Orbon Alija/E+ via Getty Images

Ubiquiti (NYSE:UI) has shown great returns overall but a deeper look suggests that the stock’s returns are fueled by the heavy use of debt. The company has been generous in the past with its stock buybacks and dividends but it is not sustainable in the long run. Going forward, the company has limited options and its priority would be to shore up its balance sheet which may harm the very nature of its returns. The high valuation is still too optimistic of the future and it is highly likely that an investor would find better returns outside of this stock.

Performance

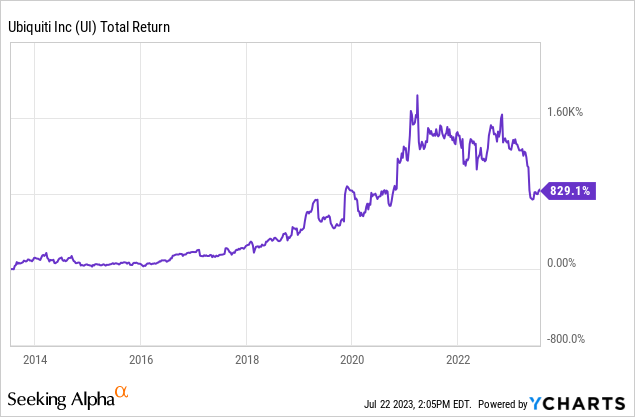

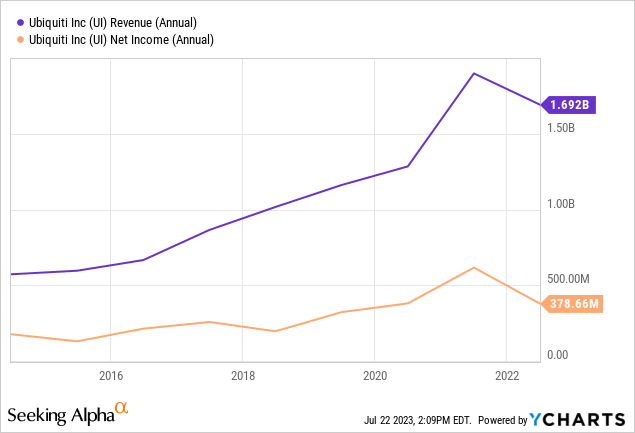

Over the last ten years, the company has returned more than 800% backed up by sufficient revenue and net income increases. We have seen both of these dip in the last year, followed by a drop in the stock price. But a major part of these returns has been boosted by dividends and stock buybacks.

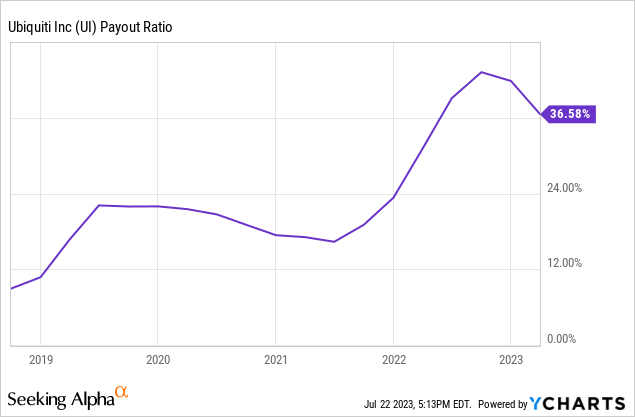

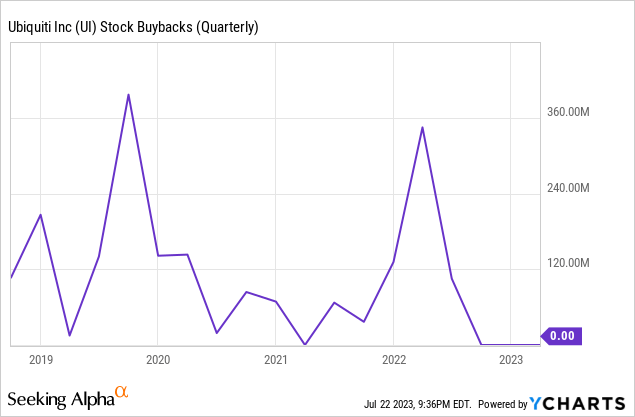

The high payout ratio suggests that a big proportion of earnings is being paid out to shareholders in the form of dividends. The company has also been quite aggressive with its stock buybacks and has managed to bring down its share count by more than 20% in the last five years.

