jetcityimage

Introduction

Thermo Fisher Scientific (NYSE:TMO) is a bit of a controversial dividend stock for one reason only: it has an extremely low dividend yield of less than 0.3%. While that may be a turn-off, it has a lot of other qualities that make it a consistent outperformer with subdued volatility, high dividend growth, and a terrific balance sheet, thanks to a bulletproof wide-moat business model.

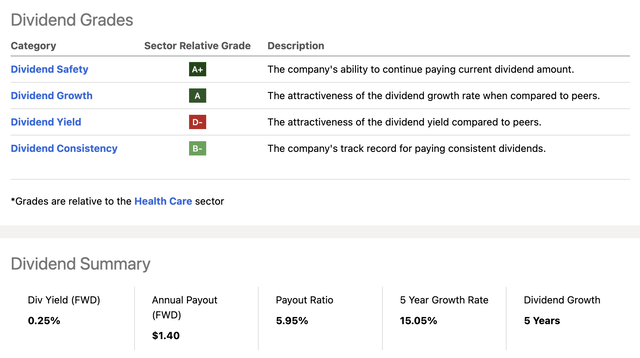

Seeking Alpha

In this article, I am going to re-assess my bull case, as the company just reported its earnings. Like its peer Danaher (DHR), which I covered in this article, the company is seeing lower demand related to the pandemic and some funding risks related to high rates. However, its core business remains strong, which leads me to believe that TMO remains a buy on any weakness.

So, let’s get to it!

A Low Yield Isn’t Always Bad

There’s no denying that a 0.25% dividend yield is a terrible investment for investors that require a high yield – like retired investors.

