GOCMEN/iStock via Getty Images

Investment Thesis

Global X Uranium (NYSEARCA:URA) is an ETF that tracks uranium equities. Here I describe the reasons to be bullish on uranium, the key element in the generation of nuclear energy.

My analysis focuses on nuclear energy as a complement to green energy sources by offering a dependable and low-carbon energy solution that can work in tandem with renewables to meet our growing energy demands while minimizing our environmental impact.

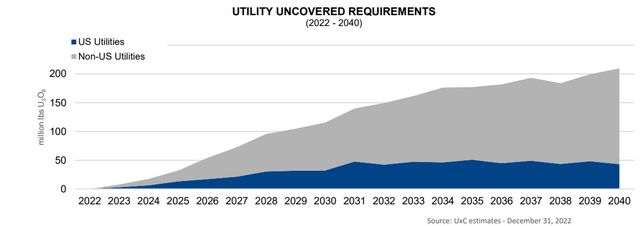

On this occasion, I haven’t focused my discussion on the supply-demand balance question facing uranium, but you can see this neatly described below in graphic form.

CCJ annual report

Uranium is used as fuel in nuclear reactors, and utilities require uranium to meet the increasing gap between supply and demand that is expected to build into the middle of this decade, highlighted above.

Without further ado, here’s why I’m bullish on ETF, while also noting its drawback.

Why Invest in Nuclear Energy?

I believe that nuclear energy has a crucial role to play in complementing green energy sources as we transition towards a more sustainable future. While renewable energy sources like solar and wind are undoubtedly vital, they do have limitations, such as intermittency and energy storage challenges. Nuclear power offers a compelling solution by providing a steady, low-carbon source of electricity.

I’ll repeat this for emphasis. Nuclear power can replace our use of fossil fuels because it has four criteria.

- Cheap.

- Flexible.

- Reliable.

- Scalable.

If you notice in the above 4 criteria, I could have said the same thing about fossil fuels. But nuclear energy brings one more important characteristic to the table, it’s a low-carbon source. This makes nuclear power an essential ally in our battle against climate change. By integrating nuclear energy into the energy supply sources, we can make substantial strides in reducing our carbon footprint while ensuring a consistent power supply.

Furthermore, nuclear power provides base load electricity generation, contributing to grid stability. While renewables rely on weather conditions, nuclear reactors can operate continuously, delivering a reliable source of electricity day and night. This reliability is crucial for balancing the grid and ensuring a consistent power supply, even when renewable sources face fluctuations in generation.

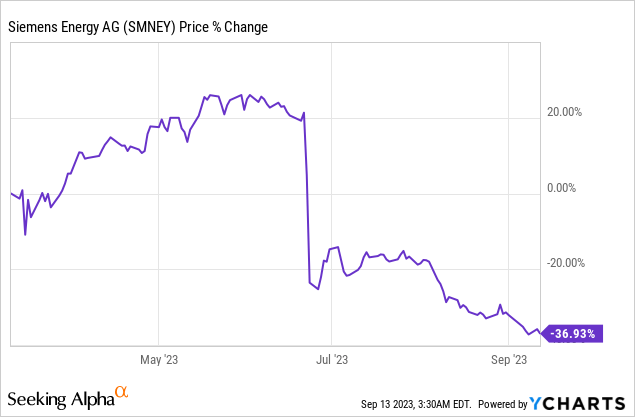

What’s more, above we see Siemens Energy’s (OTCPK:SMNEY) share price, one of the biggest manufacturers of wind turbines.

Wind turbines, despite their potential for generating renewable energy, often face economic challenges that hinder their viability for a complete energy transition. Yes, I’ve singled out Siemens, but you may read around, that the impact is broad across both onshore and offshore wind turbines. On top of that, putting aside the high upfront costs, maintaining wind turbines can be prohibitively high.

However, I believe one of the biggest problems facing both solar and wind turbines is its struggle with electrical grid integration. This is something that I believe is missing from the discussion at a high level.

Everyone is focusing on renewable energy’s lack of reliability to consistently produce energy, but too few are considering the substantial amount of energy storage solutions required to make the system viable.

Also, nuclear energy enhances energy security by diversifying our energy sources. What I’m describing here is incorporating nuclear power into our energy mix, can bolster our energy resilience, and reduce our reliance on fossil fuels.

Why Invest in Global X Uranium?

Global X Uranium is an ETF that provides investors with exposure to companies involved in the uranium mining industry. By investing in this ETF, investors can gain exposure to the uranium industry without directly owning the underlying stocks of individual companies. The upside here is obvious, it’s a case of diversification that helps spread the risk while offering the potential growth of the nuclear energy sector.

