Kevin Burkholder/iStock Editorial via Getty Images

Boeing (NYSE:BA) is said to be in position to resume deliveries of wide body jets to China with deliveries of single aisle jets expected be restarted in July. For Boeing, which is going through its safety crisis. This is good news. While Boeing has a lot of issues at present, the delivery stop in my view should more be seen in the context of tense US-Chino relations. In this report, I will discuss why that is the case supported with data insights.

Why Did China Halt Boeing Deliveries?

In May, news broke that China had halted deliveries of Boeing airplanes amid a review of lithium batteries used in the cockpit voice recorder. That technical review of the cockpit voice recorder, which now is able to store 25-hours of recordings and data, is now completed and should pave the way for airplane deliveries to China to be restarted.

Timing Of Boeing Airplane Delivery Stop Is Interesting

It’s important for aviation regulators to study system architectures in the interest of safety. The fact that China halted the deliveries and the timing of the delivery stop are highly interesting. First of all, it should be noted that for a long time the FAA and NTSB have recommended a CVR capable of 25 hours data and audio logging and this was mandated in May this year. Furthermore, the design of the new CVR was certified by the FAA and accepted by the EASA. Now, the FAA might have lost credibility due to the problems that Boeing faces but the reputation of EASA still stands firm. I don’t believe that there was an immediate safety issue that would justify halting deliveries.

The Boeing Company

The reason why Boeing deliveries were likely halted is the continued tension between China and the United States. More than once over the past few years we have seen Boeing airplane deliveries become the playball of the tension between these two superpowers. The news of Boeing deliveries being halted came at a time when both countries were sanctioning each other. In May 2024, the Biden Administration announced 300 new sanctions including companies in China for supporting Russia in the war in Ukraine. In the following weeks after, China retaliated, sanctioning 12 companies in response to arms sales to Taiwan. While the sanctions are in response to the situation with Taiwan, I believe they should be viewed as retaliation for the sanctions that the US announced. During those days, China also held military drills near Taiwan in a response to military exercises by Taiwan and the United States in the Pacific a month earlier.

I believe it’s no surprise that the delivery stop of Boeing airplanes became public during those days. Moreover, given the certification of the CVR system architecture by the FAA and the acceptance by the EASA I do not believe there was a real safety concern at all regarding the CVR that would justify halting the deliveries. Viewing things in the bigger picture, I do believe the delivery stop was not a function of safety but a function of increased tensions between the US and China. Boeing is just an easy target due to the dented reputation the company has following years of incidents and accidents.

China Continues To Secure Capacity For Peak Travel Moments

I have been following airplane deliveries and the tension between China and the US for several years. In an interview with NPR in April 2018, I already pointed out that China has been imposing tariffs that were more word than action. China carefully crafted a tariff on airplanes that would exclude the Boeing 737 MAX. So, at all times China has been announcing tariffs without hurting their own airline industry. In the same way, the Boeing 737 MAX remained grounded in China much longer than in other countries and that was likely driven by the fact that China at that time did not need the capacity of new Boeing 737 MAX airplanes due to pandemic restrictions. The moment restrictions were eased in China, we also saw the Boeing 737 MAX being allowed back in service. So, the delivery stops are a function of US-China relations and demand for air travel in China.

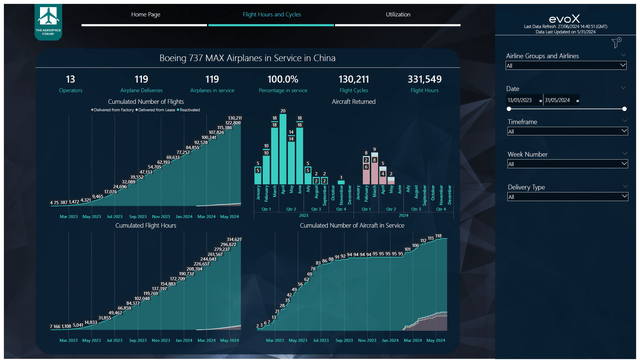

The Aerospace Forum

Each month I track the flight hours of the Boeing 737 MAX fleet in China and what we see is that the Boeing 737 MAX fleet in China has grown from 95 to 119 airplanes which indicates a 25% growth in the fleet. Since the reintroduction of the Boeing 737 MAX in China, there have been more than 130,000 flights and more than 330,000 flight hours. We’re also seeing that the share of flights executed with new delivered aircraft is expanding. Deliveries restarted in February this year and they already account for nearly 5% of the flight hours and 3.3% of the total number of flights. In May 2024, the delivered aircraft from February onwards accounted for 11.4% of the total number of flights and 19% of the flight hours. The newly delivered fleet flies significantly more per flight than the reactivated fleet. The new deliveries clock five hours per flight cycle while the reactivated fleet clocks 2.7 hours per flight. Since deliveries recommenced, we have seen a significant increase in utilization from around eight hours per day to around nine hours per day. So, there definitely seems to be demand for the Boeing 737 MAX jets. The delivery stream, as mentioned, is a function of the tensions and demand.

