imaginima

I continue to emphasize my core strategy for investing in this volatile, high interest-rate environment: lean in on “growth at a reasonable price” stocks that are executing well in this macroeconomy while also trading at appealing valuations. Fundamental strength provides for an upside case should the market rally from here, and a cheap valuation will protect from too much downside if the market drops.

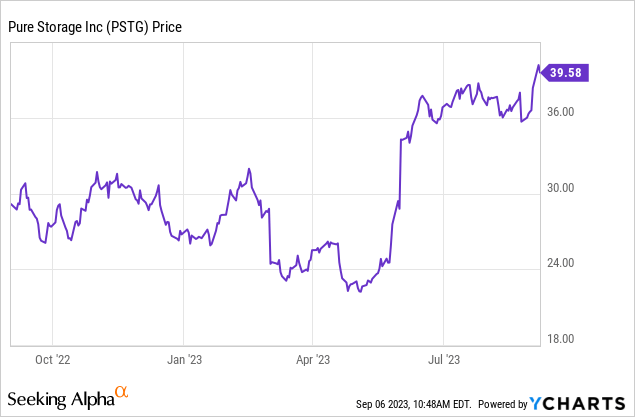

Pure Storage (NYSE:PSTG), in my view, has been one of the most successful of the so-called “GARP” trades this year. Up more than 40% year to date, this storage company has leaned in on its software sales strategy and delivered terrific ARR expansion alongside meaningful profits, making it an easy stock to cheer for. The stock has also continued to rally after a late August earnings release.

Of course, after a big rally and after every earnings release, we have to re-evaluate our positions – another critical element of investing in stocks in this environment, when cash can easily earn ~5% risk-free, is that we also have to monitor each individual holding more carefully. In the case of Pure Storage, I remain bullish on the stock, though that’s a slightly more muted opinion than a prior very bullish opinion as I do think Pure Storage’s recent upward drive takes some wind out of its sails. That being said, I still believe in further upside through the end of the year.

Pure Storage, in particular, has excelled this year at delivering consistent sales growth and introducing new products at a time when most IT departments are cutting back on meaningful back-office capex investments. Pure Storage attributes its sales momentum to its product leadership – while most legacy storage architecture solutions are purpose-built and result in disparate environments that require modifications as use cases change, Pure Storage is able to offer a flash-driven, all-in-one solution that scales as its customers grow.

For investors who are newer to Pure Storage, I’m reiterating my long-term bull case for the stock here:

- Shifting into a subscription/services play, which will help drive multiple appreciations for Pure Storage. Despite macro headwinds, Pure Storage still grew subscription services at a mid-20s y/y pace. This kind of revenue stream is just what Wall Street prizes: a recurring, high-margin stream of revenue from repeat customers. Yet in spite of this, the market’s valuation of Pure Storage still treats it like a commodity hardware play, even if its pro forma gross margin now resembles most SaaS stocks in the high 60s/low 70s.

- Industry recognition. Pure Storage has been named a leader in storage for eight consecutive years by Gartner, the most influential software industry ranking system. Customers choose Pure Storage for the combination of its broad platform, its modern cloud-first approach, and simplicity for installation, and an unintimidating pay-as-you-go pricing model.

- Huge TAM. Pure Storage estimates its TAM at $60+ billion, which means its current ~$2.5 billion revenue run rate is only ~4% penetrated into this overall market.

- Pay-for-consumption is a win-win for both Pure Storage and its customers. Pure-as-a-Service is priced based on usage, generally priced on a GiB/month basis. Outside of relatively low minimum commitments, this is a benefit for new customers because they can start out with Pure Storage for select workloads only, reducing the barriers to entry. For Pure Storage, it’s an advantage because, over time, these customers can expand to become major clients.

- Enterprise focus is growing. More to the point above, more than 50% of Pure Storage’s revenue is now coming from enterprise clients, and the top 10 customers spend more than $100 million annually.

- Cash flow. Pure Storage is delivering huge cash flow, but with FCF margins in the mid-single-digits versus a low-teens pro forma operating margin, there’s still plenty of room for expansion.

From a valuation perspective: at current share prices near $40, Pure Storage trades at a market cap of $12.18 billion. After we net off the $1.29 billion of cash and $869.9 million of debt on Pure Storage’s most recent balance sheet, the company’s resulting enterprise value is $11.76 billion.

Meanwhile, for next year FY25, Wall Street analysts are expecting Pure Storage to generate $3.41 billion in revenue (+15% y/y), $1.67 in pro forma EPS (+18% y/y). This puts Pure Storage’s valuation multiples at:

- 3.4x EV/FY25 revenue

- 23.7x FY25 P/E

Especially for a company that is still executing strong gross margin gains and building up a wide subscription base, there’s room for upside in these multiples. Stay long here and keep riding the upward wave in Pure Storage.

Q2 download

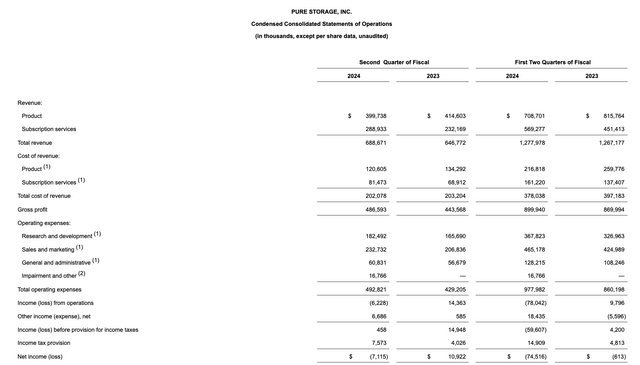

Let’s now go through Pure Storage’s latest quarterly results in greater detail. The Q2 earnings summary is shown below:

Pure Storage Q2 results (Pure Storage Q2 earnings release)

Pure Storage’s total revenue grew 7% y/y to $688.7 million, beating Wall Street’s expectations of $683.4 million (+5% y/y) and accelerating versus the prior quarter’s -5% y/y revenue decline (which was colored by a tough one-time hardware/product revenue comparison in the prior year). Underlying subscription revenue, meanwhile, grew 24% y/y to $288.9 million.

