OlenaMykhaylova

Utilities have been a solid, long-term investment for generations, and many writers, commentators, and investors here on Seeking Alpha and elsewhere are counting on the asset class to recover and resume its positive returns.

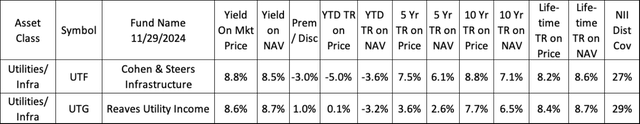

Many of us hold closed-end funds in the utility/infrastructure sector, with Cohen & Steers Infrastructure (NYSE:UTF) and Reaves Utility Income (NYSE:UTG) among the favorites. Both have good long-term records, with annualized lifetime total returns, since their inceptions in 2004, of 8.2% on market price and an even better 8.6% on NAV, for UTF; and 8.4% on market price and 8.7% on NAV, for UTG. UTG is especially highly regarded by investors for its history (until 2021) of steady dividend increases, with 12 of them in 17 years since its inception in 2004.

Although UTF and UTG have suffered during the recent downturn, they have both fared better than the overall utility sector. The SPDR Utilities ETF (XLU) has a negative total return of -8.5% for 2023 year-to-date, while the Dow Jones Utility Index (DJUTR) has a year-to-date total return of -8.3%, both of them somewhat worse than the UTG and UTF performances.

So it is not surprising that many investors have included UTG and UTF in their portfolios and are patiently waiting for the sector to turn around. What makes the wait somewhat easier to bear for some investors are the generous cash yields of 8.6% and 8.8% currently offered by UTG and UTF respectively. In fact, I suspect that one reason UTG and UTF may have performed somewhat better this past year than the indices that cover the same utility asset class could have something to do with the higher distribution rates; which may provide some comfort to UTG and UTF investors while they wait for the recovery. Investors in XLU may find the 3.4% yields the ETF pays to be less reassuring that a turn-around is close than the 8%+ yields of UTF and UTG.

Closed-End Fund Distributions: Not All the Same

Unfortunately, high distributions paid by closed-end funds in the midst of “losing streaks” in terms of their total return performance, are often not quite the positive sign for investors as they might appear. The reason, of course, has to do with the source of the funds’ distributions. Most closed-end fund investors know that their funds tend to fall into one of two categories with regard to where they get the cash to pay their distributions. They are either:

- Fixed income or credit funds (loans, bonds, preferred stock, etc.) where most or all of the total return comes from interest or other fixed payments that the capital of the fund generates on a recurring basis. For example, a high yield bond fund with $100 million in capital earns 10% interest (i.e. $10 million per annum). That $10 million, minus the expenses of running the fund, say 1% or $1 million, is all available to pay a fund distribution of 9%, or $9 million, without touching the original $100 million capital of the fund. That provides a certain stability to the fund’s distribution since the interest earned on the capital isn’t dependent on the capital increasing in value; nor is it at risk of shrinking merely because the fund’s capital might drop in value.

- Equity funds are in a different position since their cash income (dividends from the stock they own) usually amounts to a yield of only about 1-2%. That means an equity fund has to earn an additional 6-8% or more in order to achieve its total return target of 8-10% or whatever it is. With lifetime annual total return averages over 8%, both UTG and UTF have managed to do that for the past 20 years. But we haven’t seen that sort of performance in recent years, which raises the question: Where has the cash come from to pay the more recent dividends? The answer, of course, is that equity funds, even really good ones like UTG and UTF, have no choice but to invade their capital (“eat their seed corn”) if they want to keep their shareholders happy and continue making distribution payments during a downturn.

That practice is called “managing distributions” and many closed-end funds (primarily equity funds) do it in order to bridge periods when they are not earning enough income to support their distributions. It makes sense as a way to bridge the gap between profitable periods, but if the gap is too long it turns into “a bridge too far” and begins to eat away at the capital of the fund. Then some months later (or even years, but we hope not) when the market turns positive, the shareholders have less capital remaining in the fund and aren’t able to fully participate in the rally.

Investors who want to hold UTG, UTF, and other funds that they believe are good recovery candidates, and don’t want to erode their capital while they wait, have two options:

- Hang on to your UTG, UTF, and other equity funds that are paying generous dividends but not currently earning them, but be sure to reinvest the distributions, so your money stays in the fund and you’ll fully participate in the recovery when it comes.

- If you really need the income, and can’t afford to reinvest all or any of it, then consider swapping out your UTF, UTG, or similar equity funds for credit funds, many of which are themselves still underwater price-wise, selling at discounts and paying big distributions. But unlike equity funds, most credit funds are fully earning the cash they use to pay their distributions as part of their net investment income (“NII”). I think of that as their “business as usual” income because it flows in more or less automatically as interest on the debt they hold in their portfolio; and even if the market price of that debt drops, the cash income from it remains the same.

CEF Data is an excellent site for checking out closed-end funds (and also business development companies (“BDCs”) which have many similar characteristics) and includes the earnings coverage ratio of their distributions. Readers looking for credit funds that have 100% coverage (or close to it) of distributions, and whose payouts can be kept and not reinvested without fear of eroding the capital base, may wish to consider (1) Closed-End funds like Blackstone Long-Short Credit (BGX), Invesco Senior Income (VVR), Barings Participation Investors (MPV), or Oxford Lane Capital (OXLC), and (2) Business Development Companies like Ares Capital (ARCC), Barings BDC (BBDC) and Bain Capital Specialty Finance (BCSF).

When I introduced the Income Factory ten years ago I was quickly labeled a heretic. Now, many of my 14,500+ followers, readers of The Income Factory® (McGraw-Hill, 2020), and members of Inside the Income Factory say they sleep better through market downturns as they “create their own growth” and free themselves from being fixated with market ups and downs.

Here are some comments:

- “Learned the hard way how exceptional the Income Factory is”

- “As close to investment management heaven as one can get.”

- “Continues to be a killer bargain.”

- “Slept better through the bear market”

Click here to learn more.

Thanks,

Steven Bavaria

Credit: Source link