JHVEPhoto

Sherwin-Williams Analysis (NYSE:SHW)

sherwin-williams.com

SHW has many attributes quality company investors look for. They dominate the industry they operate in, strong historical returns, competitive advantages that insulate them from competition, and favorable future growth data. Even with all this positive information about the company, price does matter and the valuation is rich. I highly recommend following SHW as prices ebb and flow.

The Company Snapshot by Graphs

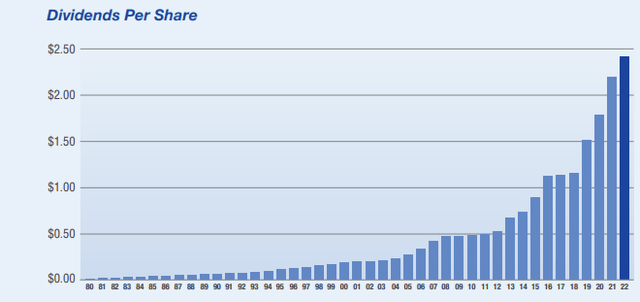

A dividend grower:

Annual Reports (investors.sherwin-williams.com)

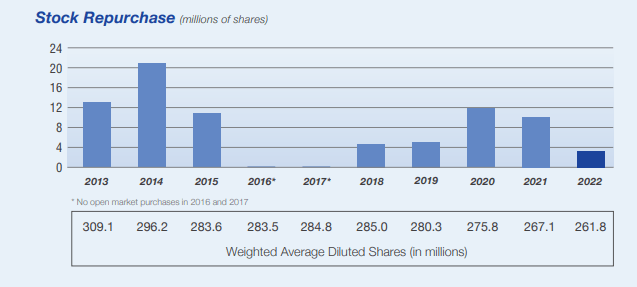

A cannibal of their own shares outstanding:

Annual Report (investors.sherwin-williams.com)

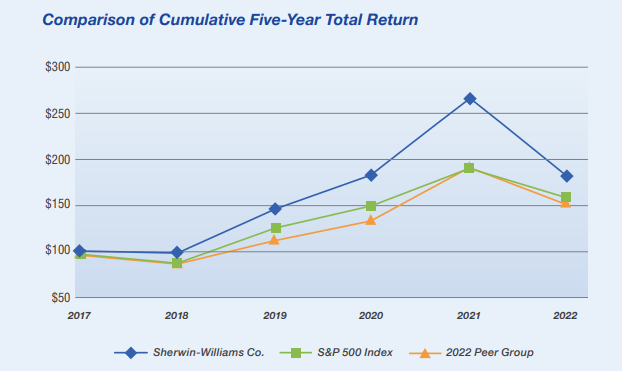

A stock providing positive historical cumulative return:

Annual Report (investors.sherwin-williams.com)

Brief History

- 1866 – The business was created by Henry A. Sherwin and Edward P Williams.

- 1877 – Sherwin-Williams patents the first resealable paint can.

- 1884 – Hired the first chemist to work at a paint manufacturing company.

- 1885 – First dividend payment to stockholders.

- 1925 – Traded for the first time on an American stock exchange.

- 1961 – Company develops paint can shaker which helps mix 5-gallon paint cans.

- 1964 – Listed on the New York Stock Exchange.

- 2009 – Produces its billionth gallon of paint.

- 2014 – 4,000th store opens.

- 2017 – Acquires Valspar the largest acquisition in company history.

Mission Statement/Pledge

“We aim to cover the earth-to become the world leader in the world of paint.”

Competitive Advantages

- Customer Service and Supply Chain

- Propriety CRM system. They own the customer data and a robust digital platform. Thousands to tens of thousands of transactions are occurring daily through their store footprint giving them real time data insight. This allows management to understand key insights for customer needs, by having such a direct to customer sales funnel. SHW holds full ownership over pricing decisions and promotional activity. Note: Third party reselling is still a significant portion of their business.

- All these insights through sales data allow SHW to create a better customer experience and enhance sales strategies.

- Consolidating industry allows stable pricing power.

- The coating industry is highly regulated, manufacturers have been adopting low-solvent technologies over the last few decades and will continue to do so. Environmental regulations are becoming stricter on the emissions of volatile organic compounds (VOC) and hazardous air pollutants (HAP).

As the industry is highly regulated in the United States, getting permits to build a manufacturing facility that produces paints and coating products are extremely difficult. As such, barriers to entry are high. In addition, considering time, cost of entry, specialized knowledge, and scale advantages would make it a mountain to climb over.

