SlobodanMiljevic

Investment Summary

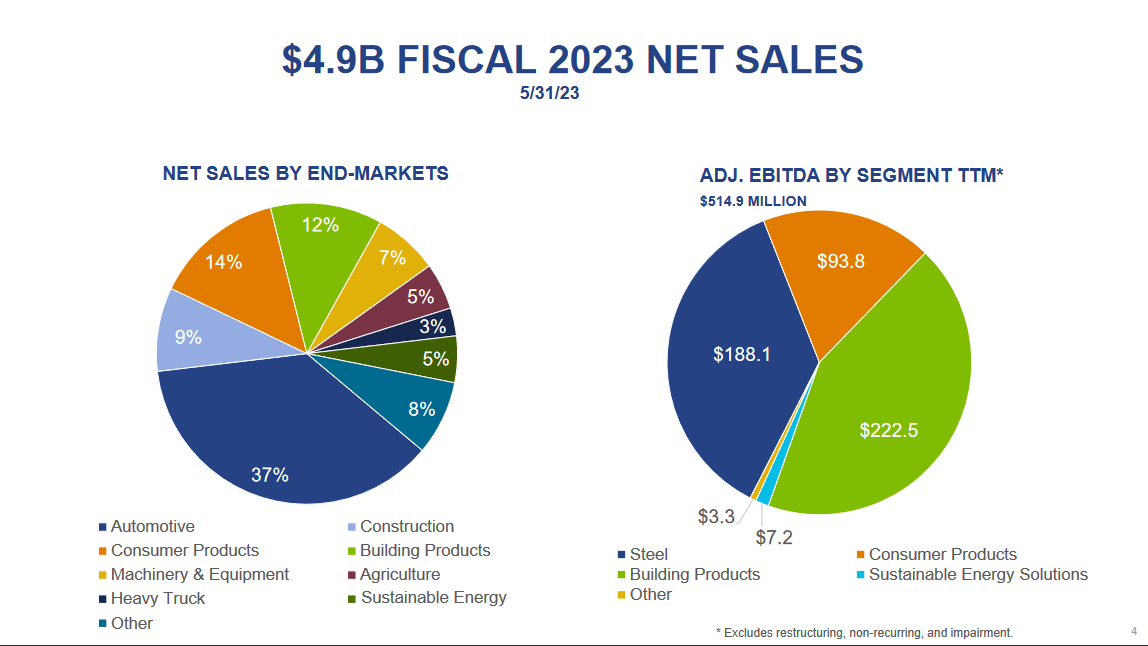

Almost a month ago Worthington Industries Inc (NYSE:WOR) released its Q4 2023 results that showed another strong quarter from the company. Net earnings YoY were up significantly, reaching $129 million in the quarter, and a EPS of $2.61. Saying that WOR is just a steel play might be doing it a disservice though, they do generate revenues from other sources too. A bit over half of the adjusted EBITDA came from whilst other noticeable sources were consumer products and building products.

A diversified revenue mix and management that sees the difficulties in the market and acts accordingly makes me confident about the outlook for the company. In the Q4 2023 report the management reiterated that they are reigning in on expenses to produce more consistent quarterly reports that clearly show a red line trending upwards. Just like the last article I wrote about Worthington, I am maintaining my buy rating. I am bullish on the outlook and if we see any significant pullback given the runup it has had, I would even consider it a strong buy, if it drops below $60 – $55 per share.

