Trevor Williams

Introduction

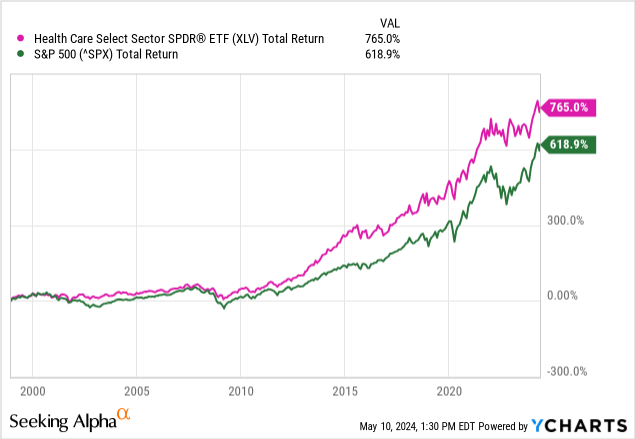

Recently, I published an article where I briefly discussed the healthcare sector and its driving investment theses. After that, I’ve felt myself wanting to dive deeper into healthcare specifically. This has led me to the SPDR Healthcare Sector ETF (NYSEARCA:XLV), which holds the healthcare components of the S&P 500.

This sector covers an estimated 12% of the S&P 500 components and has done very well against the wider index since inception.

Fund Overview

The SPDR Healthcare Sector ETF carries an expense ratio of 0.09%, one of the lowest in the market. This is one of the things XLV outshines its competitors that cover the same sector on.

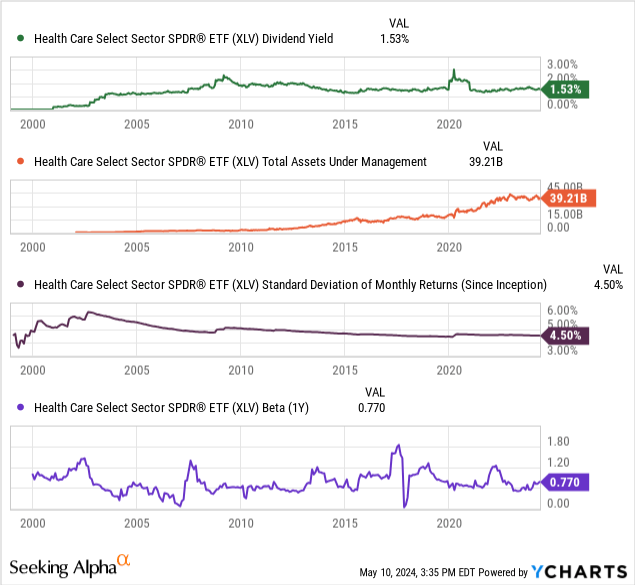

Below are the dividend yield, AUM, volatility, and beta histories for XLV.

The fund carries a market average dividend yield, but is less volatile overall according to both the fund’s 1Y beta and its standard deviation. This is a good sign for investors wanting a more stable fund that should fall less during market downturns (although it may rise less in market uptrends as well).

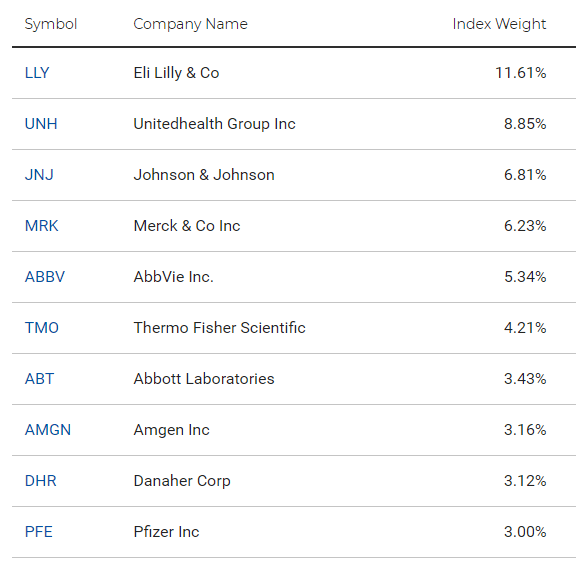

XLV has sixty-four holdings, with its top ten comprising over 55% of the fund’s weight. Its top ten, as of the time of writing, looks like this:

Figure 1 (SPDR)

