LoudRedCreative/E+ via Getty Images

Quantitative Factors Support Buying VirTra

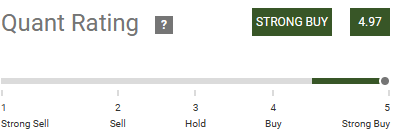

Shares of VirTra, Inc. (NASDAQ:VTSI) caught my attention when they were recently assigned a “Strong Buy” rating by the Seeking Alpha Quant system:

Seeking Alpha

VirTra is a small-cap company. I like investing in small caps because they tend not to catch the attention of professional investors. Professional traders often won’t buy them because even though they offer volatility, the low volume and low float associated with small caps make it hard to manage risk. For institutional investors, small caps are largely untradeable. Moving billions of dollars into a small-cap position, by definition, isn’t possible. Even placing a few million into a small cap could greatly impact the price of the stock because of the demand it creates, or it could take a long time to fill the order. Exiting the position creates the same kind of problems.

But that leaves interesting opportunities on the table for retail traders like me investing relatively modest sums. Investing in small caps selected based on quantitative factors – like the Seeking Alpha Quant system – could help you beat the market significantly.

In the case of VirTra, the stock gapped up on April 29 as the stock advanced more than 12% in a day. This follows up on an advance of ~180% in the past year. When a stock goes up that much, investors naturally will ask if it could possibly go any further, and often will shy away to avoid a potential reversal.

But as the Quant system teaches – it grades the price momentum of the stock among other factors – you should let your winners run. It’s a common mistake to assume that a stock that has gone up can’t continue – or to sell it too soon. If you’re not already in the stock, very often you’ll see a stock that has come up a lot actually continue going for a long while.

If you’re never buying stocks with momentum, you’re leaving profits on the table.

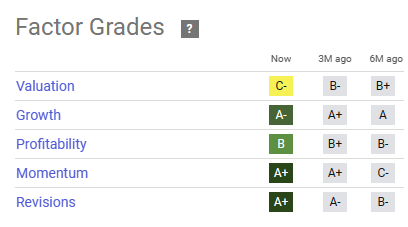

Besides, VirTra does well on several other factors that are fed into the Quant system. The factor grades are scored as follows:

Seeking Alpha

With strong quantitative factors going for it – such as the growth and profitability – there could be further upside, even with the stock having already gone up a lot. As I’ll cover in my analysis on qualitative factors below, much of the growth that caused the recent surge in the stock price – or at least in terms of the underlying fundamentals – came because of a revamp of VirTra’s production assets. But the effects of that should continue well into the future, and management is stepping up sales efforts. This could support further price appreciation and/or stronger fundamentals in the future.

If you’re willing to trade on quantitative factors alone, you could theoretically go ahead and buy just based on the Quant rating. At the same time, it’s good to know what you’re getting yourself into.

This is what I found in my research on VirTra – what I call qualitative factors:

Qualitative Factors Support What The Quant Has Found

VirTra is a global provider of judgmental use of force training simulators for the law enforcement and military markets. The simulators offer a realistic experience to law enforcement and military personnel. It differs from conventional gun range practice in that it requires decision-making on the part of the user and thereby safely induces stress into the situation.

One of the key selling points of VirTra’s simulator (as noted in VirTra’s most recent investor presentation) is that it is inexpensive versus gun range training. It creates a more realistic and demanding environment.

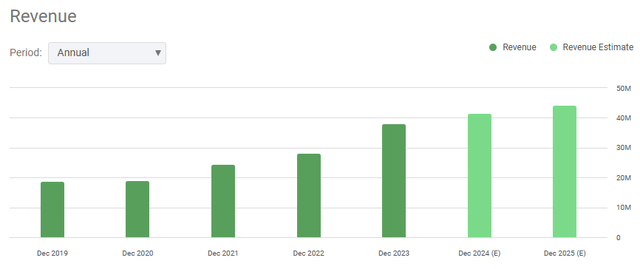

Coming out of COVID in particular, VirTra’s products seem to have been gaining in popularity. Revenues started growing fast a few years ago:

VirTra investor presentation

Growth seems to continue with VirTra expanding their footprint. The company recently reported entering into a major $5.9 million deal with Microsoft (MSFT) to deliver bolt kits and magazines and high-pressure air fill stations for a US Army program that Microsoft is the prime contractor on.

