WildLivingArts/iStock via Getty Images

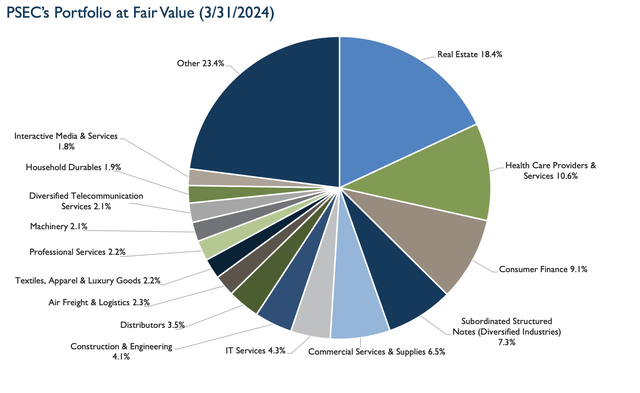

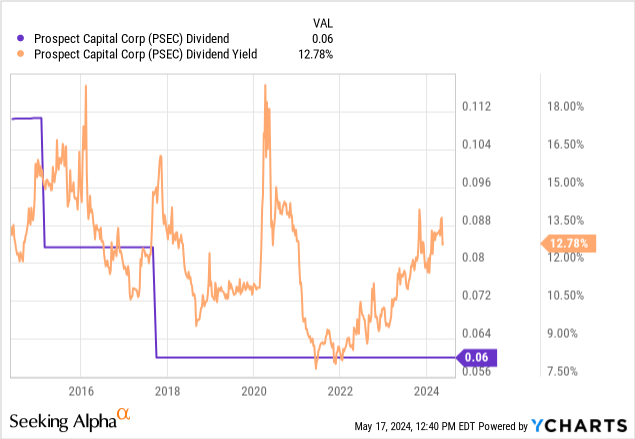

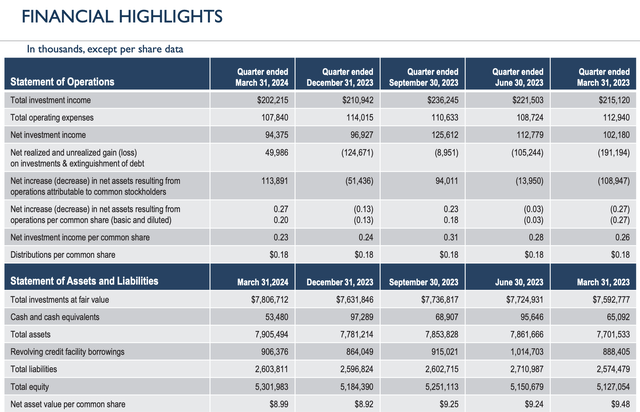

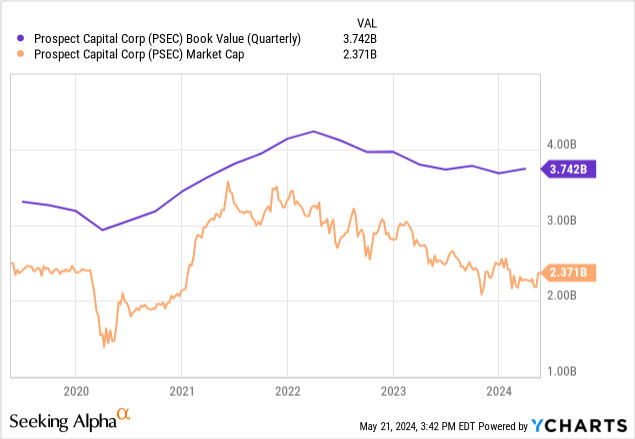

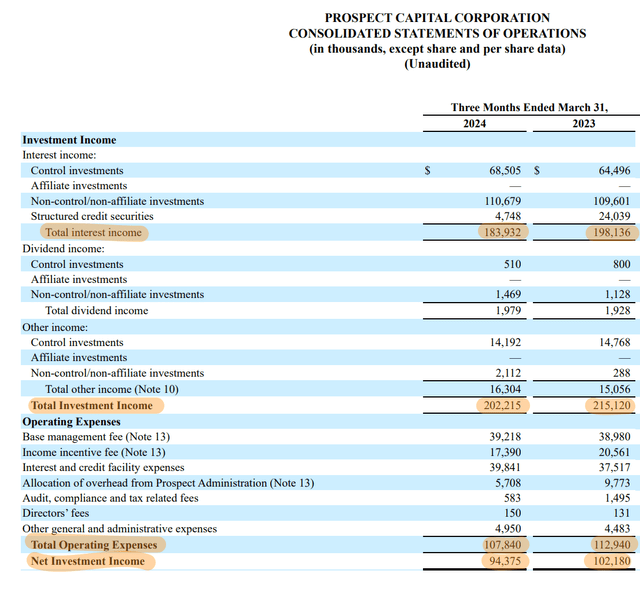

Prospect Capital (NASDAQ:PSEC) last declared a monthly cash dividend of $0.06 per share, kept unchanged from its prior quarter and $0.72 per share annualized for a 12.7% dividend yield. The BDC generated fiscal 2024 third quarter net investment income (“NII”) of $94.4 million, $0.23 per share, beating consensus but down sequentially from $0.24 per share and by 3 cents from the year-ago period. PSEC’s third quarter ended March 31, 2024. The dividend has been stable at its current level since 2018 but has come against GAAP NAV sporadically dipping since 2022. PSEC’s portfolio at the end of its third quarter held a fair value of $7.8 billion, spread across 122 portfolio companies, with its equity position in private equity REIT National Property REIT Corp its largest allocation. The REIT owns a portfolio of multifamily, senior living, and student housing properties.

Prospect Capital Fiscal 2024 Third Quarter Presentation

My prior coverage on PSEC has been negative due to the BDC’s historic inability to grow its dividend in line with its peers during the last two years of elevated high-interest rates, wrapped within the backdrop of a booming US economy. This had driven record NII growth for BDCs, with PSEC forming an outlier against this golden age for BDCs. While PSEC currently covers the quarterly aggregate of the monthly distributions by 128%, the BDC excludes preferred stock dividends from its calculation of NII. PSEC spent $24.8 million on payments to its preferred stockholders during the quarter, up $4.88 million from its year-ago comp, to form a roughly 26% hit to the headline NII. Adjusting the per share NII figure for these payments would see NII dip to $0.17 per share, with coverage slipping to 94.4%. This lack of adjusted coverage comes as the headline NII figure dropped by 16 basis points from the year-ago quarter on the back of higher interest expenses and a rise in loans on non-accrual status.

The Prefereds And Non-Accruals

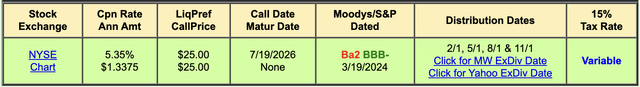

QuantumOnline