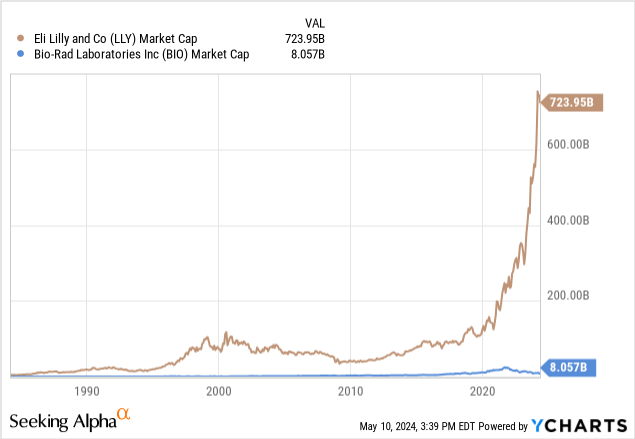

The reason for having such heavy weights at the top is the gap between the size of the largest healthcare firms in the index being massive. For example, the largest holding is Eli Lilly and Company (LLY) and the smallest holding is Bio-Rad Laboratories (BIO). There is a $725B gap in their market caps. The median market cap for the fund is $42.16B.

We Will Always Need Healthcare

In Economics, there is a concept called “elastic demand” or “demand elasticity.” This is a measure of how sensitive demand for a good or service is to outside factors. Luxury cars have incredibly elastic demand because a poor economy tanks their sales, for example, stretching its demand far outside the norm. This kind of issue translates to volatility in the firms that sell goods with high demand elasticity.

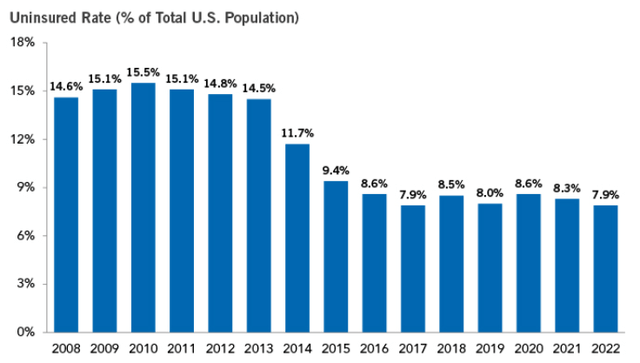

Healthcare, by contrast, has very inelastic demand. Regardless of many outside variables, demand for healthcare products and services remains very strong. The health insurance system is designed to make payments non-optional and regular, further cementing the inelasticity of its demand. It’s not something most consumers can just drop when money is tight. The amount of Americans who are uninsured has been dropping in the last decade, staying now at a consistent rate of 92% insured.

Figure 2 (Peterson Foundation)

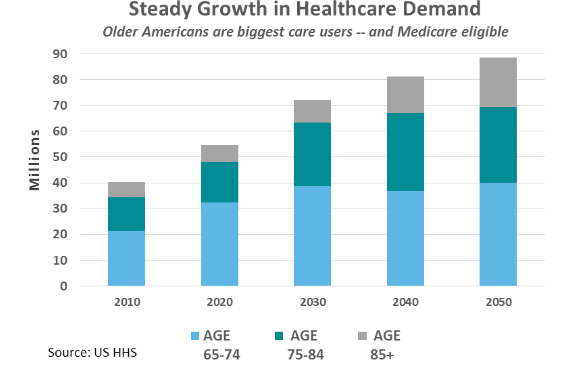

In the last few years, we’ve seen increases in demands for healthcare, particularly among the older generations. This checks out, as most people require more medical care the older they get. Projections from the US Department of Health and Human Services estimates that our medical spending will nearly double by 2050.

Figure 3 (US HHS)

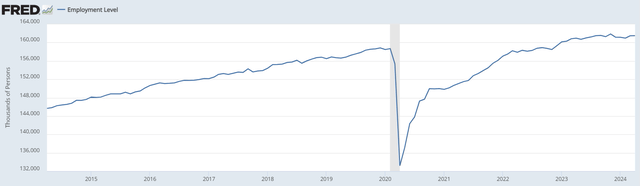

Bar the pandemic layoffs (which were a black swan that we have since recovered from in this aspect), employment has been on the rise and will likely continue doing so.

Figure 4 (FRED)

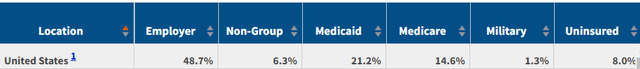

Employment is one of the driving forces behind folks becoming insured, with almost half of Americans getting their insurance through their employer.

Note: Dependents are counted depending on where the policyholder obtains their insurance.

Figure 5 (KFF)

Valuation

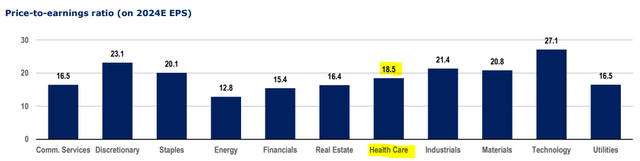

The healthcare sector carries a lower average price-to-earnings ratio than the S&P 500 itself, which is sitting at 20.

