chapin31

Texas Roadhouse (NASDAQ:TXRH) is a fantastic business, offering a clear and straightforward path for growth in the long term. Investors are now questioning whether the recent 41.2% surge in the past year has already priced in the company’s potential. So, let’s dive deeper into the company’s growth prospects and what factors are necessary to justify its valuation.

—

For those interested in reading previous articles I wrote about companies in the industry for additional color, here are the links:

- Chipotle: The Underlying Assumptions In Its Valuation Aren’t Unreasonable

- Starbucks: One Of The Most Attractive Plays In The Sector, But There Are Risks

Company Overview

Texas Roadhouse franchises and operates casual-dining restaurants under Texas Roadhouse, Bubba’s 33, and Jaggers. The company was founded in 1993 with the opening of the first Texas Roadhouse location in Indiana and has grown to 704 restaurants in 49 states and 10 foreign countries.

The Texas Roadhouse concept offers a steakhouse menu and serves fresh hand-cut meats, as well as its signature homemade baked rolls. As of Q1-23, there were 564 operated locations in the U.S. and 93 franchised locations worldwide.

The Bubba’s 33 concept is a family-friendly location that serves signature drinks, burgers, pizza, wings, sandwiches, and a wide variety of appetizers. The first Bubba restaurant opened in May 2013, in North Carolina.

Jaggers is a fast-casual restaurant offering burgers, hand-breaded chicken tenders, sandwiches, and fresh salads. Jaggers also offers drive-thru and carry-out options. The first Jaggers location was opened in December 2014 in Indiana.

Growth Strategy

I wrote extensively about the five core factors for a food service chain in my Starbucks (SBUX) and Chipotle (CMG) articles, and I encourage you to read them. In short, I categorize the food chain growth formula under Predictability of quality; Recognizability & Customer Loyalty; Disciplined capital allocation; Geographic expansion; and Same-store growth. Let’s see how TXRH does in each category.

Predictability of Quality

We place a great deal of emphasis on providing our guests with high quality, freshly prepared food. As part of our process, we have developed proprietary recipes to provide consistency in quality and taste throughout all restaurants. We expect a management level employee to inspect every entrée before it leaves the kitchen to confirm it matches the guest’s order and meets our standards for quality, portion size, appearance and presentation. In addition, we employ a team of product coaches whose function is to provide continual, hands-on training and education to our kitchen staff for the purpose of promoting consistent adherence to recipes, food preparation procedures, food safety standards and overall food quality.

— Texas Roadhouse 2022 Annual Report (10-K)

Historically, Texas Roadhouse has never had to deal with health problems in its kitchen. The company serves pretty much the same food in each of its locations, and while there are a few complaints, the place is packed almost all of the time, reflecting returning customers and great service. Furthermore, each restaurant manager is titled “managing partner” and immediately gets performance-based compensation, which forms strong accountability at the restaurant level.

Recognizability & Customer Loyalty

One of the most important assets of a restaurant is loyal customers. Especially in a dine-in dinner-focused concept, the company can’t rely on the fact that people work near its location for recurring business (unlike a Starbucks or a Chipotle for example). On that front, Texas Roadhouse created its ‘VIP Club’, and members enjoy exclusive offers, priority seating, birthday rewards, and some additional benefits. It’s not as significant as the Starbucks Cards program, but it’s clear the company engages with customers on that front.

Disciplined Capital Allocation

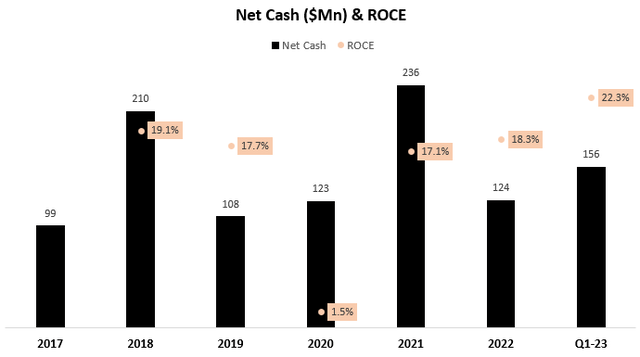

Looking at Capital Allocation, Texas Roadhouse is one of the most impressive companies I’ve seen, even outside the restaurant industry. For the majority of its operating years, Texas Roadhouse has been in a positive net cash position while maintaining an above-average ROCE for its industry.