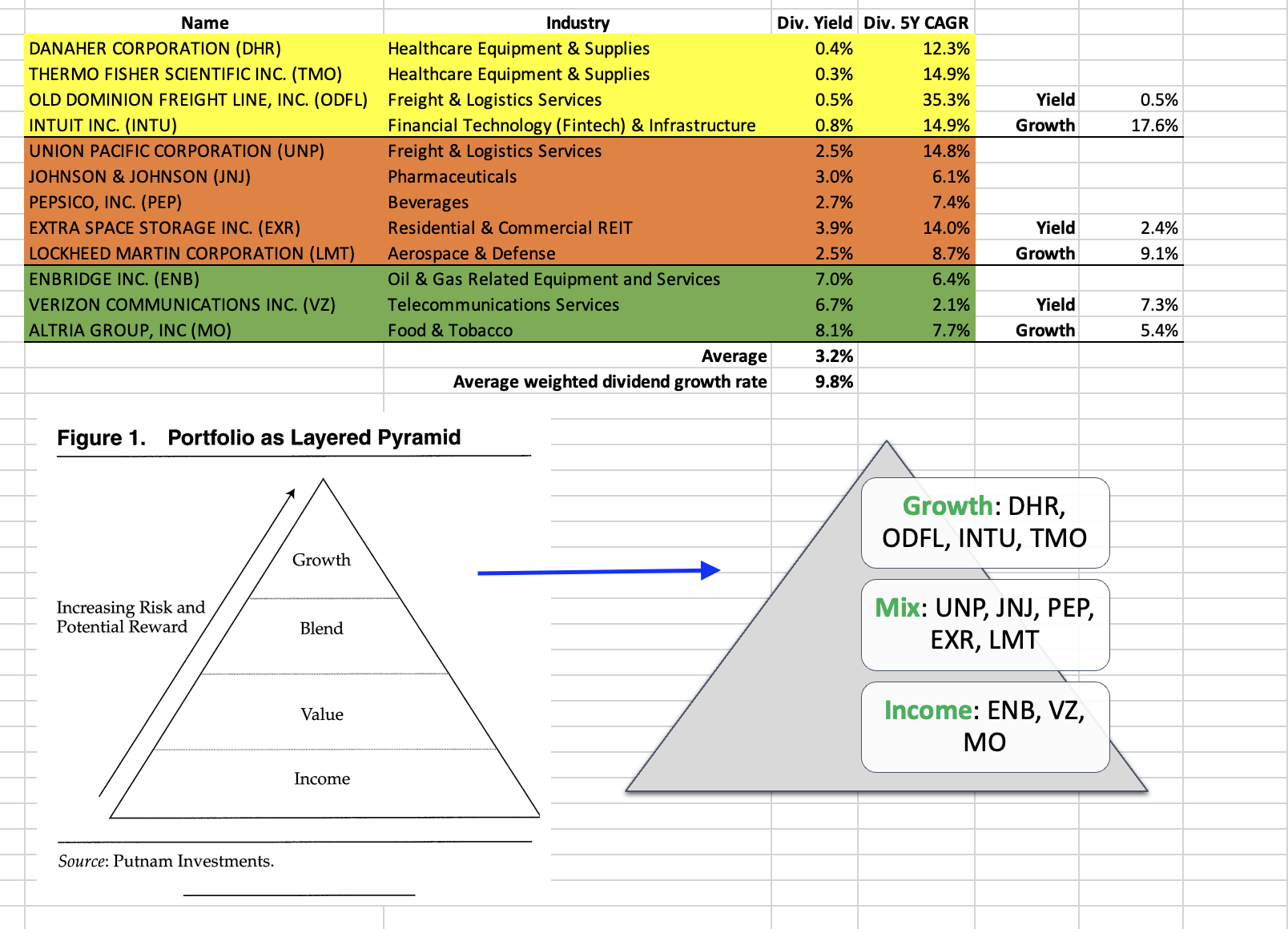

While that may be the case, one of the reasons why buying TMO makes sense is its terrific profile of low-volatility outperformance. It’s why I included it in a recent article, which covered the layered-pyramid strategy.

Leo Nelissen (Article: Danaher: The Secret To Successful (Dividend) Investing)

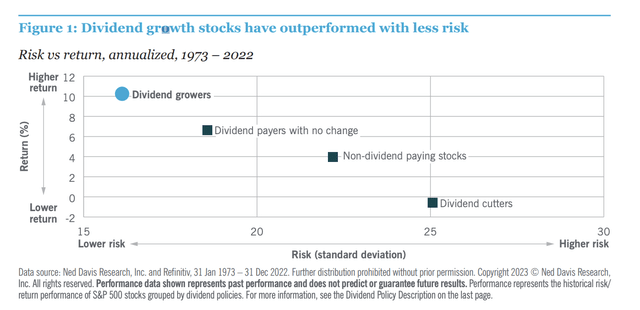

As discussed by Vanguard, buying a low-yield stock isn’t necessarily a problem – far from it. Not as long as it comes with significant capital gains that make up for the fact that cash flows (dividends) are somewhat subdued.

Moreover, when dealing with high-quality companies, investors can significantly enhance the returns of their portfolio while lowering the volatility.

Nuveen

This is the reason why I bought Danaher and why I’m eying TMO, despite my goal to keep a dividend yield close to 2.5%.

