vovan13

In May, In believed that it was time to go to Waters Corporation (NYSE:WAT) in case it rains. This came after shares had seen a correction during the spring on the back of a soft first quarter earnings report, while the full-year guidance was maintained.

Valuations had re-rated to much more attractive multiples, as I was waiting for another move lower before getting involved with shares which traded around the $270 mark at the time.

In the end, I wound up buying the dip around the $250 mark, but this has come in part on the back of softer than expected operating performance, which makes me hesitant to be involved in a substantial manner here. Hence, a modest long position is the most I am willing to commit here, as I lack conviction given the somewhat unexplainable softer operating performance this year.

A Strong Niche Player

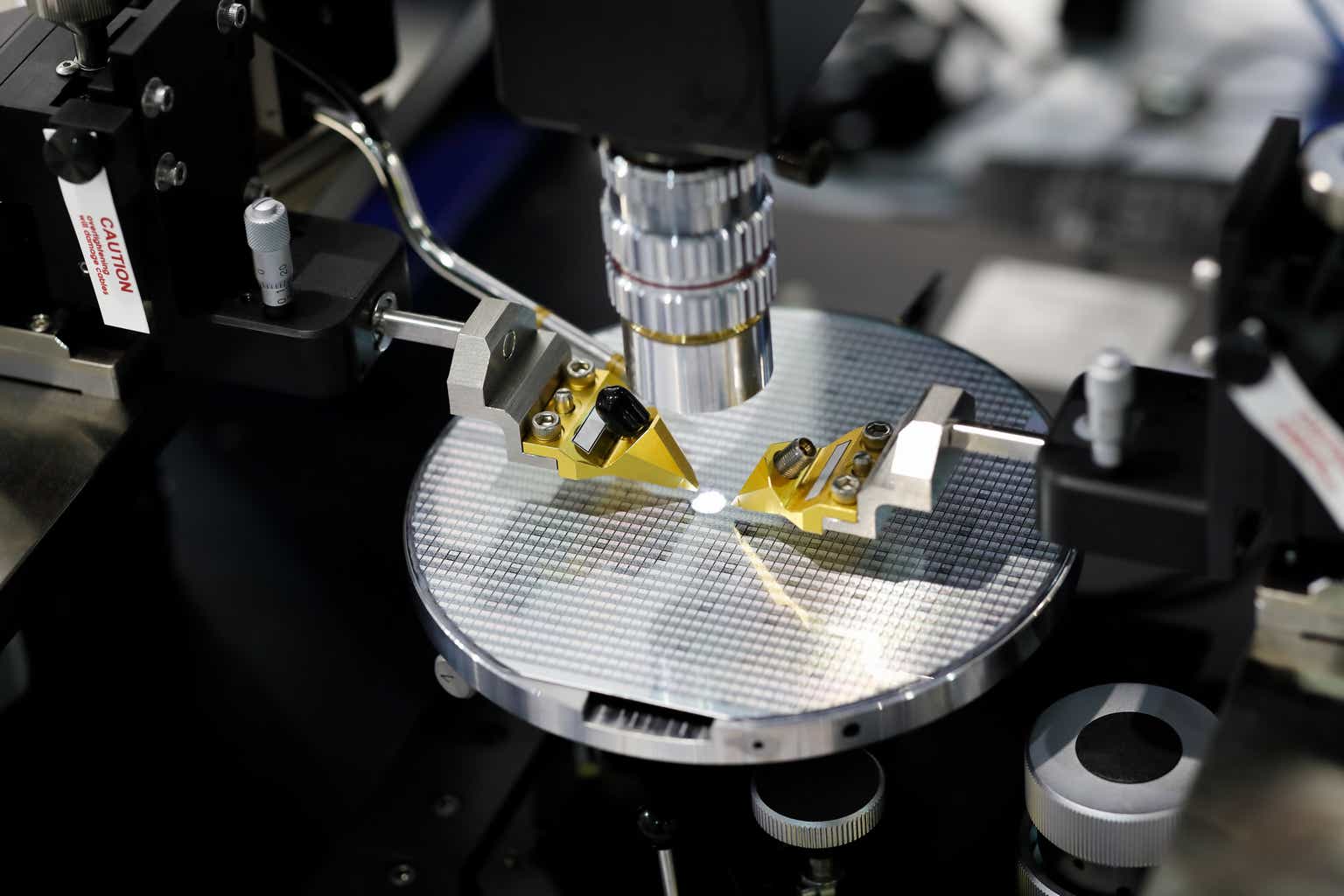

Waters is a diversified business which focuses on some real interesting niche markets which include liquid chromatography, mass spectrometry and thermal analysis innovation. Such services are key in making sure that medicines and vaccines have efficiency, safety and quality which are desired. Similar services and solutions are applied to food and water industries as well.