Created and calculated by the author using data from Texas Roadhouse financial reports (10-K).

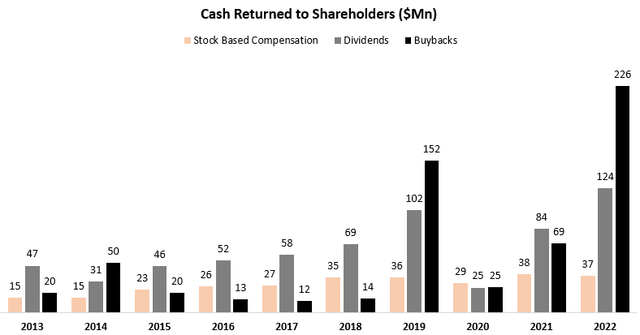

This has allowed the company to return an extraordinary amount of cash to its shareholders throughout the years, growing its annual dividend payout (unadjusted for buybacks) at an 11.4% CAGR between 2013-2022, while decreasing the amount of its shares outstanding by nearly 5.0%.

Created and calculated by the author using data from Texas Roadhouse financial reports (10-K).

Overall, I think it’s clear Texas Roadhouse has a very disciplined management team that doesn’t take unnecessary risks and puts emphasis on its shareholders’ interests.

Geographic Expansion

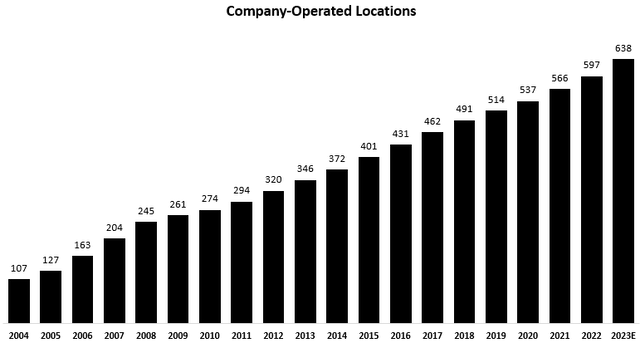

If I had to pick one reason restaurants are so simple to understand, it’s their simple growth trajectory. Even a 5-year-old can understand that a company with 638 locations will probably make more money than a company with 107.

Created and calculated by the author using data from Texas Roadhouse financial reports (10-K)

As we can see, Texas Roadhouse has been growing its presence sequentially for the last 20 years, at a very impressive CAGR of 10.4%. Strategically, management expansion targets are 20-25 Texas Roadhouse restaurants per year, and in the mid-term, they plan to accelerate Bubba’s 33 to at least 10 locations per year as well.

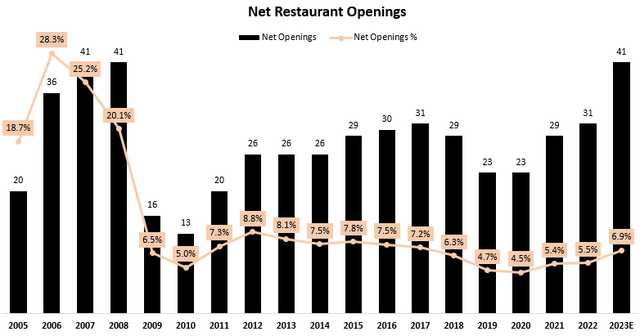

Created and calculated by the author using data from Texas Roadhouse financial reports (10-K)

Notably, the company has consistently maintained an impressive range of 20-30 annual openings since 2011. However, 2023 is anticipated to stand out as an exception, primarily due to the acquisition of a substantial number of franchised locations (8) and the delayed development of certain projects, culminating in a densely packed year of expansion.

Although the number of annual openings has continued to increase, it is evident that the growth rate in terms of percentage has gradually decelerated. As Texas Roadhouse attains a significant scale, concerns regarding the remaining opportunities naturally emerge. Currently, the company operates one of the most expansive dine-in chains in North America, second only to Darden Restaurants (DRI) and its 905 Olive Garden locations, to the best of my knowledge. While the disparity between the two indicates at least a decade of growth at the current pace, it is apparent that the geographical expansion, which has been a major growth driver, will naturally slow down as a result of the company’s size. Thus, same-store-sales growth becomes much more important.

Same-Store Growth

Texas Roadhouse prides itself on being an attractively-priced concept, meaning they take pricing actions with caution. Management has repeatedly said it won’t take pricing actions to mitigate cyclical commodity swings, whereas it will act on stickier inflationary items like wages.