Speaking of growth, VirTra delivered around 34% of revenue growth from 2022 to 2023. VirTra CEO John Givens credited this growth with a substantial upgrade to VirTra’s machine shop that it had been carrying out. Entering 2023, VirTra faced a bit of a dilemma: It had a substantial backlog of unfilled orders. This led to VirTra doing a strategic overhaul of its production. Aside from the machine shop overhaul, it involved consolidating production into a single facility.

While these strategic moves helped VirTra grow significantly and achieve record revenues, it also kind of created just the opposite problem: As VirTra entered 2024, the backlog had come down to $19.4 million, about half VirTra’s 2023 revenue. As noted by CEO John Givens, growing the pipeline is critical to VirTra’s (continued) growth trajectory going forward. VirTra has hired a VP to oversee sales efforts in this regard.

In terms of product innovation, VirTra has also launched V-XR, a training platform in the form of an extended reality headset. VirTra has stated that they expect strong delivery volumes. This should help VirTra grow.

VirTra has even indicated that they are willing to sacrifice on margins to grow and expand market share:

Our strategy is squarely focused on expanding our market share, even if it means temporarily dialing back on our strong margin position. We are confident in our strategy because we believe in the unparalleled quality and comprehensiveness of our content library. – VirTra CEO John Givens

I would expect the international markets to be one such area where market share could be grown – and where growth in absolute numbers could be achieved, too. VirTra has delivered products to about 40 countries, but its combined revenues from abroad come in at just $5.8 million for 2023 (against $4.2 million for 2022). This is against combined revenues of almost $40 million in 2023. Plenty of room to grow.

Turning to finances, VirTra has what I would call a fortress balance sheet: It has just $8.8 million of debt (relating to a mortgage on a property) against cash of $18.8 million. With $42.6 million of total equity against the $8.8 million of debt, solvency is great too.

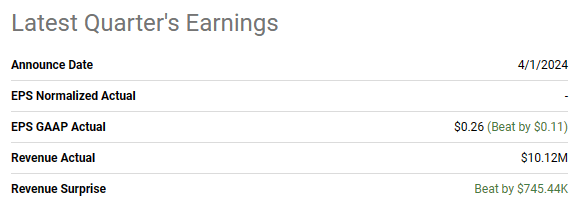

On April 1, VirTra announced full-year results. Revenues came in at $38 million for a 34% YoY growth rate. VirTra beat estimates on both top and bottom lines:

Seeking Alpha

The impressive growth and outpacing of expectations get me to the future outlook for VirTra. According to data from Seeking Alpha, revenue is estimated to reach $44.2 million by the end of 2025:

Seeking Alpha

If VirTra reaches $44.2 million by the end of 2025 (a 2-year stretch from the end of 2023), that turns out to be an annual growth rate of 8%. The growth rate is important in determining the fair value of VirTra’s stock, which I will get to in the following section.

Valuation And Benchmarking

Seeking Alpha lists the following peers for VirTra:

| Company | P/E FW |

| VirTra | 21.4 |

| Byrna Technologies Inc. (BYRN) | neg. |

| Terran Orbital Corporation (LLAP) | neg. |

| Redwire Corporation (RDW) | neg. |

| Mynaric AG (MYNA) | neg. |

| Vertical Aerospace Ltd. (EVTL) | neg. |

VirTra is quite a unique company, and that makes it difficult to compare it to any of the peers listed by Seeking Alpha. All of the peers listed above are similar to VirTra in terms of size and market cap – but not in terms of their products. VirTra also stands out among these peers as the only profitable company. At the same time, it wouldn’t make more sense to compare VirTra to large defense contractors like Lockheed Martin (LMT) and General Dynamics (GD). That’s a completely different ballpark, too. This makes it difficult to benchmark VirTra’s P/E to any other defense contractor or the industry as a whole. Because of this, VirTra should probably be valued rather on the merits of its growth prospects and concrete plans as laid out by management.

