We Are/DigitalVision via Getty Images

Introduction

As a younger investor who wasn’t in the market during the Dot Com Bubble or the GFC, I’ve only lived through markets dominated by the technology sector and a world dominated by the technology these companies have produced.

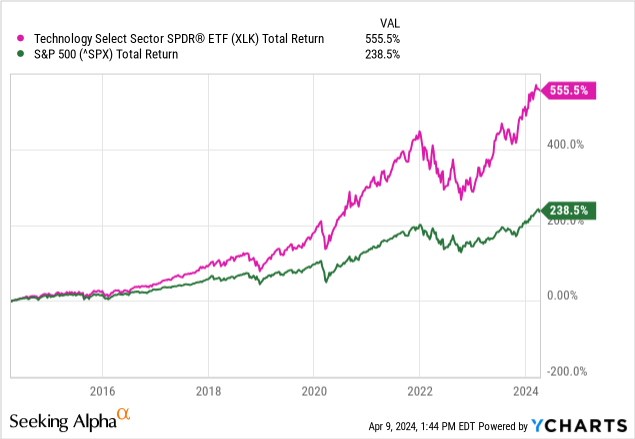

Look no further than the last ten years of the Technology Select Sector SPDR ETF (NYSEARCA:XLK) for visual evidence of this.

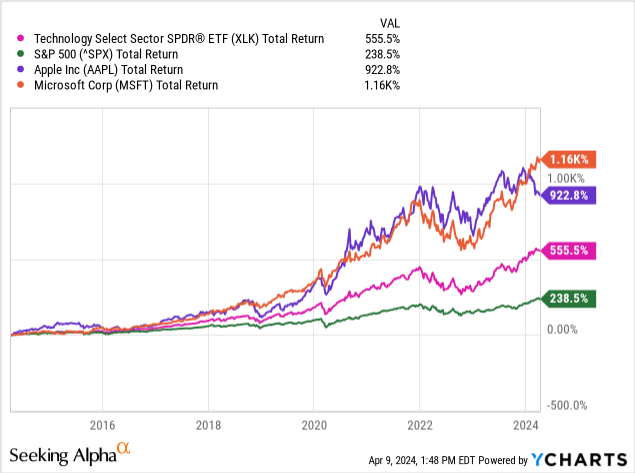

The largest constituents today, the two largest public companies in the US, Apple (AAPL) and Microsoft (MSFT), have been public favorites for some time as well, even outperforming XLK over the last ten years.

With a fund this red-hot, and big-name leaders pushing it further, why would investors look elsewhere?

A Massive Spread Has Emerged

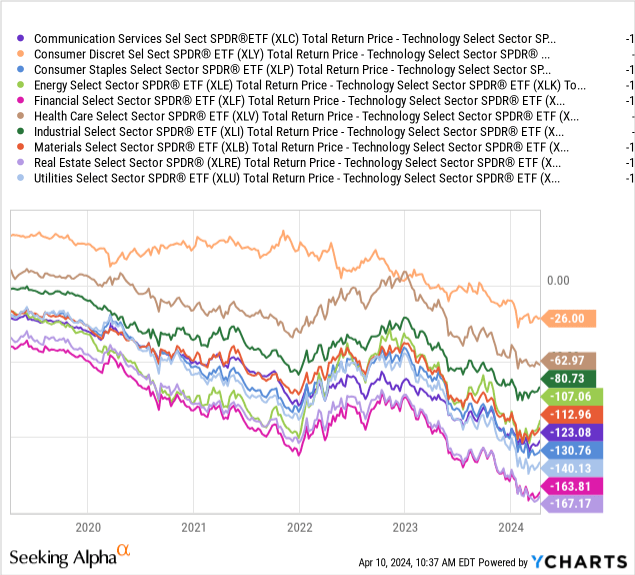

When we look at the spread in returns between the tech sector and other sectors over the last five years, we can see that the spreads range from 26 points to 167 points.

This has left a lot of room for these sectors to revert back to the mean if a rotation were to occur. The sectors most ripe for this are the worst underperformers, like real estate, financials, and utilities.

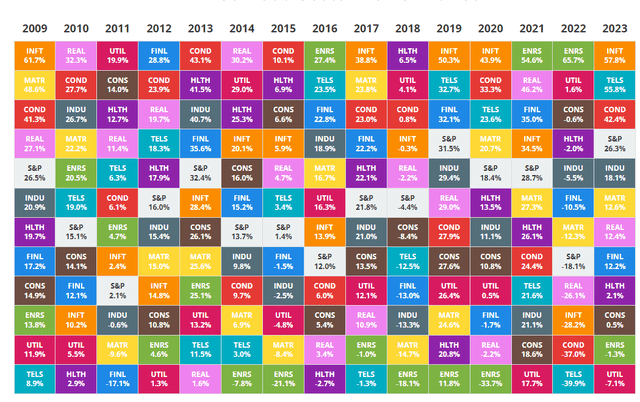

These sectors have not always underperformed, as shown in this comparison chart of annual returns.

