PeopleImages/iStock via Getty Images

Sprinklr, Inc. (NYSE:CXM) has been one of the victims of the recent tech bear market that brought down many high-performing names. The company went public at the wrong time – in June 2021, just a few months before the Nasdaq peaked and started a nearly 40% decline. And while Sprinklr’s share price performed poorly, the company has executed well and has grown revenues better than it guided since going public.

Sprinklr aspires to be the leader in the CCaaS market – Contact Center as a Service. The company has a suite of product offerings that are powered by artificial intelligence (“AI”) since 2018, and this represents a decent head start over its competitors given the recent surge in interest in generative AI. Sprinklr has fully embraced generative AI and has integrated with OpenAI’s models to create “better content faster and with fewer resources.”

The growth rates since the company went public were not exceptional (from the low 30s initially to the low 20s more recently), but look steady and reliable.

Last year, the company decided to revamp the business, restructure global operations, and simplify its product offerings, and it eliminated projects that were not producing the required ROI. And in February, it cut the workforce by 4%. These changes appear to have caused little to no disruption and have already begun to yield results, evidenced by the strong sequential subscription revenue growth in fiscal Q4 2023 and by the strong guidance for fiscal 2024 that caused the surge in the share price in late March.

Last year’s changes are having a negative impact on the low-margin services business, but that is by design as the company decided not to take on additional projects on that side. This is a small segment – it represented approximately 11% of total revenues in fiscal 2023 and only slightly more than 2% of the company’s gross profit. The fiscal 2024 guidance of $66 million for the services business implies a mid-single-digit decline over fiscal 2023, and it will be a slight drag on total revenue growth.

On the other hand, the high-margin subscription business is expected to continue to deliver strong growth in fiscal 2024. Subscription revenues grew 28% in fiscal 2023, and fiscal 2024 guidance implies 18% Y/Y growth at the mid-point of the range. However, the company has a history of providing guidance it can beat, and I believe it is reasonable to expect the subscription revenue growth rate in fiscal 2024 to be in the 22-23% range.

The fiscal 2024 guidance also takes into account the deteriorating macro conditions, although that may not mean guidance was more conservative than usual as the overall conditions may deteriorate more than the company assumed. Even so, the business seemed quite healthy when the company held the earnings call in late March, and management was encouraged by the leading indicators and the momentum across the business. And should the economy start to recover, the growth rates could also improve in the latter part of the year or in calendar 2024, but the recent trends do not point in that direction.

And last but not least, operating margins have continuously improved in the last few quarters, and Sprinklr expects to generate positive non-GAAP income and positive cash flow this year.

Recent share price momentum is supported by growth expectations and reasonable valuation

Sprinklr’s share price recently rose to levels last seen in September 2022 after the strong fiscal Q4 2023 results in late March.

Seeking Alpha, Trading View

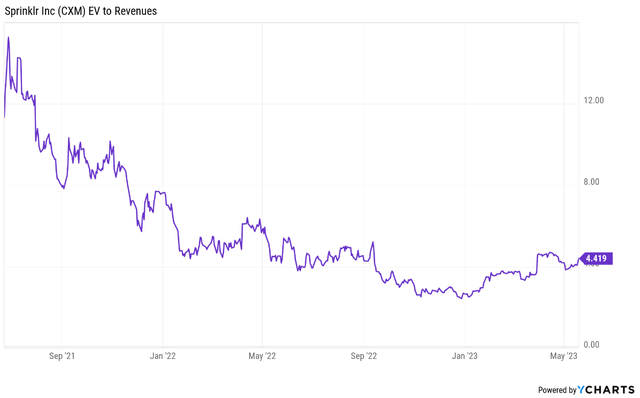

The combination of good business momentum, improving margins, and a reasonable valuation could result in the stock re-rating higher in the coming quarters. By reasonable valuation, I mean the enterprise value to revenue ratio of around 4.4 and the assumption of much higher operating margins at scale in a few years.

Ycharts

The key risk in the near term is Sprinklr, Inc. underperforming expectations and missing its guidance, but this risk appears low based on the company’s historical performance. The risks in the medium and long term are related to the company’s core competency – the use of AI in its CCaaS industry. Sprinklr, Inc. has been a disruptor in the field since its founding, but it could fall behind due to the rapid pace of development of generative AI, and better and more affordable solutions could appear in the following years.

Credit: Source link