Hitra

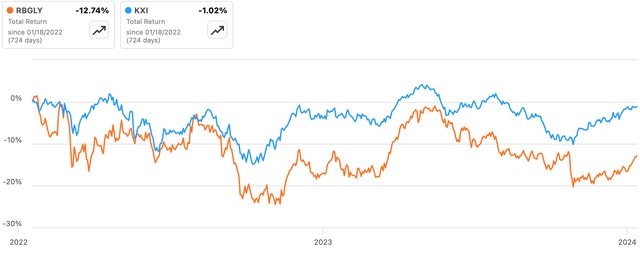

British consumer staples giant Reckitt Benckiser (OTCPK:RBGLY)(OTCPK:RBGPF) has continued to underwhelm, with the dollar-denominated ADSs underperforming the global peer group by circa 12ppt over the past couple of years. Performance has been similarly disappointing since I last covered the company on Seeking Alpha back in 2021, with a negative 15% total return representing nearly 20ppt of underperformance versus global peers in that time.

Source: Seeking Alpha

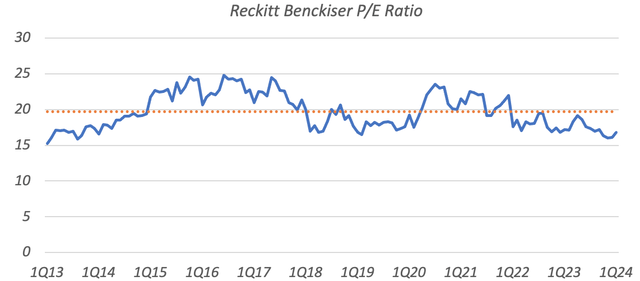

While disappointing, a little context is required here, as Reckitt’s underperformance has been driven in large part by multiple de-rating, with EPS evolution only slightly below the low-end of my 7-9% annualized growth target. Now trading for around 17x EPS, Reckitt offers a meaningful discount to both its historical average as well as peers, with that coming despite the company appearing to possess a more attractive long-term growth profile. As a result, I reaffirm my Buy rating, viewing the shares as being roughly 25% undervalued right now.

More Of The Same

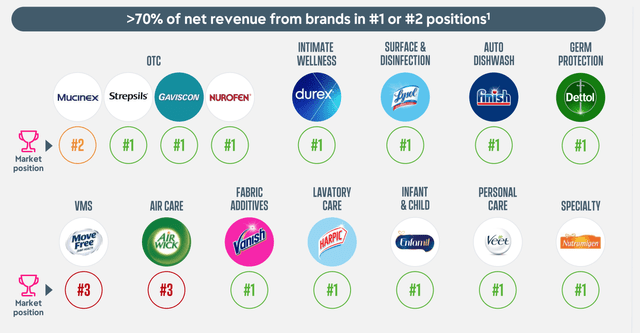

As a reminder, Reckitt reports across three broadly-defined business units: Hygiene (~42% of 2023 sales through Q3), Health (~41%) and Nutrition (~17%). Health EBIT margins are typically the company’s highest, landing in the high-20s area and leading to a slightly higher share of group EBIT, with Health and Nutrition operating in the high-teens region. The company owns market-leading brands in each unit, including Durex (Health), Gaviscon (Health), Finish (Hygiene), Lysol (Hygiene) and Enfamil (Nutrition).

Source: Reckitt Benckiser Q3 2023 Trading And Strategic Update Presentation

Performance since prior coverage has by-and-large been in line with expectations. Previously, the company’s growth algorithm consisted of mid-single-digit (“MSD”) annualized revenue growth which, following a margin reset post-2019, was seen leveraged into circa 7-9% annual EPS growth. Since previous coverage in mid-2021, Reckitt has delivered like-for-like sales (“LFL”) growth of 3.5% (2021), 7.6% (2022) and 5.1% (2023 through Q3, with full-year results not due until late February). Similarly, the 2023 consensus adjusted EPS estimate of circa £3.36 (~$0.85 per RBGLY ADS) would represent a circa 6% CAGR on the £3 I expected it to earn in 2021, slightly below the low-end of the above EPS growth target.

Performance has been somewhat lumpy, but this is in large part due to non-company-specific factors. For instance, 2021 lapped the COVID demand surge in 2020, while 2022 saw the firm benefit from an unexpected tailwind in Nutrition following product recalls and subsequent supply chain issues at competitor Abbott (NYSE:ABT) in the United States.