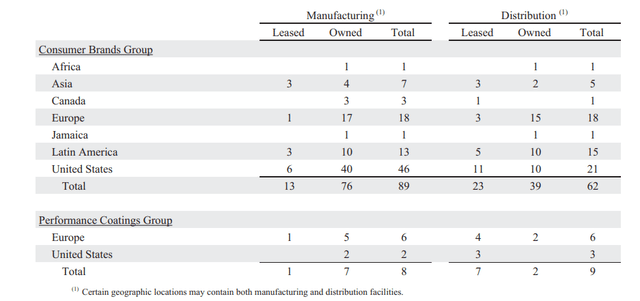

Here’s a breakdown of facilities owned for manufacturing and distribution:

Annual Report (investors.sherwin-williams.com)

Economics, Strategy, and Industry Dynamics

Explained by Sherwin-Williams management:

Sustained household formation underpins housing demand. And this looks to remain very solid for the next several years. 72 million millennials, now aged 26 to 41, are forming households. They’re becoming first-time homebuyers. They’re driving demand for entry-level homes. The issue is not demand, but rather supply. We’ve gone from a significant housing surplus prior to the Great Recession to a significant housing deficit today. According to a 2021 survey by the Rosen Consulting Group, the underbuilding gap in the U.S. totaled more than 5.5 million units over the last 20 years relative to household formation. When you add the loss of existing units through demolition, natural disaster or obsolescence, the implied cumulative demand-supply gap totals 6.8 million units. In order to fill the gap 5.5 million over the next 10 years and accounting for growth, building would have to accelerate well above the current trend to more than 2 million units per year. In 2021, just to put it in perspective, we built about 1.3 million units per year – for the year.”

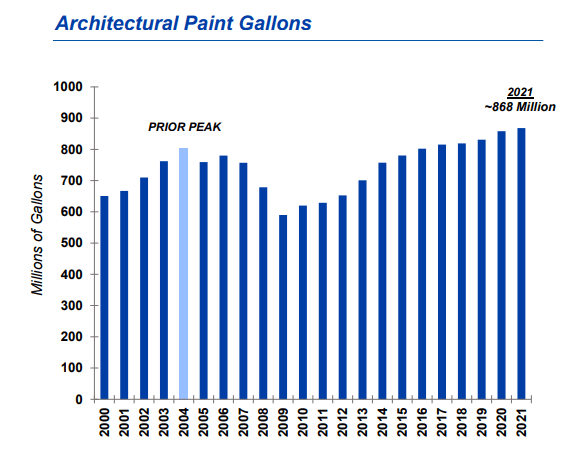

A metric to follow on how well the industry is doing is the demand for U.S. Architectural paint. From the investor presentation management provides estimates over a significant period.

Investor Presentations (investors.sherwin-williams.com)

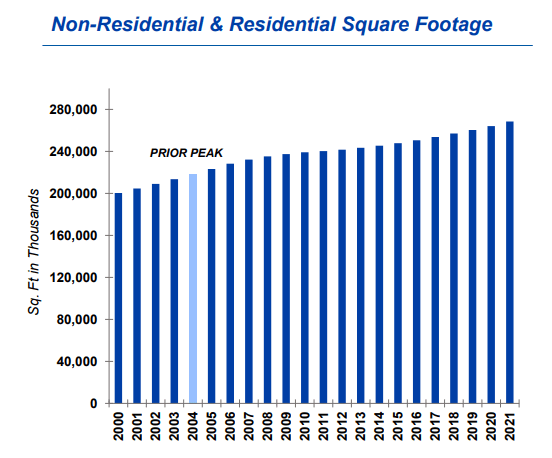

Prior peaks to 2021 estimates don’t show significant growth. We must remember 2008 and 2009 was a major recession in terms of real estate which shows paint gallons fell around 25%. This was a major hole to dig out of. During this peak to trough to peak again sq. footage for non-residential and residential has been steadily growing.

Investor Presentations (investors.sherwin-williams.com)

This bodes well for SHW. The 23% total sq footage growth will help continue the paint gallon growth over the years to come because of repaint. Gallons paint demand might not be a linear straight line up but with sq footage growth and population growth it’s hard not to see how these numbers don’t go up over a long-time horizon.

Residential repaint is a key metric for SHW in terms of top line growth. Existing home sales allow us to understand this important metric. When a homeowner is getting ready to sell their home, they usually repaint the home to freshen up the product they are about to sell. Once the home is sold, the new owner will typically repaint the home to their personal style. On average people in the U.S. stay in their first home 2-5 years and is slightly longer as they get older/into a second or third home.

Positive factors

- Sq. footage pool is much larger than prior peak.

- Has shown steady growth over two decades.

- Housing deficit won’t be resolved in the short-term.

