Georgijevic/E+ via Getty Images

By James Knightley, Chief International Economist

Entertainment drives a strong summer for services

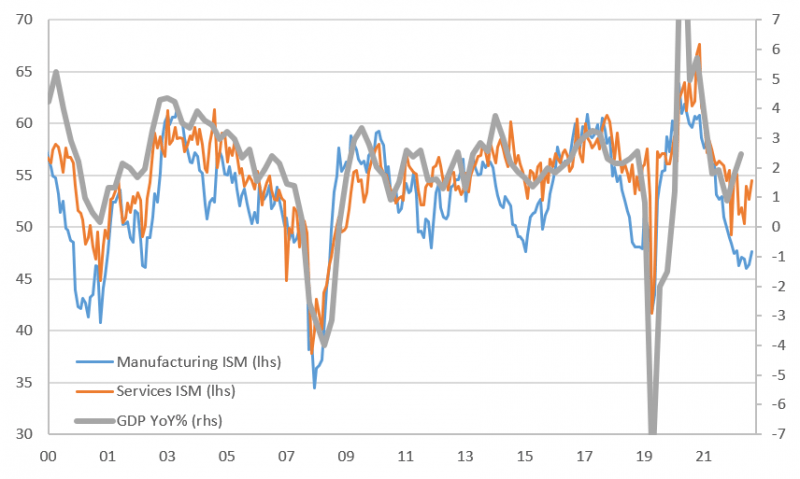

The US ISM services index was surprisingly strong in August, rising to 54.5 from 52.7. This is well ahead of the 52.5 consensus expectation and in fact above every single forecast submitted by economists, leaving the index at a six-month high. Activity improved to 57.3 from 57.1, new orders jumped to 57.5 from 55.0 while employment rose to 54.7 from 50.7, indicating broad-based strength throughout the report. It may well be that the summer entertainment boon has been a big factor with concerts and cinemas pulling in record revenues and ancillary businesses feeling the benefits too. Nonetheless, as the chart shows, the headline reading is still at levels that would historically point to lower YoY GDP growth than the 2.5% recorded in the second quarter.

US ISM indices and US GDP growth (YoY%)

Macrobond, ING

Inflation concerns to keep the hawks wary amid data uncertainty

The prices paid component rising to 58.9 from 56.8 is a concern though and is likely to keep the hawks wary even if there does seem to be a consensus amongst Federal Reserve officials that it can afford to pause in September and assess the situation again in November. Interestingly, S&P’s PMI measure for services, also released this morning, told a very different story. The headline index dropped sharply to 50.5 from 52.3, indicating barely any growth with its employment measure weakening and its prices measure recording their lowest reading since February. Just shows you how tricky it is to get a clear reading of what is going on in the economy right now and reinforces the view that a pause at the September FOMC makes sense.

Content Disclaimer

This publication has been prepared by ING solely for information purposes irrespective of a particular user’s means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Credit: Source link