Focusing on demand, it should be noted that China has three travel peaks known as Golden Weeks. These peaks are the following:

- Chinese New Year in January or February depending on the year.

- Labor Day in May.

- National Day in October.

If we overlay that with the reactivation and deliveries, we see that reactivation of the fleet commenced in 2023 in preparation for the Chinese New Year in January and Labor Day and in 2024 deliveries have paced with Chinese New Year in February and Labor Day. So, once again, China has been very meticulous in timing of the reactivation and delivery stop, because they’re pacing with demand. China is tough on Boeing deliveries, when travel demand allows them to. Or else, they’re taking deliveries of airplanes. July through September also is a strong season for Chinese airlines as it is for many, so that deliveries are set to recommence in July fits China’s demand profile.

Boeing And China Need Each Other

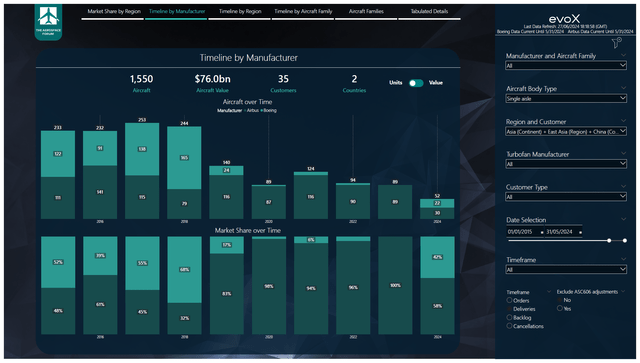

The Aerospace Forum

What’s often overlooked is that while tensions are high between the US and China, Boeing remains a key airplane manufacturer for China. Not just to carry the demand for air travel, but also for its own ambitions in the aerospace industry. China aims to take a bigger piece of the domestic pie initially and most likely later on it will try to challenge Boeing and Airbus globally as well. However, the fact is that C919 deliveries are not near the levels where demand can be serviced without Boeing or Airbus. The coming 20 years there’s demand for nearly 6,500 single aisle jets for the Chinese market and that equates to 27 airplanes per month.

If we look at the number of deliveries in the single aisle segment to China, we see that indeed Boeing’s market share has declined significantly since the Boeing 737 MAX crashes and the pandemic. However, before that we see that depending on the year Boeing had an annual share in deliveries between 50% and 70% and we see that so far this year Boeing has been recapturing some share in the delivery stream. Deliveries topped at 253 single aisles or 21 airplanes per month of which Boeing provided 55%. What this does tell us is that Boeing needs China and China needs Boeing. Airbus is not able to fill all demand and its recent downward revision for commercial aircraft deliveries shows as much and shows that it’s in China’s best interest to have two strong airplane manufacturers.

C919 for the time being is not going to make a major difference. In the first five months, three C919 airplanes were delivered. Annualized this would indicate up to 10 deliveries for 2024. That’s nowhere near the levels where Boeing and Airbus can really be hurt. Eventually the rate for the C919 should go up to 150 airplanes per year, but that’s something that optimistically can be achieved by the end of this decade. And even if China attempts to one day force Boeing or Airbus out of the market it will be a major task to retrain all pilots for the C919.

One of the reasons why there are Golden Weeks in China is to promote domestic tourism. China is seen as the industrial area of the world. However, what’s quite often forgotten is that pre-pandemic tourism accounted for more than 10% of the country’s GDP. Key to that is having adequate travel infrastructure and affordable ticket prices. So, China is really not serving itself well if it would either temporarily or permanently force Boeing out of its airline market knowing Airbus cannot carry demand by itself and China’s C919 is nowhere near required levels to replace Boeing.

Conclusion: China And Boeing Will Need Each Other For Years To Come

While we see that Boeing deliveries get halted by the Chinese regulator, I believe this is more a function of tension between China and the US. While deliveries are temporarily blocked, we also see that as soon as demand starts ticking up China lifts the delivery ban to keep it its airline industry at required levels that would allow for handling peak travel moments without making travel as a whole expensive. Tourism is a significant contributor to the GDP, and in the same way Boeing is important to the US export strength, Boeing and tourism are significant contributors to Chinese GDP.

While Boeing faces a significant list of issues, I believe that for the longer term Boeing is a buy. The restart of deliveries to China is a positive. We also see cleaner fuselages entering Boeing’s production facilities which will bode well for quality and efficiency, and Boeing’s CEO will depart by year-end. All of these things are positives. Free cash flow will be depressed this year, but the key for Boeing and the key focus of investors should be execution on the fundamentals for Boeing to generate strong free cash flows. Free cash flow shouldn’t solely be the target, it should be the byproduct of quality manufacturing and engineering.

Credit: Source link