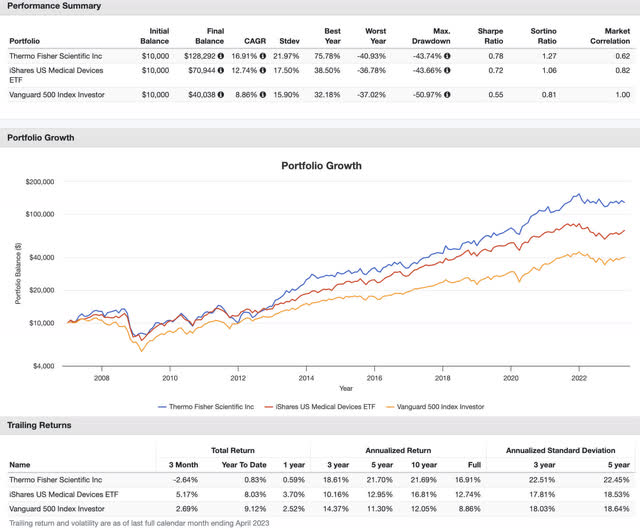

Going back to 2007, TMO shares have returned 16.9% per year, beating the iShares U.S. Medical Devices ETF (IHI) by more than 400 basis points per year. Please note that TMO has a weighting of roughly 16% in that ETF. The S&P 500 has returned 8.9% during this period. Also, note that TMO’s standard deviation was just 22%, which is extremely low for a single stock. Hence, the company beats both the IHI ETF and the market on a risk-adjusted basis (Sharpe Ratio).

Portfolio Visualizer

Furthermore, this outperformance has been consistent, as the lower part of the chart above shows.

With regard to its dividend, the company has a dividend payout ratio of less than 6%, which is ultra-low, and an average annual dividend growth rate of 15% over the past five years.

What Makes TMO So Special

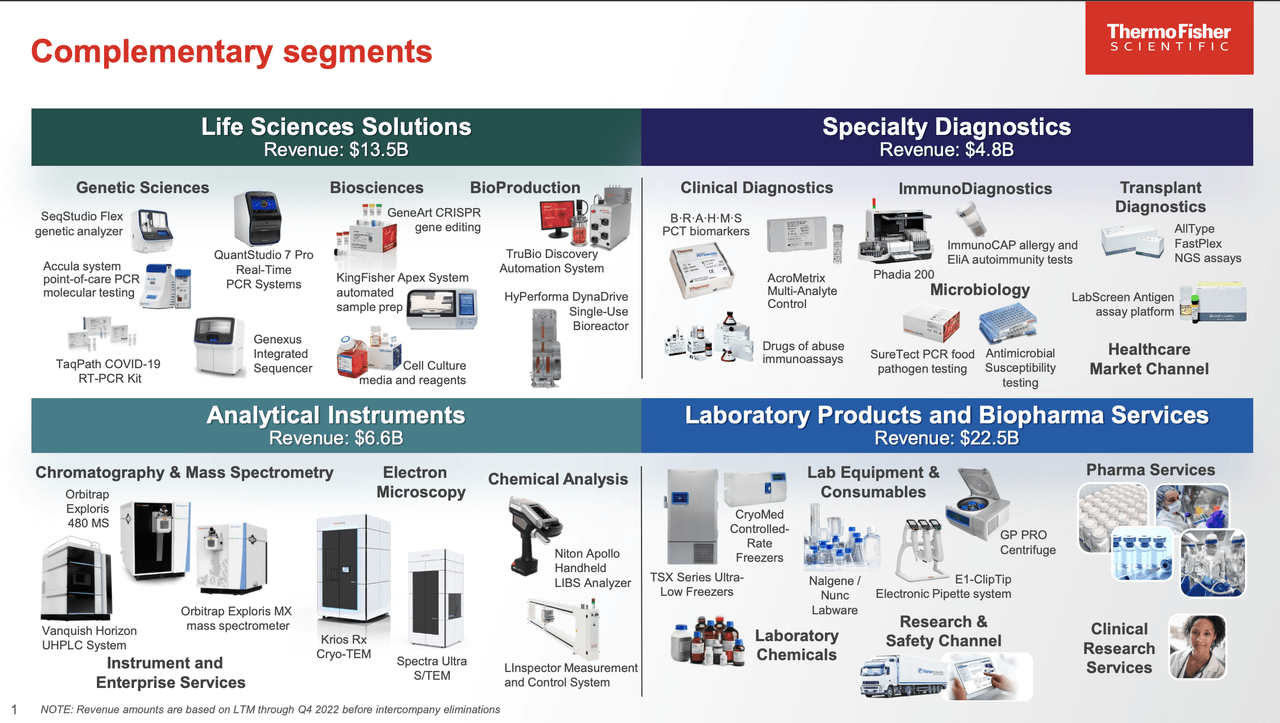

With a market cap of $214 billion, Waltham-MA-based Thermo Fisher is the largest healthcare supplier in the world. Unlike its peer Danaher, TMO is (almost) exclusively focused on healthcare, which includes Life Science Solutions, Specialty Diagnostics, Analytical Instruments, and a wide range of Laboratory Products and Biopharma Services.

