LoveTheWind

The February PCE report throws the whole disinflationary narrative out the window. The report reveals troubling trends that are now developing within goods. With service inflation remaining sticky and a rebound in goods inflation, mainly driven by energy prices, returning to a 2% inflation target will be more complex than thought. This is why the market is now pricing in fewer than three rate cuts in 2024, following the report.

The February PCE report was mainly as expected, but some of the pieces beneath the surface seemed troubling, and the revisions weren’t favorable. For February, headline PCE rose by 0.3% versus estimates of 0.4%, but last month’s headline PCE was revised higher to 0.4% from 0.3%. Meanwhile, core PCE rose by 0.3% as expected, but last month’s core PCE was revised higher to 0.5% from 0.4%.

Trouble Beneath The Surface

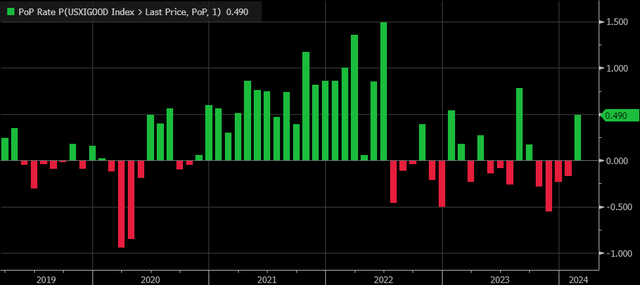

The headline y/y PCE came in at 2.5% as expected, up from 2.4%, while core PCE rose by 2.8%, which is in line with estimates and down from an upwardly revised 2.9% last month. More troubling was the resurgence of goods in inflation in the month, which increased by 0.5%, the most significant jump since August.

Bloomberg

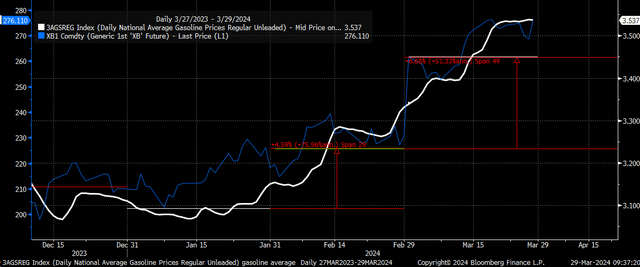

The big jump in goods prices resulted from non-durable goods, which rose by 0.66% m/m in February, with the most significant jump coming from gasoline. Gasoline prices have been mainly on the decline since 2022 and, for the most part, have been helping to drive the disinflation process on the headline. However, gasoline in March was up even more than it was in February, and that means that goods prices may continue to rise in March.

Bloomberg

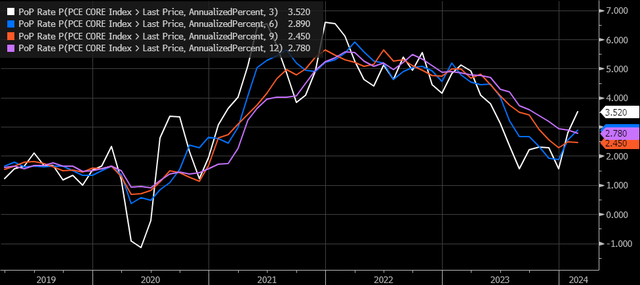

Meanwhile, core PCE appears to have increased at a 3-month and 6-month annualized rate of change, rising by 3.5% and 2.9%, respectively. These are both higher than the one-year rate of change, which is 2.8%, not a favorable trend.

Bloomberg

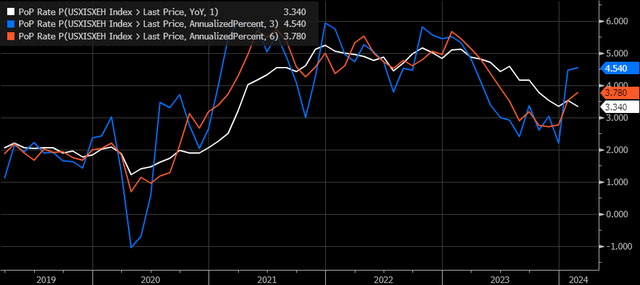

Services Inflation Is Not Going Away

Supercore PCE declined to 3.3% in February from 3.5% in January, but more importantly, it has been sideways since December. However, it is now up by 4.54% at an annualized rate over the past three months and 3.8% over the past six months, again an unfavorable trend upward.

Bloomberg

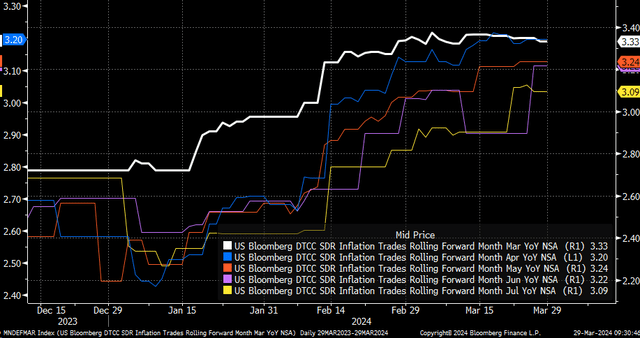

Energy’s Revival

The outlook for inflation doesn’t get much better, and based on CPI swaps, the recent reversal of the trend in the PCE isn’t likely to see much improvement. Currently, CPI swaps see inflation on a y/y basis remaining above 3% through July. Expectations have been trending higher for the past several weeks.

Bloomberg

What is driving most of the uptick in CPI swaps prices appears on the surface to be energy-related. After falling energy prices are generally what has driven the disinflation narrative over the past year, and if energy prices are now on the rise again, then it seems highly probable that inflation rates are going to start trending higher again because, in the end, services inflation has not gone away. Sure, services inflation has moderated, but it remains well above pre-pandemic trends, as noted by supercore.

The national average price of gasoline in March was up about 6.7%, which is higher than the 4.6% change in gasoline prices in February. This increase will likely not help improve goods prices in March CPI or March PCE reports.

Bloomberg

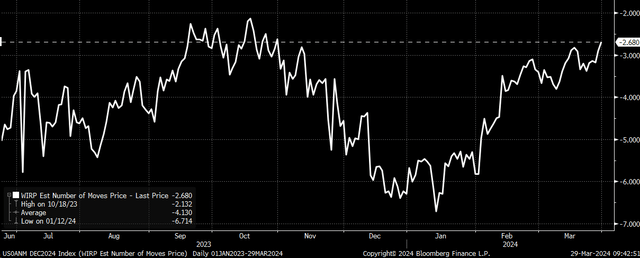

Fewer Rate Cuts

Based on the day’s data, Fed Fund futures now price fewer than three rate cuts in 2024. The futures now see 2.68 rate cuts in 2024, the highest value, or the fewest rate cuts, since before the November FOMC meeting.

Bloomberg

Today’s PCE reports call into question the disinflation narrative spun at the end of 2023 and rate cuts in 2024, given the unflattering trends of annualized 3— and 6-month core PCE and super core PCE numbers. Additionally, if energy prices continue to rise, it will make getting back to the Fed’s target harder since it has been the overall driving trend of the disinflation process for the past year.

Credit: Source link