Pakin Jarerndee/iStock via Getty Images

A Quick Take On Stagwell

Stagwell Inc. (NASDAQ:STGW) reported its Q3 2023 financial results on November 2, 2023, missing both revenue and consensus earnings estimates.

The firm provides an array of digital marketing solutions and services to online marketers worldwide.

While technology spending may begin to return and an active political season lies just ahead, my near-term outlook on Stagwell Inc. is Neutral [Hold] on concerns about revenue growth and a higher-for-longer interest rate environment.

Stagwell Overview And Market

New York-based Stagwell was founded to provide a growing array of digital marketing services to marketers globally.

The company went public via a merger with MDC Partners in April 2021, combining the two marketing services companies.

The firm is headed by Chairman and CEO Mark Penn, who has been President and Managing Partner of The Stagwell Group, a private equity firm focused on the marketing services industry.

The company’s primary offerings include the following:

-

Marketing Cloud

-

Digital Transformation

-

Performance Media & Data

-

Consumer Insights & Strategy

-

Creativity & Communications.

The firm acquires customers through its direct sales and marketing efforts and through referrals and word of mouth.

By region, Stagwell is active in the U.S., the UK and other regions.

According to a 2023 market research report by Expert Marketing Research, the global market for digital marketing was estimated at $363 billion in 2023 and is forecast to reach nearly $1.1 trillion by 2032.

This represents a forecast CAGR (Compound Annual Growth Rate) of 13.1% from 2024 to 2032.

The main drivers for this expected growth are a growing population of people consuming content through digital channels and increasing availability of precise measurement of campaign performance.

Also, the expenditures on mobile advertising has grown to around 40% of budget in major Western European markets.

Digital marketing investment in the Asia Pacific region has exceeded that of Europe’s, driven by rapidly advancing countries like China.

Major competitive or other industry participants include:

-

Omnicom Group

-

The Interpublic Group Of Companies

-

WPP plc

-

Publicis Groupe

-

Dentsu

-

Havas SA

-

Accenture Interactive

-

Others.