US Manufacturing And Infrastructure Spending Drive Growth

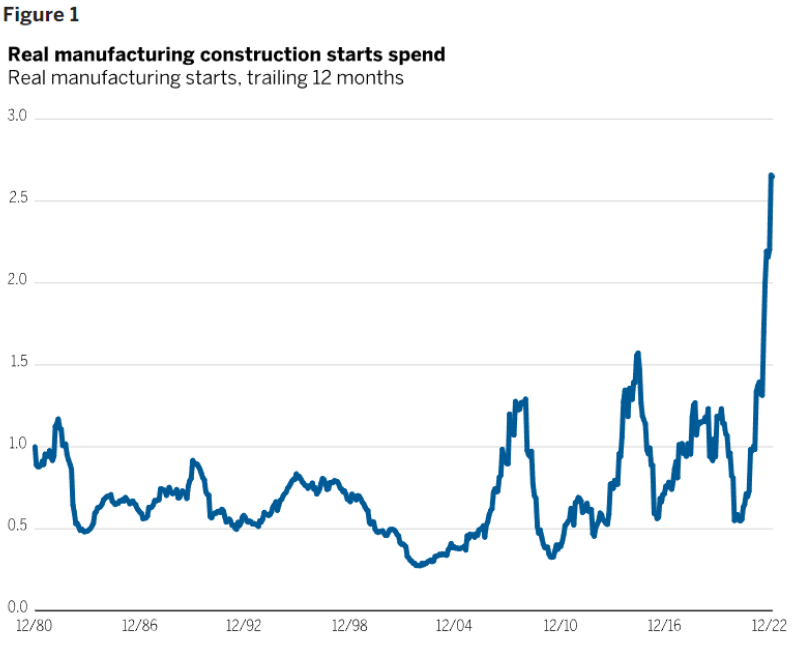

Some of the significant changes that are driving growth and demand for steel in the US is a shifting manufacturing climate. More and more companies are returning to the US to set up shop. This seems to come off the back of global worries about political instability in otherwise clear regions for manufacturing.

Net Sales (Earnings Presentation)

WOR has a long history of operating in the steel industry, dating back to 1955. I view it as almost a pure-play steel company that focuses on value-added steel processing. They make manufactured consumer and building products in the United States but also have an international market. The largest end market they serve is still the automotive. 37% of net sales come from automotive. Despite the market experiencing some challenges in the short term it’s set to clear up and the automotive industry resumes growth. For WOR, this means continued demand and growing sales.

Steel Prices (iea)

What I am looking at right now though is the fact that manufacturing is returning to the US. This will benefit not only WOR but many other related companies and industries also. The material sector as a whole seems to have a very positive outlook and I am very bullish on the sector. What the US government, however, is doing is also creating more incentives and tailwinds for steel. In 2021 the Bipartisan Infrastructure Bill was passed and this resulted in significant amounts of investment being divested to projects that need steel for example.

It will be increasingly important for the US to set up solid sources of steel seeing there is a shortage on the horizon. Seeing as WOR operates in the US market they are in a great place to offer products to a demanding market. That would catapult prices and make further investors difficult and not benign cost efficient. With strong US steel supplies it incentives continued economic activity and for investors in WOR it should translate to stronger earnings.

To underscore these arguments, the CEO Andy Rose said the following in the last report, “We are very well positioned heading into our new fiscal year. We have solid growth strategies and a strong balance sheet, both of which create opportunities for us regardless of economic conditions”.

With a positive outlook from the management like this I think it’s reasonable to expect Q1 2024 to produce a QoQ growth in both the top and bottom lines. As far as my views on the coming reports, solid uptrends in both volumes and prices seem likely. More investments are entering the infrastructure industry and basic materials like steel are something WOR can help supply with.

What would help make this assumption true is the fact that the segment for building products will experience an uptick in sales and volumes. It seems likely the automotive end market might drop off slightly, but that would be offset by gains in the construction end market instead. This all accumulates to me being very optimistic about coming reports.

Risks

One of the prominent risks that companies like WOR face, as highlighted in their recent report, is the impact of commodity fluctuations on their margins, leading to inconsistent financial results. The steel industry, by its very nature, is susceptible to price volatility, which can pose challenges for companies like WOR in maintaining stable profitability.

However, despite these short-term challenges, the long-term outlook for the steel industry appears promising, particularly with robust markets like India and China continuing to exhibit significant demand for steel products. This sustained demand offers potential growth opportunities for companies in the steel sector, including WOR.

Moreover, a noteworthy development on the horizon is WOR’s plan to separate its steel processing segment by early 2024. This strategic move could present investors with the opportunity to make a pure steel play with a company that has a solid financial footing, like WOR. Investors should closely monitor further news and updates regarding this potential separation and evaluate the potential benefits of holding shares in WOR in the meantime.

