Dragon Claws

REITs are often thought of in a monolithic fashion. A piece of economic news will come out and a pundit on CNBC will say:

“That’s good for REITs”

I find that to be an odd perspective because there are so many distinct property types within REITs and any given piece of news impacts each property type differently.

So I’m seeing that same piece of news and thinking:

“That’s good for this handful of property types, neutral for another property type and bad for a particular subset.”

I suppose on a weighted average basis that would mean it is good for REITs broadly, but that broad brushstroke view loses so much granularity.

With so much of the market viewing REITs from that thousand-foot perspective, there is often substantial mispricing between the property types. Fundamental strengths and weaknesses are not properly priced in, leaving some sectors substantially overvalued and others significantly undervalued. Below is the average (unweighted mean) AFFO multiple of each major REIT property sector.

- Hotel – 10.6X AFFO.

- Diversified – 13.8X AFFO.

- Office – 14.5X AFFO.

- Healthcare – 14.9X AFFO.

- Retail – 16.7X AFFO.

- Tower – 18.2X AFFO.

- Apartments – 18.9X AFFO.

- Industrial – 20.0X AFFO.

- Storage – 20.4X AFFO.

- Manufactured Housing – 21.6X AFFO.

- Single Family Rental – 21.7X AFFO.

- Data Center – 24.37X AFFO.

- Timber – 27.4X AFFO.

- Farmland – 39.23X AFFO.

7 sectors are below 20X and the other 7 at or above 20X. This article will focus on the sectors trading at a premium, and we will follow up later with an analysis of the discounted sectors.

If each sector were priced correctly, the higher multiple sectors would have faster growth and/or lower risk. Think of the multiple as the bar a given REIT’s fundamentals have to hurdle. The higher the multiple, the better the fundamentals have to be to justify it.

As we discuss each sector, the goal is to discuss broad over or undervaluation as well as to point out anomalous pricing within the sectors.

Industrial REITs

At 20X AFFO, Industrial is the cheapest of the premium sectors, which would not have been the case until recently. Relative underperformance of industrial in recent quarters is warranted in my opinion because fundamentals have weakened considerably.

New supply has been high while incremental demand has been reduced by churn resulting in overall decreased occupancy. The weakness is most apparent in large footprint logistics warehouses which is the asset type most heavily developed.

Note that while industrial fundamentals are materially weakened, there is still strength here. Mark-to-market leasing spreads remain enormous in the 20%-80% range depending on the vintage of expiring leases. Essentially, what has changed is that it was formerly a growing mark-to-market with asking rents marching upward, but now that asking rent has stagnated it puts a timer on the rapid growth. Eventually, existing leases will catch up to market rates and without further rate growth, the mark-to-market opportunity will not be extended. Thus, rapid AFFO growth for the sector now has a ~5-year runway as opposed to its former 5-10+ year runway.

With more normalized growth, I think the sector is correctly priced at just a slight premium.

Within the sector, however, there are significant gaps in both fundamentals and valuation. The cheaper industrial REITs happen to be the ones less exposed to the new supply, making STAG Industrial, Inc. (STAG) and Plymouth Industrial REIT, Inc. (PLYM) opportunistic within the sector.

Storage REITs – 20.4X AFFO

Storage is a tiny sector by company count, but not so small when it comes to market capitalization.

S&P Global Market Intelligence

As self-storage is trading at essentially the same multiple as industrial, I think it is useful to compare the growth of each sector.

A 20X multiple implies the market is anticipating a significant amount of growth. In industrial there is good visibility in the growth. If an existing lease is at $6 per square foot and market rates on similar properties are at $9 per square foot, it is quite reasonable to anticipate that when the lease expires it will be renewed at closer to the $9 market rate for 50% growth.

I find the assumed growth in self-storage to be much more speculative as the mark-to-market dynamic is the opposite.

Existing self-storage leases are at price points substantially above street asking rates. Initial rents are low to get customers in the door at which point they use the hassle of moving to keep customers in while they jack rates up.

That dynamic worked wonderfully for self-storage in the past 25 years while the sector was undersupplied. Customers had few convenient options. Today, however, self-storage is dramatically oversupplied such that nearly every operator is offering extreme discounting to get customers in the door. It is similar to cell phone plans where customers are incented to switch providers every couple of years to refresh the new customer discounts.