Thermo Fisher Scientific

In 2006, a merger between Thermo Electron Corporation and Fisher Scientific International gave birth to the company. Its range of offerings comprises an array of instruments, such as mass spectrometers, chromatography systems, microplate readers, and gene sequencers, alongside reagents, consumables, and software that cater to data analysis and management needs.

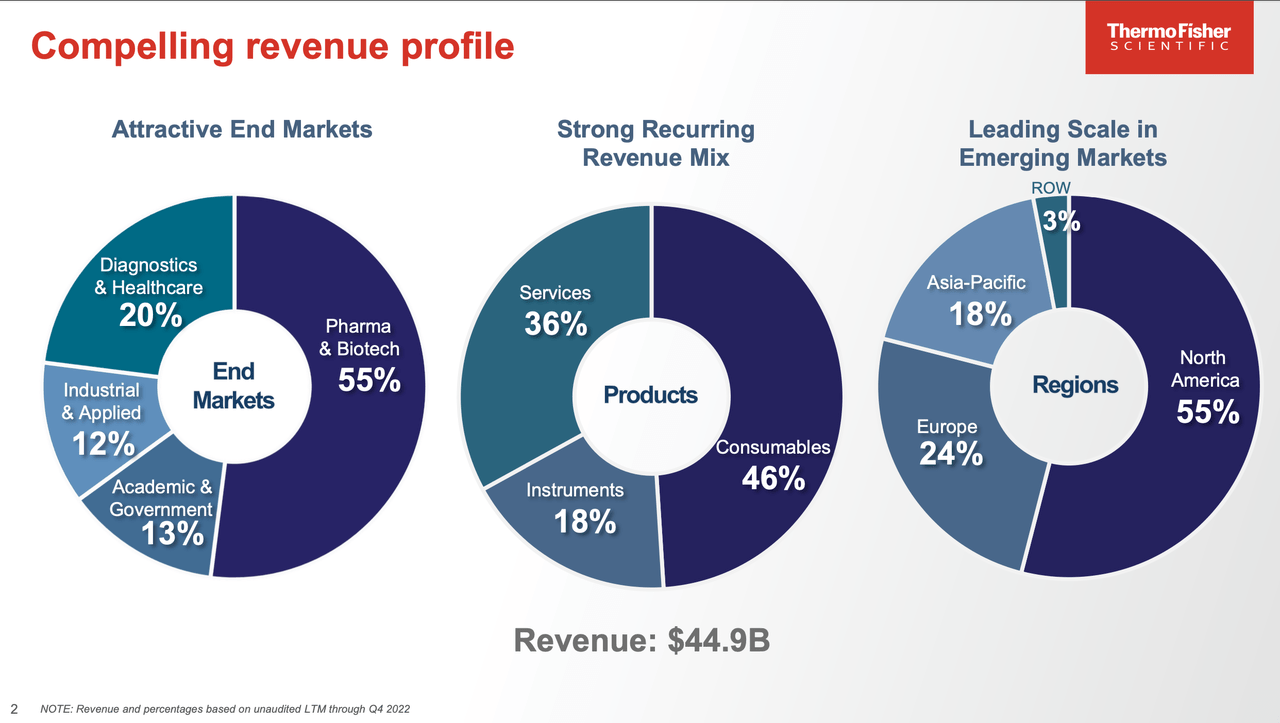

Roughly half of its sales are generated outside of the United States, with more than a third of its revenue consisting of services.