Stagwell’s Recent Financial Trends

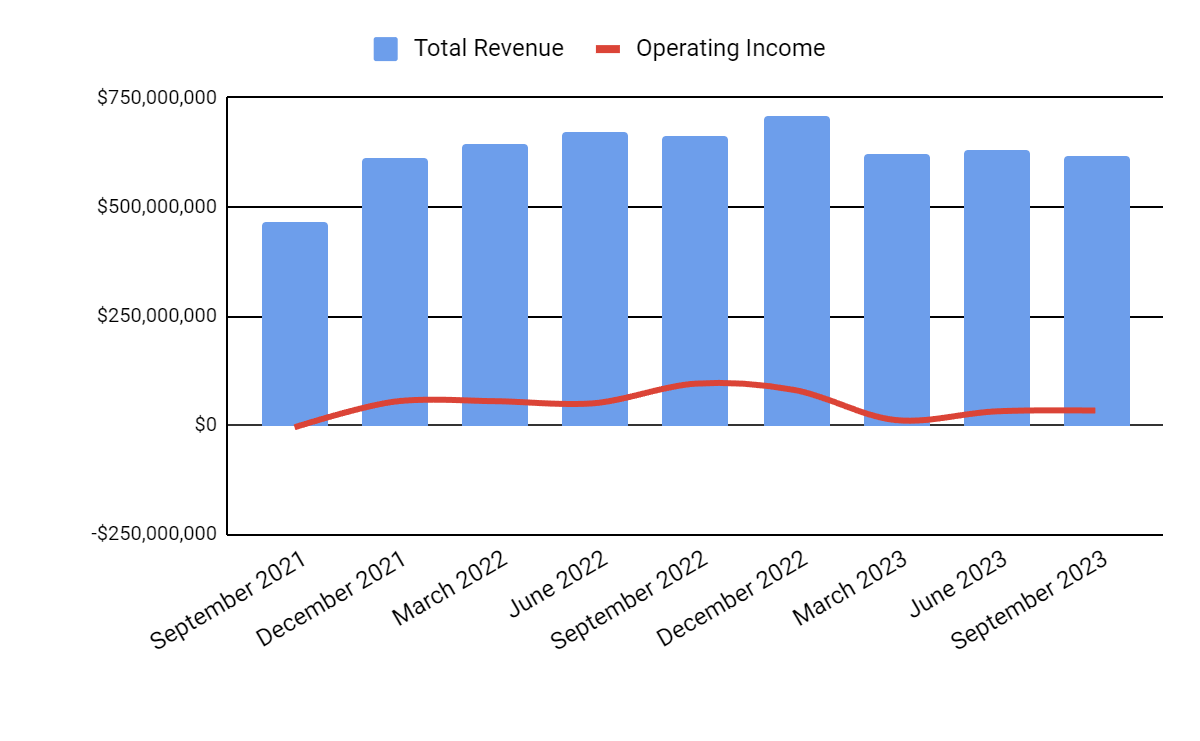

Total revenue by quarter (blue columns) has dipped in recent quarters; Operating income by quarter (red line) has also moved lower more recently:

Seeking Alpha

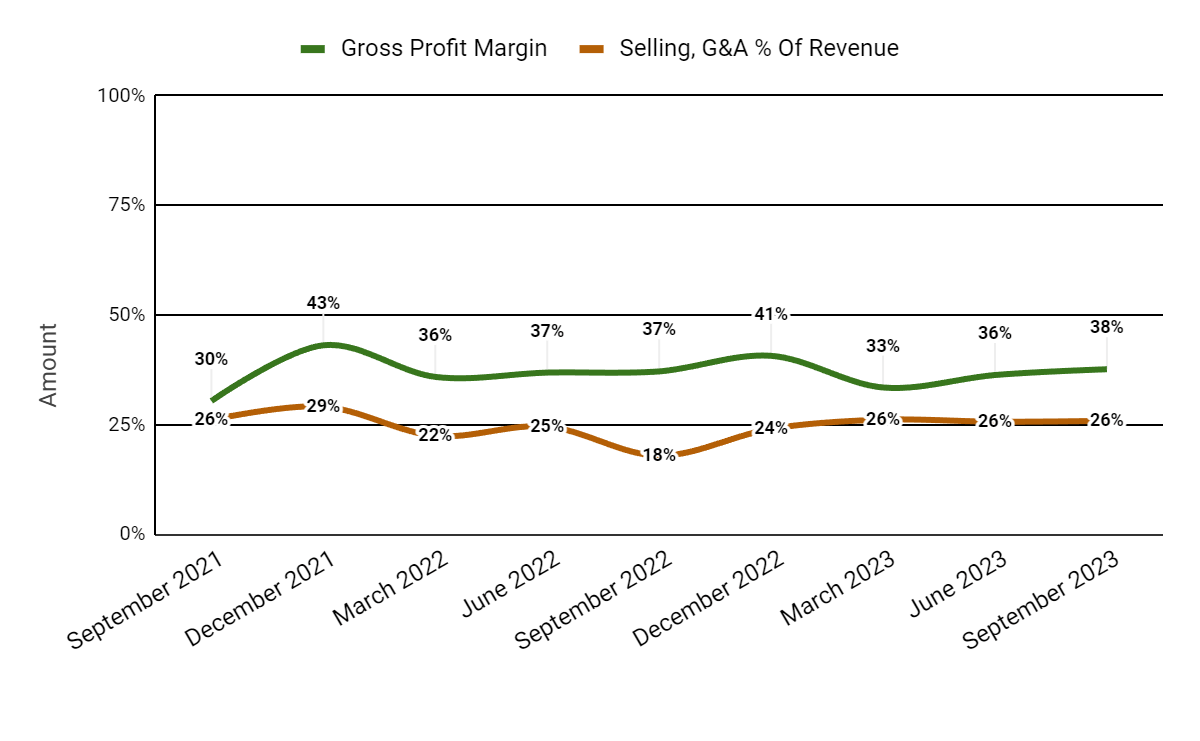

Gross profit margin by quarter (green line) has varied within a narrow range recently; Selling and G&A expenses as a percentage of total revenue by quarter (amber line) have remained flat in recent quarters:

