Aree Sarak/iStock via Getty Images

Dear Partners,

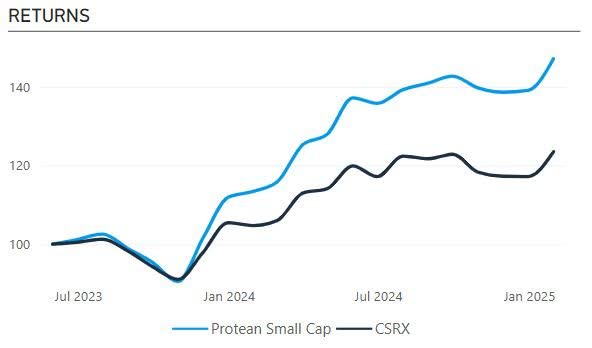

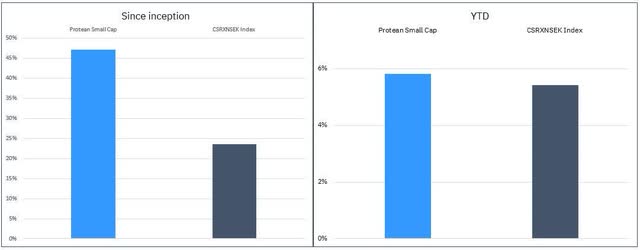

Protean Small Cap beat its benchmark (again) in January. It returned 5.8%, compared to the index 5.4%. Since launching in June 2023 it has gained 47.2%, which is 23.6% ahead of the Carnegie Nordic Small Cap Index.

Top contributors were Getinge (OTCPK:GNGBF), Acast (OTCPK:ACASF) and Mowi (mhgby). Detractors include Coor, Biotage (OTCPK:BITGF) and Fasadgruppen.

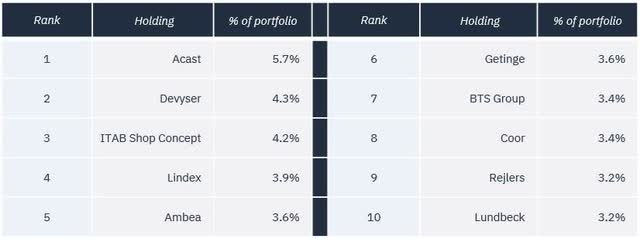

The hedge fund Protean Select returned 2.7% in January. We are approaching the 3-year mark in April, and since launch the fund has returned 29% with less than a third of the market’s volatility.

Top contributors were long positions in Hexagon (OTCPK:HXGCF), Getinge and Mowi. Notable detractors were shorts in index futures and a basket of small caps.

This month’s letter elaborates on an antidote to smugness in the wake of media exposure and price awards, the state of markets and how increasing unpredictability leads to higher risk premiums for citizens and corporates alike. Plus, as always, commentary on holdings and portfolio development.

Thank you for being an investor!

// Team Protean

Divine discontent

During January we won an award for Protean Small Cap. Sweden’s oldest savings and business magazine Privata Affärer recognized our performance and during a big ceremony Protean Small Cap was crowned Challenger of the Year.

In one sense it is very gratifying that the good 2024 performance is recognized. In another sense, reflecting too much on past performance risks leading to complacency. “Look how great we are, we even won a prize!”.

My hero David Ogilvy had a great saying on this (and I’m probably butchering it, but you get the gist): You should always operate with a divine discontent, because it’s an antidote to smugness.

In the past month Protean Funds have featured in various articles, a leading podcast and a few TV-studios. It has been a conscious choice, because we want to raise awareness of Protean ahead of the launch of our third fund. A fund that, contrary to the specialized niche-funds we currently operate, aim at the mass market. Also, since the third fund will have Very Low Fees (less than half of the average active fund) and cut the fee further the bigger the fund gets, the fund will get better the more it grows. It needs scale to share the benefits.

Let me tell you one thing about featuring in media: it’s exhausting. Every minute spent talking about how you are doing things is a minute not spent doing things. And it’s weird. What sounded so good inside one’s head, can be interpreted wildly differently by the listener. Offering views on individual stocks also comes with a drawback: you risk being completely wrong. In public. Example: we elaborated on a handful of cases in the widely followed podcast “Börspodden”. Only days after the episode was released, one of them (Coor) saw fit to issue a material profit warning and promptly dropped 15%. Cue hair-pulling and relentless social media snickering. Thankfully, some of the others we talked about hit the mark (Hexagon and Getinge). Coor was a moderate negative contributor for us this month, thankfully, and both funds managed more than acceptable returns.