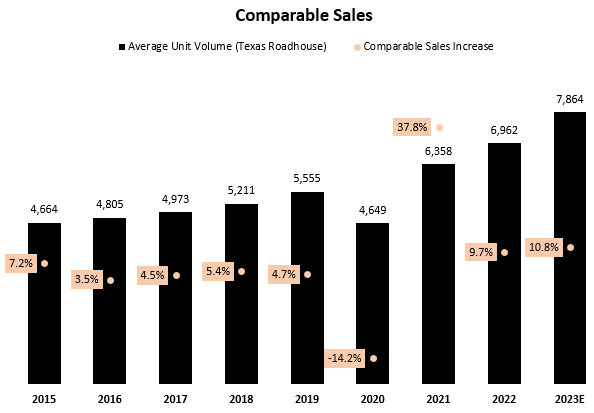

Created and calculated by the author using data from Texas Roadhouse financial reports (10-K); Average Unit Volume = average annual sales per location.

Historically, Texas Roadhouse has consistently achieved mid-single-digit growth in comparable sales. However, over the past three years, same-store sales growth has experienced a remarkable acceleration, primarily fueled by post-pandemic demand and price adjustments in response to inflationary pressures. It is crucial for investors to be aware of a potential recency bias, which may lead them to perceive the current 9%-10% threshold as a new norm.

I don’t think sustaining such levels will be feasible, even with the company’s concerted efforts to enhance restaurant throughput. Weekends are already filled with customers, and the concept operates exclusively during dinner hours on weekdays. There are inherent limitations to accommodating additional customers, and there is a ceiling on the extent to which prices can be increased. Consequently, I firmly believe that a return to the mid-single-digit growth range is an inevitable outcome, and thus, margin expansion is critical for the company to be able to continue to grow its EPS at its historical pace.

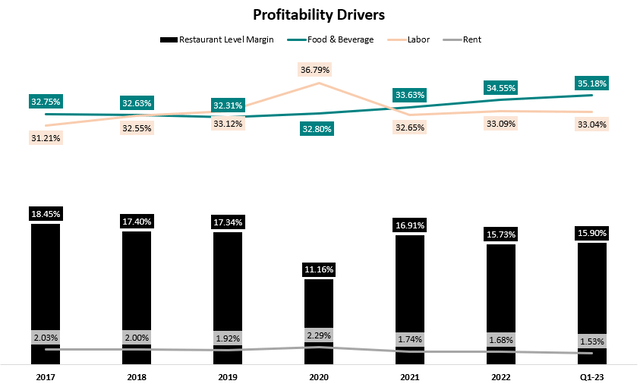

Created and calculated by the author using data from Texas Roadhouse financial reports (10-K)

As we can see, the restaurant-level margin is still low compared to the targeted 17%-18% range, primarily due to high food & beverage costs, and labor pressure. Unfortunately, most of the margin problems are external and macro-related, making it very challenging to mitigate. Bear in mind that Texas Roadhouse is already running a very efficient operation, but its bill of materials is just more expensive. For reference, Darden Restaurant’s food & beverage costs are only 30.8% of sales.

Valuation

In general, Texas Roadhouse meets the majority of my qualitative criteria, and I regard it as an exceptionally high-quality business. However, I have strong convictions about its growth slowing down and the restricted potential for margin expansion. Consequently, I would consider it a favorable investment only if its valuation aligns with its inherent potential.

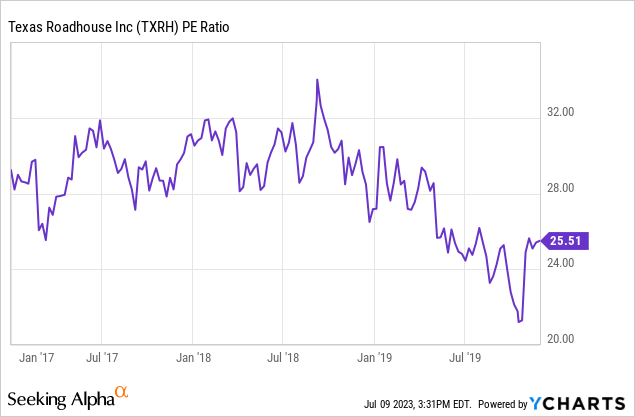

Looking at its historical pre-pandemic P/E ratio, we see that TXRH was trading in the 22x-30x range, and today we’re looking at a 26.6x multiple. Looking forward, consensus estimates put the company at 23.7x, close to the lower end of the range.