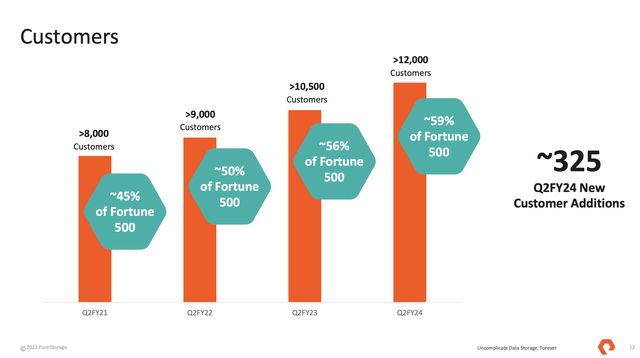

What remains impressive about Pure Storage is that even at scale, the company continues to add an impressive amount of new customers – while also having plenty of room in the large enterprise market to expand. It added 325 net-new customers in Q2 to land at over 12,000 total customers, and over the past year it has added another 3% of the Fortune 500 – with 41% of greenfield market opportunity left to go.

Pure Storage customer growth (Pure Storage Q2 earnings deck)

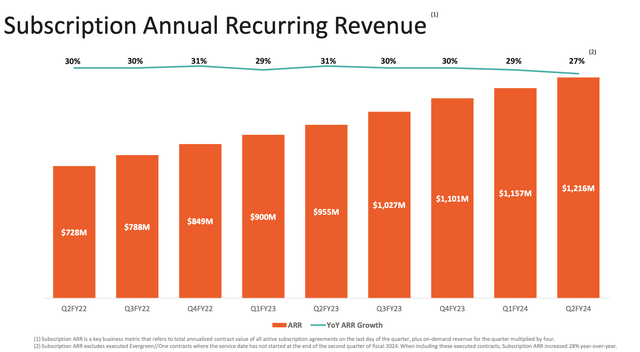

Subscription ARR, meanwhile, grew 27% y/y to $1.22 billion, adding $63 million of net-new ARR in the quarter.

Pure Storage ARR growth (Pure Storage Q2 earnings deck)

Product strength has been driving sales momentum. The company noted that its newly released FlashBlade//E product has been the fastest-growing product at launch in the company’s history. The company will follow up later this year with FlashArray//E to enable low-cost bulk storage.

Sales strength is also in spite of a softer spending environment, which management noted is consistent with the past several quarters. Per CFO Kevan Krysler’s remarks on the Q2 earnings call:

We achieved record sales of our entire FlashBlade portfolio including FlashBlade//E in saw continued high demand for our Evergreen//One subscription services, as sales more than doubled year-over-year.

While the spending environment remains relatively consistent to what we have seen over the last couple of quarters, our customers are choosing to invest in our high technology data storage solutions for their key, strategic projects. As we have seen with the sales performance of both our FlashBlade and Evergreen//One offerings this quarter.

Momentum we saw across our entire FlashBlade portfolio included specific AI and ML use cases, including a significant Generative AI win that Charlie highlighted. We are excited with the historic ramp for both sales and pipeline of FlashBlade//E throughout the quarter. Customers no longer need to settle for hard-disk systems and can now choose Pure’s higher performance flash solutions at competitive price points.”

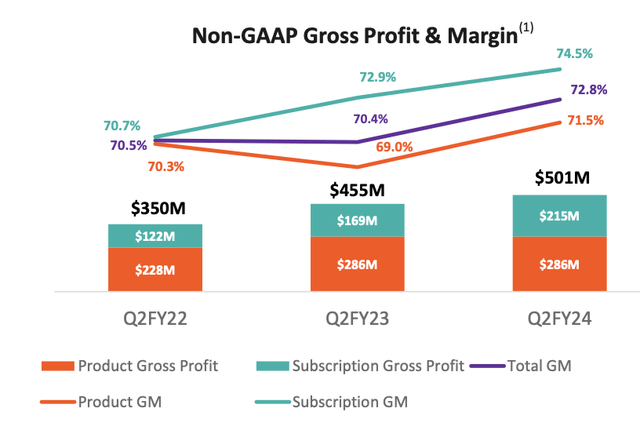

Pure Storage also excelled on margins: pro forma gross margins rose 240bps y/y to 72.8%, driven by healthy gains in subscription gross margins as well as a more favorable subscription revenue mix.

Pure Storage gross margins (Pure Storage Q2 earnings deck)

Pro forma operating margins of 16.2%, meanwhile, held relatively flat y/y as gross margin gains were offset by more aggressive spending on sales and marketing to drive growth in the company’s new E lineup. Pro forma EPS of $0.34, meanwhile, grew 6% y/y and meaningfully outperformed Wall Street’s $0.30 expectations.

Key takeaways

With strong product momentum, a consistent buildup in subscription ARR, consistent gross margin gains, and meaningful profit growth, there are a lot of reasons to like Pure Storage, especially at a muted multiple of revenue. Stay long here and continue to enjoy the upward momentum.

Credit: Source link