Thermo Fisher Scientific

What this means is that the company benefits from a number of tailwinds. For example, the global aging population and what this means for healthcare demand.

According to the World Health Organization:

By 2030, 1 in 6 people in the world will be aged 60 years or over. At this time the share of the population aged 60 years and over will increase from 1 billion in 2020 to 1.4 billion. By 2050, the world’s population of people aged 60 years and older will double (2.1 billion). The number of persons aged 80 years or older is expected to triple between 2020 and 2050 to reach 426 million.

Related to this, a major benefit is anti-cyclical growth.

During last year’s Morgan Stanley Annual Global Healthcare Conference, the company mentioned that its business model has become extremely resilient over the past few years (emphasis added).

When I think about how the company, how we’ve evolved our mix by executing our strategy, the company is — has a more favorable set of end markets than we did back at the end of the 2000s. And today, pharmaceutical and biotech which is the least economically exposed end market, represents just under 60% of our core revenue. And back then, it was about 1/4 of our core revenue. And our consumables and service business is about 85% of our revenue. Back then, it was about 2/3 of our revenue. So the company’s mix has evolved and that positions us to navigate whatever the world throws at us.

With that in mind, the company isn’t bulletproof, which comes with new opportunities.

A Look Behind The Numbers

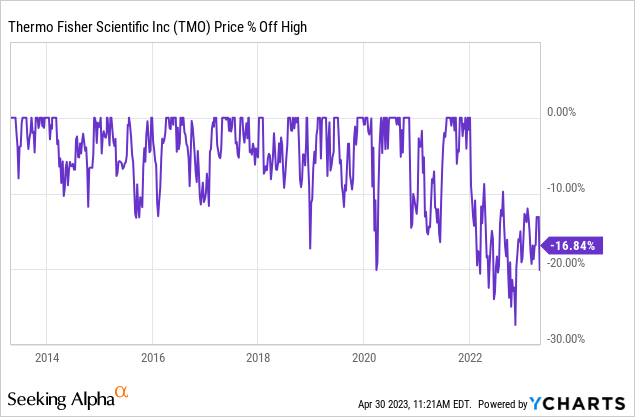

TMO shares are currently 17% below their all-time high. This makes the current sell-off the worst of the past ten years – using weekly closing prices. The pandemic sell-off was 26%, which was reversed in slightly more than four weeks. After all, TMO was one of the biggest winners of the pandemic.

Interestingly enough, the fact that the company did so well during the pandemic is one of the reasons why it is somewhat struggling now.

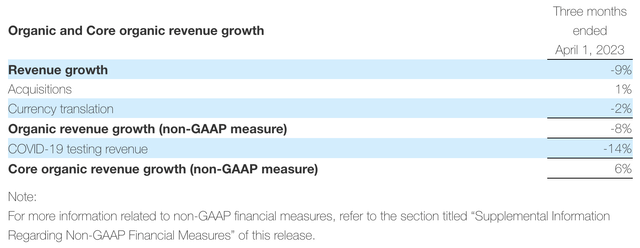

On April 26, the company reported its first-quarter earnings, which showed a revenue decline of 9.4% to $10.7 billion. This was the result of COVID-related weakness.

As the overview below shows, the company saw 8% lower organic revenue growth. That number is based on 9% lower revenue growth, 1% added through acquisitions, and a 2% headwind from unfavorable currency translations – after all, the company is prone to dollar changes, as operating revenue is hard to hedge.

The good thing is that these numbers were caused by post-COVID developments. COVID-19 testing revenue was down 14%. Without this decline, the company would have reported 6% revenue growth.

Thermo Fisher Scientific

We obviously cannot just eliminate headwinds that make numbers look bad. However, the purpose of excluding COVID numbers is to assess the core business. Everyone knew that COVID would eventually turn into a headwind for the company. What matters is that its core market isn’t weakening.