Financial Model

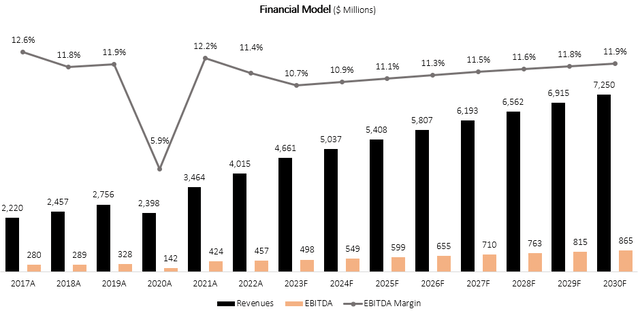

I used a discounted cash flow methodology to evaluate TXRH’s fair value. I assume the company will grow revenues at a 6.5% CAGR between 2023-2030, based on my growth expectations described above.

I project EBITDA margins to increase incrementally up to 11.9% in 2030, as commodity prices average back to normal and the company improves its throughput, as well as a decrease of pre-opening and restructuring costs as a percentage of sales.

Created and calculated by the author based on Texas Roadhouse financial reports and the author’s projections.

Taking a WACC of 8.1%, and adding its net cash position, I estimate the company’s fair value at $7.7B or $115 per share.

Risks

The risks associated with Texas Roadhouse are primarily derived not from fundamental factors, but rather from the lofty expectations already embedded in its present valuation.

Beginning with margins, I think investors are overestimating the company’s ability to see margins recover in the near term.

We are always looking at how to get back to that point [17%-18% restaurant margin]. We have made some progress I think from Q4 to Q1. Although we still have some improvements to do, the labor inflation, we know what it’s looking like going into the rest of the year. Beef inflation, that’s a little higher, but we hope that our digital technology is teaching us to be a little faster when we expedite our food through the kitchen. Roadhouse Pay is definitely another enhancement to the service level and maybe even a little bit of the speeding of a table turn. So, we have several things that are doing to allow us to continue to elevate how many guests we can get through the building in any given day, which as obviously the inflationary pressures settle will help us get back to that.

— Jerry Morgan, CEO, Q1-23 Earnings Call

While I don’t want to disrespect the company’s ambitions regarding improving throughput, it’s obvious that the main problem is commodity inflation, which the company is reluctant to mitigate through pricing.

With half of our basket being beef that our overall commodity lock has to be somewhat in-line with what our beef is, I’ll tell you, our outlook for beef has really not changed, since the last time we spoke to you all, we do think it will drive the majority of our inflation for 2023 (5%-6%). And that other items in the basket will see their inflation moderate to bring our overall inflation down. On the last point you brought up about menu pricing, that is still the way we think about it, we price for the structural component of inflation, which tends to be wage inflation. And we don’t tend to overreact in price for the cyclical items like commodities beef will probably be inflationary for a period of time.

— Michael Bailen, Head of Investor Relations, Q1-23 Earnings Call

Furthermore, as consumers start to manage their budgets more cautiously, the company is already seeing a trade-down trend from both returning and new customers, which will affect topline and bottom-line growth.

There is certainly some guests who may be doing a little bit of check management. But as I also mentioned on the previous call, I think we are seeing new guests coming into Texas Roadhouse and maybe starting at the lower on the value side of the menu.

— Michael Bailen, Head of Investor Relations, Q1-23 Earnings Call

Overall, I firmly believe the near term isn’t as great as the stock price suggests, which means I see limited upside at current prices.

Conclusion

Texas Roadhouse stands out as one of the most commendably managed companies within the restaurant sector. With great service and delicious food across its 704 locations, the company consistently expands its geographic footprint while remaining debt-free. Additionally, its management prioritizes operational efficiency and maximizing shareholder returns.

Nevertheless, the current valuation leaves limited room for upside, as the company naturally faces growth deceleration at its current size, and a margin recovery heavily relies on external factors. Moreover, I believe investors may be overly optimistic about the company’s short-term prospects, disregarding historical averages and the presence of near-term headwinds. Therefore, I assign a Hold rating to the stock and intend to closely monitor it in case of a drop in valuation or the easing of some of its near-term challenges.

Credit: Source link