Joe Raedle/Getty Images News

Airlines generally are not my preferred investments despite the fact that I see some names that could provide very rewarding returns. Spirit Airlines, Inc. (NYSE:SAVE) is one of the companies that has performed slightly better than the markets. The reason is very simple, the company can lean on a JetBlue Airways Corporation (NASDAQ:JBLU) that is significantly higher than the current trading levels.

That, however, does not take away that there are significant concerns about the takeover gaining approval. In this report, I will briefly discuss what makes Spirit Airlines attractive for JetBlue, the proposed merger objections and how the challenges at both

Why Did JetBlue Want To Buy Spirit Airlines?

Let’s first discuss why JetBlue wanted to buy Spirit Airlines in the first place. That was actually not so much driven by JetBlue looking for a partner to merge with. What happened is that as Frontier Airlines did bid for Spirit Airlines, JetBlue would see itself ending up as the weaker player in a further consolidated market with significantly ultra-low-cost pressure in their key markets such as Florida, the New York-Boston area and Las Vegas. By blocking the combination with Frontier Airlines, JetBlue would already have what it wanted.

Beyond that, there were other reasons to actually be interested in Spirit Airlines. Spirit Airlines aims at an aggressive market penetration and to be frank that would hurt JetBlue most. JetBlue prides itself as bringing the JetBlue effect to legacy carriers, forcing prices down. Their argument for approving the combination with Spirit Airlines is that as a bigger airline they could compete more effectively with the legacy carriers and bring down prices even more.

However, none of that fits with the reality that Spirit Airlines post acquisition would see its business model disappear as the aircraft would be reconfigured closer to JetBlue configuration. That’s where the focus of the Department of Justice on cost-conscious travelers is interesting. The DOJ argues that aircraft would be configured less densely and the ancillary revenues business set up where customers pay for the services and products require would be eliminated.

For years, we have been seeing how there’s some opposition against letting travelers pay for every bit of service they require, but the DOJ is now highlighting densely-configured aircraft and having to pay for everything as a nice business model. With that, the DOJ aligns itself in a trend where service and comfort is eroding. So, while good for the cost-conscious traveler, the DOJ also sends a questionable signal to the industry.

Another reason why JetBlue would be interested in Spirit Airlines is the simple fact that JetBlue is some steps behind in its fleet renewal and Spirit Airlines has aircraft on order that could support the JetBlue fleet renewal. So, what Spirit Airlines has in the order books with aircraft manufacturers to grow and compete more fiercely is what JetBlue wants to use to update its fleet.

The Spirit Airlines JetBlue Merger Details

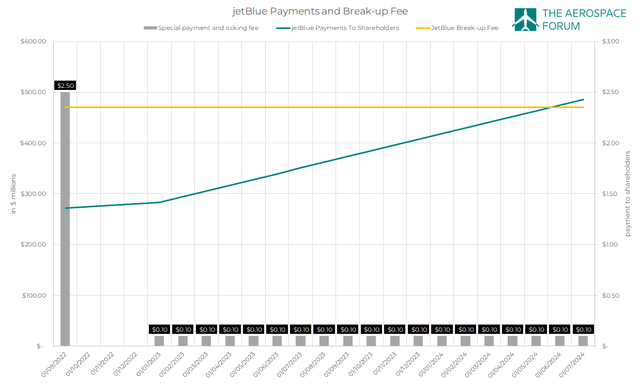

The Aerospace Forum

JetBlue offered $3.8 billion or $33.50 per share. This includes a $2.50 per share payment which happened on approval of the JetBlue takeover by Spirit Airlines shareholders and a $0.10 ticking fee starting January 2023. With the combination in jeopardy, it’s also interesting to look at the break-up fee conditions which was one reason for JetBlue to end up on top of Frontier Airlines to acquire Spirit Airlines. If Spirit Airlines walks away from the proposed combination, it will have to pay $94.2 million to JetBlue. If JetBlue walks away from the merger agreement, it will pay $70 million to Spirit Airlines and $400 million to Spirit Airlines shareholders.

