ljubaphoto/E+ via Getty Images

Business updates

Once again, The Joint Corp. (NASDAQ:JYNT) has demonstrated resilience amidst macro uncertainties, exceeding both EPS and revenue expectations. The company is still the leading force to introduce chiropractic care to the general public. They experienced a remarkable 17% growth in system-wide sales, with revenue increasing by 27% to $28.5 million in Q1 2023, compared to $22.4 million in Q1 2022. Additionally, comparable sales for clinics open for at least 13 full months saw a notable 8% increase. JYNT also saw a small improvement in adjusted EBITDA, which reached $2 million compared to $1.8 million in Q1 2022. The development of new clinics for JYNT has progressed slightly ahead of schedule. In Q1 2023, the company successfully opened 33 clinics, consisting of 29 franchised clinics and 4 Greenfield clinics. This marks an increase compared to the 31 clinics opened in Q1, 2022, which included 27 franchised clinics and 4 Greenfield clinics. Notably, the closure rate has remained consistently low, staying below 1%.

New licenses and new patient acquisition

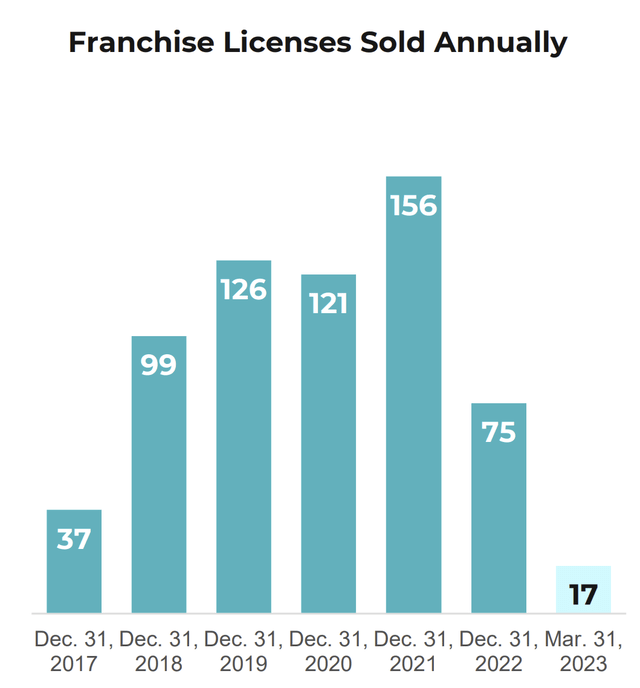

Franchise Licenses sold (JYNT presentation)

It appears that JYNT’s momentum has slowed down to some extent. As of the end of the quarter, JYNT had a solid pipeline for future franchise clinic openings, with 218 active development and franchise licenses. In terms of franchise license sales, they sold 17 licenses, maintaining the same number as Q4, 2022, but lower than the 22 licenses sold in Q1, 2022. Additionally, new patient acquisition has seen a decline of 7%. Historically, JYNT has a successful track record of building a chiropractic brand for a younger and generally healthy demographic. Notably, 34% of their new patients are entirely new to chiropractic care, and the median age of patients stands at 37.6 years. Going forward, JYNT’s management will remain focused on attracting new patients and carving out its own niche in the market.

JYNT will keep investing in its marketing capabilities

In the 2023 Q1, JYNT experienced a notable 14% year-over-year increase in organic traffic to their website. Their promotional campaigns have yielded impressive results, particularly on the Joint National Instagram account, where they garnered nearly 15,000 entries and comments, received over 20,000 likes, and attracted more than 13,000 new followers. The effectiveness of their PR strategies has also reached new heights, as they surpassed 1 billion in earned editorial impressions in Q1 alone. 63% of new patients have touched JYNT digitally. These achievements reflect the growing engagement and visibility of JYNT’s brand and their ability to connect with a broader audience. All these activities have strengthened JYNT’s position as a strong national brand.

In order to continue attracting customers and franchisees, it is likely that JYNT will maintain its marketing spending. As a franchisor, one of JYNT’s key competitive advantages lies in its ability to support franchisees with market and promotion activities, enabling them to focus on delivering high-quality services and treatments to customers without the burden of marketing. During the earnings call, JYNT mentioned launching a test to capture leads through chat technology and exploring the use of enhanced doctor or chiropractic profiles on online medical sites as a new source of patient leads. Additionally, with a network of 870 clinics in operation, JYNT will leverage its extensive customer data to develop business intelligence and analytical reporting tools, as well as implement an automated marketing program. I am glad to see these initiatives, which should contribute to JYNT’s success in capturing the attention and loyalty of the younger demographic.

Cost seems a little out of control under labor inflation

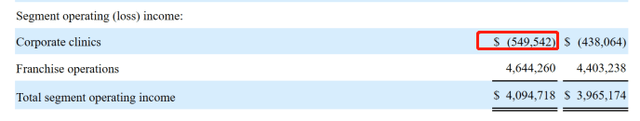

One notable concern this quarter is the ongoing financial losses experienced by JYNT’s corporate clinics. Based on the Q1 filing, the revenue from JYNT’s corporate clinics amounted to $17 million, with an operating loss of $0.55 million. In comparison, the revenue for last year was $12 million, with an operating loss of $0.43 million. Given that these clinics are directly owned by JYNT, it is important to see improved profitability from them. However, we are not seeing that yet.

Segment operation (JYNT filings)

The SG&A rate of 84.7% observed in Q1 is the highest JYNT has ever recorded, raising concerns about the company’s cost management. Selling and marketing expenses in Q1 reached $4.2 million, marking a 27% YOY increase. Additionally, G&A expenses amounted to $19.9 million, representing a 30% YOY, which surpasses the revenue growth. The management attributed this increase to higher payroll to stay competitive in the current tight labor market. This poses a significant challenge moving forward. As clinics face the necessity of paying chiropractors higher salaries than before, it becomes uncertain how JYNT’s future profitability will be affected after it passes its growth phase.

Bottom Line

Overall, JYNT continues to prove the effectiveness of its model in a depressed economic period. As the management said:

people are tightening their belts and making decisions, it feels like they’re going to be more willing to give up that cup of coffee or that frozen yogurt, than pain relief.

Given no changes in the 2023 outlook following the first quarter, JYNT is still expected to achieve revenue of 123M+ and EBITDA of 12.5M+. With a projected revenue growth rate of 20% and an EV/sales rate of 1.95, the stock appears to be reasonably priced, indicating that it is not considered expensive.

Credit: Source link