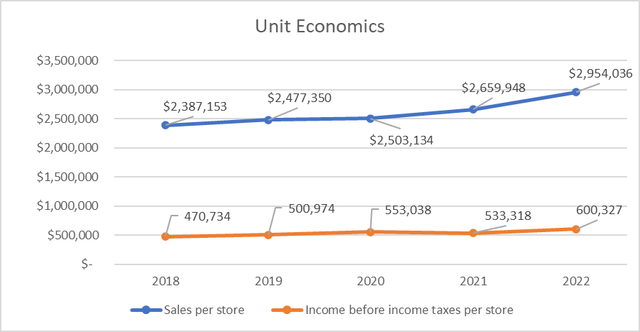

Unit Economics

Own Work and Annual Filings (investors.sherwin-williams.com)

- Unit economics look attractive running at 20% net income before taxes.

- Overall operating costs are relatively fixed at the store level:

- Two full-time employees manage the store. Depending on the store they do have some part-time.

- Lease expense.

- Delivery expenses and small miscellaneous expenses.

Consumer Brand Group Segment

- Sales through third-party retailers.

- Lowes attracts large amounts of foot traffic for DIY customers.

- Net margins not as attractive at 12.4% but allows them to capture a customer base their stores aren’t strategically focused on.

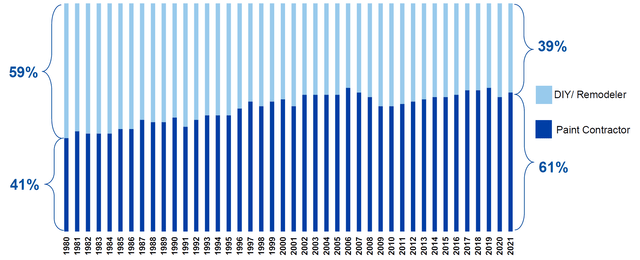

Investor Presentation (investors.sherwin-williams.com) Investor Presentation (investors.sherwin-williams.com)

DIYer’s still make up 40% of the market and SHW would be leaving out a large part of the customer base without strategic partnership channels.

Recent Quarter

- SHW had a positive second quarter showing all metrics trending in a positive growth direction.

- Sales increased by 6%.

- Diluted net income per share increased 38.9% to $3.07 per share in the quarter compared to $2.21 per share in the second quarter 2022.

- SHW has been working on reducing costs and increasing margins which showed through this recent quarter. Margins increased between 3-5% for all reporting segments.

- Full year earnings guidance now is $9.30 to $9.70 per share giving an expected earnings yield of 3.5% at SHW’s current share price.

Risks

The main key risk I have with SHW is a short-term housing slow down. Highlighted above I believe housing demand will be strong for years to come but any short-term blips with interest rates increasing can cause a contraction in the valuation which I’ll be waiting for as below I show why I believe the valuation doesn’t make much sense at its current market capitalization.

Valuation Snapshot

Free Cash Flow Yield: 1.82%

Earnings Yield: 3%

Current 5-10 year treasury yields: 4%

Expensive!!

I wrote about SHW in 2019 when the cash flow yield was at 4% which I thought was attractive when comparing it to interest rates and other high quality companies at the time. Today, the valuation is rich.

For more mature companies, I’m looking at free cash flow yield and earnings yield to get a quick judgement of does the valuation make sense. SHW has a bright future with good growth attributes, but the valuation doesn’t look attractive at its current metrics. A risk free data metric for treasury yields is higher than the current free cash flow yield. With SHW not being a hyper growth company, this correlation doesn’t make sense from a valuation standpoint.

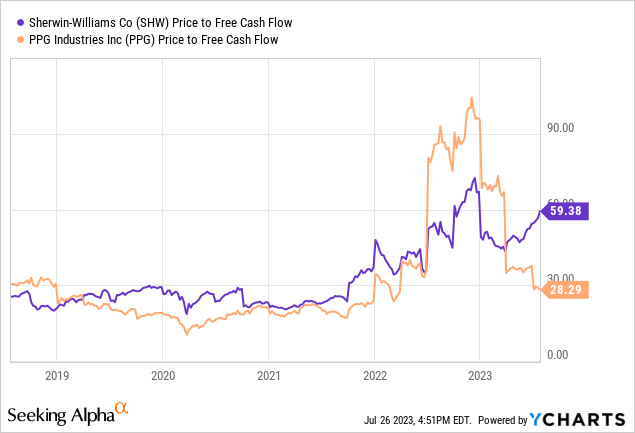

Even a quick competitor comparison shows SHW being expensive against its main competitor, PPG Industries (PPG).

The price would have to cut in half for me to consider the valuation to be reasonable as that would put it close to a 4% cash flow yield.

SHW should be on investors’ watchlist, especially for quality/moat investors as there are many characteristics to like.

Credit: Source link