There is a thin line to walk between raising awareness and selling. There are many tiny funds that have good performance but close because of lack of scale. At the same time, there are several really massive funds that have mediocre-to-terrible performance but manage to raise assets through aggressive marketing and being available to media all hours of the day. Simply thinking that decent performance will scale your business is naïve. As a start-up, we are dependent on getting the word out. But we’re acutely aware how exaggerated exposure and attention risks we start believing we’re the greatest stock pickers around (we’re not).

We have an internal trick we’ve been using since day one to remain sober and vigilant: every month end we zero all performance figures. Our sheets are blank when the month starts. Previous outperformance is irrelevant, it’s a new month, a new game. We have seen the complacency that comes from “we’re 500bps ahead of benchmark this year, we can cruise”.

Zeroing performance is a small feature, but it helps keep the divine discontent alive and kicking. No resting on old laurels: new month, new playing field.

What’s around the corner?

Played as a short-to-medium-term game, investing is about gauging expectations. What’s priced in? What are consensus expectations going forward? If you can decipher that, and in addition be moderately right on fundamentals, you have an embryo of decent performance. Price matters because it tells you something about what’s expected.

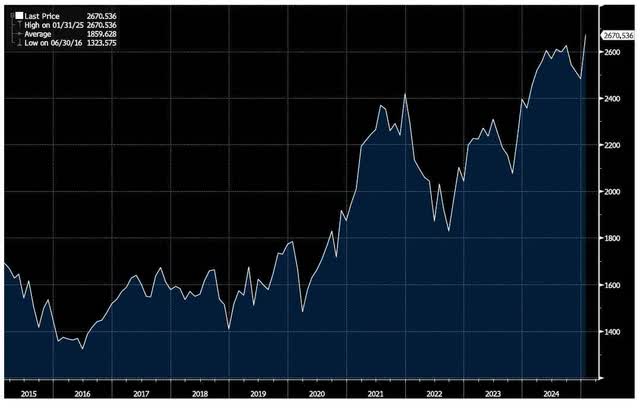

As but one example of price, the Swedish stock market printed a fresh all-time-high this week.

Source: Bloomberg

It is an interesting proxy for expectations. Our Swedish leading companies are truly global. The stocks that have had a strong performance this year have minimal exposure to Scandinavia and only moderate exposure to Europe. In many instances, the US is the biggest and most profitable market. It seems, from my vantage point, that expectations are for profit growth to continue, particularly in the US. Many reporting companies this Q4 season have thrown H1 2025 under the bus, expecting demand to pick up “later this year”. Markets haven’t cared. Yet.

The orange exogenous factor that now inhabits the executive office in the US might have other thoughts. With a penchant for tape bombs and inflammatory commentary, Trump has (again) introduced a fresh bout of volatility to rates, energy prices, equities, and a plethora of industries that are now forced to in record time manufacture supply chain contingency plans to cope with sweeping tariffs, and ESG and DEI-policy re-writes not to get on the wrong side of the suddenly unforgiving Federal government.

Regardless of whether this “new” decisiveness is a surprise or not, the unchecked execution of the America First policy has potentially far-reaching consequences. Not only on short-term earnings estimates but on global GDP on a systematic level.

Taking a few steps back the 2nd Trump administration is accelerating the trend of US isolationism that started in earnest in 2017. The US has withdrawn from several international agreements, significantly scaled back its involvement in international conflicts and put focus on domestic priorities. This in a time where many of the World’s big problems (environment, immigration, the erosion of trust in public institutions) are truly global. Heck, reading up on your Peter Zeihan, you see the effects clearly when simply looking at trade routes and geography: would a Roosevelt or Truman have accepted a closure of the Red Sea trade route? Or come out swinging like a drunk boxer about annexing Greenland, the Panama Canal and making Canada the 51st state?

The 1890’s all over again

A notable paradox is how the Trump policy complex has turned decidedly William McKinley. While reducing idealistic involvement in the cause for free trade and democracy as the primary tool for US prosperity, an increased imperialistic ambition can be clearly seen. All in the name of MAGA.