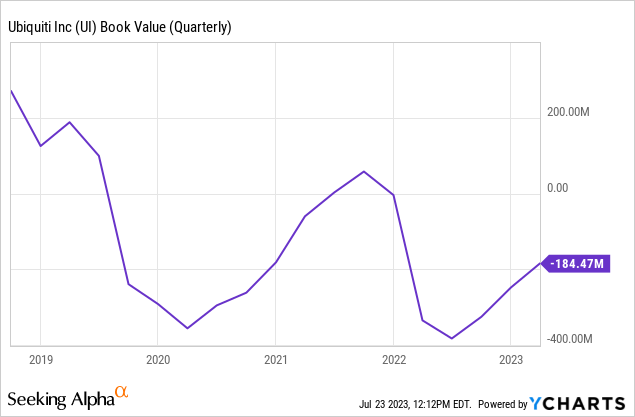

Role of Debt

Normally, I like these moves from the company when they were funded through excess operational cash flows and can continue to be funded through cash flows. But the high debt levels are concerning. Debt can play many roles in a business and I become particularly wary of situations where I see dividends and stock buybacks followed by negative equity. Internal cash flows have certainly not been able to cover the company’s dividends and stock buybacks (In 2022 alone, the company spent close to $750M more than twice its OCF)

Snapshot of Cash Flow Statement (Seeking Alpha Financial Pages)

When we see the operational cash flow, debt, stock buyback, and dividends through the lens of the company’s equity we observe that there is a clear imbalance here.

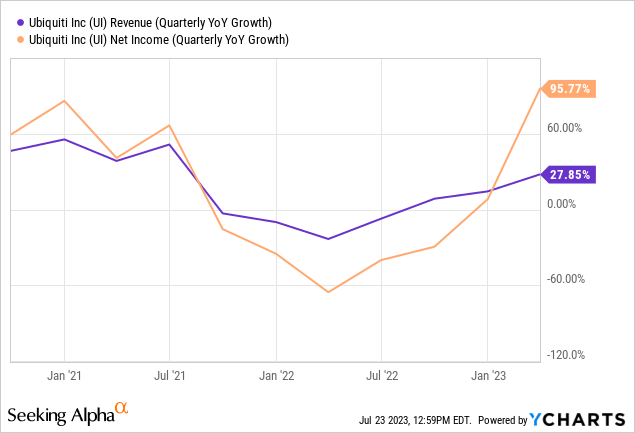

Recent quarters

It is encouraging to see that the company has prioritized its balance sheet and its equity is improving. Recent quarters showed a jump in revenues and net income which was mainly possible as the company was coming off of a bad 2022.

Multiple reasons led to a bad 2022 including a supply chain crisis and a pandemic blow over. So this puts us back to the levels last seen in 2021. It would be prudent to be cautious and wait for the next few quarters to see where this is trending.

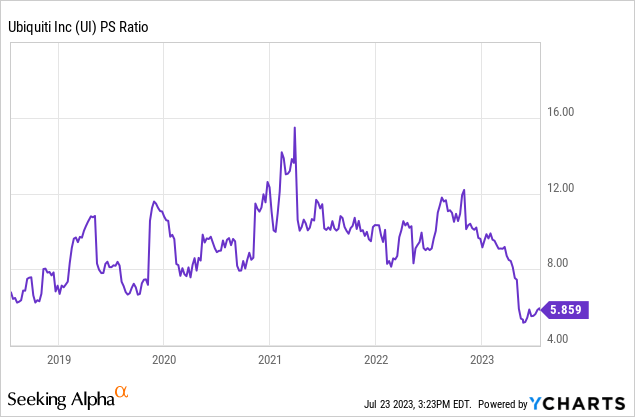

Disconnected Valuation

Bearing the current financials of the company in mind, the current valuation of the company cannot be justified. As we saw earlier, the negative stockholders’ equity means the book value ratio becomes meaningless. The company’s earnings haven’t recovered well enough which results in a PE of 28x.

