resulmuslu/iStock Editorial via Getty Images

Compagnie Financière Richemont (OTCPK:CFRHF) announced its Q1-24 revenue numbers at the beginning of this week, reporting 14.0% growth from the prior year period. Growth declines of 4.0% in the Americas overshadowed double-digit growth in every other geography, including a 40.0% increase in Asia Pacific, and sent the stock into a 10.0% drop. I reiterate a Buy rating, with a price target of €152.7 per share, which equals $177.5 per share of the company’s ADR.

Introduction

A week ago, I published an article about Richemont, claiming its turnaround story is over, but there’s still room for upside. I urge you to read that article, in which I described the company’s turnaround story in detail and explained why I view it as a mid-tier luxury group.

In short, I find that some of Richemont’s businesses are dragging the company down, and in my opinion its management is somewhat complacent in the post-takeover-threat era. On the flip side, its most successful businesses, namely Cartier, Van Cleef & Arpels, and Buccellati, are at the top tier in the industry.

Regarding valuation, I showed that Richemont trades right where it should, which is above the industry laggers in Kering (OTCPK:PPRUF) and Burberry (OTCPK:BBRYF), and below the industry leaders in LVMH (OTCPK:LVMHF) and Hermès (OTCPK:HESAF).

Now, let’s focus on the company’s results, and assess whether the post-earnings selloff provides an opportunity.

Q1-24 Highlights

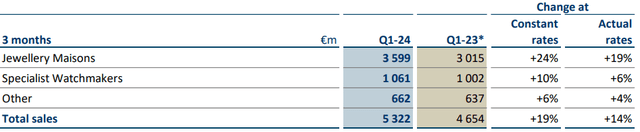

Richemont reported consolidated revenues of €5.3B, a 14.0% increase from the prior year (19.0% in constant currency). Based on historical seasonality, the company is on pace to achieve record sales of €21.0B for the year, which is in line with consensus estimates.

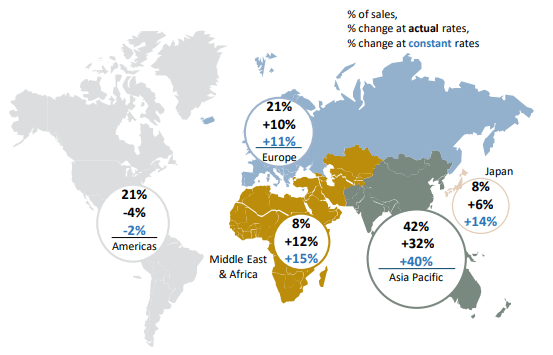

Richemont Q1-24 Trading Update Presentation

On a geographic breakdown, Asia Pacific grew by 32%, Japan grew by 6%, Europe grew by 10%, and the Middle East & Africa grew by 12%. The real story here was the Americas, which declined by 4% and overshadowed great performance in all other geographies. Understandably so, as the Americas are presumably the most profitable region for Richemont. Moreover, investors are probably assuming that a similar slowdown is inevitable in other regions, which are lagging behind America in terms of Covid recovery and their macroeconomic landscapes.

Richemont Q1-24 Trading Update Presentation

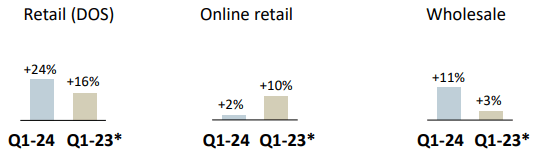

Looking at the channel breakdown, we see the strength of the direct-to-consumer distribution continue, as no wholesaler can replace the customer experience and focus of a mono-brand store. While retail is responsible for 68% of the company’s sales, which by itself is high, Richemont is still behind luxury leaders in LVMH and Hermès, and that is affecting its results.

Richemont Q1-24 Trading Update Presentation

Furthermore, we can see the resiliency of Richemont’s high-performing businesses under its Jewellery Maisons segment, which includes Buccellati, Cartier, and Van Cleef & Arpels. On the flip side, the company’s mediocre Specialist Watchmakers and Other segments are decelerating quickly.

That difference in quality is something I discussed in my previous article, which in my point affects the quality of Richemont as an investment. While its Jewellery Maisons could easily justify a ~30x multiple, their other two segments are too dilutive.

Overall, I believe Richemont’s results are decent, and don’t justify a 10.0% selloff. While we’ll need to wait another two weeks before we see results from the rest of the industry, I’m fairly confident that LVMH and Hermès are going to deliver much more impressive numbers. Therefore, if we ignore valuation for a moment, I believe my mid-tier thesis was reaffirmed by Richemont’s Q1 results.

Updated Financial Model

In my previous article, I projected Richemont will generate revenues of €22.0B for the year. Based on the Q1 results, I need to adjust my assumptions downwards. For H1 I now expect €10.1B in sales, €3.6B in EBITDA, and €3.1B in net income. For the full year, I now expect €21.0B in sales.

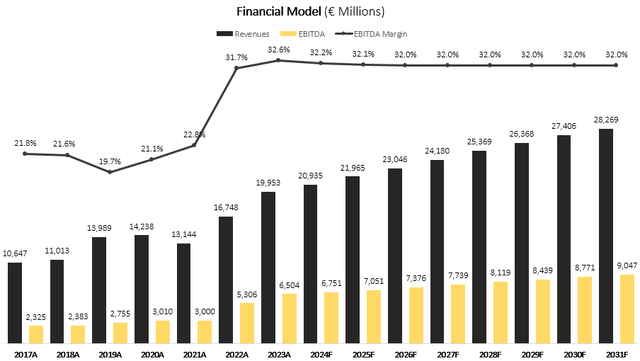

As a consequence of the quarterly adjustment, I need to update my long-term model as well. I now forecast Richemont will grow revenues at a 4.4% CAGR between 2024-2031 due to constant price increases, continued store openings, improved performance of lagging brands, recovery in China, and steady organic growth.

I still project EBITDA margins will increase gradually, up to 32.0% in 2031. In my view, this is a reasonable projection as the company should be able to improve the operating margins of lagging businesses, which will be offset by lower amortization and depreciation as it closes stores and its write-offs decelerate.

Created and calculated by the author based on data from Richemont financial reports and the author’s projections.

Taking a WACC of 8.2% and adding its net debt position, I now estimate Richemont’s fair value at €152.7 per share, which amounts to $177.5 per CFRHF ADR based on the current USD/EUR ratio.

Conclusion

Richemont announced impressive results which were overshadowed by a decline in the Americas region, its most profitable geography. I find the 10.0% selloff a bit too harsh, but believe it teaches a lesson. The fact that a company is fundamentally cheaper doesn’t necessarily mean it’s a good investment. While Richemont has decent qualitative attributes, it’s clear that it isn’t a leader in the luxury segment. Therefore, despite the decent upside and reasonable valuation, I wouldn’t make Richemont a huge position in my portfolio. That being said, I estimate the stock is currently undervalued and reiterate a Buy rating.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Credit: Source link