Seeking Alpha

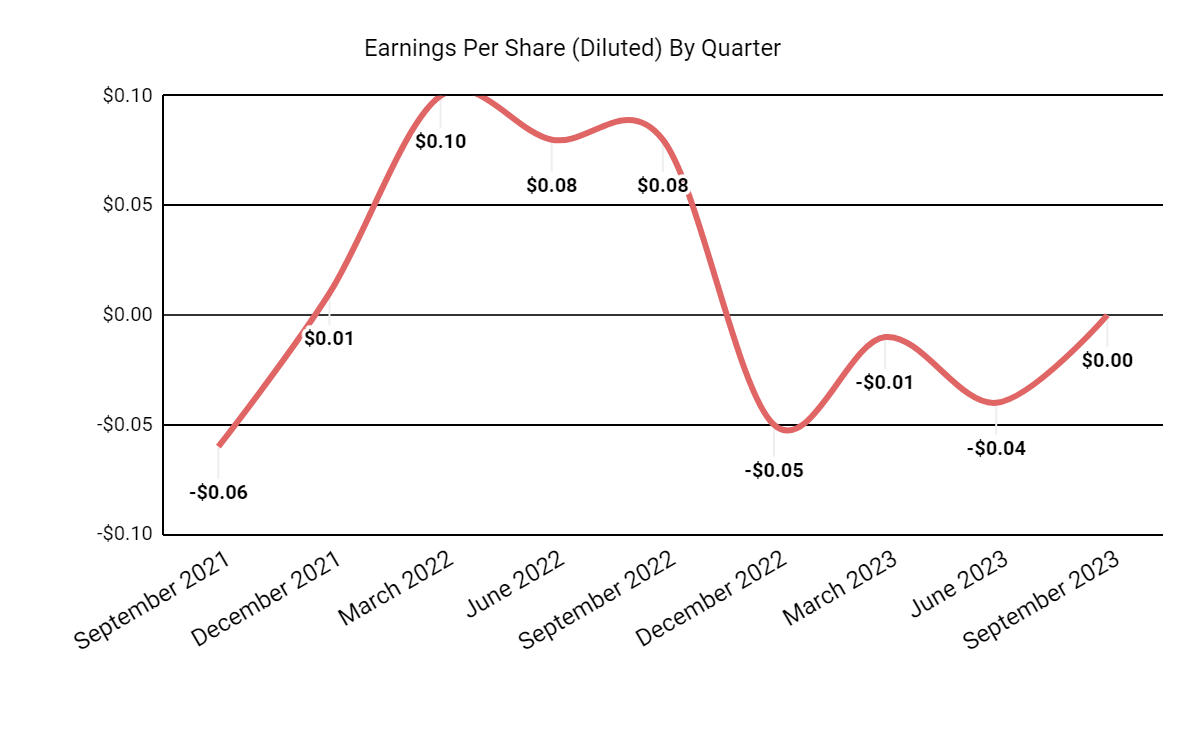

Earnings per share (Diluted) have returned to breakeven in the most recent quarter:

Seeking Alpha

(All data in the above charts is GAAP.)