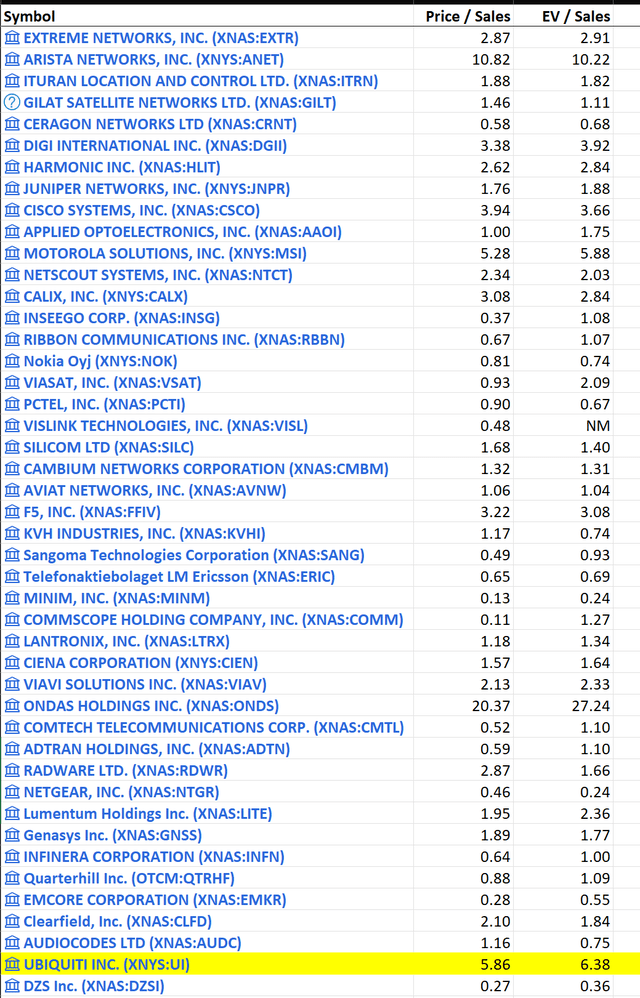

Sales Multiple Industry Peer Comparison (Seeking Alpha)

The industry PS average is 2x and EV/Sales average is 2.3x. At a current Sales multiple of 5.8x, the market sees a lot of potential in the stock when compared to other firms in the industry. When this expectation is not met there is likely to be another valuation reset (We saw one earlier instance of a big reset in valuation in 2023 but the valuation is still far from its peers)

Tying up everything together

I rate this company as a Sell. The stock’s meteoric returns in the past have been aided by the company’s generous stock buybacks and dividends. We saw that the company went increasingly into debt in the course of this journey but going forward there are limited options for the company to explore. It may not be feasible to pursue the same options to boost the return for shareholders as earlier due to limited publicly available float and increasing dividends would further strain the company’s financials. In my opinion, the only option is to grow the company organically but as of now, there is no concrete way to say if this will occur (It may even be argued that the grim economic forecast may affect Ubiquiti). From a sales and profitability standpoint, the trend is flat for the last few fiscal years which again does not give us too much hope. A recent reset in valuation does not mean we will not see another one. The company is still overvalued and any mediocre quarter will trigger another reset in valuation. If the valuation gets more aligned with the industry average it would not be surprising to see the stock correct more than 50%.

When would this thesis be wrong?

The company’s rebound from a bad year is quite strong and if this keeps up it would be able to significantly improve its financial health. The company provides wired and wireless network infrastructure and supporting software that is closely tied to internet usage all over the world. Wired networks have high costs and long lead times, limiting their use in underserved areas but wireless networks are a more appealing option to provide broadband access in both emerging and developed regions. The company has a great focus on wireless solutions so that leaves them with a huge addressable market. If Ubiquiti’s solutions are preferred over its competitors it may very well see the growth that it needs to justify the current stock price.

Credit: Source link