Wirestock/iStock Editorial via Getty Images

Note: All amounts discussed are in Canadian dollars.

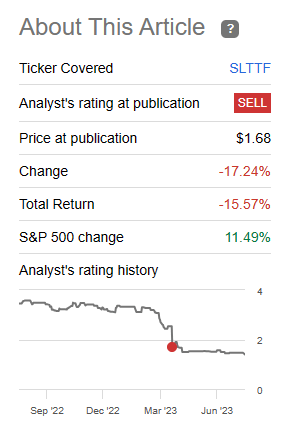

When we last covered Slate Office REIT (TSX:SOT.UN:CA, OTC:SLTTF), we did not have a lot of good news for the bulls. While the stock was down and looked cheap, we suggested that it was not too late to hit the sell button.

At present our verdict may come as a surprise, but we believe it is not too late to sell. We don’t the equity will make it through the upcoming recession and the risks look too high to even consider labeling this as a hold. This is no different than our sell rating on True North Commercial Real Estate Investment Trust (TNT.UN:CA). These stocks only look cheap due to price anchoring. They will likely go far lower, in our opinion.

Source: Another Office REIT Slashes Dividends.

Slate stock has indeed renewed its vigor to move lower and has underperformed the broader market by a fair bit.

Seeking Alpha

We look at the Q2 2023 results and update our views.

Q2 2023

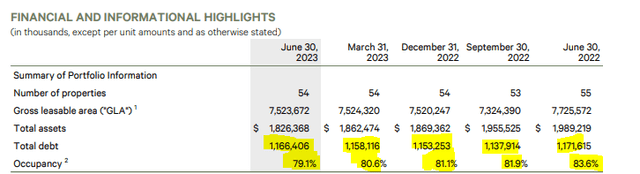

The most watched metric for Slate Office has been its occupancy levels. As an office real estate investment trust, or REIT, in secondary markets, the company has struggled to keep this up. This quarter was no different, as we saw yet another decline to 79.1%.

Slate Office Q2-2023 MD&A

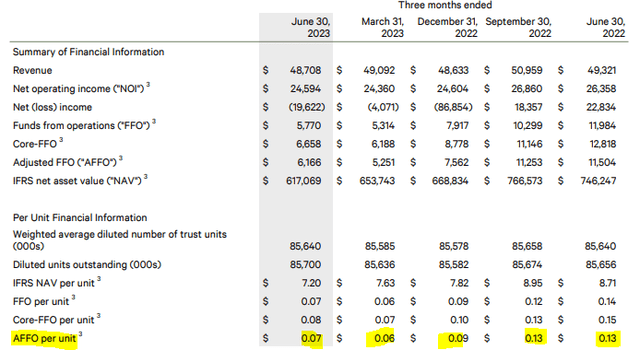

That number is getting really low and is reaching a point where it will make some refinancings (mortgage or unsecured debt) quite expensive by itself. The bull contention of course has been that the stock is cheap and certainly if you look at the adjusted funds from operations (AFFO), the valuation is not very demanding. Unfortunately, that number has trended lower over the last 12 months. This quarter, though, we saw a small uptick in the metric.

Slate Office Q2-2023 MD&A

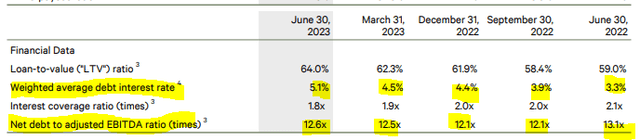

We would not get too excited about that as there are far bigger worries ahead. The first one would be the net debt to adjusted EBITDA, which is still at 12.6X and creeped up marginally this quarter. Loan to value ratio also moved up as Slate Office marked down the fair value of some of its properties.

Slate Office Q2-2023 MD&A

Investors are still smarting from the recent distribution cuts, and we don’t have to remind them that Slate Office is paying the bare minimum on that front (1 cent a month). Investors might also extrapolate that the retention of funds is high and that should help lower the debt. Unfortunately, the AFFO or FFO – or whatever similar metric you choose – is incredibly low. If you used the residual AFFO after distributions to pay off debt, you would be able to pay off about 1% of the total debt, in 1 year. So that is, in essence, what that 12.6X debt to EBITDA means. When we harp on this number and warn that even the 9.0X levels seen in Allied Properties REIT (AP.UN:CA) or RioCan REIT (REI.UN:CA) is a bit too much, we get remarks that we are “too negative.” But when you are in that territory, you need continued unfettered access to the capital markets on great terms. Getting back to Slate Office, a 9.0X multiple would be a distant dream, and there are a lot of challenges to prevent the debt to EBITDA from rising further.

Leasing & Mortgage Renewals

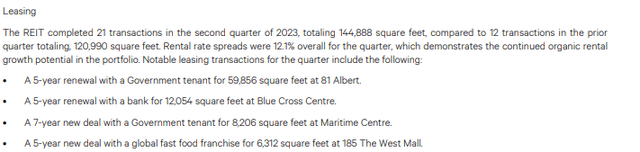

The one positive aspect for Slate Office this quarter was that the leases that got renewed did so at strong prices. Leasing spreads were solid and one reason that the company is not in even bigger trouble.

Slate Office Q2-2023 MD&A

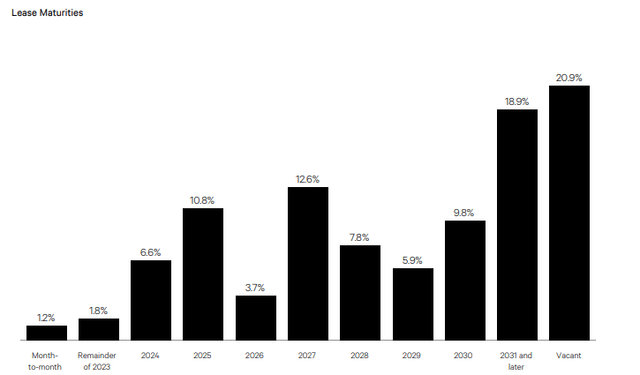

But those spreads are still secondary to the overall occupancy levels. Unless occupancy levels can stabilize and start rising, this does not have any long-term future. The company does not have a very challenging lease renewal profile, so that certainly helps.

