jetcityimage

Investment Thesis

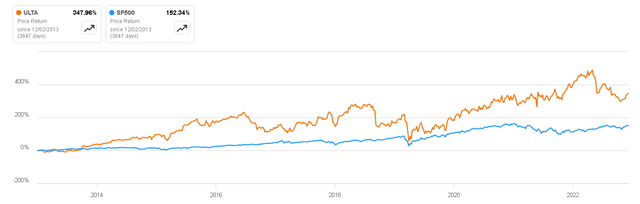

Ulta Beauty (NASDAQ:ULTA) stands out as a company with a remarkable historical performance, consistently showcasing robust financial strength year after year. This is not what one would expect from a retail business, which often entails low competitive advantages, narrow margins and revenues closely linked to discretionary consumption.

Acknowledging Ulta’s significant position in the market is evident from a glance at the stock chart and financial statements. However, it’s equally crucial to delve into the intricacies of how Ulta has achieved and sustained such prominence, setting it apart from other retailers. This article aims to unravel the positive structural characteristics of both the business and the sector, providing a comprehensive understanding. This deeper insight equips us to seize opportunities when Ulta shares are presented at an attractive price, as is the case currently, in my belief.

Ulta Beauty Performance (Seeking Alpha)

Business Model

Ulta Beauty, a prominent chain of beauty stores in the United States, boasts a diverse range of offerings, encompassing cosmetics, skincare, haircare, and fragrance products. Setting itself apart, Ulta Beauty stores showcase both high-end and drugstore brands, catering to a wide spectrum of beauty enthusiasts seeking products at various price points.

Notably, Ulta Beauty stores extend beyond mere retail spaces, often incorporating salon services such as haircuts, styling, and beauty treatments. This multi-channel approach allows customers the flexibility to make purchases either in-store or online. Over time, Ulta Beauty has solidified its position as one of the largest beauty retailers in the United States, recognized for its expansive product selection and rewarding loyalty program designed for frequent shoppers.

Now, let’s delve into key aspects of Ulta’s business model that contribute to its success and explore why this momentum might continue for years to come.

Selling Third-Party Products: Not a Risk

Ulta Beauty has established a substantial presence in the retail sector through its exclusive ‘Ulta Beauty Collection’ line. This plays a crucial role in the retail landscape because own products generate notably higher profit margins than selling third-party products. Still, the majority of ULTA’s revenue is derived from the sale of third-party products, leading to initial concerns about the potential risk of suppliers bypassing the middleman to sell directly to consumers. However, the beauty market possesses structural nuances that complicate this scenario.

Firstly, women often prefer different brands for various beauty products, akin to the diverse choices made while shopping in a supermarket. Not all products purchased by a consumer are sourced from a single supplier. Consequently, it becomes challenging for customers, particularly women in this hypothetical example, to navigate from store to store searching for each brand. Ulta, acting as a supermarket for beauty products, provides a one-stop destination where customers can access a variety of products from the best brands. This centralized approach facilitates easy comparison of prices and specifications.

Beauty Product Manufacturers (Avery Mae Beauty)

