AndreyPopov/iStock via Getty Images

One of the biggest beneficiaries of climate-related law changes since 2020 has been Hudson Technologies (NASDAQ:HDSN). The company essentially recycles “freon” (fluorinated hydrocarbons) and other refrigerant gases/chemicals for air conditioners and cooling equipment. Hudson’s products/services include refrigerant and industrial gas sales, plus management services consisting primarily of reclamation of refrigerants, re-usable cylinder refurbishment, and hydrostatic testing services.

In fact, Hudson has outperformed fully 98% of all U.S. equity investments over the past three years, with a +700% price rise from under $1 a share in the middle of 2020. The good news is a consolidation from the $12 peak in late 2022 into this week’s sub-$7 price may be providing another excellent entry point for a double or triple in price over the next 18-24 months.

YCharts – Hudson Technologies, Weekly Price Changes, 3 Years

Bullish Operating Background

During 2020-21 EPA regulations in the U.S. changed with the AIM Act, clamping down on the types and quantities of refrigerants acceptable to use in the industry, all an effort to fight carbon emissions thrown into the atmosphere by tens of millions of air conditioners and cooling towers in the nation. Just this week Hudson was added to the EPA’s GreenChill Emissions Reduction Program, a refrigerant sustainability partnership.

Company Website – May 5th, 2023 Company Website – May 5th, 2023

In terms of recycling, the company holds a 35% market share of this business in the U.S. Plus, the hydrofluorocarbon (HFC) market is projected to experience an even greater shortage of supply starting in 2024, as another 30% reduction in newly produced (virgin) gases takes effect.

April 2023 Investor Presentation April 2023 Investor Presentation April 2023 Investor Presentation April 2023 Investor Presentation April 2023 Investor Presentation April 2023 Investor Presentation

Valuation Story

So, if shortages of refrigerant HFCs continue, prices should remain high, and Hudson should be rerated on this reality! Nope, the stock is acting like 2022 was the peak in its business, despite Wall Street analyst projections of a strong 2023, and even better 2024 for the operating business. This disconnect opens the buy proposition, in my view.

Seeking Alpha Table – Hudson Technologies, Analyst Estimates for 2023-24, Made on May 5th, 2023

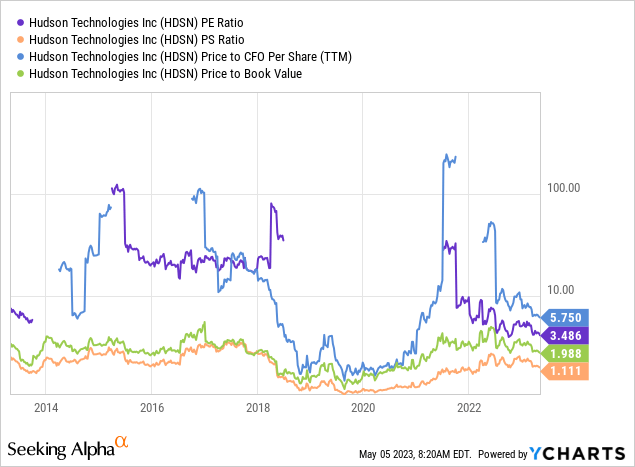

On basic price to trailing earnings, sales, cash flow, and book value, Hudson remains in a normal to undervaluation setup for new investors. Below is a 10-year graph of this fundamental ratio analysis.

YCharts – Hudson Technologies, Fundamental Valuation Ratios, 10 Years

When we include debt and subtract cash holdings from Hudson’s equity capitalization, enterprise value stats are equally appealing. Where else can you find an industry leader, with pricing trends blowing in the right direction for years to come, sitting at an EV to cash EBITDA number of 3x to 4x? I cannot locate an equivalent value and growth setup elsewhere.

YCharts – Hudson Technologies, Enterprise Valuation Ratios, 3 Years

Assuming HFC prices stay elevated or rise further, the robust growth in revenues since 2020 should continue until at least 2025. No doubt, Wall Street expectations may even prove on the low side of reality in a sizable shortage situation next year.

Seeking Alpha Graph, Annual Revenues Trailing & Projected, 2018-24

Technical Momentum Turnaround Due?

When I review my favorite momentum indicators and the chart pattern, a mixed technical rating is my readout. Indicators like the Accumulation/Distribution Line and On Balance Volume are in downtrends (not pictured). Plus, price is trading below its 50-day and 200-day moving averages. For me, price under both MAs is the simplest definition of a bearish trend.

On the positive side of the equation, a super-low 21-day Average Directional Index score under 10 the past week has usually opened a great time to buy over the last 18-months (circled in green). The current 8 reading indicates a clear low-volatility balance between buyers and sellers over the last month of trading. So, the next price move either higher or lower could be a key tell.

The Negative Volume Index trend higher is highlighting considerable buying-on-weakness interest. And, the oversold 14-day Relative Strength Index close to 20 in March may have pinpointed a crest in selling pressure (circled in red).

In terms of a price reversal, the first thing to look for will be several days of closing quotes above the 50-day moving average. You cannot experience a major price advance without taking some minor steps in the right direction to start.

StockCharts.com – Hudson Technologies, Author Reference Points, 18 Months of Daily Price & Volume Changes

Final Thoughts

In the end, a lack of immediate upside momentum is why I consider Hudson more of a bottom fishing expedition. For sure, the valuation story becomes more compelling on price weakness. My suggestion is initiating a stake now makes plenty of sense, while cost-averaging down may be the smartest way to acquire a full position.

I would note heavy insider selling of shares took place last year in the $10 to $11 range. However, over the latest three months, no sells and one buy from director Vincent Abbatecola at $8.27 have appeared. Part of the change in sentiment may be based on expectations for next year’s HFC mandated reduction in new product sales. Expected shortages may keep recycled prices and margins for the company at heightened levels for a number of years. My forecast is low valuation multiples on current operating results and a stronger balance sheet each quarter may act as a springboard for future stock quote appreciation.

With its 2-year moving average today at $6.60 acting as powerful price support, and a bargain valuation backstop limiting downside potential, I don’t foresee tons of risk outside of a stock market crash scenario. If worst-case scenario downside is -20% and best-case upside is a double (+100%) or triple (+200%) into 2025, the buy argument is not hard to understand. Assuming EPS of $1.50 in 2025 and investor acceptance of a bright long-term future, a repeatable valuation multiple of 12x seems fair. That gets price to $18 a share in 18-24 months. I rate shares a Buy around $8.

Thanks for reading. Please consider this article a first step in your due diligence process. Consulting with a registered and experienced investment advisor is recommended before making any trade.

Credit: Source link