McKinley was decisively imperialistic and added Puerto Rico, Guam and the Philippines to US Territories back in the 1890’s. American exceptionalism expressed as imperialism. Indeed, a troubling proposition.

We are no scholars on US politics, and our tea leaves only serve to steer the allocation of what capital you have entrusted us, but the predictability and stability of US policy and rule of law is trending downwards. This should, at a minimum, raise the risk premium in calculations of future returns. When that’s the conclusion, and prices reflect something else, we remain cautious.

Then again, the cult around Trump as an individual means we should pay attention to his motivations. From my perspective, he appears remarkably childish. Holding grudges, calling names, and going for easy and noticeable wins. Making money. Markets going up. A common view is the S&P500 is likely what he uses to gauge success. A stab at formalizing Trumps reaction function courtesy of X:

Brainfart bingo

The latest brainfart from the Oval Office, the sweeping tariffs implemented via Presidential Order, is a proper head fake for the consensus belief (myself included) that financial markets have replaced public opinion as the checks and balances for policy action.

Tariffs are in and of themselves a net negative for global growth but have been expected and should to some degree be priced in. They have, after all, been a key part of any stump speech since the election cycle kicked off almost a year ago. The new new thing here is how they are implemented: irrationally, aggressively, suddenly, on doubtful legal grounds, without a clear strategic rationale.

The bleakest prophecies might not materialize, but the conclusion about increasing volatility raising risk premia still stands.

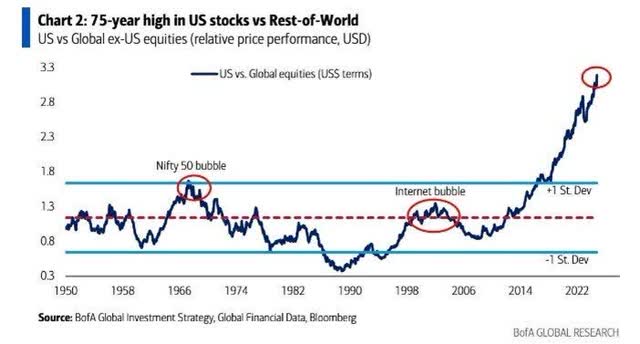

At the same time, it is noteworthy the US markets are at extremes. Driven by its technology hegemony the weight in global indices is setting new records on a weekly basis. US stocks’ relative outperformance is the highest it’s been in 75 years.

Bank of America Global Research

This (of course) coincides with every allocator in the world comfortably recommending investors to “put your money in a global index fund” because it’s worked wonders (and been FX-boosted) for the past 20 years.

A weaker USD, a weakened domestic US market, the AI-trade deflating. Pick one and that’s enough to capsize the performance of that “Global” fund that just happens to have a 70%+ weighting of US stocks.

Although Trump can sack people and dismantle institutions at will, the final boss for a country with checks.

… a big deficit is bond markets. When 25c of one federal revenue dollars goes towards servicing debt, rate levels matter. Particularly if you are running a 7% budget deficit and are looking to aggressively cut taxes further. DOGE needs to work wonders for this to end well.

The next round of debt ceiling extension negotiation will be interesting. It’s pretty much the only issue where Democrats have some leverage.

Ai, ai, ouch

Since a lot of the most recent outperformance has been driven by AI-euphoria, the DeepSeek (DEEPSEEK) tantrum was an interesting shot across the bow. The modest start-up apparently posted strong model performance despite using only a fraction of the hardware and training dollars other leading models require. There is a lot of ifs and buts here, of course, as with all things Chinese. Can one trust the data? Probably not, but to me it was a reminder of how this tech cycle is likely to resemble the same S-curve as all previous ones.

With the anomalous US outperformance vs Europe in mind, it is encouraging that Ms von der Leyen and her European Commission partners are starting to make both sustained and coherent noise on investments and red tape cutting. Triggered and bolstered by the Super Mario report from late 2024, the EU seems on track to at least attempt to de-clutter the industrial policy framework.

The tearing of the democratic and social fabric is a painful process to watch. A thoughtful observer of geopolitical events can be excused for going from boomer to doomer.

When things are bleak, this C.S. Lewis quote serves well in a figurative sense:

“The first action to be taken is to pull ourselves together. If we are going to be destroyed by an atomic bomb, let that bomb, when it comes, find us doing sensible and human things — praying, working, teaching, reading, listening to music, bathing the children, playing tennis, chatting to our friends over a pint and a game of darts — not huddled together like frightened sheep and thinking about bombs.”