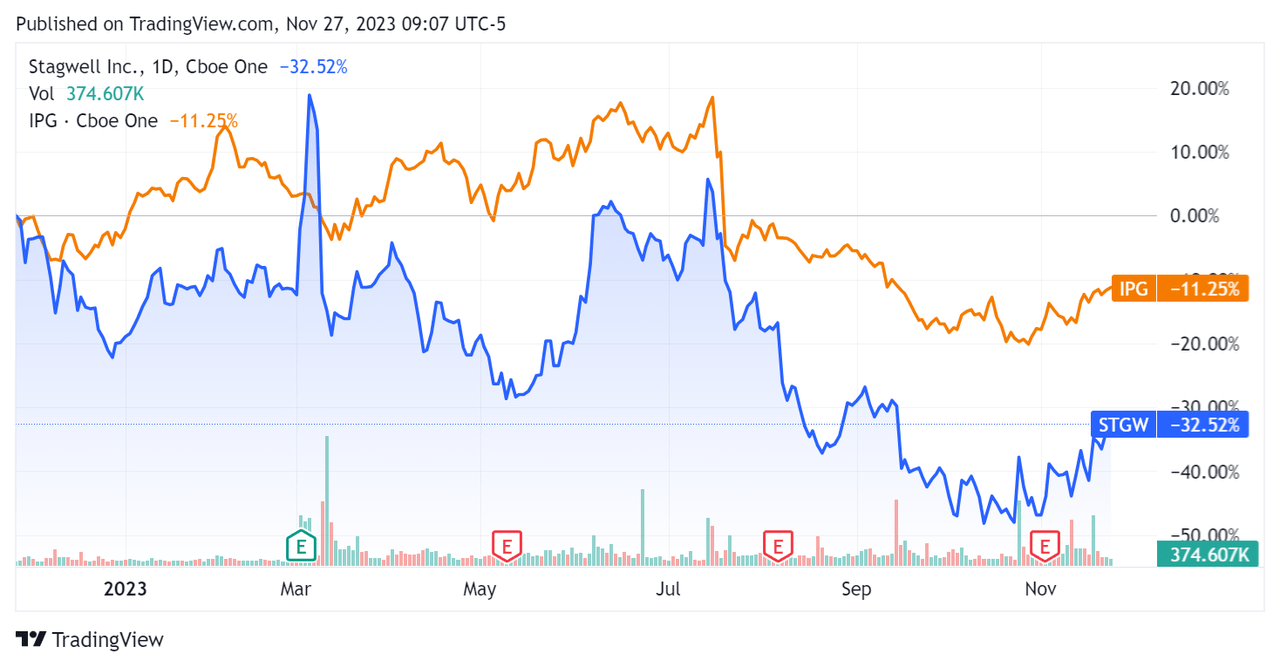

In the past 12 months, STGW’s stock price has fallen 32.52% vs. that of The Interpublic Group Of Companies’ (IPG) drop of 11.25%:

Seeking Alpha

For balance sheet results, the firm ended the quarter with $98.7 million in cash and equivalents and $1.5 billion in total debt, all of which was categorized as long-term.

Over the trailing twelve months, free cash flow was $128.2 million, during which capital expenditures were $18.8 million. The company paid $34.4 million in stock-based compensation in the last four quarters.

Valuation And Other Metrics For Stagwell

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure (Trailing Twelve Months) |

Amount |

|

Enterprise Value / Sales |

1.1 |

|

Enterprise Value / EBITDA |

9.1 |

|

Price / Sales |

0.2 |

|

Revenue Growth Rate |

-0.4% |

|

Net Income Margin |

-0.4% |

|

EBITDA % |

11.7% |

|

Market Capitalization |

$1,350,000,000 |

|

Enterprise Value |

$2,770,000,000 |

|

Operating Cash Flow |

$146,960,000 |

|

Earnings Per Share (Fully Diluted) |

-$0.10 |

|

Forward EPS Estimate |

$0.74 |

|

Free Cash Flow Per Share |

$0.83 |

|

SA Quant Score |

Hold – 2.83 |

(Source – Seeking Alpha.)

As a reference, a relevant partial public comparable would be The Interpublic Group Of Companies:

|

Metric (Trailing Twelve Months) |

The Interpublic Group |

Stagwell |

Variance |

|

Enterprise Value / Sales |

1.6 |

1.1 |

-31.8% |

|

Enterprise Value / EBITDA |

8.7 |

9.1 |

5.4% |

|

Revenue Growth Rate |

-0.9% |

-0.4% |

–% |

|

Net Income Margin |

10.0% |

-0.4% |

–% |

|

Operating Cash Flow |

$927,500,000 |

$146,960,000 |

-84.2% |

(Source – Seeking Alpha.)

Commentary On Stagwell

In its last earnings call (Source – Seeking Alpha), covering Q3 2023’s results, management’s prepared remarks highlighted its prior cost control actions as having placed it in a good position to now focus on expanding its “digital and global footprint.”

The firm believes that the worst is over for technology firms and their employee cutbacks, especially as they gear up for competing in the new “AI” world.

Management also expects the upcoming political season to “be a record one.”