Thus, I don’t think the REITs will have as much success as they had in the past at locking customers in for 8 years at ever higher rental rates. As such, I see the sector as overvalued because it is pricing in growth that has low visibility.

There is minimal valuation or fundamental variance within the sector, so I don’t see a way to play the individual stocks either. For me, self-storage is either a no-touch or a short opportunity.

Manufactured housing – 21.6X AFFO

This is a sector that absolutely deserves to trade at a premium. Manufactured housing REITs have been consistently topping the list for the highest same-store NOI growth.

There are 2 underlying strengths of the sector which, I think, will make it a long-term outperformer.

- Large affordability gap – the cost of manufactured housing compared to site-built or apartments is so much cheaper that MH prices/rents can go up another 50% and still be competitive.

- Constrained supply.

Real estate is usually capped in its growth by developers coming in and stealing growth from incumbent properties. Manufactured housing is known to be particularly difficult to get zoned which has kept new supply in check and funneled growth to existing communities.

At current pricing, I think MH is a great sector in which to invest. Even with the somewhat high 21.6X multiple, the growth is strong enough to outperform.

Within the sector, there are cheaper ways to access the same growth fundamentals.

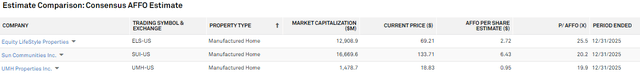

UMH Properties, Inc. (UMH) comes at a slightly discounted 19.9X multiple and its same-store NOI growth has actually been superior to Equity LifeStyle Properties, Inc. (ELS) and Sun Communities, Inc. (SUI).

S&P Global Market Intelligence

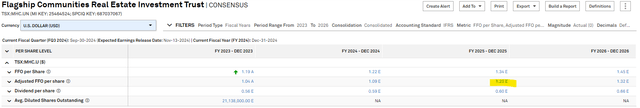

Flagship Communities Real Estate Investment Trust (OTCPK:MHCUF) has been flying under the radar with its Canadian domicile and is what I would consider absurdly cheap at 12.7X 2025 estimated AFFO.

S&P Global Market Intelligence

We discuss Flagship in more depth here. The main idea is that it has essentially the same growth as the rest of the sector, but illiquidity, small size and some potential tax hassles cause it to trade at a massive discount. If an investor has the skills and patience to jump through a few hoops the value proposition is impressive.

Single Family Rental -21.7X AFFO

Single family rental REITs sit in a niche between apartments and homes where they provide tenants with the homeowner lifestyle but are more accessible to those who can’t afford the massive down payment.

In recent years they have benefitted from 2 factors:

- Apartment rents have risen substantially giving SFR the greenlight to raise rents as well.

- Home values have soared to all-time highs making down payments even more unaffordable thereby increasing their customer base.

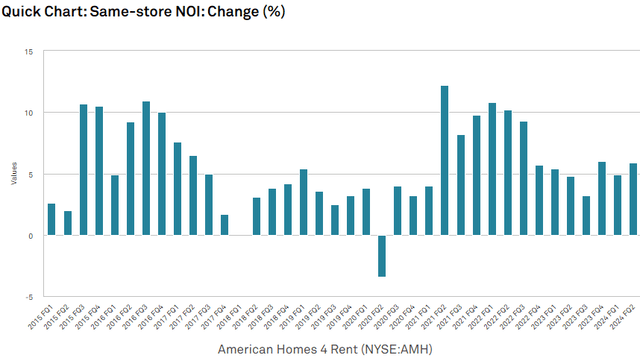

The result has been excellent same-store NOI growth as seen with American Homes 4 Rent (AMH).

S&P Global Market Intelligence

An additional benefit of higher home prices has been asset appreciation since the SFR REITs acquired a large chunk of their assets at prices well below current value.

If the future were to be an extrapolation of the past, the SFR sector would be a great buy at 21.7X. However, the aforementioned drivers are unlikely to continue at the same pace.

Home appreciation was pulled forward by the dramatic change in interest rates which made homeowners not want to sell or move to preserve their 2% mortgages. This reduced supply, concurrent with fairly normal demand caused home prices to shoot up to all-time highs.

I see no reason to think home prices will come back down, but since so much appreciation was pulled forward, there is likely to be a catch-up period of lower than normal appreciation until the longer-run trajectory is restored.