On a personal level we all have strong political views and engage in various causes across the political spectrum. We are not frightened sheep. But we note a temptation to vent frustrations with how things should be by positioning accordingly. A portfolio is a poor tool for expressing moral judgment or venting political frustration. That should be reserved for the political and personal domain.

A fund, and indeed a corporation, serves to first and foremost generate a profit for its shareholders. This is why we try to remain cool observers, rather than portray ourselves as leveraging the fund to express normative views through investing activities.

Investors in funds that subscribe to stakeholder capitalism, or have a different objective than profit maximizing, should be aware of the costs involved when allocation decisions are driven by something else than profit motifs.

So what is around the corner?

Increased uncertainty. And therefore, increased risk premia. And the starting point appears high.

Buckle up.

Protean Small Cap

– Carl’s update for January

Protean Small Cap returned +5.8% in January. That is 0.4%-points ahead of the CSXRN (SEK) benchmark index for the month. This puts the fund 23.6%-points ahead of our index (CSRXN SEK) since inception. The fund now manages SEK520m. Thank you for your trust.

Notable performers in January were Getinge, Acast, and Mowi. Detractors include Coor, Biotage and Fasadgruppen.

We have written in earlier Partner Letters about our thesis in Getinge. It appears our thinking was largely right that the market was confusing frequency with magnitude. The company, plagued by historic quality issues, threw the kitchen sink at the guidance in early 2024, in order to lower expectations properly. The Q4 report showed steady progress and a wildly different outcome than the possible worst-case scenario. Margins rebounded significantly faster than analysts were thinking, and orders continue to grow. Leading indicators for quality are improving, and should Getinge return to industry-average snafus, there is ample valuation upside in the year(s) ahead. Meeting management after results our impression is they are breathing easier than in a long time (pun intended). We remain owners of the stock. It was our biggest contributor for the month.

Perceptions change quickly. Only a few months ago the dominating narrative in the Nordic seafood sector was how this year’s outbreak of “perlesnor” jellyfish could impact the size and quality of fish in the water. It quickly became a non-issue as the outbreak abated. Fast forward to today, and the story is rather “wow the quality and size of this generation of fish looks better and bigger than almost anytime before”. There is a lot of noise in salmon farming. The stocks remain cheap, and only last week Mowi closed what looks like a great acquisition, buying a controlling stake in Nova Sea, taking its ownership from 49% to 95%. The deal is accretive, and there are ample synergies. Mowi trades on ca 10x 2026 P/E post the deal, leaving upside to valuation.

Coor was a poor performer for us, as the company issued a profit warning for Q4 and new restructuring programs. We think the problems are homemade, not structural. We welcome the changes announced to the Board of Directors, where the very competent earlier CEO of Coor, Mikael Stöhr, is proposed as new Chairman.

During the month we remained active. We sold our entire position in TF Bank in the excitement on reporting day. It has been a great trade for us. We bought the position around 220 SEK only seven months ago. When selling out almost 100% later the valuation has gone from ridiculous to ok, and we think the easy money has been made.

Protean Small Cap vs CSRX N SEK Index

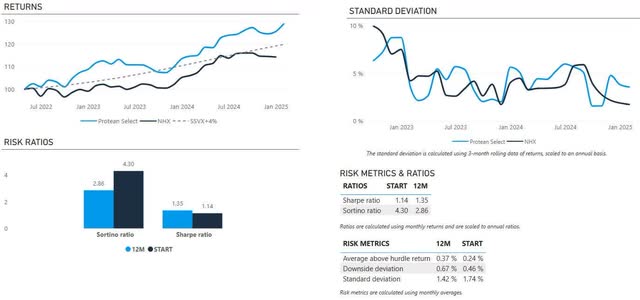

The ten largest positions in Protean Small Cap as we enter February

Protean Select

– Pontus’ update for January

|

*We illustrate our performance by showing a comparison with the NHX Equities index. This is an index constructed from the performance of 54 Nordic hedge funds focusing on equity strategies. NHX is published after our Partner Letter, so updates with one-month lag in the chart above. We aim to have positive returns regardless of the market, but no return is created in a vacuum, and a net-long strategy will correlate. Our hurdle rate is 6.3275% annualized (4% + 90-day Swedish T-bills). All figures are net of fees and ratios in the above charts are calculated using monthly returns. |

Protean Select returned 2.7% in January. Since inception in May 2022 the fund has generated performance of 29%, with low volatility.

