a really good performance in the last year in terms of stock appreciation, I argue that the growth Thomson Reuters (NYSE:TRI) is projecting is not good enough to warrant such a high PE multiple and I believe that risk-to-reward ratio is not very good right now. I would wait for a pullback, which may come during the foreseen economic recession in the next 6-12 months. The company is a bit too expensive now.

Briefly on Q1 Results

The revenue beat expectations slightly and was up 4.2% y-o-y. The big three segments got 7% organic growth. The company also maintained its full-year ’23 guidance of around 5.5% to 6% revenue growth, and adjusted EBITDA margins of around 38%.

To be honest, I am not the biggest fan of non-GAAP measures or non-IFRS measures, but that’s how the company reports its results. EBITDA is already a non-IFRS measure, so adjusted EBITDA is even more so. However, if we take these as they are, the results were fine, nothing outstanding, with the positive that the company maintained its full-year guidance also. These results do not reflect a company that should be trading at around 43x FY22 earnings, however.

Potential Growth Catalyst – AI

From going through the latest transcript, the company is very excited about AI. Another company that is jumping on the AI train hopes that it will bring better efficiency in the long run. The last 4 acquisitions that the company made were purely AI-driven plays. The Thought Trace acquisition of last spring helped with bringing AI implementation into their legal document intelligence offerings.

SurePrep acquisition helps with document ingestion capabilities and provides workflow automation to customers and tax businesses.

The company has been working on large language models for a few years now and is very excited to bring generative AI to the forefront and will incorporate it in the 2nd half of ’23.

I’m sure that AI will help a lot with tax and law workflows. The clients will be able to search easily for the right laws that apply to their situation more naturally. The AI tool will have all of the knowledge of rules and regulations, some that may be more obscure that are not as easy to explain or understand. It will be able to draft proposals according to these regulations within minutes and that is fantastic, I’m excited about generative AI also, but I’m not sure how much of a help it will be in the future as it is still quite early in the evolution. I know my efficiency improved once I was able to start using Bing search more naturally than looking up keywords and clicking every link on Google that I think would help me. With AI’s integration within Bing, I can just ask it a question and it will have all the citations ready for me to look into further.

However, I do feel like, for now, the management is slightly too excited about the potential of this technology. I will be approaching it more skeptically.

Biggest Risk in the Short Run – Looming Recession

The main reason I believe that the company is a little bit overpriced right now is the fact that we haven’t seen much from the supposed economic downturn yet. We are in May already and I’ve been mentioning the looming recession fears since January. It’s bound to happen sooner rather than later, and the effect will be felt by the company in terms of the demand for the company’s services. The management, as I mentioned above, reiterated their full-year guidance of 5.5% – 6% revenue growth, which to me doesn’t seem to have an upcoming mild recession factored in as the company, over the last 5 years, has averaged 5% annual growth. Well, I don’t blame them for not factoring in the supposed recession, it may not even come this year.

On the other hand, the news segment of the company saw basically flat growth over the year citing a “lighter seasonal events calendar”. If we do get into a recession, I wouldn’t be surprised if the segment sees some meaningful increases in revenue as there will be a lot more stuff to report on.

Financials

All the graphs I will be showing will be as of FY22 because I prefer to look at the full picture of the company rather than quarterly, which can fluctuate. I will mention some quarterly figures if I believe they are necessary for more color on the company.

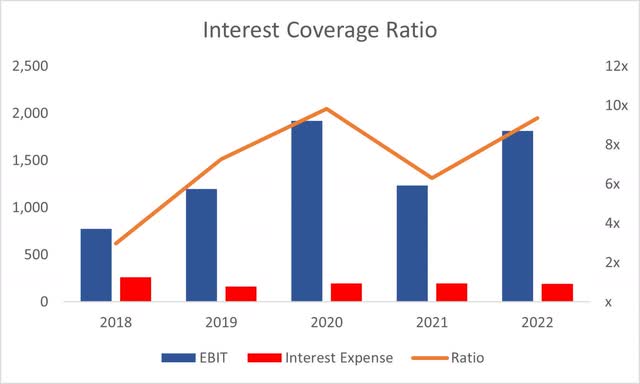

The company, at the end of ’22, had $988m in cash and $204m in short-term investments. This position has improved quite considerably to $1.7B in cash and $84m in ST investments at the end of Q1 ’23. The long-term debt remained somewhat unchanged at around $3.1B, which is not a bad position, considering the interest coverage ratio was around 10 at the end of FY22.

Coverage Ratio (Own Calculations)

The debt figure is not alarming because EBIT can cover annual interest expenses 10 times over.

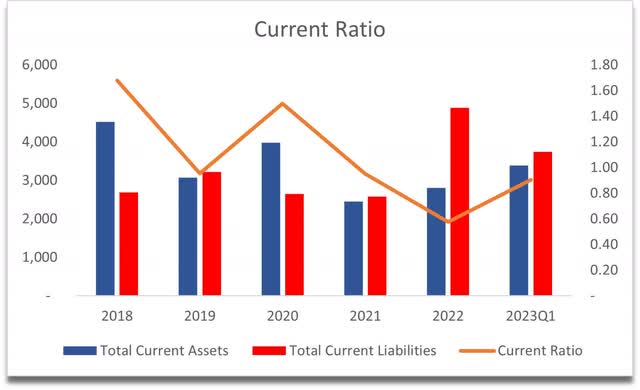

The company’s current ratio was quite poor at the end of ’22. It was well below the minimum of 1 and well below my acceptable ratio of at least 1.5 to 2.0. As of Q1 ’23, it has improved quite a bit, however, still under that minimum threshold of 1.0 but seeing that the company manages to operate without trouble, I would expect this ratio not to be a problem, unless we see something really dramatic happening in the short run, which could present some liquidity issues if push comes to shove.