The company has typically grown sales at a decent mid-single digit percentage pace to a revenue base of $3 billion, with a slight majority of sales generated from the pharmaceutical industry, 30% from industrial and applied applications, accompanied by a smaller academic & government clients business. Sales are split pretty evenly between equipment sales as well as services, materials and consumables.

On top of the somewhat modest but steady top line sales growth, Waters has typically posted very strong margins in the mid-twenties, as it has been a serial buyer of its own shares. All these favorable trends mean that a $100 stock in 2013 rose to $200 in 2018, after shares peaked at levels over $400 in 2021.

Establishing A Base

Early this year, Waters posted its results for 2022, a year in which revenues rose 7% to $2.97 billion, as net earnings rose in a modest fashion to $708 million, with earnings reported at $11.80 per share. Higher taxes and interest rates hurt the progress on the bottom line.

With shares still trading around $320, the company traded at 7 times sales and 27 times earnings, as the company operated with a relatively modest net debt load of $1.1 billion. This was in part explained by a solid outlook for 2023, with sales seen up 5.0-6.5%, as adjusted earnings per share were seen up to $12.65 per share.

This thesis changed a bit as the company announced a somewhat expensive but interesting deal for light scattering instruments company Wyatt Technology in February. With the business adding bioanalytical characterization activities, such as cell and gene therapies, the deal was expensive as a $1.36 billion deal was set to add a mere $110 million in revenues. The deal would result in pro forma net debt of $2.5 billion, and while it would add to revenue growth and the growth profile, incremental interest expenses would prevent for earnings accretion, in fact the opposite was the case.

Shares fell to the $270 mark after first quarter sales fell a percent to $685 million, although the constant currency growth was up 3%. The lack of growth and higher interest rates meant that GAAP earnings fell twenty-four cents to $2.38 per share. Nonetheless, the company maintained the $12.65 per share earnings guidance (even including a $0.15 per share headwind from Wyatt) as it was evident that risks to the full-year guidance were up.

As shares fell to the $270 mark, appeal has improved greatly, yet I concluded to be a patient investor, waiting for an initial entry target at $250 before getting involved.

Getting In

Shares briefly hit the $250 mark in June, only to rally to $300 in August, as I bought the dip in the higher $240s in October.

This came after Waters posted second quarter sales for the three-month period ending on the first of July back in August. Reported revenues rose 4% to $741 million, with the purchase of Wyatt closing halfway during the quarter, that is by mid-May. GAAP operating profits were flat at $200 million, even as amortization charges rose by $5 million towards $7 million following the Wyatt deal.

The deal meant that interest expenses rose as well, with GAAP earnings down seventeen cents to $2.55 per share. Adjusted earnings rose five cents to $2.80 per share, with many of these costs related to the Wyatt deal.

Net debt was posted at $2.3 billion, a bit below the pro forma net debt load upon the deal announcement, as leverage is not a great concern given the secular growth of the business and the fact that EBITDA approaches a billion dollars.

Nonetheless, the company cut the guidance in quite a substantial way. Full year reported sales growth, seen at 3-4%, is not that much lower as the initial outlook, but this includes a substantial contribution of Wyatt, of course, all while adjusted earnings are seen at $12.20-$12.30 per share here.

In November, third quarter results were reported, and they were soft. Reported revenues rose in a very minimal fashion (less than 1%) to $712 million, down four percent in constant currency terms with all the growth driven by Wyatt. GAAP earnings fell by thirty-tree cents to $2.27 per share on the back of amortization charges and interest expenses, with adjusted earnings up twenty cents to $2.84 per share.

Continued cash flow generation meant that net debt ticked down to $2.17 billion. Softness is attributed to China, and there is no quick avail with full year sales seen between flat at best, and potentially down a percent. Adjusted earnings are seen down further to $11.65-$11.75 per share, down about a dollar since the original outlook.

While deleveraging is impressive, adjusted EBITDA trends closer to $900 million rather than a billion, making leverage that ratios have not come down much, even as absolute debt is rapidly coming down.

And Now?

The reality is that I am quite disappointed by the organic performance of Waters this year, but many companies in this space have sold off this year on the back of tougher operating conditions, making it likely that this is not an issue of organic performance (or better said, lack of organic performance).

Trading at $255 and an original 20 times earnings multiple (based on the initial outlook for this year), the Waters Corporation multiple has ticked up to 22 times, while organic growth is negative. This is not too interesting, and while I am sitting in on minimal gains, essentially breakeven levels, I am more cautious than I was in May. This comes after a soft third quarter, and implied forecast for the fourth quarter, as there is no quick avail. After all, the company cut 5% of its workforce in the third quarter, limiting the potential of a quick turnaround.

Hence, I am willing to sell Waters Corporation shares on substantial rips, but for now I am willing to hold onto a modest long position, hoping for a modest rebound in the operating performance in 2024.

Credit: Source link