Top contributors were long positions in Getinge, Hexagon and Mowi. Notable detractors were short positions in index futures and a basket of small caps.

We exit January with 31% beta-adjusted net long exposure and 115% gross exposure (adjusted for cash and cash equivalents). The portfolio remains diversified, with one single position >4% of assets.

The big three

It is rewarding that a not insignificant part of this month’s performance was generated from stocks where we have detailed our reasoning in earlier Partner Letters. And stocks where we have above average sizing in the portfolio. Getinge’s business continues to stabilize, Hexagon returned to organic growth and generated impressive free cash flow, and Mowi benefitted from benign biological conditions and a well-executed acquisition.

We have a sizeable position in Hexagon. The share of international owners of Hexagon has been steadily declining for the past few years, as its relative lack of exposure to the semi and chip sector, plus short-seller gripes about governance, has triggered a vaning interest. If (when?) that pendulum starts to swing back – the ALI spin may well help – there remains upside in Hexagon.

The stock exchange cleaning crew

Reporting seasons have a tendency to exhibit an unusual amount of outrageous movements. For a smaller fund, with no restrictions on taking a position either long or short, there are always opportunities. IN January we took the opportunity to help clear up a big seller in Medcap. The trade turned out to be the bottom tick and the stock traded 10% higher in the days after. We shorted HMS when it popped 20%+ on numbers and closed out when it faded to +5% on the day. These types of smaller trades sometimes go spectacularly wrong, but on average they are a steady contributor to returns. Plus, which shouldn’t be underestimated, it’s fun.

Essity

Essity (OTCPK:ETTYF) is the only position in the fund with above 4% weight. We added materially to the position as the stock dropped on the Q4 numbers. The significant strengthening of the USD in December caused some volatility in earnings, flipping the switch on the markets’ muscle memory to turn back the clock to when Essity was an inherently more volatile business thanks to its significant pulp exposure. We think it’s wrong.

In a nutshell Essity today is a better company than the market gives it credit for. Zooming out they appear to be doing the right things: exiting volatile and price-taking businesses, and growing in high-margin defendable ones. One shouldn’t fool oneself, however, it’s a relatively boring space, with femcare, baby diapers, incontinence products, and a still material exposure to the unattractive consumer tissue segment. But is it valued as such. It is also deleveraging, despite the increased shareholder remuneration.

The improving returns on capital employed, a more shareholder-friendly approach, and a new CEO soon to be announced, means there is every opportunity for things to heat up. The key point, however, is that the downside should be limited from here. And as it is a large and liquid stock, we feel relatively comfortable with an above average position.

Performance fee and hurdles

We charge 1.2% fixed management fee in Protean Select. On top of that comes trading costs which are borne by the fund. They are not insignificant since we are very active. We also charge a performance fee, but only if and when we beat our hurdle rate, which accumulates and has a high-water mark.

When designing the fund we thought: there should only be a performance fee if we do VERY well. Hence why, in a year like 2024 when we generated a reasonable 10.6% return (net of fees) with low volatility, we booked no performance fee (ok, a rounding error of less than a tenth of a percent in one month). If we have a mediocre year, we don’t charge a performance fee.

Our hurdle is 4% plus the 3-month SSVX interest rate. It translates to roughly 0.6% per month. This is added every month to the highest ever NAV the fund has achieved. It’s a tough hurdle, particularly when running a diversified portfolio with a 30% average net exposure. But that’s the way it should be.

The monthy reminder

We optimize for performance, not for convenience, size, or marketing. You can withdraw money only quarterly (monthly in Small Cap). We tell you very little about our holdings. Our strategy is tricky to describe as we aim to be versatile. A hedge fund can lose money even if markets are up. We charge a performance fee if we do well. You do not get a discount if you have a larger sum to invest. We do not have a long track record.

Thank you for being an investor.

Pontus Dackmo, CEO & Investment Manager

Protean Funds Scandinavia AB

DISCLAIMER: Investments in a fund can both increase and decrease in value. You are not guaranteed preservation of invested capital.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Credit: Source link