EuToch

Acquiring a company and entering the big league through inorganic growth is always fascinating until the post-acquisition truths start crystallizing. Usually it takes a couple of years for the management to realize (and admit) that they probably overpaid and now need to write down some of the goodwill and intangibles. Interestingly, Semtech (NASDAQ:SMTC) management figured this out relatively quick (in less than a year) regarding its acquisition of Sierra Wireless. Unfortunately, it seems a little too late.

Hopes and Dreams

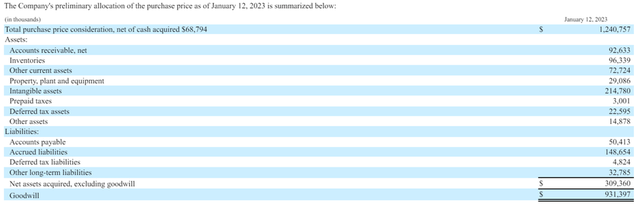

It was probably envisioned that the acquisition will catapult the company into a completely different business sphere when they paid US$1.3 billion for the net tangible assets of only US$94.6m. Although the multiple was way higher than we would be comfortable with for an acquisition, the management must have had their analysis done and developed the potential business plans that backed the decision at that time.

10K Filing

The Frantic Efforts to Save the Ship

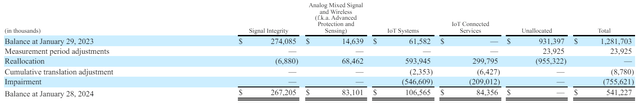

The decision to write down a large portion of Goodwill and Intangibles so soon would also have been based on some insights gained over the last one year. The company recorded a total of $755.6 million of pre-tax non-cash goodwill impairment charge for the fiscal year 2024, citing reduced earnings forecasts for the acquired business (specifically, the IoT Connected Services, IoT Systems–Modules and IoT Systems–Routers reporting units), current macroeconomic conditions including the interest rates.

10K Filing

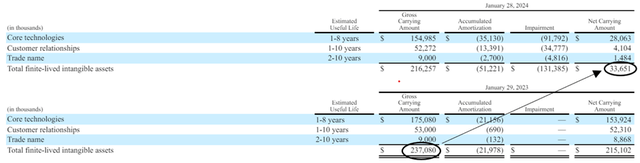

10K Filing

What we find more interesting is that impairments were recorded in multiple tests during the year, which increases the possibility of even further write-downs in the coming year. It doesn’t give us any comfort in repeating it here that the company hasn’t ruled that out either.

Chained to a Dead-weight, Missing the Promised Fuel Tank

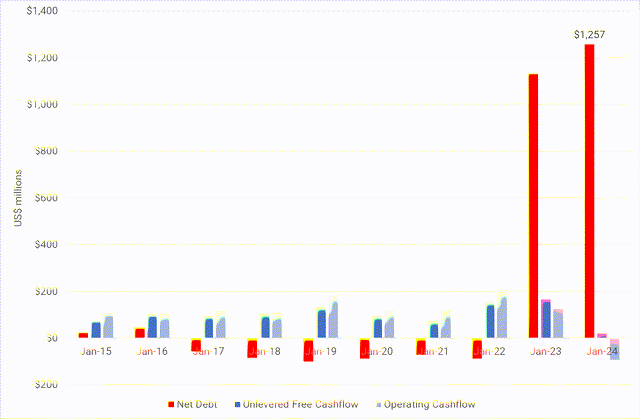

The business would now be reported on the balance sheet at a much lower fraction of the original investment. However, the debt that was acquired to fund the acquisition would still be there and will continue to bleed the company even more when it is already struggling to improve margins, resulting in an unimpressive trend in bottom line.

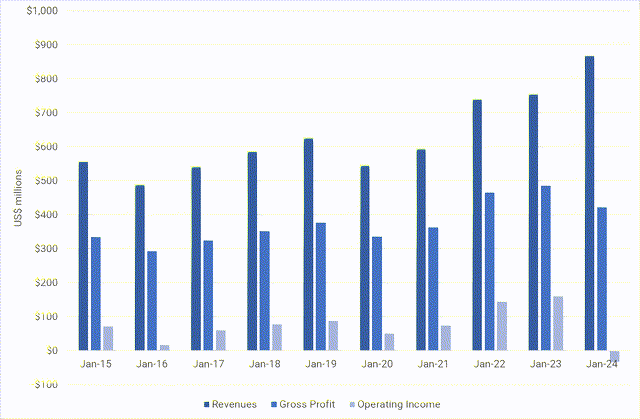

SeekingAlpha

SeekingAlpha

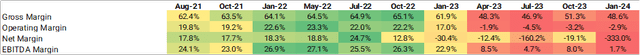

The average revenue growth since 2015 has been at 5% p.a. with gross profits growing even slower at 2.6% p.a. One may argue that the profitability growth could return to the levels achieved by the company before acquisition. It is a plausible argument because the gross, operating and net profits grew at an annual rate of 4.8%, 10.6% and 10.4% during 2015-2022.

