CHUNYIP WONG

By Amanda Townsley

At a Glance

- Over the past 15 years, Cushing has seen a dramatic increase in its tankage and pipeline connectivity, solidifying its position as the world’s largest crude oil hub

- Crude oil traded across North America is negotiated and transacted as a differential to the WTI futures contract

2025 marks the 10th anniversary of the lifting of the U.S. crude oil export ban, a development that helped launch North America into the top echelon of global oil suppliers while also recasting the landscape for crude oil trading.

Previously, a system designed for importing crude oil, the North American grid flipped outward, upending price dynamics and forming new trading hubs. As the North American crude oil trading system has adapted to its place in the global pricing system, here’s a look at what’s changed, what hasn’t and what might be next.

The push to export crude oil after a 40-year ban resulted from burgeoning production and a race to build the infrastructure to efficiently deliver it to market. From a low of 8 million barrels per day in 2008, Canadian and U.S. oil supply grew to 13 million in 2015, and rose to 18 million in 2024. Over that period, production that had been dwindling began pushing the onshore pipeline system to capacity, requiring major investment to reroute flows and deliver the growing supply to refineries, trading hubs and coastal docks for export.

At the heart of the vast North American crude oil trading system is the NYMEX Light Sweet Crude Oil futures contract, often called “WTI”. The price of WTI futures represents the outright price of a barrel of domestic light sweet crude oil at Cushing, Oklahoma. Cushing has been an effective delivery location for crude oil since the 1980s, as a vibrant hub for cash market trading of crude oil with an unparalleled network of pipelines, refineries and storage terminals.

Cushing Tank Farms: 1995 and 2024; Source: Google Earth

If the Cushing of the 1980s was a “vibrant” hub, the Cushing of the last decade would be akin to a thriving metropolis. As the epicenter of both the pipeline and trading system, Cushing’s tankage and pipeline connectivity has ballooned along with the North American grid over the last 15 years. The pipeline system channels crude oil from Western Canada, the Rockies, Bakken, Permian and regional plays into Cushing, where it can be stored, blended or delivered to local refineries and onto the Gulf Coast. In 2024, Cushing was home to 98 million barrels of crude oil storage capacity, making it the largest single hub in the world. Over 20 inbound pipelines, 16 outbound pipelines and more than 30 intra-Cushing lines provide unrivaled connectivity between a diverse mix of operators, across terminals and between production basins and other market hubs like the Gulf Coast.

North America Crude Oil Pipelines: Cushing at the Hub; Source: EIA, CME Group

Despite recent low inventory levels, records are being set at Cushing. In 2024, WTI futures set a record for physical deliveries of over 317K contracts, or 317 million barrels, the highest level since 2017. WTI futures rank number two globally for physical deliveries, behind the GME’s Oman futures contract, and in 2024 saw twice the volume exchanged for barrels of the physically delivered Gulf Coast futures contract.

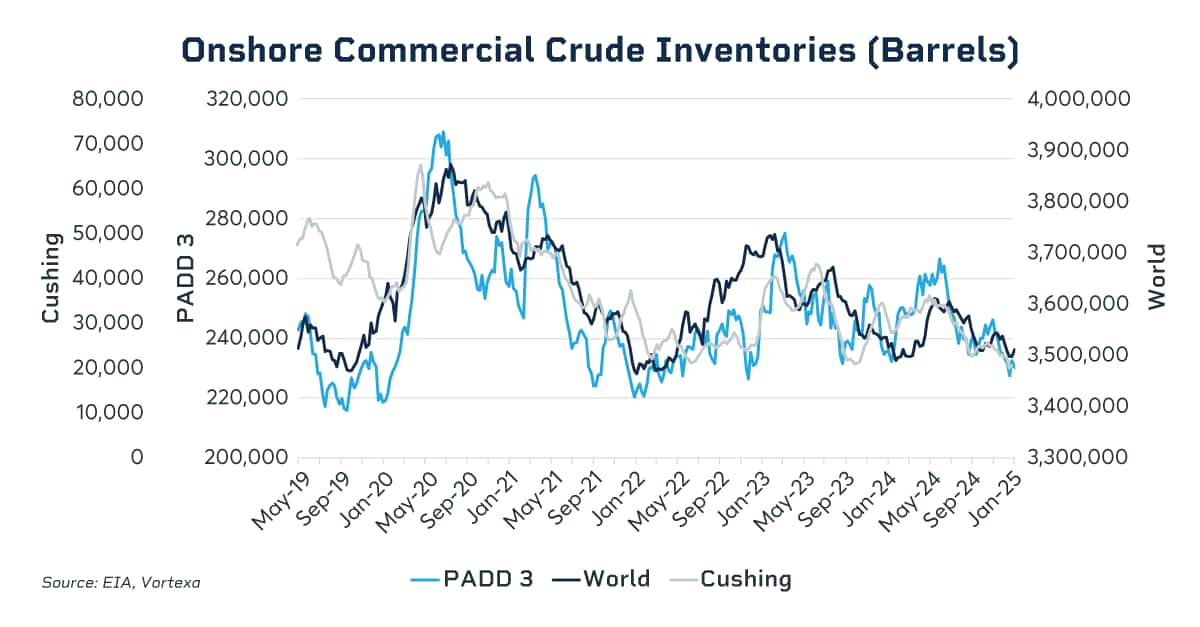

Whether global oil inventories remain near the low end of the historical range or build back toward historical highs, the ample export capacity and responsive pricing system mean that strong correlations between U.S., Cushing, and global inventories will continue.

WTI: So Much More than Crude at Cushing

As Cushing is the heart of the oil pipeline system, the WTI futures contract is the heart of the North American trading system.