With that in mind, the company achieved mid-single-digit growth in the pharma and biotech sector, driven by strong performance in its chromatography, mass spectrometry, and clinical research businesses. In academic and government sales, the company saw growth in the high-single digits, with strong demand in all regions.

Furthermore, the company delivered strong growth in all of its analytical instrument businesses, including electron microscopy, chemical analysis, chromatography, and mass spectrometry in industrial and applied.

In diagnostics and healthcare, revenue was around 45% lower than the prior-year quarter, with good core business growth in immunodiagnostics, microbiology, and transplant diagnostic businesses, which shows that despite COVID headwinds, the core of these segments is extremely healthy.

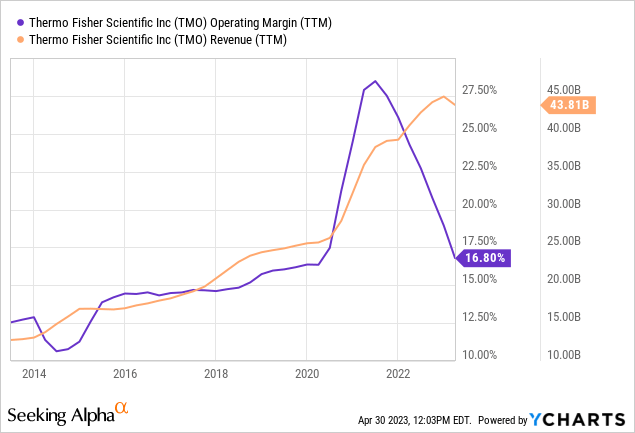

Needless to say, these COVID headwinds did a number on margins, which more than offset the company’s pricing power.

According to the company (emphasis added):

With respect to our operational performance, adjusted operating income in the quarter decreased 32% and adjusted operating margin was 21.8%, 740 basis points lower than Q1 last year. In the quarter, we achieved strong price realization to effectively address inflation while also driving strong productivity. This was more than offset by lower pandemic related revenue and continued strategic investments.

The company also commented on its outlook.

Thermo Fisher has maintained its guidance for the full year 2023, with a revenue projection of $45.3 billion, including 7% core organic revenue growth and adjusted EPS guidance of $23.70. The company expects to offset the additional $0.25 of EPS headwinds caused by an unfavorable mix and forex through cost management and similar actions.

Furthermore, Thermo Fisher’s underlying assumptions remain unchanged, with 7% core organic revenue growth from market growth of 4% to 6%. The company expects $500 million of vaccines and therapies revenue in 2023, $1.2 billion less than the prior year, with the majority of revenue expected to be in the pharma services business. The company is assuming $400 million in testing revenue for 2023, with The Binding Site acquisition contributing approximately $250 million to reported revenue growth.

Moreover, Danaher noted some funding struggles among its biotech clients. After all, biotechnology is highly capital-intensive. Thermo Fisher didn’t say that it saw these issues. However, it mentioned that the funding environment is a factor worth monitoring.

The company mentioned talks with clients that are eager to boost innovation.

According to Mr. Marc Casper, Chairman, President, and CEO of Thermo Fisher (emphasis added):

The science is phenomenal. So there’s clearly going to be more caution in that segment, depending on the funding environment, but the science is great. The passion is extraordinary. And we are the company that people come to advance the molecule from a scientific idea to an improved medicine.

Valuation

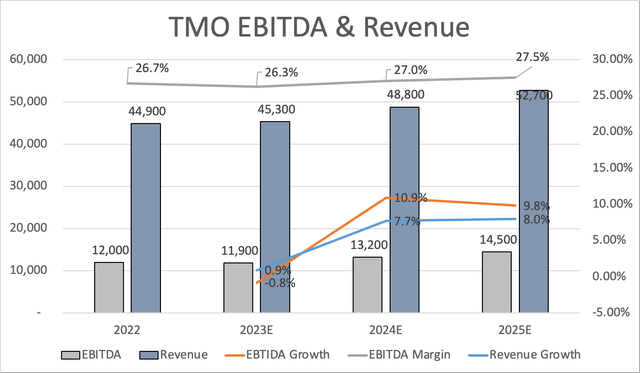

Despite the impact of COVID, analysts do not expect TMO to show much weakness this year, which is in line with company guidance.