That’s where it becomes interesting. Investors have been looking at the break-up fee as being a positive to the deal falling apart. The reality is that shareholders have little to gain here. The deal is structured such that the payment to shareholders upon termination is $400 million less all payments that were already made which includes a ticking fee of $0.10 per month and the $2.50 special payment. By the end of the year, JetBlue would already reach that $400 million payment to shareholders. So, only a merger termination before that point will actually be beneficial to shareholders as it accelerates the payment.

However, we also see that the complete payment of $470 million upon break-up is structured such that by the time JetBlue hopes to have the deal fully approved, it will have returned approximately $470 million to shareholders. That means that with the break-up fee in mind there is little reason for JetBlue to walk away from the merger at a point earlier than July 2024.

What does this mean? It basically means there is little to no value in the break-up fee and for Spirit Airlines investors the only positive is that they get paid $0.10 per month in dividends putting the dividend yield at a juicy 7.3%, but perhaps not juicy enough given the undeniable uncertainty surrounding the deal.

The DOJ Opposition Against the Proposed The Spirit Airlines JetBlue Merger

In March, the DOJ announced that it would go to court to stop the takeover of Spirit Airlines by JetBlue arguing that such a takeover would eliminate options for the cost conscious traveler. Furthermore, the DOJ argued that given the NEA, an alliance between American Airlines (AAL) and JetBlue, competition was eliminated and if JetBlue would take over Spirit Airlines, Spirit Airlines would also align itself with the alliance.

The alliance eventually was deemed illegal. The argument that the alliance is pro-competitive carried no significance. This was due to a reduction in some NEA markets following the operations of the alliance, and the elimination of competition between American and JetBlue was weighed heavier than the combined ability to compete with Delta Air Lines (DAL) in the markets. What this means for the path toward an eventual combination of JetBlue and Spirit Airlines is unknown, but if the removal of competition between two parties that combine operations weighs heavier than an ability to compete with a third party, then things do not bode well for the targeted combination between the two. From there, JetBlue focused itself on the combination with Spirit Airlines and committed to sell all of Spirit Airlines assets at Boston and Newark Liberty airports in an attempt to gain regulatory approval and give back some slots at Fort Lauderdale.

So, the DOJ’s argument about the NEA has been nixed as that alliance has been dissolved and a monopoly on the East Coast is also not happening given the commitment to divest Spirit assets which throws two arguments of the DOJ out of the window. However, in my view, while there is a commitment to relinquish slots in Florida, a merger still means that JetBlue will strengthen its position on the Latin American market.

The JetBlue or Spirit Effect and Higher Fares?

As Spirit Airlines initially tried to fend off JetBlue’s advances for a combination, it put together a presentation that serves the DOJ well. It was Spirit Airlines that argued a combination with JetBlue would reduce capacity by 50% in the ULCC segment and earlier this year’s documents surfaced suggesting rates on Spirit Airlines airplanes would be hiked by 24 to 40 percent which does not bode well for the chances of approval either. Just measured by seat count reduction, 13% would already come from reduction of seat count. The remainder could be explained by a difference in service level. The DOJ likely perceives this as anti-competitive but while there is competition the low-cost model operated by JetBlue and the ultra-low cost model operated by Spirit are different in nature. If the DOJ argues that this cost bracket option should remain available, it is solely making a case for the cost-conscious travel and not for the entire traveling public.

Why is that? The DOJ rightfully points out that while there is a JetBlue effect, the fares on sectors where Spirit Airlines is active resulted in a drop in air fares, which means that on top of the JetBlue Effect there is a Spirit Effect, which would be eliminated.

Will The Effect Last Without A Spirit JetBlue Merger?

Looking at JetBlue , I would say that the JetBlue effect that it prides itself with has been less and less pronounced and what becomes more apparent the last couple of years is the lack of innovation and delays in the New York/Boston operations are lingering without the company having been able to address them adequately. I would not say that the JetBlue effect is a figment of the past, but it can certainly be said that if the company proceeds as a stand-alone company that a JetBlue effect will almost certainly fade even more, which makes competition with the legacy carriers even more difficult.

