Oat_Phawat

Triple Flag Precious Metals Corp (NYSE:TFPM) reported its first quarter results, highlighted by strong growth and climbing profitability.

The timing of an ongoing ramp-up in gold-equivalent ounces (GEOs) sales from the group’s streaming and royalties portfolio has benefited from the favorable metals pricing environment.

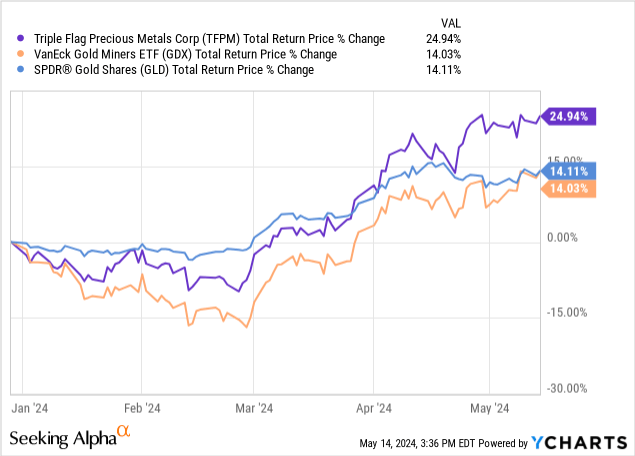

Shares of TFPM have returned 25% year to date, outperforming the price of gold (GLD) and precious metals mining benchmarks like the VanEck Gold Miners ETF (GDX).

Indeed, with the price of gold at a record high and silver gaining momentum, the setup here is a positive outlook and tailwind for this stock. We like TFPM’s high-quality profile and see room for the rally to continue.

TFPM Q1 Earnings Recap

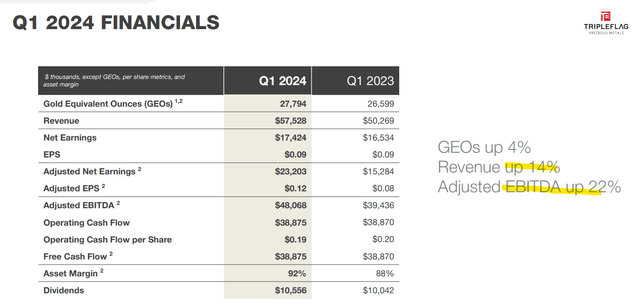

TFPM Q1 EPS of $0.12 was up from $0.08 in the period last year. Total revenue of $57.5 million represented an increase of 14% year-over-year. This was driven by a record 27.8k GEOs sold, an increase of 4.5% y/y, coupled with a higher average gold price per ounce of $2,070, compared to $1,890 in the period last year. That momentum allowed adjusted EBITDA to reach $48.1 million, up 22% y/y.

Notably, Q2 gold prices are averaging over $2,300 per ounce, which offers a runway for further earnings gains into the second half of the year.

source: company IR

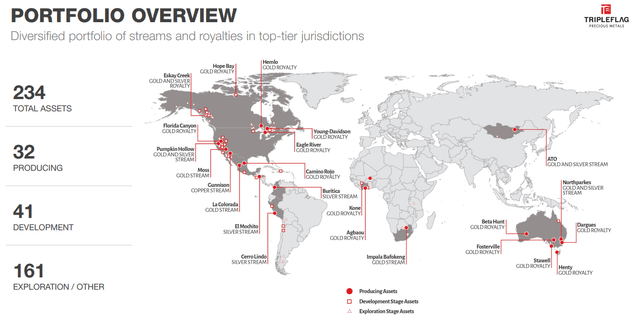

The big story in Q1 was the strong performance from the Northparkes asset, a 54% gold stream and 80% silver stream, operated by Evolution Mining Ltd. (OTCPK:CAHPF).

The open-pit mine in New South Wales, Australia generated sales of 6,286 GEOs, up 89% sequentially from Q4 2023 as it began processing higher-gold-grade ores.

The company is looking forward to a feasibility study for the “E22 underground orebody” expected to be released this quarter. The idea here is that the future expansion of operations will add a new growth driver over the next several years.

Northparkes helped balance weaker trends from other assets, notably the “Beta Hunt” asset operated by Karora Resources Inc. (OTCQX:KRRGF) impacted by inclement weather during the quarter.

source: company IR

A key update this quarter was the favorable settlement to resolve a litigation dispute regarding royalty terms held by Triple Flat at the “Kensington” gold mine in Alaska, operated by Coeur Mining Inc. (CDE).

According to the terms, the company received 737k shares of CDE, with a market value of approximately $3.8 million, that has already been divested in the current Q2. Triple Flag will also receive another $3.75 million in CDE shares in 2025.

The inflow adds to the cash position that ended the quarter at $29 million against $60 million in total debt. Considering the adjusted EBITDA annual run rate approaching $200 million, or even the $38 million in free cash flow last quarter, we view the balance sheet as a strong point in the company’s investment profile.