Revenue is expected to contract by less than 1%. The same goes for EBITDA. Just like its margins, both revenue and EBITDA are expected to hit new highs in 2024, followed by another strong surge in 2025.

Leo Nelissen

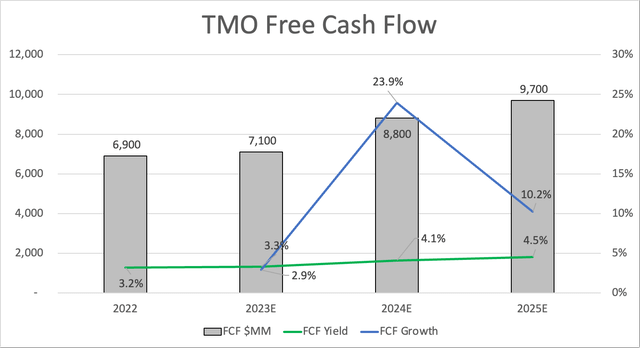

Free cash flow is not expected to fall this year. Free cash flow could grow by 3.3% in 2023, followed by a rapid double-digit acceleration in the next few years.

Leo Nelissen

While these numbers are subject to a lot of influencing factors, it displays the company’s tremendous earnings power.

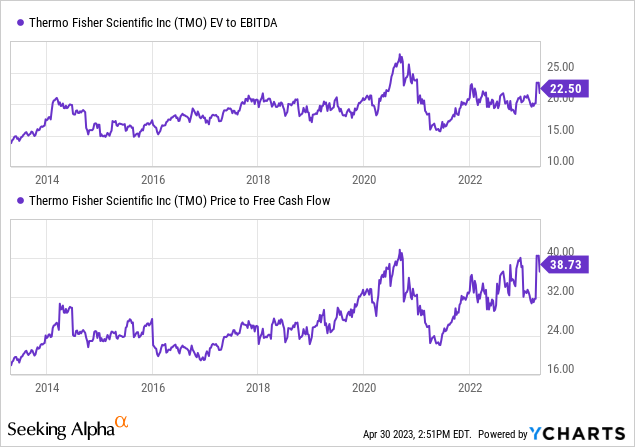

The way things are now, we could be looking at a 4.1% free cash flow yield in 2024, which is a good number, given the high expected long-term FCF growth. It implies a free cash flow multiple of 24.4x.

This implies that the valuation is normalizing. While we’re dealing with 2024 expectations, it would imply that TMO is trading at fair value. The same goes for EV/EBITDA, which is close to 20x, using forward-looking numbers.

While I cannot make the case that TMO is undervalued, I believe it’s a good investment on weakness.

As vague as that may sound when I believe that this applies to stocks that I monitor, I usually hold some cash to buy these stocks if they show weakness. Sometimes I don’t get a good buying opportunity and watch stocks go up without having any exposure. However, I prefer that over chasing rallies.

Takeaway

In this article, we discussed a somewhat unusual dividend growth stock. While TMO has an extremely low dividend yield, it has a fantastic business model that benefits from (among other things) strong and anti-cyclical demand, secular health-related tailwinds, a wide moat, and strong pricing power.

In the past, these qualities have allowed the company to outperform the market with subdued volatility. I expect this to continue.

While 2023 is an unusual year due to the impact of fading COVID demand, the company is set to remain in a great spot to maintain strong revenue with an outlook of accelerating growth in the next few years.

I consider the valuation to be fair, which means investors interested in adding low-volatility dividend growth might benefit from monitoring this stock for any weakness down the road.

Given the macroeconomic environment, I wouldn’t bet against another correction this year.

Credit: Source link