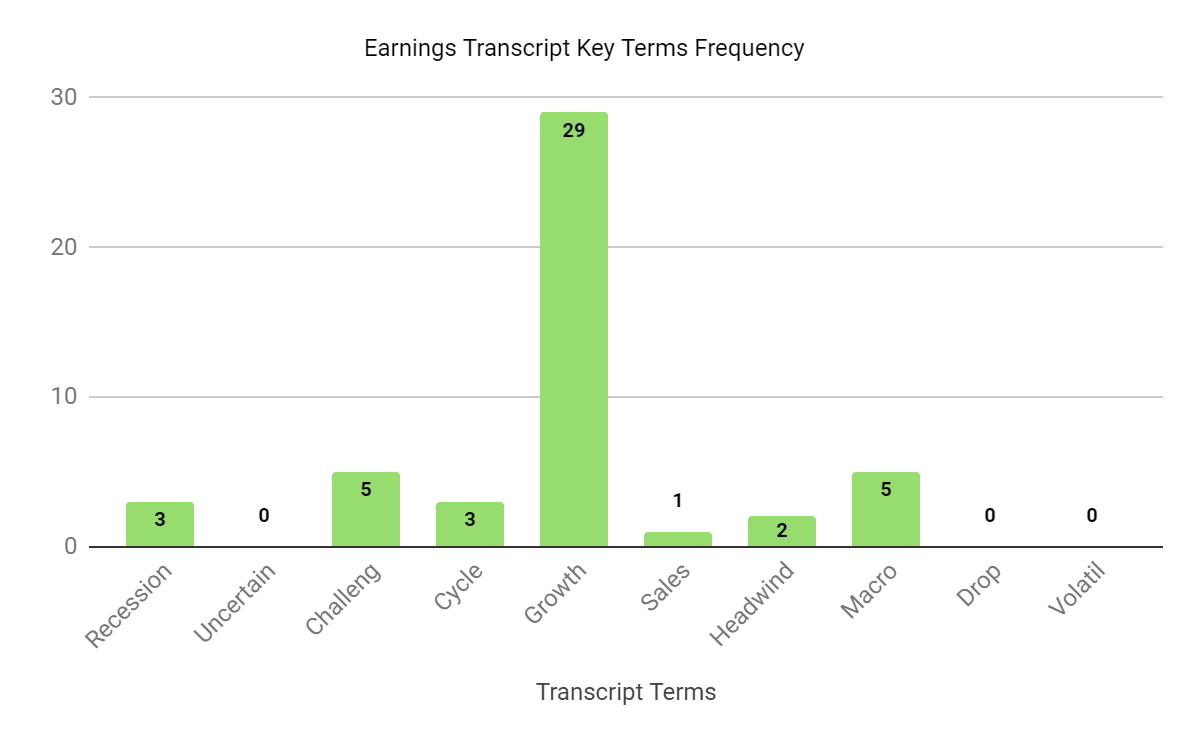

In the earnings call, I tracked the frequency of various terms and keywords used by analysts and management as shown in the chart below:

Seeking Alpha

The chart indicates the firm and its clients are dealing with macroeconomic headwinds and recession fears, although those fears appear to be abating in favor of a so-called “soft landing.”

Analysts asked leadership about signals of recovery in client spending, international expansion paths and the reason for lower free cash flow.

Management said it is seeing larger firms contemplating new business engagements with new RFPs (Request For Proposal) after a year of focus on efficiency and cost takeout.

The firm has reorganized its existing international teams and is planning to look at Latin America and the Middle East for future expansion opportunities.

Lower free cash flow was due to higher interest costs on its substantial long-term debt load and expects interest costs to drop in 2024.

Total revenue for Q3 2023 dropped 7.0% year-over-year, while gross profit margin rose by 0.5%.

Selling and G&A expenses as a percentage of revenue rose by 7.9% YoY, and operating income fell by 64.6% compared to Q3 2022’s results.

The company’s financial position is moderate, with some liquidity, significant long-term debt but strong free cash flow.

Looking ahead, management believes that its expertise in providing AI-enabled marketing and transformation positions the firm well in the upcoming AI-centric upgrade cycle.

The firm is executing various divestitures while seeking to acquire or expand internationally as management adjusts to new opportunities.

In the past twelve months, the firm’s EV/EBITDA valuation multiple has increased by a net of 12%, as the chart from Seeking Alpha shows below:

Seeking Alpha

A potential upside catalyst to the stock could include further progress from new bookings in the technology and digital transformation spaces related to its AI capabilities.

However, the effects of higher interest rate expenses on its significant debt load will likely weigh on its financial results in the near term.

Accordingly, my short-term outlook on STGW is Neutral [Hold] on concerns about revenue growth and a higher-for-longer interest rate environment.

Credit: Source link