Going forward SFR fundamentals look fine. Growth looks to be positive, but perhaps a bit slower than we would like for a 21.7X multiple. As such, we are on the sidelines at this time but will watch for either a cheaper entry point or a reacceleration of fundamentals.

Tricon Residential (TCN) was essentially the Flagship of SFR in that it was the much cheaper way to play it. It has since been bought out by Blackstone.

Data Centers – 24.37X AFFO

Data centers have ridden the AI hype train to sort of egregious valuations. There is no question that there is astronomical demand growth in data centers, and I understand why that gets the market excited.

However, most data centers are unprotected from new supply, so there is minimal mechanism to funnel demand growth to existing data centers and prevent developers from just eating their cake.

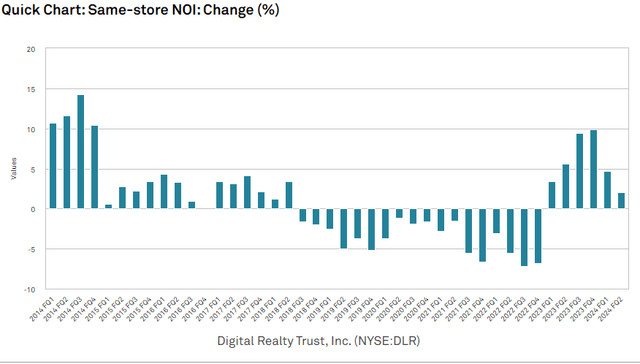

Digital Realty Trust, Inc. (DLR), for example, has had mixed success at raising rents.

S&P Global Market Intelligence

They seem to be fighting a perpetual battle with tenants in that if they try to raise rent, the tenants can just leave and build their own data center.

Thus, rental rates are tied to the time value of money in relation to the cost to build data centers. One could even argue that newly developed data centers are better as they would be configured specifically for AI or whatever the intended application is.

The exception to incumbents having no advantage would be colocation centers where direct connections create a sort of network externality. By having a vibrant ecosystem of tenants with which to connect, an existing data center can potentially have an advantage over a new build.

Equinix, Inc. (EQIX) has had significant success in colocation and cross connects which to me makes them the better play within the sector.

Overall, however, I think data centers are significantly overvalued, and it is time to get off that hype train.

Timber – 27.4X AFFO and Farmland – 39.23X AFFO

At this point, I have lost count of how many times I have heard people saying they won’t invest in the timber REITs or farmland REITs because they are too expensive. I suspect this perception comes from their very high AFFO multiples.

REITs in general are so consistently valued on either AFFO or FFO that it gets universally applied, even when it is not applicable.

Land is a different asset class. It gets at least half of its return from appreciation or special purposes like higher-better-use.

It just comes down to a misunderstanding of how FFO and AFFO are calculated. Depreciation is added back and gains on sale are taken out. Well, land has no depreciation and due to appreciation, HBU and other opportunistic sales, often enjoy huge gains on sale.

Thus, AFFO and FFO are materially understating true earnings.

These are actually among the most discounted REIT sectors, it just isn’t obvious because of the headline numbers as they still report in AFFO.

The timberland REITs trade at about 80% of asset value and the farmland REITs trade even lower based on recent sale prices.

To get a truer AFFO figure one should add appreciation to AFFO. Land has historically appreciated north of 5% a year, but even if we use a conservative 3% appreciation on book value it shows how cheap these REITs are. Here are some back of the napkin figures:

- Farmland Partners Inc. (FPI) – $30.8 million annual appreciation or $0.64 per share.

- Weyerhaeuser Company (WY) – $502 million annual appreciation or $0.70 a share.

- Gladstone Land Corporation (LAND) – $40.5 million annual appreciation or $1.13 per share.

Obviously, this calculation methodology is extremely oversimplified and there are all sorts of granular reasons to think appreciation will be higher or lower for a given set of assets, but this gets you roughly in the ballpark of true earnings.

Adding these above figures to the stated AFFO puts these REITs at quite cheap multiples.

There could be fundamental reasons not to like investing in these stocks, but don’t make the mistake of thinking they are expensive just because nominal multiples are high.

Wrapping it up

REIT sector AFFO multiples are not well correlated with fundamental growth. There are plenty of traps as well as opportunities to get high growth at a cheap price.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Credit: Source link