However, the lower margins post-acquisition, higher interest expense (on absolute and relative basis) are the differentiating factor now as we have seen in the last few quarters. The results have been rather disappointing and we believe the optimism reflected in the stock price since Dec’2023 is most likely based on technical analyses which showed the stocks as oversold.

SeekingAlpha and Analyst Calculations

Accruing Debt Woes

As of the last reporting date, the company had $622.6 million outstanding under the Term Loans. The outstanding amount under the Revolving Credit Facility is $215.0 million, and available undrawn borrowing capacity of $282.2 million, but the borrowing capacity of $162.5 million on this facility is scheduled to mature on November 7, 2024 and $337.5 million is scheduled to mature on January 12, 2028.

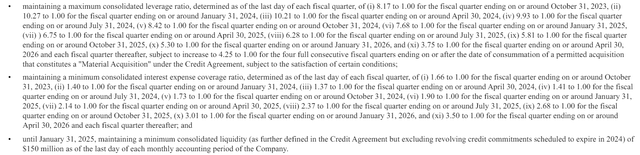

The company’s credit agreement has been subject to at least three amendments since Jan’2023 with discussions revolving around increasing the maximum consolidated leverage ratio covenant, reduce the minimum consolidated interest coverage ratio covenant and modify the pricing among other things. A snapshot of these covenants is given below and we would like to highlight the fact that the book value turned negative as of last reporting period. Therefore, it is strongly likely that the lenders will have to be approached again (if not already by now) in case things don’t improve on the liquidity front.

10K Filings

It is also important to mention that SMTC’s loan is based on floating rate plus margin (different for each type of facility), which is priced at the higher end of the agreed range if the company chooses to roll over its interest payments. This differentiates the company from a number of other listed companies that managed to secure medium term loans at comparatively lower fixed rate during 2020-22 and obviously puts it in a much more difficult position.

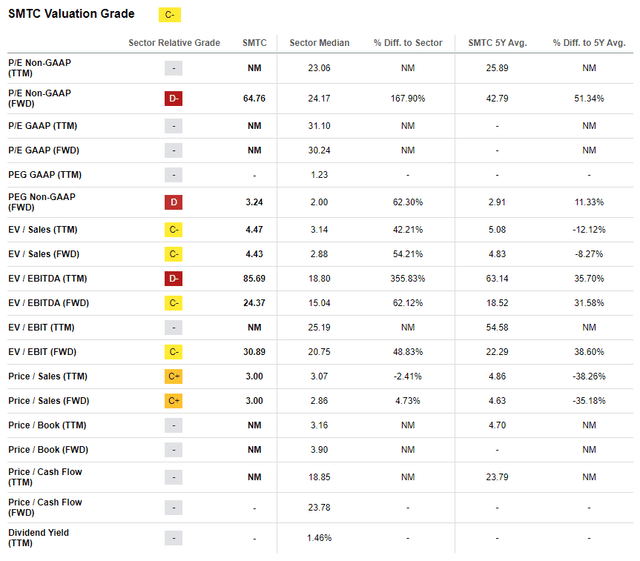

Valuation

The company ranks poorly on the SA valuation metrics and it is very hard to use DDM or FCFE projections to value the company until we have some visibility on the future prospects. One may be tempted to put together all kind of growth scenarios but those would be speculative and unfair to consider in our opinion until there is a baseline established more recently through reported numbers.

SeekingAlpha

Upside Risk

Obviously all is not lost and there is a possibility that the management would now be able to focus better on growing the business after having gone through the business alignment challenges post-acquisition. An improvement or return to the earlier profitability margin levels would definitely boost the cash availability. One thing we consider worth mentioning here is that these liquidity and profitability challenges make SMTC a decent acquisition target especially now that it holds its own IP as well as acquired through Sierra Wireless purchase.

Conclusion

We are looking forward to the management’s plans on how they plan to handle the current situation effectively. If the next result announcement does not show a credible turnaround in fortunes, we expect the price decline from current levels to be very sharp and persistent. We prefer to park on the sideline and wait for this curtain of fog to be lifted a little before getting on the road to SMTC shareholding.

Credit: Source link