PSEC has been highly reliant on issuing perpetual preferred stock to bolster its balance sheet, with $1.8 billion in aggregate issuance of these and its listed 5.35% Series A preferreds (NYSE:PSEC.PR.A). The listed preferreds remain the optimal security to invest in PSEC as they’re currently trading hands for $18.13 per share, a nearly 28% discount to their $25 per share liquidation value as their $1.3775 annual coupon drives a 7.6% yield on cost. The yield is 500 basis points less than the commons, but total 1-year returns for both securities place the preferreds ahead at 30.7% versus a decline of 1.5% for the commons.

Prospect Capital Fiscal 2024 Third Quarter Presentation

PSEC’s NAV was $8.99 per share at the end of the third quarter, up 7 cents sequentially but down from $9.48 a year ago. The overall direction of NAV since 2022 has not been great, but the third quarter represents a partial reversal of this trend. The common shares at $5.70 per share are trading at a material 37% discount to NAV. This discount to NAV has become a perpetual feature of PSEC; hence, it’s hard to pitch the current divergence of the commons to NAV as bullish. Bulls would be right to highlight that the commons come with a margin of safety as they’re essentially trading for 63 cents on the dollar with the discount to NAV currently at a historically larger distance, and as PSEC’s NAV per share sees some sequential growth.

Loans on non-accrual status as a percent of total assets at the end of the third quarter stood at 0.4%, up 20 basis points from PSEC’s year-ago comp. This figure has roughly remained in the same band for the last two years. PSEC generated a total investment income of $202.2 million, down $13 million from its year-ago comp on the back of a dip in total interest income despite the growth of its portfolio at fair value from $7.63 billion at the end of the second quarter. This came as its annualized current yield on all investments fell sequentially by 40 basis points to 9.7% from 10.1% in the second quarter.

Prospect Capital Fiscal 2024 Third Quarter Form 10-Q

The dip in yields is set to continue as the Fed looks set to push through a September rate cut by a 49.4% probability, according to the CME FedWatch Tool. A falling rate environment could form a headwind for PSEC as 83% of its interest-bearing assets are priced at floating rates. Hence, the BDC’s already precarious coverage could see further deterioration in the quarters ahead, which would be ominous for its quarterly dividend distribution. PSEC is one to not buy against this specter of risk.

Credit: Source link