AdrianHancu/iStock Editorial via Getty Images

Introduction

Volvo Group (OTCPK:VOLAF; OTCPK:VLVLY) has been my favorite pick within the truck and bus manufacturing industry. It is time to look at the latest earnings report, to see if there is any reason to confirm or change my buy rating.

Summary of previous coverage

Volvo Group is the most profitable truck manufacturer, and it seems to be one of the leading players when considering the EV turnaround, which is also affecting trucks and buses. Its financials are healthy, with net income growing around 7.7% annually, which supports a healthy dividend that has grown, in the past decade, at a 4.58% CAGR. Free cash flow has also grown consistently from negative territory in 2012, when it was -$1.58 per share, to $0.54 per share considering the TTM.

I also liked how Volvo Group was among the first manufacturers to understand what was happening with supply chain constraints and inflationary pressure. To protect its margins, the company started earlier than its peers to pursue a restrictive order intake policy. In this way, the company was able to take orders with better visibility and production costs, unlike its peers. Since we understood this fact back in October, the stock is up almost 43% vs. the +14% of the S&P500. I think Volvo Group started to stand out in the industry as investors sought resilient and well-run businesses whose focus on profitability could help weather any kind of economic environment. As Martin Lundsted, President and CEO of Volvo Group, wrote in the most recent Q1 2023 earnings report: “A good profitability is important for us to be able to continue to increase our investments in the biggest technological shift ever in our industries”.

Q1 2023 Earnings Review

Reported Data

Before we go through some numbers, remember that Volvo Group reports its results in SEK. To make things easier, I use the conversion ratio of 10 SEK = 1 USD (currently it is 10 SEK = 0.97 USD). This is why I will report in USD, considering that most SA readers are not familiar with the Swedish krona.

Let’s start from the top line and then move down towards the bottom line of the income statement and other metrics:

- Net sales were $13.14 billion, up 17% YoY. All five geographical regions (Europe, North America, South America, Asia, Africa, and Oceania) were up between 8% (South America) and 34% (North America).

- Operating income amounted to $1.84 billion (+45 YoY), which is a 14% operating margin (+200 bps YoY).

- Net income reached $1.29 billion (+82% YoY), and EPS per share for the quarter were $0.635 vs. $0.346 in Q1 2022. This is an EPS growth of 83.5%.

- Operating cash flow was positive in the amount of $500 million, up more than $1 billion compared to the -$540 million of Q1 2022.

- The return on capital employed in industrial operations was 30.3%, +500 bps YoY.

My considerations

While many industries are seeing softening demand since the beginning of the year, Volvo Group seems to be able to take advantage of the huge pent-up demand that was created after the pandemic and that is still unfulfilled. In fact, during the first quarter of the year, truck orders increased by 32%. Buses and Volvo Penta also saw an order increase of 4% and 6%, respectively. On the other hand, construction equipment did see a big slow-down as orders decreased by 35%. In addition, we have gotten used to hearing on most earnings calls that truck fleets are aging faster than what it takes for the replacement cycle to keep things even. Therefore, further demand is being created and is going to go through the order pipeline. As we read in Volvo’s report:

There is a continued pent-up need to replace aging fleets, which is noticeable on the truck side, where order intake rose as we gradually opened the order books for the second half of 2023.

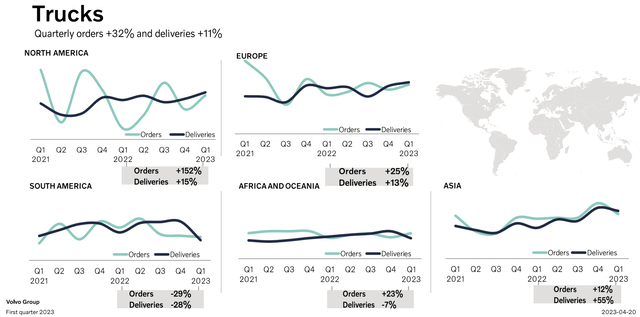

Below, we can take a look at how quarterly orders and deliveries performed in the past two years across all five geographical regions Volvo Group considers.

Volvo Group 1Q 2023 Results Presentation

What strikes me is the difference between the deliveries and the orders curves. The former is less volatile and moves according to a trend. Orders, on the other hand, swing rapidly from one quarter to the next, but they tend to stabilize around the deliveries line.

Another positive note came from service sales development, where Volvo Group reported 13% currency-adjusted growth. As it was said during the earnings call:

This is the result of a continuous high-activity level amongst our customers, and the efforts of our commercial organization to increase contract penetration and other services are successful, both when it comes to the products and services around the products and also financial services.

I think the growth in services is linked to what we have said above: as fleets age, demand for spare parts and maintenance grows. In the meantime, deliveries are sky-high and this creates the basis for further service revenue down the road.

Buses also improved a bit. This was the hardest-hit segment during the pandemic, and it still needs to recover. We finally see a margin of 4.2%, which is not that high, but at least we are in profitable territory.

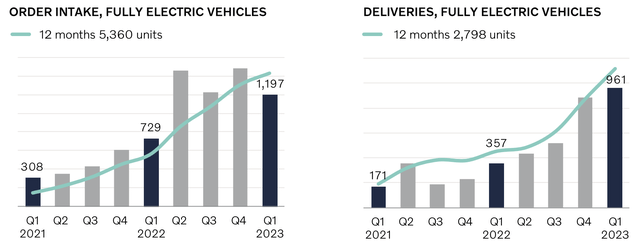

As far as electric vehicle orders and sales go, Volvo Group confirmed what I have been pointing out for a while: it is leading the market (66% market share in Europe). True, orders and deliveries are still in the thousands, but if we look at other competitors, we see Volvo is picking up speed. I actually expect Volvo to have an order intake of almost 10,000 vehicles in 2023, while it should be able to deliver around 5,000 units.

Volvo Group 1Q 2023 Results Presentation

Valuation and Conclusion

In this report, I see nothing that changes my bull-thesis on Volvo Group. When I invest, I try to stick with the industry leader if I can make sure there are true reasons to support this leadership. In the case of Volvo, I see a company whose fundamentals are all pointing in the right direction. The company is perceived as reliable and able to deliver according to what it promises. In addition, it is taking advantage of a double-sided situation with aging truck fleets and strong post-pandemic pent-up demand for machinery in general. I confirm my buy rating and my conservative target price of $23-25, which stands for a potential upside, not counting dividends, of up to 25% from today’s price.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Credit: Source link