Figure 1 (Novel Investor)

Overextended Valuation

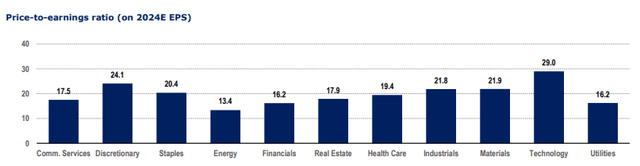

There is also a dramatic spread in P/E ratios, although these have far more staying power because of differences in growth expectations, so we may not expect these to change without major disruptions to a sector’s earnings.

Figure 2 (AltaVista Research)

What it does demonstrate to us is the risk of owning these sectors should the “valuation reaper” come to pop the bubble. In the event of a crash, the lower P/E sectors will likely be more resilient and weather the downturn better.

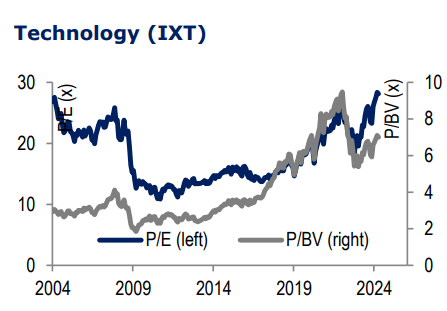

But does tech justify its crazy high P/E of 29? Recently, we’ve seen a re-emergence of the P/E ratio rising above and causing another spread over the price-to-book value ratio. Over the past few years, since 2019, we have seen an overtaking of the spread. The Stagflation episode and 2022 market downturn has led to a re-emergence of the P/E ratio above the P/BV.

Figure 3 (AltaVista Research)

The PE of this sector hasn’t been this high since 2004, and has historically not gone above this level. This may be a warning to investors that tech is overextended and overvalued at its current levels.

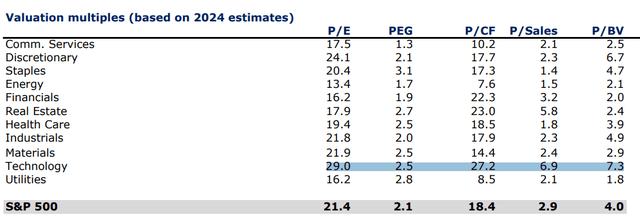

It carries the highest valuation metrics across the board, in P/E, PEG, P/CF, P/S, and P/BV.

Figure 4 (AltaVista Research)

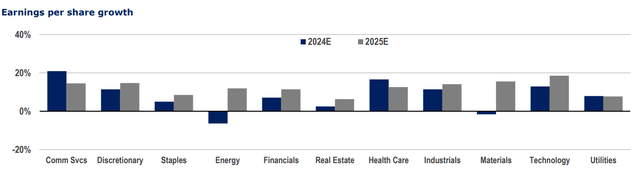

Despite this, consensus estimates show their EPS growth as being on par or below other sectors like healthcare and communications services.

Figure 5 (AltaVista Research)

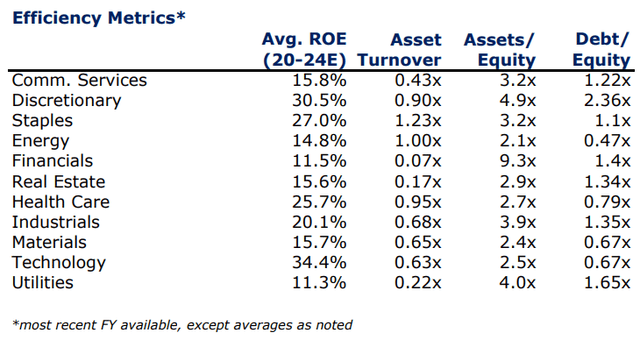

That being said, tech has justified this by having the largest average ROE for the past few years. These companies are highly efficient.

Figure 6 (AltaVista Research)

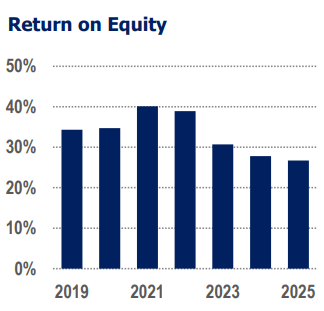

But that ROE is falling, and has been in decline since 2021. Estimate consensus is that over the rest of this year and through 2025, the tech sector is expected to continue this trend.