On this point, Triple Flag has been active with share repurchases, buying back $3.6 million in stock in Q1. The company also distributes a quarterly dividend with the current rate of $0.0525 per share, representing a modest yield of 1.3%.

What’s Next For TFPM?

The attraction of Triple Flag comes down to its globally diversified profile and pure-play exposure to precious metals. The company notes that its 98% exposure to precious metals stands out in the sector compared to other streamers that also deal with industrial metal contracts.

The 64% gold and 34% silver split in revenues is particularly compelling given the current market pricing action as a tailwind for results going forward.

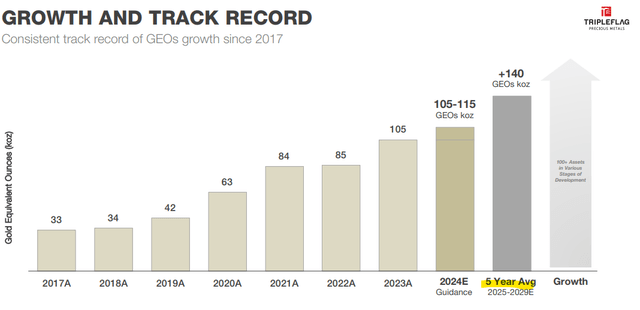

Management is reiterating its full-year guidance of 100-115k GEOs, marking the eighth consecutive year of an annual increase. The expectation is for earnings to be leveraged even higher.

The company is also targeting GEOs to reach 140k as a 5-year average between 2025 and 2029, based on additional projects in various stages of development coming online.

source: company IR

Overall, there’s a lot to like about Triple Flag, which appears to be hitting its operational and financial stride at an excellent moment in the market.

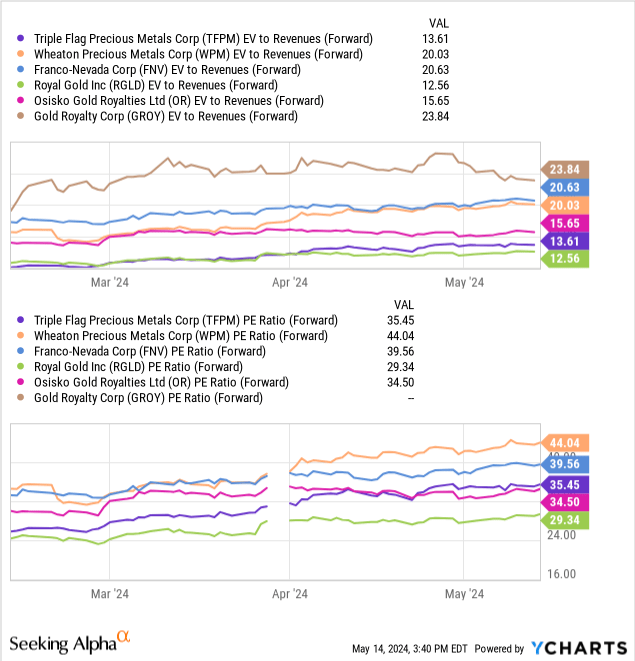

As it relates to valuation, we note that TFPM trading at 13.6x sales is at a discount to larger streaming and royalties peers like Wheaton Precious Metals Corp. (WPM) or Franco-Nevada Corp. (FNV) with a multiple closer to 20x. TFPM also appears reasonably priced through its forward P/E multiple of 35x which compares to WPM at 44x and FNV at 40x.

Ultimately, it’s going to be the direction of precious metals prices that will drive the stock, but some incremental gain with room for the valuation multiples to expand should add to the upside potential.

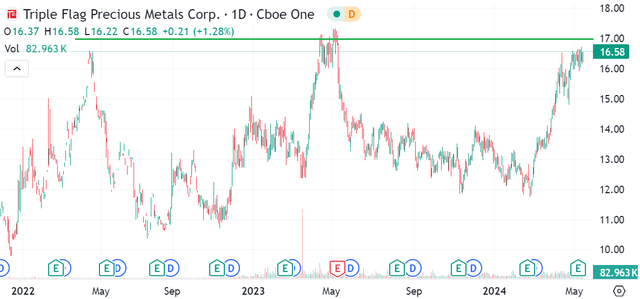

With shares approaching a multi-year high of above $16.50, there’s a good chance the momentum can continue as gold and silver prices remain elevated. The environment of stubbornly high inflation and uncertainty regarding the strength of the global economy have allowed gold and silver to gain as a safe-haven, which we expect to continue.

Seeking Alpha

Final Thoughts

We rate TFPM as a buy with an initial price target of $20.00 allowing its valuation premium to converge with sector leaders like WPM and FNV. Longer-term, the upside is only constrained by how high gold and silver can climb during this bull run.

At the same time, the main risk to consider would be a prolonged correction in metals prices for any number of reasons. Weaker-than-expected results or a major setback at one of the key mining assets could open the door for a selloff in the stock. Monitoring points over the next few quarters include the GEO metric as well as free cash trends.

Credit: Source link