Viorika/E+ via Getty Images

Right after Realty Income Corporation (NYSE:O) issued its Q1’24 earnings report, I wrote an article synthesizing the key fundamental dynamics. The bottom line was clear – while O managed to prove the bears wrong, the question was still open whether the FFO growth per share is sustainable against the backdrop of a weakening economy and higher for longer scenario.

In my opinion, the positives (e.g., upper investment grade credit rating, relatively conservative FFO payout and steady growth profile) outweighed the negatives stemming from potentially a subdued growth going forward.

Now, since the moment when I issued the article, a couple of things have changed (or occurred).

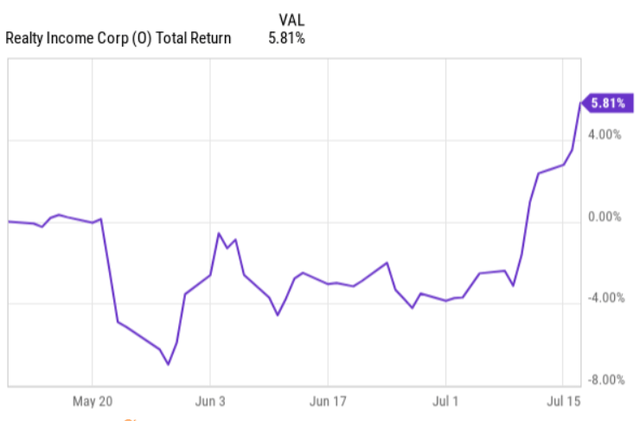

The first one is the fact that O has registered quite decent returns and assumed a clear upwards momentum. Higher stock price (and especially a continued uptick if it really takes place) has an unfavorable impact for yield-chasing investors as the multiple goes up making the entry yield lower.

Ycharts

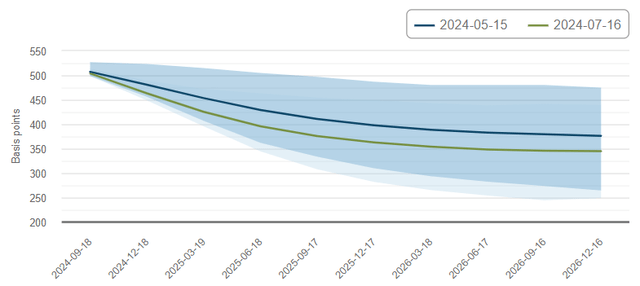

The second aspect that has changed and also has been the most significant driver of O’s rising market cap level is the recalibrated view on future interest rates. Namely, given the emergence of more favorable inflation data (e.g., cooling CPI figure) the market has started to factor in sooner and more accelerated interest rate cuts. The chart below depicts this dynamic very well, where it is evident how the interest rate expectations have dropped from the date when I circulated my previous article on O.

Atlanta Fed

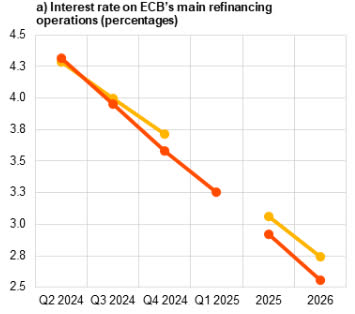

The third item that has occurred during this period is the ECB’s decision to cut by 25 basis points, while sending signals on a gradual interest rate normalization going forward. Looking at the chart below, we can also observe a similar trajectory that has been formed by the consensus exceptions for the SOFR.

European Central Bank

For O this is positive news considering its presence and rather ambitious strategy in European markets.

The fourth aspect is more related to O’s internal dynamics, where management boosted the investment volume guidance from $2 billion to $3 billion. It also communicated a stronger guidance on adjusted FFO per share of $4.15-$4.21, compared with its prior guidance of $4.13-$4.21.

With all of these factors in mind, let me now explain why, in my opinion, investors have to really consider going long O before the current opportunity is priced away from a likely rising stock price.