One can also question how procompetitive blocking the deal will actually be. In the same way JetBlue disrupted the markets two decades ago with the JetBlue effect, Spirit has done the same but a lot of the effect comes from the ability to scale the business. This is where labor and airplane shortages as well as growth trajectories come together. JetBlue has been dealing with labor issues and it has been awfully late with its fleet renewal, so the next leg of the JetBlue effect should have come from the absorption of Spirit which would allow the company to exerting increased pricing pressure on the legacy carriers.

The DOJ projects JetBlue as a static component that will align itself in the market as one of the major players when combined. The reality however is that airlines are notorious for destructing value trying to win market share and eroding air fare strength, so the DOJ’s view might not be fully accurate. In the same way, the JetBlue effect ran out of steam the Spirit effect might also not be a lasting one.

Spirit Airlines is currently dealing with the Pratt & Whitney issues that will ground 7 airplanes on top of the 7 airplanes that were already parked. This does lead to capacity weakening. Furthermore, the company has amended its delivery schedule with Airbus to absorb growth but likely also to reduce pressure on Airbus. The company has reduced 2024 planned deliveries by 11 units, up-gauged A319neo deliveries to A321neo deliveries with planned deliveries between 2025 and 2029 and postponed the options for more airplane purchases by another year. I wouldn’t say that the Spirit effect is running out of steam, because in 2024 capacity should see an increase in the high teens which is also what we saw in prior years but the assumption that an effect will last might be somewhat unfounded for the simple reason that in the initial high-growth phase that effect is most prominent.

Furthermore, it should be noted that the Spirit effect in recent years have been stronger as the company kept growing throughout the pandemic while other carriers were in the best case trying to regrow to pre-pandemic levels. However, it is all but reasonable to assume this high-growth can be seamlessly projected into the future as airlines also know that in order to run a strong business yields have to be managed and even with that knowledge they have not done that efficiently for years. The result is that whether it is a JetBlue effect or a Spirit effect, at some point it is almost certain that the effect will weaken as companies grow more mature and provide scale for better cost absorption. In that sense, the combination of the two airlines would provide a bundled airline that alters the business costs in a way that allows for better cost competition rather than the growth added to the fleet.

Is Spirit Airlines Stock A Buy Amid JetBlue Merger Talks?

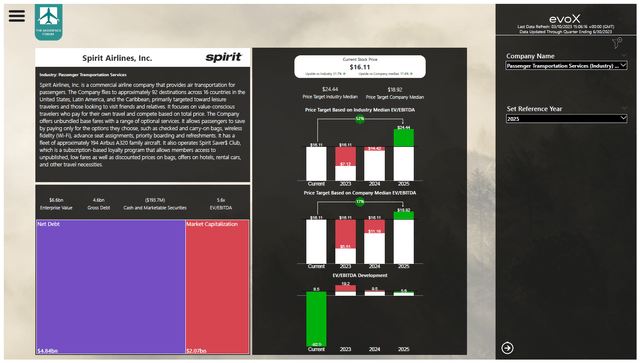

Stock price target for Spirit Airlines using evoX Financial Analytics stock picker (The Aerospace Forum)

I previously had a buy rating on Spirit Airlines stock based on the offer from JetBlue as well as the prospects of JetBlue as a stand-alone business. However, most of the upside is concentrated around 2025 and that is a very long time from now. A time in which we don’t know in what direction the merger will proceed and we don’t know what the industry will look like in two years from now. As a result, I am downgrading the stock to Hold with a $19 price target in line with the company median.

Conclusion: An Uncertain Merger Path Ahead For Spirit Airlines

By the end of this year, we should know whether the Spirit Airlines and JetBlue merger will get a greenlight. For, now I am not quite counting on it, but I do find the DOJ reasoning somewhat flawed assuming the Spirit and JetBlue effect will continue as is, especially when considering the challenges faced in the industry. While Spirit Airlines focuses on the cost-conscious traveler, they are still in the business to make money meaning that at some point when scale is achieved we will see the Spirit effect becoming less prominent in the same way it happened to JetBlue which hardly is a big disruptor these days.

Whatever the decision of the DOJ will be, I do see valid points from both sides. For investors, I do not see a compelling path to invest and would recommend holding the stock or a speculative buy position if you are expecting the merger to be approved.

Credit: Source link