Current Ratio (Own Calculations)

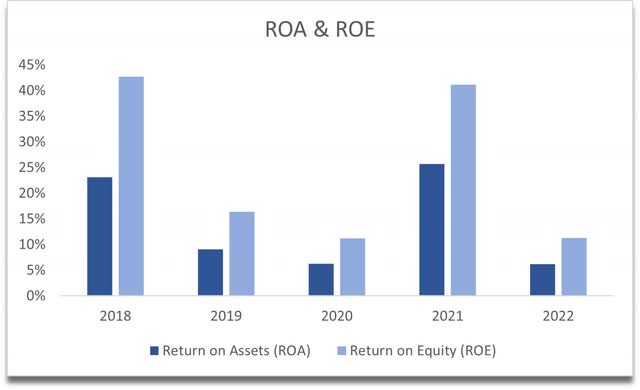

In terms of the company’s efficiency and profitability, ROA and ROE are acceptable, however, these have been much higher in the past, especially in 2018 and 2021, which seem to be the outliers. If the company can keep these levels or increase them again, it would be great.

ROA and ROE (Own Calculations)

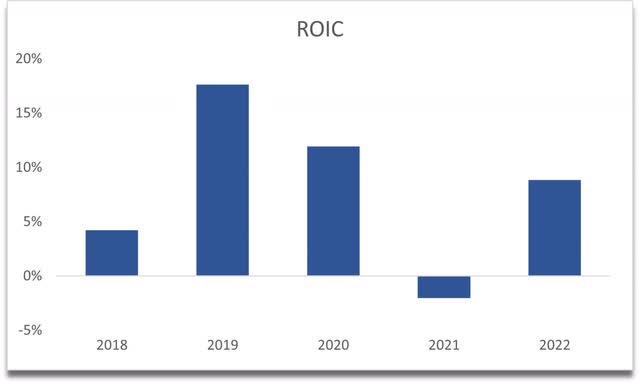

The management mentioned that their return on invested capital has been hovering at around their weighted average cost of capital for a while and that right now it is much higher at around 15% as of Q1 ’23. According to my calculations, the company’s WACC is around 6.2%, so the company managed to more than double its return in recent times. I’m a little skeptical of the ROIC calculation that the management did as I believe that it’s slightly inflated by using non-IFRS metrics. According to my calculations, the ROIC is around 9% as of FY22, which is still a decent return. This suggests the company has a decent moat and a competitive advantage. It did enjoy higher returns a couple of years back, but if AI strategies and other initiatives work out, I could see this going back up also.

ROIC (Own Calculations)

Overall, the company seems to have a decent balance sheet that will no doubt be able to weather the supposed mild economic recession. I’d like to see the current ratio finally cross over 1 in the future, so the company is even stronger in terms of liquidity, but the debt that the company has is not an issue either as I mentioned before. The big question is what am I willing to pay for this balance sheet and the potential growth of the company? Let’s have a look.

Valuation

I could go crazy and assign a huge revenue growth because of the potential of AI and the exuberance surrounding it, however, I’ll be more conservative and say that yes, AI is a big enhancement of operations in the future, but it is very hard to put a number on it for now as not much has been implemented. We haven’t really seen how AI is going to affect the company’s margins. I do know that it will improve efficiency and profitability in the future. I took that into account when I set up my model.

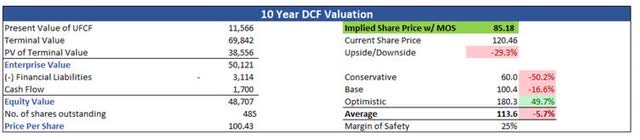

For the base case, I went with the company’s historical revenue growth of around 5% per year. For the optimistic case, I went with around 200bps higher for the decade, and on the conservative case, vice versa.

I can’t assign a much higher revenue growth as there was no indication of how effective the AI tech will be and because of my negative sentiment about the upcoming mild economic recession.

In terms of margins, I will acknowledge that AI will improve profitability and efficiency, which will expand gross and operating margins by around 200bps by ’32. Nothing too crazy as it’s better to be safe than sorry. The margins are already quite decent, so I didn’t want to be too optimistic here.

On top of these inputs, I will add a 25% margin of safety, which is the lowest I assign to any company, and it only increases if the company’s balance sheet is not great. In this case, the books are fine in my opinion.

With that said, the company’s intrinsic value with the above inputs is $85.18 per share, implying a 29% downside from the current valuation.

Intrinsic Value (Own Calculations)

Closing Comments

The risk/reward ratio is not very appealing to me at these levels. The company is just a bit too expensive for my liking and I would look for it to come back down, which may happen if we see a recession coming. Even if the company was trading at my intrinsic value, the company’s PE ratio is still at around 30x FY22 earnings. The last time the company was at these levels was around June ’22, so it can come back down to these levels in the future, especially if the volatility persists.

I’m setting up price alerts at $100, $90, and $80 a share so I won’t forget to look into it if it does come closer to my risk/reward ratio. Right now, there is just too much risk on the table.

Credit: Source link