Thesis review

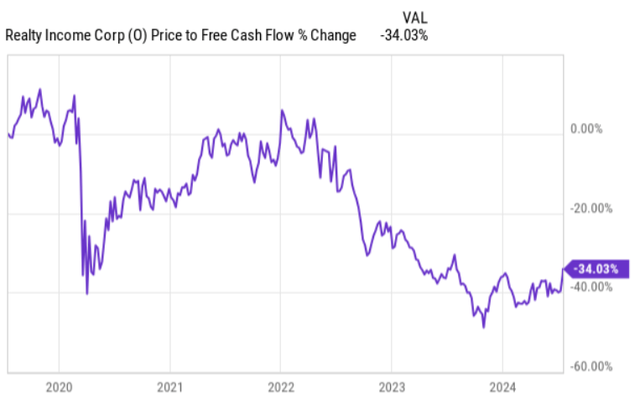

The chart below is critical, as it reflects how deeply discounted O is relative to its valuation levels that it had before the Fed decided to hike interest rates. What is important to note in this context is that during this time period (which is depicted in the chart), O has actually registered a consistent growth in the FFO per share generation. This just confirms that the multiple concentration has been driven solely by the cost of capital factor.

Ycharts

Another aspect, which indicates that the underlying fundamentals of O have been improving, is the recent dividend hikes (by 2.1% in May and by 0.2% in June) over the past three-month period.

What this means for us now is that once the interest rate cuts start to materialize, it is extremely likely that we will experience a surge in the stock price from the process of market recalibrating the cost of capital level.

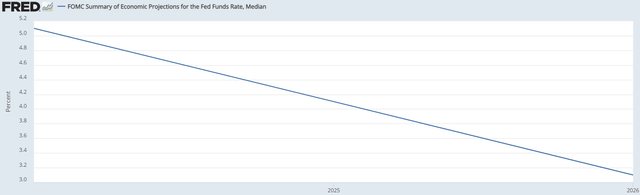

Granted, I do not think that this will happen overnight or be a quick process as if we look at the FOMC dot plot, we can clearly see that the path of interest rate normalization is projected to be a gradual one.

FOMC; St. Louis Fed

However, based on the recent market dynamics and O’s share price response to a slight improvement in the interest rate cut outlook, we can safely imply that once the cuts start to take place and the market begins to focus on the next ones, O’s share price should go up.

Having said that, we have to still take this kind of thesis with a grain of salt. It was not that long ago (mid-2023), when the market was pricing in 4-5 cuts in 2024 and a fast pace of getting back to 2% SOFR.

Here I would argue that even if the interest rates stay where they are now for a longer period of time, the overall investment case still remains attractive.

Besides the depressed multiple, growing FFO (including positive revisions on the FFO guidance) and one of the strongest balance sheets in the REIT space (as implied by the upper investment grade level), O is one of the few REITs out there that can benefit from the cap rate divergence between the U.S. and EU markets.

Currently, the cap rates in the EU markets are higher than in the U.S. On top of this, the cost of financing is lower in the EU, which creates further opportunities for O to deploy larger amounts of capital in these markets. For instance, the U.S. AAA 20-year corporate bond yield is at 5.13%, while a similar security in the EU yields 2.72%.

During Q1, O invested circa $600 million at an initial weighted average cash yield of 7.8%, where over half of this volume was put to work in Europe and the U.K. territories at an 8.2% initial weighted average cash yield. The relevant initial weighted average cash yield for U.S. transactions was 7.3%.

Here is a relevant commentary from the recent earnings call by Sumit Roy – President & Chief Executive Officer – on where O is putting focus in terms of the deal execution:

Thanks, Nate. Good question. I think what you’re seeing here in the U.S. is largely a confusion around where the rates are going. When will the rate cuts materialize and it’s a function of what we’ve seen play out over the last six months in terms of mixed data that is causing this confusion. And the way it’s manifesting in our space is this reluctance of sellers to transact at what is reflective of the cost of capital environment today. And so for us, this is one of the advantages we bring to the table is we play in multiple geographies. And we are seeing much better risk-adjusted return opportunities in Europe today, where the data has been a lot more consistent, and therefore, the ability to transact with potential sellers much more real.

The bottom line

All in all, the recent data points confirm two things:

- O is extremely sensitive to the changes in the interest rate path, whereas we get closer to the actual cuts and start to calibrate the next ones, the multiple expansion is almost inevitable.

- The underlying business is performing well and generates a sufficient amount of FFO to provide confidence for management to increase the divided twice in the past three months, as well as to assume ambitious M&A volumes.

In my opinion, this is the right moment to go long Realty Income before the price does not go too far from the current level. And the positive aspect in this context is that even if the Fed decides to keep the current interest rates unchanged for a longer period of time, the FFO generation still looks solid and is supported by accretive M&A opportunities located in the EU markets.

Credit: Source link