Boarding1Now/iStock Editorial via Getty Images

A year ago, I covered Sun Country Airlines (NASDAQ:SNCY), and back then, I noted that I like its business model, which combines scheduled passenger services, cargo services as well as ad-hoc services. Despite the fact that I like the diverse business model, I didn’t attach a buy rating to the stock as its second quarter outlook was disappointing, and the company elected to focus on scheduled service instead of parts of the business where it can pass through the fuel costs which were on the rise at the time. In this report, I revisit the diversified airline and analyze the first quarter results along with a valuation of its stock.

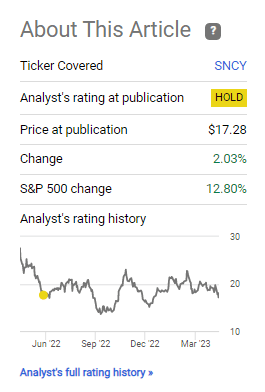

Sun Country Airlines Stock Underperformed

Seeking Alpha

Looking at the stock performance since I issued the hold rating, it’s quite evident that a Hold rating has been the only right rating, with the stock gaining only 2% while the market appreciated by 12.8%, underlining the importance of identifying attractive entry points for a stock.

Strong Margins For Sun Country Airlines

Sun Country Airlines

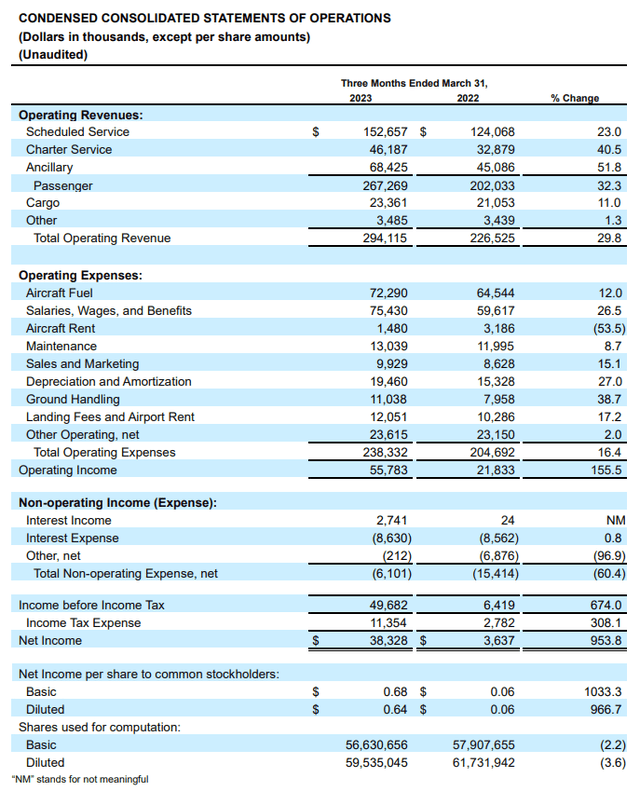

Revenues rose by 30% year-over-year, with growth in all of its business lines. Scheduled services revenues were up 23% driven by higher fares, an increased load factor, and higher ancillary revenues. The company last year decided to prioritize its scheduled services. Operating statistics show that year-over-year the capacity declined by 3.5% on a 2.2% decline in block hours. So, the topline growth was mostly driven by better load factor and fares. Charter service revenues were up 40.5% on 28% higher capacity and 33% more block hours while cargo block hours were up 5.2% generating 11% higher revenues. I wouldn’t say that Sun Country Airlines made a wrong decision by focusing on scheduled services since $52 million out of the $65 million increase in passenger revenues came from strength in the scheduled services business.

Total operating expenses were up 16.4%, which I see as acceptable given the inflationary costs, as well as 8% higher unit fuel costs and a 26% increase in pilot pay. Aircraft rent is down over 50% as Sun Country Airlines is transitioning its operational model from leasing to owning the flight equipment directly or via financial leases. This leads to lower cash costs during the quarter, but higher capital expenditures and depreciation and amortization.

The purchase of five Boeing 737-900ERs also shows this mindset of owning rather than leasing. Sun Country Airlines is not interested in buying the most fuel-efficient airplanes but looks at what airplanes make sense for their business from a cost perspective, and so they’re buying older Boeing models and will do so in the years to come. The purchased airplanes will be coming off lease from Oman Air over a one-year period from November 2024. Until November 2024, Sun Country will record around $1 million per month in lease profits. It shows the opportunistic purchasing strategy from Sun Country Airlines in a market that at this moment is tight due to airplane shortages. For the hybrid low-cost carrier, the addition of 14 extra seats on the Boeing 737-900ER is a win as it adds revenues on almost stable costs compared to the Boeing 737-800.