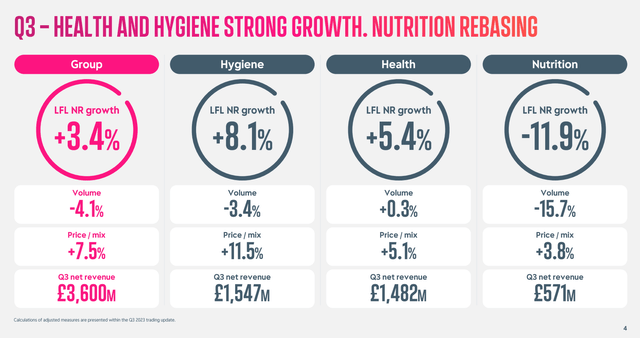

This also adds context to recent sub-par results, with Q3 LFL sales growth looking light at 3.4% but driven by a below-consensus 11.5% decline in Nutrition, where volumes fell nearly 16% year-on-year as the company lapped the Abbott tailwind. Health (+5.4%) and Hygiene (+8.1%) were either in-line or ahead of consensus, and of a level that is commensurate with overall company-wide MSD annualized sales growth.

Source: Reckitt Benckiser Q3 2023 Trading And Strategic Update Presentation

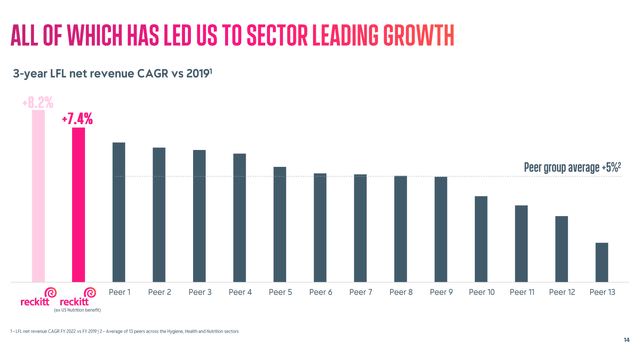

Management have since updated long-term guidance, though are essentially targeting more of the same, with the goal of mid-single-digit annualized sales growth still in place and adjusted operating profit growth now simply targeted “ahead of net revenue growth”. Although fairly high for a global staples firm, note that Reckitt’s business skews more to higher-growth areas like consumer health, offsetting lower-growth segments like Nutrition, which as per above is less than 20% of group sales and an even smaller share of EBIT. With Health a higher margin business for the firm, this should naturally lead to a degree of company-wide margin expansion over time as its share of group sales increases further, lending a degree of support to management’s growth targets.

Source: Reckitt Benckiser Q3 2023 Trading And Strategic Update Presentation

Further, Reckitt was previously diverting part of its free cash flow toward debt reduction, with leverage now at 2x EBITDA versus circa 2.6x back in 2021. With that multiple now suitably modest given the defensive nature of the company’s cashflows, more cash should now be available for capital returns. The announcement of a £1 billion buyback program in late 2023 supports this, equating to circa 2.4% of shares outstanding, and will naturally contribute positively to EPS growth. As a result, the 7-9% annualized EPS growth target from last time out remains my base case.

Shares Now Materially Cheaper

Reckitt’s valuation has de-rated significantly since last time out, which has been a key contributor to recent underperformance. Then, shares were trading for around 21x EPS, which has since fallen to circa 17x 2023 consensus. That puts the stock around 15% below its 10-year average EPS multiple, which lands closer to 20x.

Data Source: Yahoo Finance, Reckitt Benckiser Annual Reports, Author Calculation

In addition to its historical average, Reckitt also looks attractively valued compared to peers. At circa 17x EPS, Reckitt trades materially below the EPS multiple commanded by Procter & Gamble (NYSE:PG), which currently trades for circa 23.5x its forward EPS consensus estimate as per Seeking Alpha. With the latter targeting “mid-to-high single digits” in terms of long-term annualized EPS growth, growth prospects don’t appear to be driving the valuation disconnect. Indeed, Reckitt’s growth algorithm probably lands it near the top-end of its peer group, yet its P/E multiple is around 25% below the group average, with that based on data provided by BlackRock (BLK) for the iShares Global Consumer Staples ETF (NYSEARCA:KXI).

Instead, Reckitt could well be suffering from guilt by association, with British equities in general trading at record discounts to peers according to asset manager Schroders (OTCPK:SHNWF). This holds across materially all stock industry groups, including Household & Personal Products to which Reckitt belongs.

My fair value multiple of roughly 21x from last time out remains in place, equating to around $17.90 per ADS and implying circa 25% upside from the current quote. That is based on the current dividend (~$0.47 per ADS) and the low-end of a 7-9% EPS growth CAGR, which on a 21x EPS multiple would map to circa 9-10% annualized returns overall. With that, Reckitt looks priced for closer to 13-14% annualized returns over the medium-term, with that based on a current dividend yield of around 3.3%, my expectation of at least 7% annualized EPS growth, plus around 3% per annum from multiple expansion. As such, I reaffirm my Buy rating on the stock.

Risks

The main risk to Reckitt comes from an erosion of the strength of its brands. Private-label competition could prevent the company from delivering mid-single-digit annualized revenue growth, for example, with the company having to compete more aggressively on price should volumes become sluggish. This would imply that a discount to its historical valuation is justified, albeit this is already baked into the current share price to a degree. Similarly, growth expectations in higher-growth areas like consumer health could turn out to be too aggressive, which would have a similarly negative impact on company-wide growth prospects.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Credit: Source link