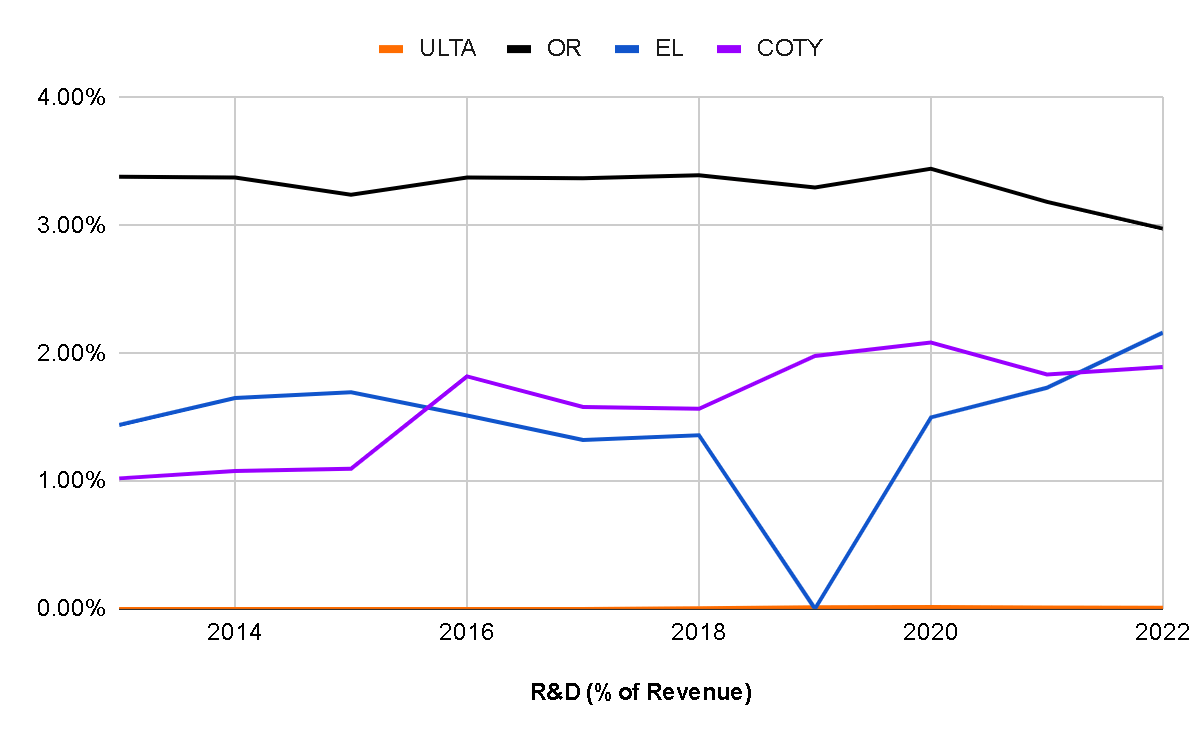

Another challenge arises in the highly competitive nature of the beauty market. To thrive, brands must continually invest in Research and Development to introduce innovative products and employ effective marketing strategies to reach consumers. Conversely, Ulta primarily focuses on expanding its store network to enhance scale and acquiring top fashion brands to drive traffic.

The accompanying graph illustrates that, while L’Oreal or Coty allocate between 1 and 4% of their revenue exclusively to Research and Development (R&D), Ulta invests minimally in this area. Therefore, attempting to sideline Ulta by merely opening one’s stores poses a significant risk to one’s market position. This is because such a strategy would require allocating resources to finding the best locations and opening stores, all while continuing to invest in innovation and marketing. It underscores the delicate balance that companies in the beauty industry must strike, as success hinges not only on retail presence but also on sustained efforts in research, development, and effective marketing strategies.

Author’s Representation

Online Stores: Not a Replacement

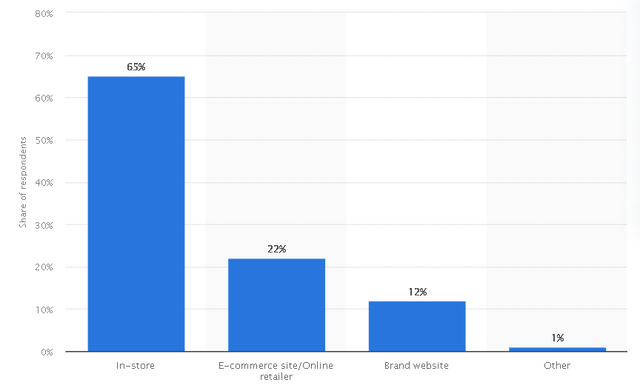

This then raises another question: What would happen to online stores? In theory, an online store offers the convenience of allowing beauty product consumers to purchase every product from every brand, eliminating the need to visit multiple physical stores. However, there is a crucial nuance – before buying a beauty product, such as a face powder or blush, consumers often want to ensure a perfect match to their skin tone or personally check the color. This nuance is reflected in a 2022 survey conducted by Statista, which, even considering the post-COVID e-commerce boom, revealed that 65% of respondents still consider In-Store shopping as their favorite channel for purchasing beauty products. And expectations for subsequent years suggest that e-commerce penetration will remain relatively low.

