klenger/iStock via Getty Images

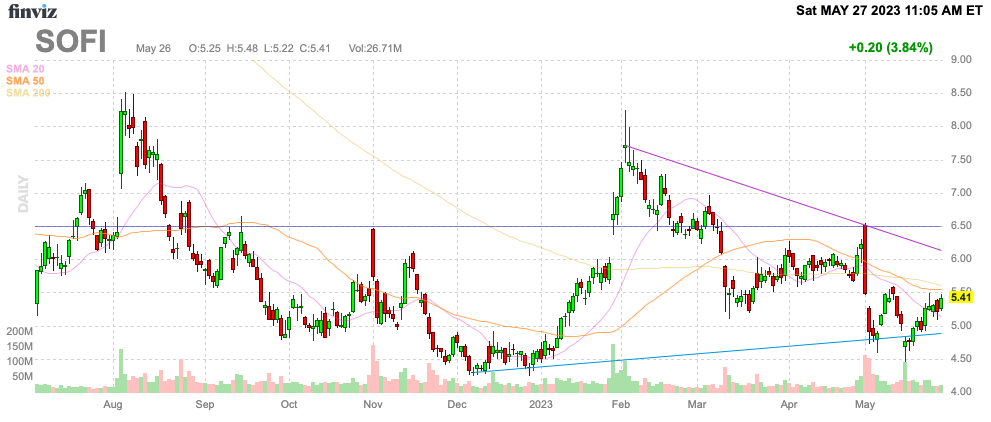

Despite SoFi Technologies (NASDAQ:SOFI) CEO making the rounds with the media and investment conferences, the market still appears to misunderstand the investment story. The fintech clearly doesn’t face an issue with how the company handles the accounting on their loan originations, yet the market constantly pushes this false narrative causing the stock to trade $5. My investment thesis remains ultra Bullish as the digital bank isn’t valued based on the growth of the business and the strong adjusted profits.

Source: Finviz

Loan Issue Laid To Rest

The prime reason to be negative on SoFi over the last few months has been related to questions on loan accounting, of course this issue popped up after shooting down the prior question on profits. Analysts such as David Chiaverini of Wedbush have questioned why the fintech didn’t sell any loans in the last quarter and stoked fears SoFi has an accounting issue with the company using fair value accounting.

Despite the Mizuho Securities analyst refuting the bear claims, the stock still hasn’t rallied much above the prices where CEO Anthony Noto has loaded up on shares. Analyst Dan Dolev made the claim SoFi was earning an ~6.4% yield holding the loans versus selling them with only a ~5.0% yield.

The market clearly doesn’t like the bullish analyst views that SoFi is only logically holding onto loans due to the better yields. During a slowing economic environment, a lender focused on unsecured personal loans just couldn’t thrive. Or at least that is the view of a lot of market participants.

The odd part is that Upstart Holdings (UPST) has nearly doubled since the May lows due to news on signing up new partners to invest in loans. The online lending marketplace obtained a deal to both sell $4 billion worth of loans to Castlelake while also alluding to signing up another $2 billion worth of committed funding agreements.

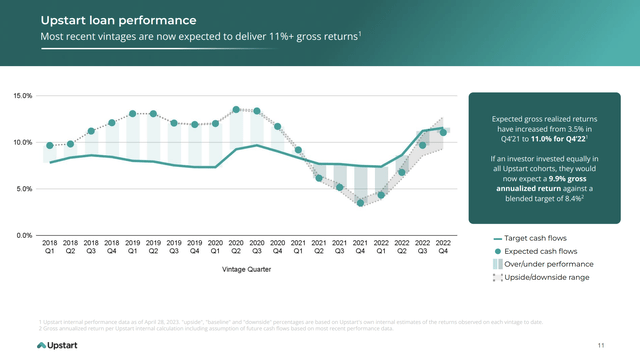

The company didn’t provide a lot of financial details on these loan agreements, but the deals indicate that personal loans are still highly profitable. In fact, Upstart highlighted how their model has new loans starting to provide higher yields again of up to 11%, not worse like a pending recession might allude towards.

Source: Upstart Q1’23 presentation

SoFi CEO Noto event went to the J.P. Morgan Technology conference to discuss the business with a huge focus on the lingering loan accounting questions. Mr. Noto made it very clear SoFi takes a fair value accounting loss on the current loans of 4.55% while the current loan losses are only 2.97%.

Back on the Q1’23 earnings call, SoFi discussed these charges the company takes for fair value accounting without providing the above loss details as follows:

And in terms of why we get confident in the sense that we would be able to sell the loans at where they’re currently marked, every single quarter we work with a third party valuation firm that marks to market each and every one of our loans on an individual basis to account for changes in every single factor that impacts loans. So that’s things like the weighted average coupon, default rates, prepayment speeds, benchmark rates, spreads as well as where secondary bonds and residuals are trading. So you see that mark to market take place every single quarter and that flows through the revenue line of our P&L.

In addition, the CEO went on Fast Money with Jim Cramer to again provide the investment story to a wider audience of individual investors. In this interview, Mr. Noto confirmed holding the loans yielding in excess of 6% while selling those loans would only yield 4%. SoFi plans to hold the loans until the yields improve similar to how 2018 operated when interest rates rose.

Source: Twitter

The biggest disappointment regarding the interview on Fast Money was Noto again talking about the goal of reaching GAAP profits. While any company should focus on maximizing profits, including GAAP profits, SoFi already has a solid adjusted profit and the comments on GAAP profits provides Bears with the runway to dispute the current profitability of the platform to the detriment of shareholders.

Supreme Court Ruling Ahead

As May comes to an end, the student debt issue should return to prominence in the markets. The ongoing debt ceiling debate has the Biden administration focused away from student debt forgiveness, but the Supreme Court should rule on the matter in weeks.

The U.S. Department of Education plans to resume loan payments 60 days after, or the end of August. In essence, the loan moratorium is expected to end by the start of October.

As a note, the only question in front of the Supreme Court is whether up to $400 billion worth of student loans on lower income borrowers will be forgiven. The Biden Administration plan only forgives up to $20k worth of outstanding loans and the majority of the loan forgiveness doesn’t impact the target SoFi customer with a FICO score above 680.

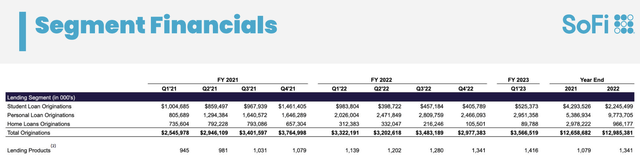

SoFi has seen student loan originations collapse in the last couple of years. The fintech had ramped up to $2.4 billion worth of loan originations back in Q4’19 and the amount has now slipped below those levels to only $2.2 billion for the whole year of 2022.

Source: SoFi Q1’23 presentation

The company won’t even operate at full capacity until the student loan refinance market normalizes.

Takeaway

The key investor takeaway is that SoFi should have the loan accounting issue behind them at this point. The stock still hasn’t recovered with SoFi trading at just 10x the adjusted EBITDA (similar to adjusted profits) target for 2024 alone while the financial metric will nearly double this year.

Credit: Source link