Artfoliophoto/iStock via Getty Images

To understand how US Treasury 3 Month Bill ETF (NASDAQ:TBIL) could be a primary component in a barbell strategy, we first need to understand what the strategy is. Popularized by Nassim Taleb, a “barbell strategy” is an investment approach that involves splitting one’s investment portfolio into two distinct and contrasting segments, resembling the shape of a barbell. One segment of the portfolio consists of low-risk, highly stable investments, while the other segment involves higher-risk, potentially higher-reward assets. This strategy aims to balance safety and growth by combining the stability of conservative investments with the growth potential of more aggressive ones. I have briefly mentioned this approach in a few of the speculative names that I have covered.

The idea is that the conservative portion provides a cushion during market downturns and offers capital preservation, while the riskier portion offers the potential for substantial gains when market conditions are favorable. The barbell strategy attempts to address both the need for stability and the desire for growth in an investment portfolio.

I believe this strategy is even more so important in the current environment.

While some of my investments have focused on the aggressive side, I have never explicitly mentioned in Seeking Alpha what I use for my conservative side. This changes today.

Diving Deeper

Diving into the conservative side of my barbell setup, I use a combination of Savings deposits with a high-interest rate, safe stocks with a high dividend, and treasury bills with a high yield. Recently, I was overjoyed to discover an ETF that makes it much easier to get involved with Treasury bills, playing nicely into my barbell strategy.

The environment

It is becoming harder and harder for me to understand the current environment in stocks. While 2022 saw some reality seep in for a lot of the mid-cap and large-cap names, we are still far from seeing a similar treatment for the mega-caps. Much of the rally Year to Date has been narrative-driven and I get especially scared of the market when it is that way. I was recently reviewing some of the biggest names that have rallied this year (Ex: Meta, Nvidia, Alphabet, etc.) and most of them have shown little to no growth yet the stocks have marched towards their all-time highs. These are the most outstanding themes in the current market –

1. Top-heavy and narrative-driven

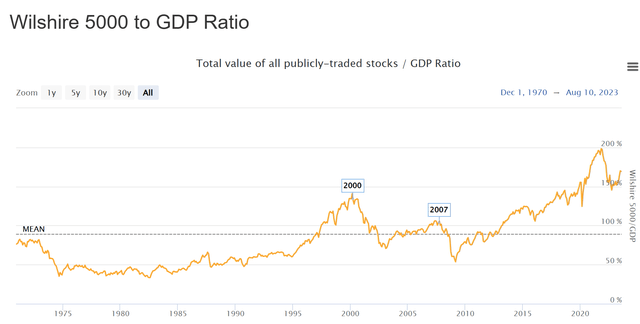

2. Ultra mega caps are valued like growth stocks, with overly optimistic and unsustainable valuations. In fact, Warren Buffett’s favorite valuation indicator which compares the value of publicly traded stocks with GDP is at 170% suggesting a big overvaluation.

Long term trends

3. Option plays especially the birth of 0DTEs driving further speculation

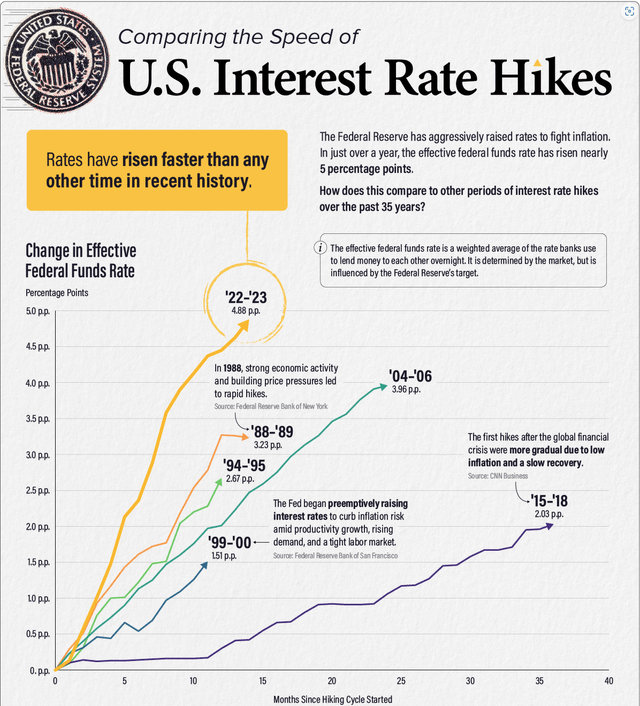

4. Fastest pace of interest rate hikes in history

Visual Capitalist

Such periods of exuberance have often come crashing down in the past as market sentiment gave way to a sobering assessment of reality. Most investors agree that timing the market is next to impossible but it would definitely help to look at the current stock market with this lens and step off or even tone down the risk. Fortunately, we can do this in a much easier way with TBIL ETF.

The ETF

1. The ETF trades on NASDAQ, is just a year old, and has a low management fee of 0.15%

2. It provides exposure to the current 3-month Treasury Bill with the convenience that comes with an ETF. Every week, the US Treasury conducts an auction for a fresh 3-month Treasury bill. This auction establishes the coupon rate for the latest note issued. Following the conclusion and settlement of the auction, TBIL will sell the existing 3-month US Treasury it currently holds and transition into the newly issued 3-month US Treasury.

3. Payments are monthly i.e. much more frequently the underlying security

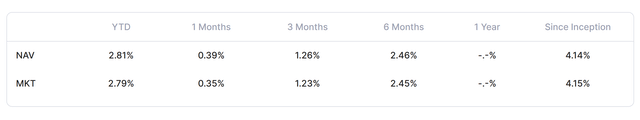

4. Has a current yield of 5.56%

2023 July Month End Performance (US Treasury)

Duration of this Play

At some point, the yield on this ETF would come down but I wouldn’t hold my breath about this happening anytime soon. While predictions come easy and we never thought we would be at this point (where Treasury yields are this high), there are “experts” again calling that Fed will start to reverse the rates next year because the rate of inflation climb is slowing down. True or not, in the current situation, the high yields allow us to be in cash and take a measured approach to investing.

If we ever get back to a low-interest-rate environment unexpectedly it could be in response to the deteriorating macro conditions in which case our conservative side of the barbell worked exactly like it should i.e. provide a safe haven and protect our capital.

Credit: Source link