Figure 7 (AltaVista Research)

Concentration Risk

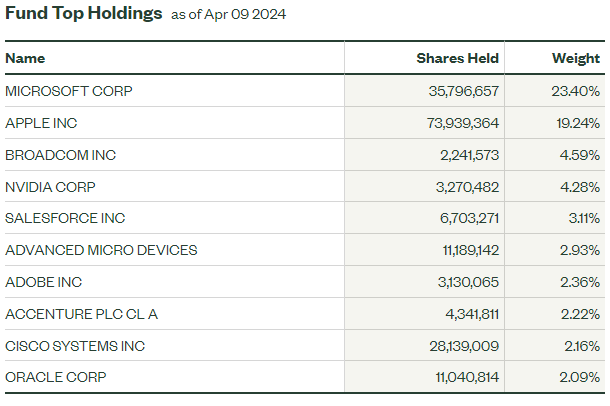

The most damning part for XLK itself is its composition. Because it focuses on the technology sector as defined by GICS, its holdings do not look like a “diversified ETF” despite it holding 65 stocks, its top two comprise a near 43% of the index.

Figure 7 (SPDR)

This is a major risk, as it means that the index’s direction can be very easily steered by idiosyncratic changes in Apple and Microsoft. This kind of concentration risk is typically not welcome by ETF buyers, especially ones interested in owning an entire sector.

Legal Risk

Since Apple v Pepper (2018) where the supreme court held that Apple was liable for the behavior of in-house apps (applications hosted on the Apple App Store) and could be trust-busted based on the anti-competitive pricing of said apps, there has been a legal precedent set around anti-trust cases being brought against modern tech companies for their online practices.

This new attention is not welcome for the tech sector, and could cause major disruptions in the practices that have secured the growth rates responsible for its overextended valuation.

In short: some of the growth we are expecting from Apple, Microsoft, et al. may have resulted from anti-competitive practices that are now being cracked down on.

In November last year, Google was required to fork up $26.3B in fines to maintain their search and advertising monopoly, which is still in jeopardy for future trust-busting.

Around the same time, Amazon was also targeted by the government for its use of anti-discounting measures meant to stop sellers from undercutting Amazon Basics products, forcing sellers to pay for Amazon-owned storage solutions for their goods, and more.

On March 21st, 2024, an anti-trust complaint was lodged against Apple for their mistreatment of the Android platform’s cross-compatibility to iOS. This included artificially limiting the compatibility of Android and iOS users when sending messages, files, etc. The complaint starts with an anecdote about the anti-competitive culture at Apple that has persisted since the Steve Job days.

In 2010, a top Apple executive emailed Apple’s then-CEO about an ad for the new Kindle e-reader. The ad began with a woman who was using her iPhone to buy and read books on the Kindle app. She then switches to an Android smartphone and continues to read her books using the same Kindle app. The executive wrote to Jobs: one “message that can’t be missed is that it is easy to switch from iPhone to Android. Not fun to watch.” Jobs was clear in his response: Apple would “force” developers to use its payment system to lock in both developers and users on its platform. Over many years, Apple has repeatedly responded to competitive threats like this one by making it harder or more expensive for its users and developers to leave than by making it more attractive for them to stay.

There is more damning evidence of anti-competitive sales culture at Apple, as the complaint continues to allege.

Apple’s conduct also stifles new paradigms that threaten Apple’s smartphone dominance, including the cloud, which could make it easier for users to enjoy high-end functionality on a lower priced smartphone—or make users device-agnostic altogether. As one Apple manager recently observed, “Imagine buying a [expletive] Android for 25 bux at a garage sale and it works fine . . . . And you have a solid cloud computing device. Imagine how many cases like that there are.” Simply put, Apple feared the disintermediation of its iPhone platform and undertook a course of conduct that locked in users and developers while protecting its profits.

The risk of having the App Store de-coupled from iOS is a serious risk for Apple’s profit margins, which have relied on its dominance in the smartphone market. This serves as a serious risk to investors in XLK who are primarily buying a fund that is 20% Apple stock.

Conclusion

The tech sector has become less attractive as it has hit all-time highs in both price and P/E, over-extending its valuation even in the face of legal troubles. The Technology Sector SPDR ETF (XLK) carries significant concentration risk in its top two names, which comprise over 40% of the fund’s NAV. On top of that, it also carries legal risk of the government targeting these firms for monopolistic practices that could result in lowered growth moving forward, something that is a major threat to sectors with higher-than-average valuations.

For these reasons, I am issuing a “hold” rating on the tech sector. If valuations fall back to a historical average and the legal troubles of trust-busting are thwarted, I would consider taking a position in the tech sector again. Until then, I am more interesting in those sectors that have been beaten down in this last bull run like real estate, financials, and utilities. They hold promise as contrarian bets in a world that has been long dominated by the tech sector.

Thanks for reading.

Credit: Source link