Slate Office Q2-2023 MD&A

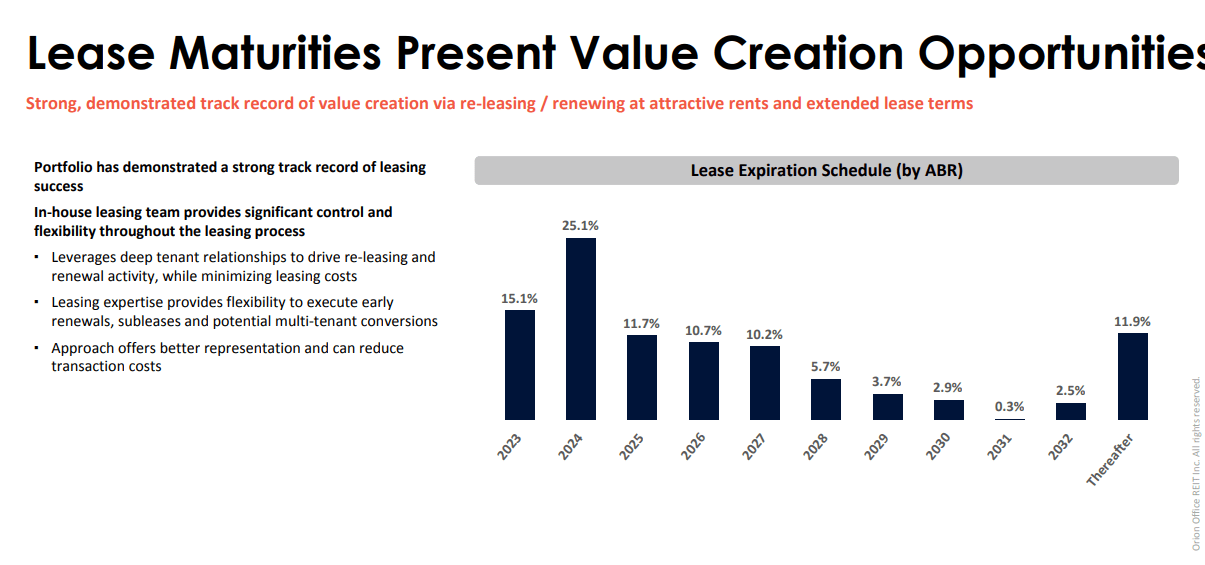

6.6% of leases maturing in 2024 is actually one of the best. An office REIT like Orion Office REIT Inc. (ONL) would be at the other end of the spectrum, with 25% of leases maturing in the next fiscal year.

Orion Office Q1-2023 Presentation

We have saved the most problematic discussion for the end, and it relates to the company’s refinancing position. The Q2 2023 report did not show any property being returned to the lender, so refinancing has occurred, albeit at higher rates.

On April 11, 2023, the REIT refinanced one of its Ontario properties for incremental proceeds of $0.7 million on a two year term with interest only payments at 6.36%.

On April 12, 2023, the REIT extended the maturity on one of its Ontario property’s financing at 1 month CDOR plus 3.00%.

On April 12, 2023, the REIT extended the maturity on a second Ontario property’s financing at 1 month CDOR plus 1.75%

Source: Slate Office Q2-2023 MD&A.

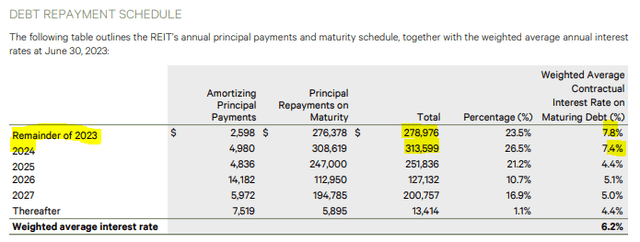

But there is more wood to chop on that front. More than $575 million is coming for renewal in the next 18 months and Slate Office is likely to have little flexibility if lenders demand a partial paydown to improve the loan to values ratios. The good part here is that the interest rate on the debt that is coming due in 2023 and 2024 already has a high rate. This probably comes from most of it being floating rate debt.

Slate Office Q2-2023 MD&A

So, bumps higher are likely to be smaller and unlikely to move the weighted average interest rate too much in the short term.

Verdict

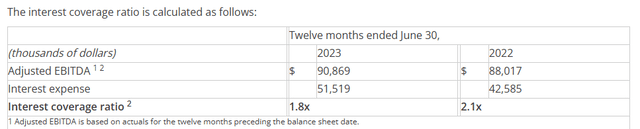

We would like to take a victory lap on our sell call and move on. After all, this market is notorious for short squeezes and we have seen office REITs rise 50% in some cases. But we just don’t see a realistic path to survival here for Slate Office REIT with those debt levels. The interest expense coverage ratio looks ok, if we view on a trailing 12-month basis.

Slate Office Q2-2023 MD&A

If we apply an 8% weighted rate eventually to the $1.16 billion of debt, it comes to $92.8 million and exceeds even the adjusted EBITDA.

We are maintaining our sell rating here, and Slate Office REIT gets an 8 on our potential pain scale.

Author’s Pain Scale

For those still interested in getting office exposure, we would look at some diversified REITs that are trading very cheap on a price to NAV basis.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Credit: Source link