Financials

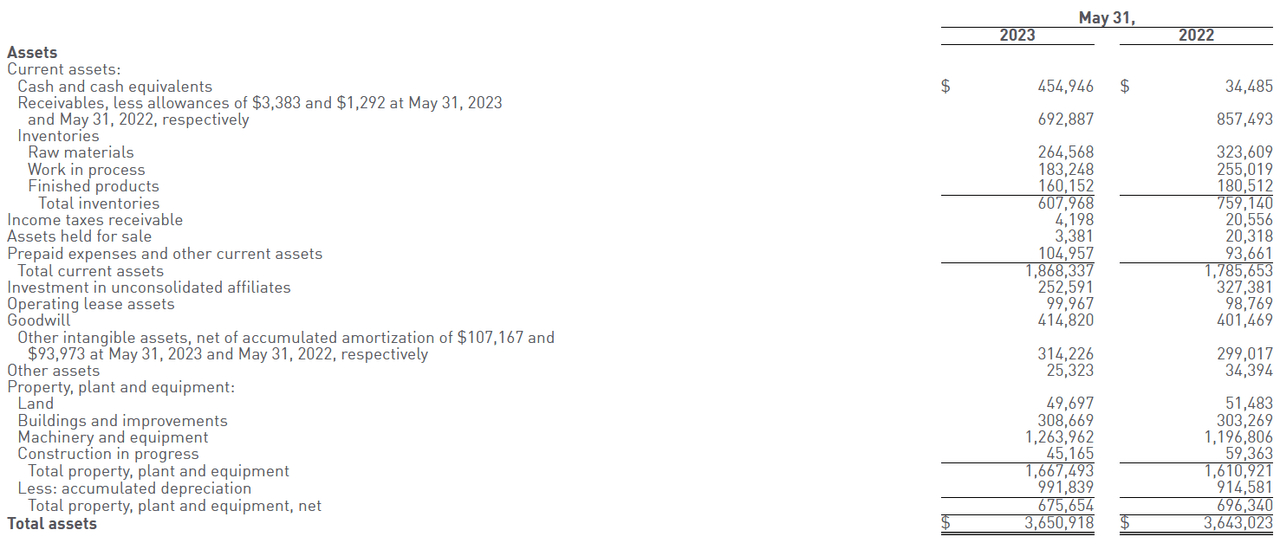

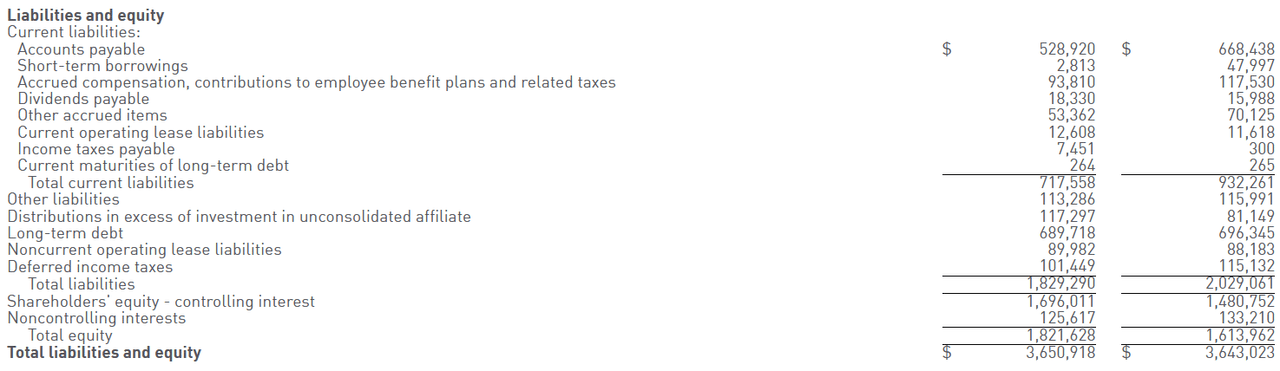

There have been a lot of improvements on the balance sheet and for reference, the p/b is around 2 right now. Slightly elevated which has been the result after the run-up the share price has had since at least September 2022.

Assets (Earnings Report) Liabilities (Earnings Report)

WOR managed to raise the cash position a large amount YoY and it now sits at over $450 million. This is enough to pay down more the half of the long-term debts and underscores why the management feels they are in such a strong financial position. ROA now is climbing back to 10% which has been WOR’s average for the last few years.

In my view, the condition of the balance sheet is very good. WOR has proven why it can perform even during downturns in prices.

Valuation & Wrap Up

Investors that want a stolid steel play should be considering WOR. I am still as bullish as my last article, especially after the results that were posted in the Q4 2023 report. In terms of valuation for WOR, it sits perhaps a little higher than its historical average, but still under the materials sectors p/e of 14. That leaves less downside risk from here in my opinion. I find it likely we are quickly returning to what we had in 2022. That would come as steel prices rebound and WOR would achieve an EPS of around $7 – $7.3. With the same multiple as the sector, a price target of $100 would be set.

This leaves an almost 30% upside from here still, which is why I am still bullish on WOR. Concluding this article I am reiterating my views on WOR and rating it a buy.

Credit: Source link