In the very near term, as noted in the previous section, VirTra is expected to grow about 6% on an annualized basis in terms of revenue. This is much less than it grew from 2022 to 2023, where it grew from about $28 million to $38 million in revenues (and from $2 million to $8.4 million in earnings). As noted previously, much of that strong growth came from VirTra managing to work through its backlog of orders and thereby starting to recognize revenues from these. As seen, not only revenues but also earnings grew very substantially between 2022 and 2023. While I believe a 6% growth rate for revenues towards 2025 seems manageable, I think there’s a good chance VirTra will do even better. As seen in the table below, VirTra has grown more than the estimated 6% (17% on average to be exact) every year except for a few in the past 9 years:

| Year | Revenue USD (YoY growth) |

| 2015 | 13.3 million (34%) |

| 2016 | 15.7 million (18%) |

| 2017 | 16.5 million (5%) |

| 2018 | 18.1 million (10%) |

| 2019 | 18.7 million (3%) |

| 2020 | 19.1 million (2%) |

| 2021 | 24.4 million (28%) |

| 2022 | 28.3 million (16%) |

| 2023 | 38.0 million (34%) |

| Average growth | 17% |

While past performance doesn’t guarantee anything in terms of the future, I think the combination of VirTra’s new product lines, including the V-XR, the increased sales efforts, and the performance history, could drive VirTra’s revenue growth into the low double-digits. I expect earnings to grow even more than revenue because margins are expanding. VirTra has actually been able to lower their cost of revenues in spite of the growth (from $13 million in 2021 to $11.4 million in 2023). I suppose this follows from the company and its products maturing, and from a focus on cost efficiencies. At the same time, I don’t expect earnings to grow quite as much coming into 2025 and ahead as they did between 2022 and 2023. But given the growth drivers, it does seem likely it could reach double-digit growth rates in terms of earnings.

According to FactSet, the average forward P/E of the S&P 500 index is 19.7. The average growth rate of the S&P 500 components is 5%. While VirTra isn’t a component of the S&P 500, I do think the index can serve as a decent benchmark in terms of valuation metrics. Small-cap indices do exist – such as the S&P SmallCap 600 – but even that index has a market cap threshold of $1 billion. This is well above VirTra’s ~$185 million market cap. Because of this – and because I believe most investors, including myself, think of the S&P 500 as the “gold standard” of indices, and therefore the market to beat – I believe the S&P 500 is an appropriate benchmark.

VirTra currently trades at a forward P/E of 21.4. This is slightly above that of the S&P 500. But with higher expected (earnings) growth, I think VirTra should trade well above the average S&P 500 component.

Risks

I’ve personally held a portfolio of stocks – alongside my larger, general portfolio – based on the Seeking Alpha Quant system for a short while now.

VirTra recently made it into that portfolio. I’ve also written about another one that recently was a part of that portfolio. Performance for the portfolio has been quite satisfactory, and I’ve personally confirmed so far what Seeking Alpha brands the Quant system on: That it generally beats the market. One thing stands out too, however: Not every stock is going to outperform. This is a risk you must handle if you decide to start looking into stocks based on Quant screens.

You could handle this by diversifying and buying a portfolio of Quant stocks. Or you could, of course, examine the individual issue, in this case VirTra, based on more qualitative factors to gain a thorough understanding of the company.

If you do analyze VirTra on a company-specific level, I think the main risk facing VirTra is one that all defense contractors face: They depend largely on government spending. Given current military conflicts on the world stage, governments are currently focused in this area. But it’s always going to fluctuate, and until recently, it barely went anywhere. Between 2011 and 2015, US military spending even decreased. As a percentage of GDP, it’s been more or less stagnant for years. Any investor in VirTra must realize they are dealing with a business greatly influenced by these

Conclusion

VirTra is an atypical defense and law enforcement contractor that develops simulators for training.

It was recently rated “Strong Buy” by the Seeking Alpha Quant system. This points to the company showing some interesting signs in terms of the quantitative factors that make up its combined investment attributes.

The strong quantitative factors are supported by management’s initiatives to grow going forward: Production has been consolidated and streamlined. Sales efforts have been stepped up. And there’s a strong focus on gaining market share and expanding globally.

Even with the expected growth, the stock trades just slightly higher than the average S&P 500 stock in terms of FW P/E. This makes the valuation attractive to me.

For the reasons stated above, I rate VirTra a “Buy”.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Credit: Source link