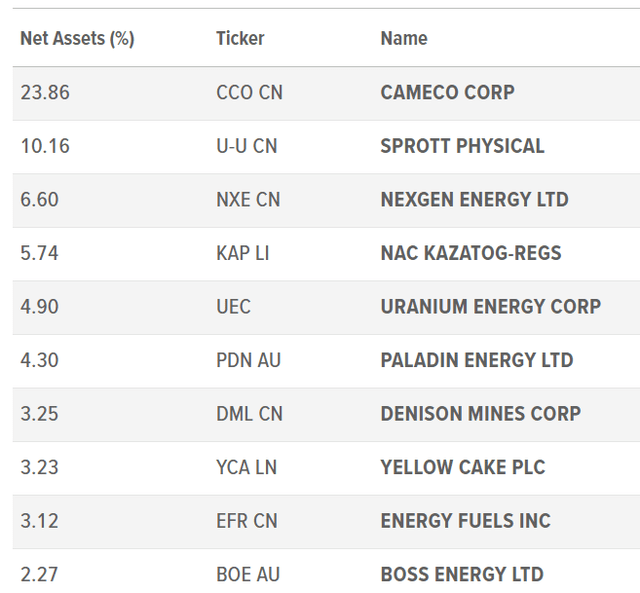

URA ETF Top 10 holdings

As you can see above, nearly a quarter of this ETF is made up of Cameco (CCJ). Consequently, if Cameco continues to perform strongly, this ETF will also perform strongly.

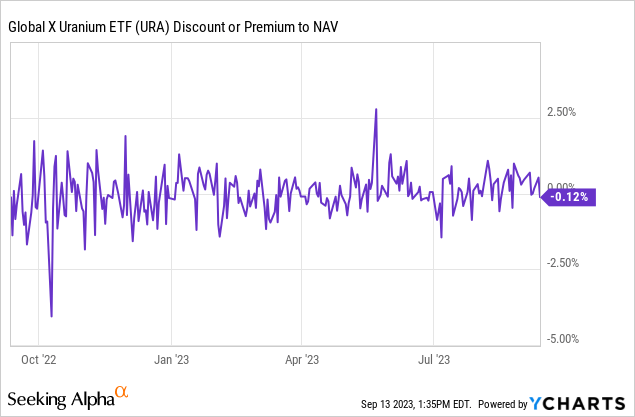

Is URA Undervalued?

It depends on one’s view of uranium. Recall, that many of the companies in the EFT, outside Cameco and Kazatomprom (the world’s biggest uranium producer) are not in production at this point. This means they have no revenues (or profits). Investors are buying into the future prospects of uranium.

What are the Drawbacks of Investing in Global X Uranium?

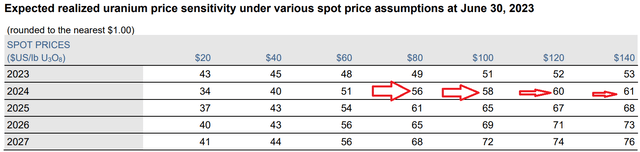

I’ve alluded to this above. Now to make it more explicit. Cameco is a great business. But they hedge their production to uranium prices, see below.

CCJ Q2 2023

There are some ladders built into Cameco’s long-term contracts, but for the most part, even if uranium prices were to soar beyond $80 per lb in 2024, Cameco’s operations wouldn’t benefit tremendously.

Personally, I’ve sought to invest in Uranium Energy Corporation (UEC), as that business is fully unhedged. But as you know, that implies substantial volatility. Something you will not get with URA.

The Bottom Line

I’m bullish on Global X Uranium (URA). The rationale behind my optimism centers on nuclear energy’s pivotal role as a complementary source of green energy. While renewables like solar and wind are crucial, they face limitations like intermittency and storage challenges.

Investing in Global X Uranium allows exposure to the uranium mining industry without directly owning individual company stocks. This ETF’s diversification spreads risk while capitalizing on the potential growth of the nuclear energy sector. It’s important to note that a significant portion of this ETF is tied to Cameco, which can positively impact URA’s performance if Cameco continues to perform well. However, one drawback of investing in Global X Uranium is that it may not benefit significantly from surging uranium prices due to its hedging. For those seeking less hedged exposure, businesses like Uranium Energy Corporation (UEC) might be worth considering, although they will come with greater volatility than URA. It very much depends on one’s risk appetite and tolerance.

Credit: Source link