While its total block hours were only 3.8% higher, the airline increased revenues by 30% and increased its operating income by 155.5% realizing an operating margin of 19% compared to 10% a year ago.

Outlook for Sun Country Airlines

Sun Country Airlines

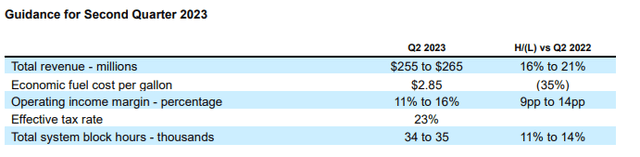

For the second quarter the airline is guiding for around 18.5% higher revenues at the mid-point compared to a year ago and helped by lower fuel costs operating margins of 11% to 16% should be achieved. From a margin and revenue perspective, it is a sequential decline. However, the second quarter is one that is a seasonally weaker quarter for Sun Country Airlines, so an 11 to 16 percent margin guide is still good.

Too Big Or Too Small Of An Airline?

In the years ahead Sun Country Airlines wants to grow its fleet which will unlock some economies of scale, and they are now also diving into upgauging which allows for higher profit potential as there’s significantly higher revenue potential on an incremental addition to cost. So, there’s a lot of growth potential ahead with a focus on older aircraft. Operating the less fuel-efficient aircraft gives them a discount on purchase and a relatively higher expense on fuel costs relative to the newest airplanes available, which can become a risk in a high fuel price environment in which case the airline will start eating through the discount it obtained on the purchase compared to the most advanced airplanes available, but that is not a wrong decision in advance.

During the earnings call, an analyst asked a question regarding the hold-off on charter flying, stating that Sun Country Airlines said it was overstaffed and oversized for what it is operating now. I read through the transcript and couldn’t find anything pointing in that direction. Sun Country Airlines attempts to remove seasonality for its business, which by some analysts is used to create a bull thesis. I think the reality is that you can barely remove the seasonal effects. Sun Country Airlines, however, has a strategy where it is sized for the peak travel moments, leaving its airplanes’ relativity underutilized over the course of the year in off-peak moments.

The reality of the business model is that they maximize around the peak travel moments and recognizing their assets would be underutilized in off-peak moments, they attempt to layer in ad-hoc flying. The airline had a lesser focus on that last year and also this year ad-hoc flying will still be a small share of the revenue pie, but there will be growth. It’s not the case that Sun Country Airlines is overstaffed and too big. They’re too big for the business year-round, especially when they cannot cater to charter services as much as they want, and that is still the case since contrary to what the analyst said they are not overstaffed. The airline is still training pilots, and it’s carrying a somewhat bigger fleet not only for the peak moments but also because it opportunistically purchased aircraft to fuel future growth when the flight crews are available. I think that is extremely important to realize.

Is Sun Country Stock A Buy?

Sun Country Airlines

I think it is. There are some growth drivers ahead and the training pipeline has improved. So while the business is not fully efficient now, we should see improvement this year. From an EBITDA perspective, relative to the enterprise value, I believe Sun Country Airlines stock is a strong buy. The company has a modest enterprise value of $1.5 billion, which combined with the outlook for 2023, brings its EV/EBITDA to 6.2x. The median for the industry would suggest that the price target should be $23.71 while the median suggests $37.20. I wouldn’t want to value the stock based on its median because it went public during the pandemic and hence doesn’t have a multiple that is necessarily reflective of operational strength, but I would feel comfortable giving the stock a $23.70 price target representing 32% upside and note that there is growth ahead for Sun Country Airlines if it manages to execute on its growth aspirations in the years ahead.

Conclusion: Sun Country Airlines Is A Strong Buy

During the first quarter, Sun Country Airlines showed strong margins, and while the margins are set to come down in the second quarter, it should be noted that this is due to a naturally weaker second quarter for the airline as opposed to other airlines. Overall, I’m liking their business model, and we’re seeing that with the scheduled services having grown, they’re benefiting from the strong demand for air travel. They have too many airlines relative to their staff base, but that’s due to opportunistically acquiring jets that they will be able to deploy in the future and for this year we should see growth in all of their flying activities and more growth ahead, meaning that even when the revenue environment weakens, Sun Country Airlines should see sustained results as it grows it business catching any future fall in unit revenue by scaling the business which will help the company reduce unit costs.

Credit: Source link