Figure 6 (AltaVista Research)

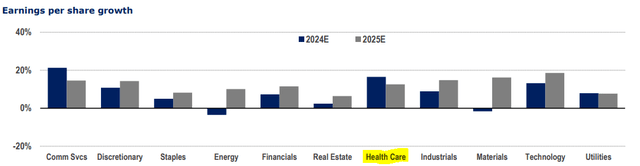

It also scores up well against the other sectors more generally, with only predictably lower-growth businesses like those in the energy or financial sectors being cheaper in a PE sense. Despite this, healthcare has one of the highest earnings-per-share growth among the other sectors.

Figure 7 (AltaVista Research)

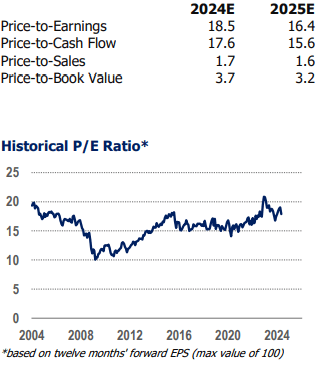

Expectations and estimates for 2025 put the PE even lower, with a reduction in price-to-cash flow and price-to-sales, and no change to price-to-book value. Historically, we’re a bit above the ten-year average.

Figure 8 (AltaVista Research)

Recent Underperformance

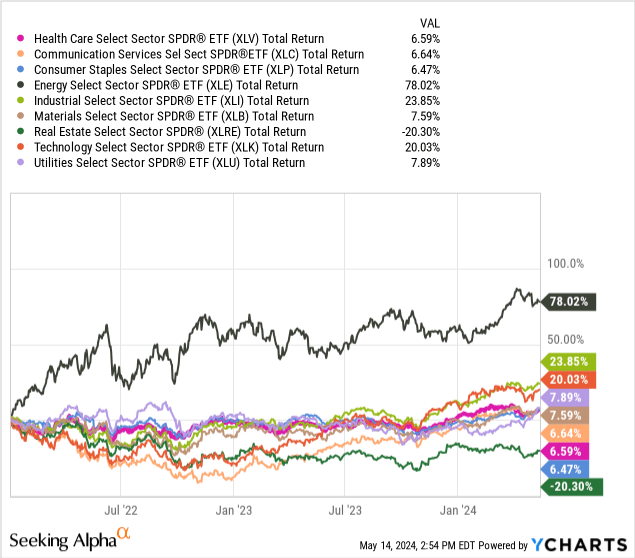

Now might be a perfect time to build a position in the healthcare sector via XLV. Healthcare has underperformed other sectors in recent history, leaving it behind with room to catch up.

Aside from general market trends, there are a few other major issues to consider that have led to recent underperformance.

- The Inflation Reduction Act of 2022 aims to reduce Medicare spending on prescription drugs, reducing profits for many of the top holdings in XLV, which are drug manufacturers

- Pharma companies are approaching a “patent cliff” with many big-name patents expiring between now and 2030 that may cause a loss of up to $180B in sales across the largest pharma firms

These two issues are counterpoints to my bullish thesis that could further harm the sector, but I believe that these have already been priced in. We’ve seen a lagging in healthcare behind many other sectors, which is likely due to these macro changes.

Since the beginning of 2022, sector returns ranged from (20.30)% to 78.02%. Healthcare performed around the same as other sectors like communications, consumer staples, materials, and utilities.

Catching up to the performance of the broader S&P 500 is inevitable, as these sectors will need to expand to catch up with the expanding PE of the tech, industrials, and energy sectors. See Figure 7 from the last section to see how their earnings compare with these sectors.

Conclusion

The SPDR Healthcare Sector ETF is ripe for buying at the moment due to several factors, including inelastic demand for its products and services; stunted valuation, and recent underperformance compared to other sectors. There is a lot of room for growth in this sector as the population expands, health insurance coverage rises, and companies work toward refining their profit margins.

There are some risks still present in the sector, such as the impending “patent cliff” that could cause a major loss in sales of name-brand drugs as they go generic, as well as shifting Medicare and Medicaid rules around prescription pricing.

I am giving XLV a “buy” rating based on these factors and believe that it could serve as a sector bet in an equity portfolio. For aggressive investors, I recommend no more than 15% of an equity portfolio be allocated to this fund. Conservative investors should keep sector exposure like XLV to 5% or less.

Thanks for reading.

Credit: Source link