Centered around the price of crude oil at Cushing is a long-established trading ecosystem that allows traders to efficiently price oil no matter its location or quality. Crude oil traded anywhere from Hardisty, Alberta, to Corpus Christi, Texas, is negotiated and transacted as a differential, or spread, to the WTI futures contract. The spread at which a specific grade of crude oil trades versus the NYMEX price reflects differences in quality, transportation costs and regional supply-demand variables. Traders carefully measure these factors to properly value different types of crude oil, as well as to route their crude oil to the most profitable destination.

Spot physical crude oil trades actively during the month before it will be delivered. Price reporting agencies such as Argus Media and Platts aggregate transactions for various grades on a daily basis and publish a daily differential index price. Price differentials are typically within a few dollars above or below NYMEX WTI, but certain grades or locations can trade at double-digit discounts. The price a seller will receive for the crude oil will be NYMEX WTI plus the differential at which the trade is executed. Rather than transacting at a fixed differential, producers and consumers can also choose to buy or sell crude at the index price: the monthly average of the differential published by the price reporting agency plus the monthly average of NYMEX WTI.

The Rise of Grades: Hedging a Differential to WTI

The trading ecosystem aggregates the majority of price discovery and liquidity at a single location: WTI futures. This allows the bulk of risk management and hedging to occur nearly around the clock, with low cost and high transparency. This also means that most of the time, fluctuations of the price of crude at Cushing via WTI futures is the main driver of fluctuations in the price of crude oil produced, traded or exported across North America.

Even before the shale boom, the large geographic footprint and quality diversity in North American crude oil gave rise not just to active physical trading in other hubs, but also demand for crude oil hedging instruments beyond domestic light sweet at Cushing.

In 2007, NYMEX launched a series of futures contracts to meet this need, offering traders the ability to hedge the price differentials around the U.S. The initial futures contracts cash-settled to the prices of Mars, West Texas Sour (WTS), and Louisiana Light Sweet (LLS) published by Argus Media, the same differentials that underpinned most physical transactions.

The expansion of the U.S. pipeline network and crude supply in the following decade led to the birth of new grades of crude oil and new trading hubs in North America. As both a refining center and a geographically convenient outlet for exports, the focus on Houston along the Gulf Coast grew. With strong quality parameters and broad connectivity to Permian production and the refining network, Magellan’s East Houston terminal (also called “MEH”) emerged as the hub. In 2015, Argus began assessing “WTI Houston” – the price differential to NYMEX WTI of WTI Midland-quality crude oil at MEH. The WTI Houston assessment quickly became the standard of value for light sweet crude oil on the Gulf Coast. Any trader that buys or sells crude oil on the Gulf Coast today will look to the Argus WTI Houston differential plus NYMEX WTI as the key indicator for the value of that crude oil. The outright price of crude oil on the Gulf Coast cannot be determined without the price of NYMEX WTI.

A CME Group futures contract for the Argus WTI Houston differential to WTI, known by the industry as its exchange code “HTT”, began trading in 2016. With the Argus WTI Houston differential and the NYMEX WTI futures contracts as the underlying prices for physical transactions, HTT was welcomed by the industry as a convenient hedge for the quality and location of the growing grade of crude.

The flexibility to add or subtract new grades and locations as the market shifts is a hallmark and benefit of the U.S. crude trading system. In 2025, open interest in these types of grades futures contracts, priced as differentials to NYMEX WTI, is approaching 800 million barrels and extends out four years. Beyond WTI and Brent, this represents more barrels than any other oil futures contract globally and highlights both CME’s HTT futures contract as the instrument of choice for managing risk on the U.S. Gulf Coast, and NYMEX WTI as the central pricing mechanism for crude oil.

NYMEX Crude Oil Grades Differentials: A Key Part of the WTI Ecosystem.png)

What WTI Means for the Rest of the World

The sheer scale of U.S. oil export capability has meant that U.S. crude oil prices have influenced crude oil prices globally for years. The WTI-Brent futures spread reflects the price difference between the U.S. and North Sea crude oil markets. At the start of the shale boom, the spread flipped from a positive value to as low as negative $25 per barrel. By 2020, the build out of U.S. export infrastructure narrowed the spread, with WTI trading $3 to $5 under Brent during 2024.

As a nod to the significance of U.S. crude supply and the decline in European production, in 2023 U.S. crude oil was added to the basket of deliverable grades under the Brent futures contract. According to Argus and Platts, U.S. WTI Midland crude oil – priced off of WTI futures – has since been setting the price of Dated Brent more than 50% of the time. This shift made explicit that anyone with exposure to the Brent complex also has exposure to U.S. NYMEX WTI crude prices, and led to the adoption of NYMEX WTI-based cargo pricing for European refiners.

In the tenth year of North America’s development as a global crude oil export powerhouse, some changes are only just beginning. Given the meteoric rise in North American exports, international use of WTI continues to grow. Trading volume of WTI originating outside the U.S. hit a high of 37% during 2024, up from 29% year-on-year, and the majority of new participants in both WTI futures and CME’s WTI Houston futures came from outside of the U.S.

The NYMEX WTI Light Sweet crude oil futures contract has been around for 42 years, serving as the benchmark for U.S. oil prices and underpinning the prices of consumer goods like gasoline, diesel and propane – and the price of all types of crude oil around North America and even overseas. With crude oil on the Gulf Coast valued and traded as a differential to WTI futures, growth in the importance of Gulf Coast crude oil is synonymous with the WTI Houston marker and the WTI futures contract that sits at its core. NYMEX WTI has truly gone global.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Credit: Source link