Statista

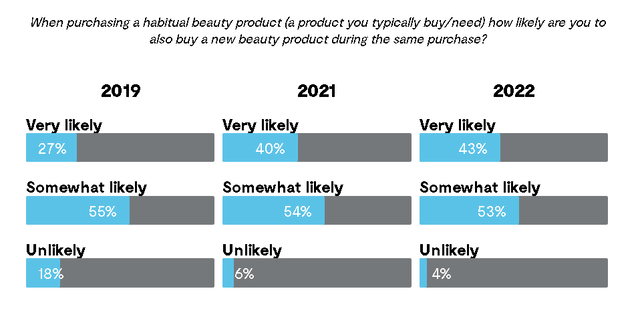

Moreover, the purchasing experience plays a significant role for consumers. E-commerce struggles to replicate the immersive experience of visiting a physical store, where customers can explore a wide variety of colors, scents, and products. The tactile and sensory aspects of the in-store experience contribute to its enduring appeal in the beauty industry and additionally, at Ulta, the staff assists you in finding the perfect makeup for your needs and provides recommendations, which you wouldn’t have when buying online and is very important, since in this Power Reviews study, 43% of those surveyed responded that when they’re purchasing a usual product, they’re somewhat likely to also buy a new product, too

Power Reviews

Superior Quality than Other Retailers

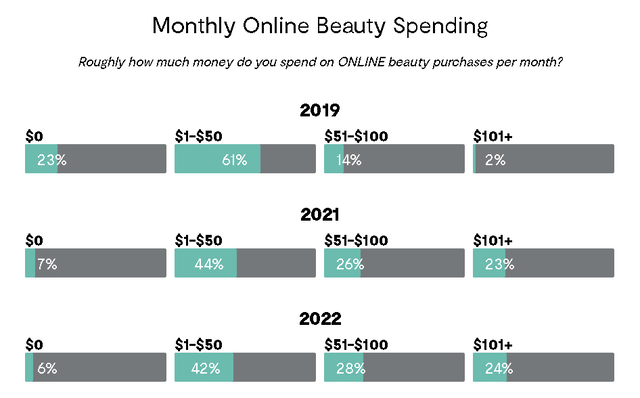

Finally, another characteristic that sets Ulta Beauty apart from retailers like Foot Locker or Target is the prevalence of quasi-recurring purchases in the beauty products category. Returning to the Power Reviews study, in 2022, only 6% of respondents reported spending $0 per month on beauty products. This implies that 94% of the sample invests at least $1 per month in beauty products, indicating a relatively recurring nature of these purchases. While not obligatory through contracts or subscriptions, they exhibit a notable frequency. The rationale behind this is quite intuitive: women are unlikely to forgo makeup and personal care, even in periods of economic recession or high inflation.

Power Reviews

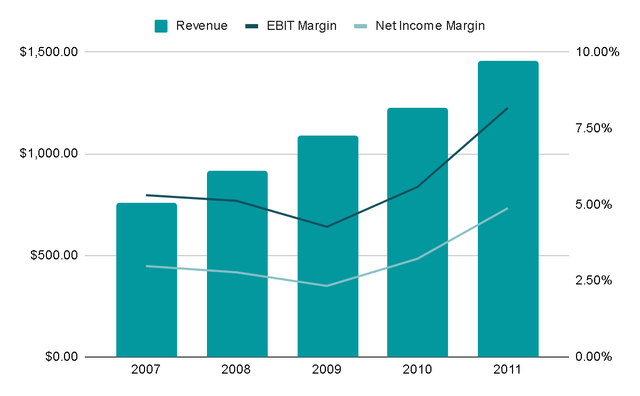

Examining the impact of the 2008 crisis, a significant benchmark for assessing business performance during crises affecting discretionary consumption, Ulta exhibited resilience. Throughout the worst phase of the crisis, it achieved a 19% growth, and its operating margins, while declining from 17% to 4.3%, remained comparatively robust at a challenging time.

