metamorworks

Investment action

I recommended a buy rating for Rogers Communications (TSX:RCI.B:CA) (NYSE:RCI) when I wrote about it the last time, as performance was tracking well against my expectations – EBITDA to continue growing and management to continue deleveraging the balance sheet. Based on my current outlook and analysis of RCI, I recommend a buy rating. RCI performance continues to track well against my expectations, with EBITDA growing in the right direction and the balance sheet deleveraging as expected. RCI’s core segments, wireless and cable, continue to have a positive outlook driven by management’s decision to strengthen its customer service and bundling products. A lower capex requirement was also guided for FY24, freeing up more FCF for debt paydown.

Review

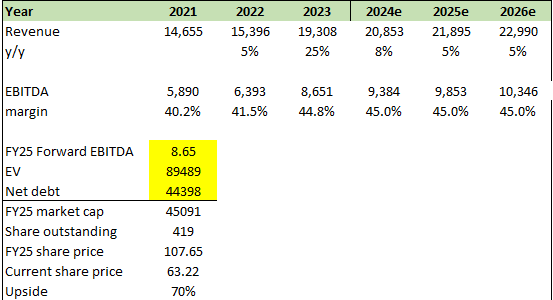

RCI ended FY23 with a less-than-expected topline performance but better-than-expected EBITDA performance (against my own expectations), which I view as an overall result as EBITDA growth was my main focus. For the full year, RCI achieved CAD19.3 billion in sales vs. my expectations of CAD20 billion, but EBITDA came in at CAD8.65 billion, modestly higher than my CAD8.6 billion expectation. For the quarter, 4Q23 saw total revenue of CAD 5.33 billion and EBITDA of CAD 2.34 billion. Reviewing both the wireless and cable segments led me to think that RCI should have no issues growing EBITDA and reducing debt levels.

Starting with the wireless segment, management guided FY24 postpaid phone net adds of $600k, driven by continued share gains, which will result in an expected EBITDA of CAD5.39 billion. While postpaid phone churn touched 1.67% in 4Q23, this is largely due to the Fido brand, which is still in the midst of integrating into the Rogers brand. In this phase of migration, it is natural to have elevated churn. The important thing is that, at the higher level, RCI is well positioned to gain share in the 5G segment given that it has the largest portfolio of wireless spectrum. As such, I expect RCI to grow above industry level – which management expects the mobile phone ecosystem to grow 4-4.5% y/y in 2024.

We tested this new technology with Ericsson across Toronto, Montreal, and Vancouver using our standalone 5G core network. This innovation will materially change how our network operates, offering multiple lanes for wireless traffic.

The acquired 3800 megahertz spectrum complements our industry-leading 3500 megahertz 5G spectrum over Canada’s largest 5G network, covering urban centers, cities and towns, and rural and indigenous communities from coast to coast, and Rogers continues to hold the largest individual portfolio of wireless spectrum among Canadian telecom operators. 4Q23 call

Regarding the Cable segment, management also raised their FY24 Internet net adds outlook to 120k following better 4Q results and also raised FY24 EBITDA to $4.56 billion. Although there were a lot of promotions in the East, I was encouraged by the strong 4Q23 Internet net adds, and I think the good momentum will pick up speed in the West. The key drivers to further growth will be improved customer service and product bundling. For customer service, we should start to see a more obvious impact going into FY24 as: RCI fully completed its repatriation of Shaw customer care roles back to Canada, and RCI further improves on its customer service matching. Some might view the investment in customer service as a non-priority, but as a consumer myself, I hate it when I have to go through multiple hoops of validation, Q&A, and long waiting times before I can speak to a customer service officer.

The second piece of it related to some of the issues we’ve been having on I would say customer service matching, not unlike what we saw in the West and the ability of our agents to match real-time.

And so we’ve changed our processes so that when David Barden calls in and says I had a bell rep at my door and they offered ex rather than saying, “Hold on, let me transfer you to someone important to give you an offer which you might lose the customer, we’ve now armed our agents with the retention tool”. It’s postal code specific or building-specific, so they know exactly what the offer is. They know it’s a legit offer. We don’t have to go through a validation process. The agents authorized to match real-time. So that’s become much more effective and starting to reduce the churn on the cable side.” BofA MC&E conference

Aside from the investment in customer service, I also thought it was a strategic decision for RCI to step up its bundle offerings, especially after the Comwave acquisition. Bundling is a great strategy for telecoms because it makes the decision-making process a lot easier for customers. If they want TV, Internet, and home line, rather than signing up for multiple single product offerings, as a consumer, it is easier to simply get the bundle and have everything settled. From an RCI perspective, bundling also makes it easier to increase prices as consumers are not able to figure out the exact “cost.”

Hence, I don’t see many issues with RCI continuing to grow its EBITDA comfortably. From a free cash flow conversion perspective, we should see a higher EBITDA to FCF conversion rate as management guides a lower 2024 capex to CAD3.8 to CAD4 billion. In addition to that, RCI has also realized $375 million of synergies in 2023 and exited the year at an annual run-rate of CAD750 million, making it well on track to achieve the $1 billion synergy target aimed for FY24. As such, in terms of deleveraging the balance sheet, I don’t see any major hurdles either.

Valuation

Author’s work

I believe the upside remains very attractive for RCI, as I expect EBITDA to continue growing over the coming few years. My FY24 estimate remains the same at 8% growth, as it should continue to benefit from the growth momentum from 4Q23 in 1H24, followed by normalization of growth to historical mid-single-digits (5%). While I have hopes for EBITDA margins to expand, I am staying conservative and modeling flat margins, as I also expect RCI to continue investing in building its retail distribution. As of 4Q23, RCI has a net debt to EBITDA ratio of around 5.6x, coming down from the previous year of 5.9x. This is good, and given my outlook for continuous EBITDA growth and better FCF conversion (due to lower capex requirements and synergies realized), RCI should have no issues continuing its debt paydown streak. Remember that I mentioned that a key catalyst to support the RCI premium valuation assumption is for valuation to come down to peers’ levels of around 4x (peers include Verizon Communications, Ooma Inc., Gogo Inc., US Cellular Corp., etc.).

Risk and final thoughts

Downside risk includes a higher need for CAPEX as RCI needs to stay competitive in terms of spectrum capacity, which will eat into FCF and its ability to pay down debt. RCI might also experience less than expected net-added value, which will impact EBITDA growth.

I maintain a buy rating for RCI as it continues to demonstrate strong performance aligned with my expectations. EBITDA growth and effective debt reduction efforts, coupled with positive outlooks in the wireless and cable segments, are the main reasons for my recommendation. The strategic focus on improving customer service, product bundling, and a leading 5G spectrum portfolio further supports RCI’s growth trajectory. With lower capex guidance for FY24 and continued synergy realization, RCI is also well-positioned to pay down debt.

Credit: Source link