Much of this resilience is because Ulta, unlike brands like Sephora or drugstores like CVS, offers beauty products for all price ranges. Therefore, during a time of economic prosperity, consumers can buy high-priced products, but during a crisis they can opt for cheaper brands, making Ulta Beauty their all-weather supplier.

Author’s Representation

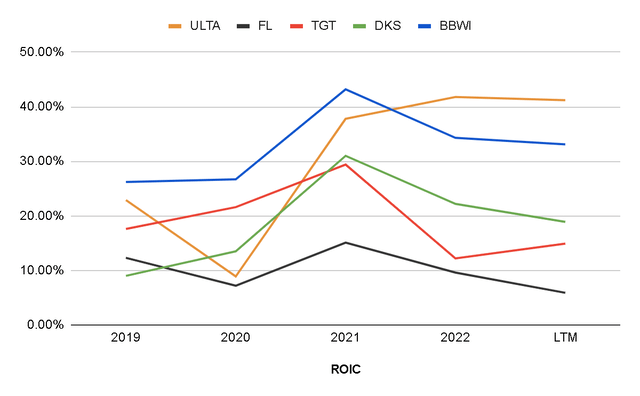

This resilience might explain why, when analyzing the Return on Invested Capital of various retailers, a noticeable trend emerges. In 2021, as the US government injected money into the system and reduced interest rates, these companies experienced a considerable boost in returns. However, over the last twelve months, most have seen a normalization – except for Ulta, which has maintained a distinct trajectory.

Moreover, in the third quarter, as reported on November 30, the company exhibited its skill in navigating through challenges posed by inflation and an economic slowdown with apparent ease. Currently, the company anticipates a growth rate between 9% and 10%, as per the latest guidance, an impressive projection even when compared to the previous year’s substantial 18% growth, given the challenging comparable base.

Author’s Representation

Key Ratios

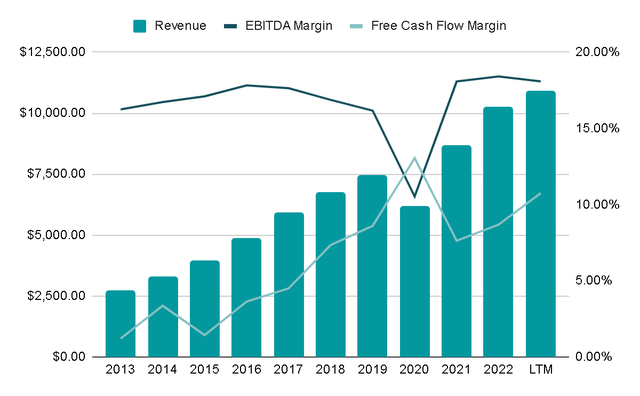

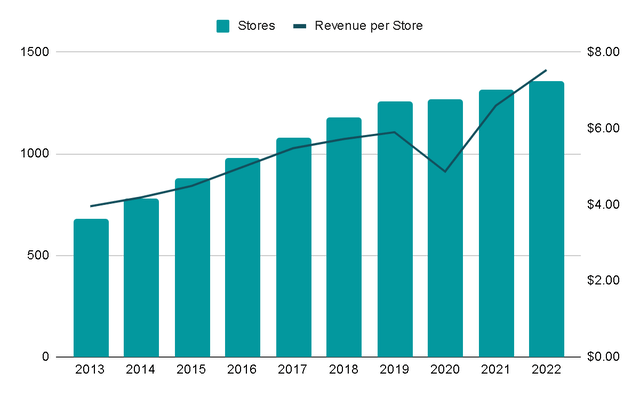

Transitioning to the numerical aspect, we can substantiate all the points discussed in the ‘Business Overview’ segment. For instance, we now comprehend the rationale behind the company’s remarkable 15% growth over the last decade, a notable feat for a retail business that might initially seem to possess limited competitive advantages (which, as we have explored, is not accurate).

It is particularly noteworthy that the company’s margins have shown remarkable resilience throughout this year. Not only has Ulta Beauty sustained its growth, but it has also done so with increased profitability compared to the previous year, as evidenced by the Free Cash Flow margin.

Author’s Representation

This growth is attributable not only to the expansion in the number of stores but also to an increase in revenue per store. It’s essential to highlight that the company is experiencing organic growth. This metric can be enhanced through strategic price adjustments in line with inflation or by encouraging consumers to spend more during each visit through refined marketing strategies.

As per the latest guidance, the company anticipates a robust growth in comparable sales, ranging between 5% and 5.5%, which appears highly positive.

Author’s Representation

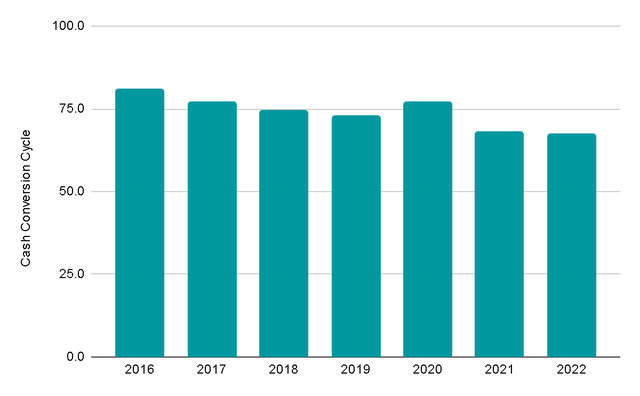

One key factor contributing to the significant expansion of margins is the consistent scale that the company has achieved over the years. This scaling effect not only fortifies Ulta Beauty’s market presence but also enhances its ability to negotiate more favorable terms with suppliers.

This operational efficiency is further underscored by examining the company’s Cash Conversion Cycle, a metric that gauges the number of days it takes for Ulta to collect payment for its inventory from the time it pays for it. Notably, this ratio has decreased from nearly 80 days in 2016 to the current 65 days. The improved management of working capital is directly linked to the augmented Free Cash Flow observed.

Author’s Representation

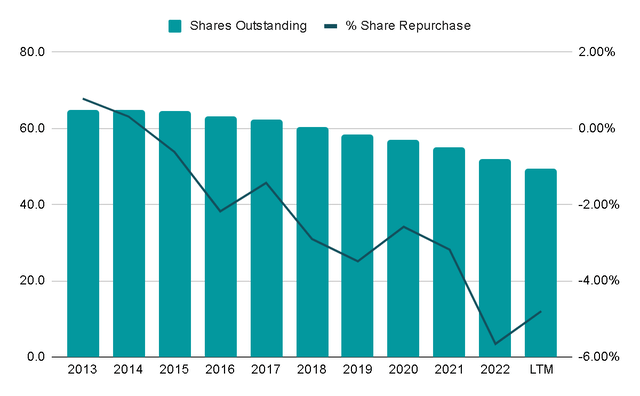

Finally, a noteworthy point is the company’s aggressive share repurchase strategy in recent years. This aggressive approach, especially during times of significant price fluctuations, underscores a capital allocation policy that is favorable to investors. This proactive stance in repurchasing shares demonstrates the company’s commitment to optimizing shareholder value.

Author’s Representation

Valuation

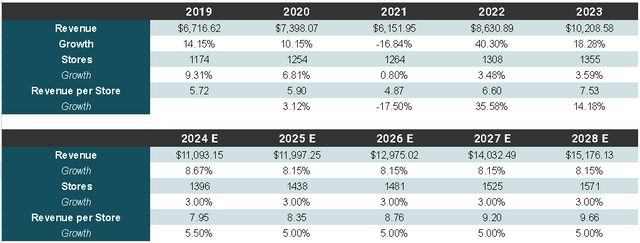

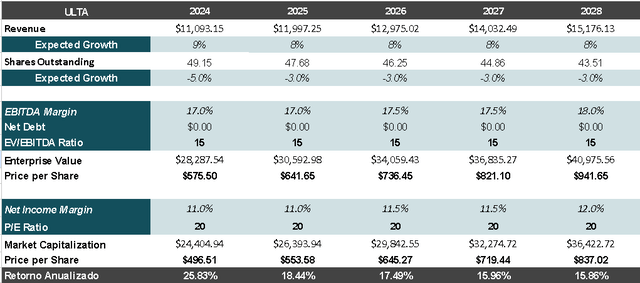

To gauge Ulta’s intrinsic value, I’ve undertaken a valuation based on two pivotal Key Performance Indicators (KPIs): the continuous expansion of the store network and the increasing profitability of each store. For context, over the past decade, the store count has grown at an annual rate of 8%, while revenue per store has seen a growth of 7.5% during the same period.

My assumptions for this valuation are that the number of stores will experience an annual growth of at least 3%, reaching 1,500 by fiscal year 2028 (the lower end of the guidance provided by management). This expansion will be complemented by a 5% annual growth in revenue per store, resulting in a cumulative sales growth rate of 8% annually over the next five years.

Author’s Representation

Moreover, I anticipate the company will persist in its annual share repurchase strategy, aiming for rates around 3%. For the current year, an estimated repurchase of about 5% of outstanding shares seems reasonable, aligning with trends observed over the last twelve months. Additionally, a modest increase in margins is anticipated, with EBITDA reaching 18% and Free Cash Flow reaching 11% over the next five years.

With these assumptions and applying valuation multiples of 15x EV/EBITDA and 20x EV/FCF, a potential share price of approximately $800 by 2028 is suggested. This projection implies a compound annual return of nearly 16% from the closing trade day price of $425. This valuation is considered conservative, given the likelihood of reaching the guided figures of $11.10 billion in revenue, $1.88 billion in EBITDA, and an EPS of $25.50.

Author’s Representation

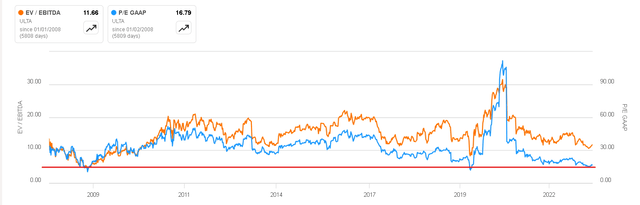

The valuation multiples were chosen according to the historical average and currently, we can notice how the PER would be at historical lows reached only during the worst of 2008 and during the COVID-19 crash.

Seeking Alpha

Risk Factors

While we have addressed several factors in this article that I don’t consider genuine risks, there are two specific concerns for the future:

- Growth: Ulta Beauty, being a substantial company, may face challenges in sustaining its growth trajectory. Although there is still room for expansion in the United States, there might be a point where the domestic market reaches saturation and currently, the company does not operate in any other country.

- Geographic Expansion: This concern stems from the growth issue. While Mexico and Canada present themselves as markets with similarities to the USA and could serve as viable options for geographical expansion, such a move requires significant resources. Poorly managed expansion efforts could potentially harm the company’s financial health and competitive standing.

In light of these concerns, I advocate for the exploration of international expansion through franchising. This approach could mitigate the risks associated with opening and operating new stores in unfamiliar geographic areas, offering a more strategic and potentially less resource-intensive avenue for growth.

Final Thoughts

It seems to me that the market is not fully appreciating the resilience of Ulta Beauty’s business and is underestimating the challenges inherent in disrupting this sector. Whether it’s an e-commerce player or established cosmetics companies like L’Oreal and Estee Lauder attempting to sell directly to consumers through their own stores, the hurdles are substantial. To match Ulta’s extensive network of over 1,400 stores, a competitor would face a considerable initial investment, with a cost per new store amounting to $1.7 million (based on figures shared by Ulta). Ignoring the complexity of securing optimal locations, the total investment would soar to a substantial $2.4 billion. Moreover, such expansion is not a swift undertaking, and success is far from guaranteed.

This underestimation significantly contributes to the current attractiveness of Ulta’s valuation, especially when considering the company’s proven stability, even amid the challenges of the 2008 crisis and current environment. Achieving a nearly 16% return in such a stable company, with a low risk of disruption, holding a leadership position in its sector, and boasting high returns on invested capital, makes it an incredibly compelling investment option. Hence, I believe the company is currently a ‘buy.‘

Credit: Source link