ipopba

Precision Biosciences (NASDAQ:DTIL) has made significant progress thus far in 2023 with clinical data from Precision’s CAR T programs as well as their in vivo gene editing programs. Unfortunately, the market appears to be overlooking the company’s headway even though the ticker is trading under a $100M market cap and with a negative enterprise value. In addition, the company expects their current cash balance to be adequate to fund the company into 2025, which should be enough time to accrue additional data to improve the company’s long-term outlook. I still believe DTIL is trading at a significant discount and is a great opportunity for biotech investors looking for a speculative ticker to get involved with for the next few years. For me, I am looking to accumulate DTIL at this valuation in anticipation the market will ultimately recognize the company’s progress in their wholly-owned and partnered programs. As a result, DTIL will remain in the Compound Healthcare Bio Boom Portfolio for the interim.

I intend to review Precision’s recent updates and will discuss their impact on the bull thesis. Then, I will discuss some downside risks that investors need to consider when managing a DTIL position. Finally, I reveal my plan for accumulating DTIL during the second half of 2023 and into 2024.

PBGENE-DMD Update

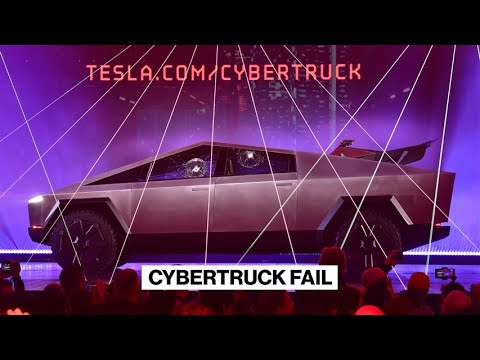

Back in May, Precision publicized preclinical data from their ARCUS-based in vivo gene editing technology that revealed its potential to treat Duchenne muscular dystrophy “DMD”. The company’s PBGENE-DMD program approach is to reestablish expression of functional dystrophin by employing a couple of ARCUS nucleases that are transported by a solitary AAV to excise a roughly 500K base pair “hot spot” mutation on the dystrophin gene, causing an alternative dystrophin protein that is capable of working like a normal functioning/structured dystrophin. The company is targeting a region that accounts for up to 50% of DMD patients, which means this therapy would be a massive breakthrough for the patients, caregivers, and providers.

Precision Biosciences DMD Strategy (Precision Biosciences)

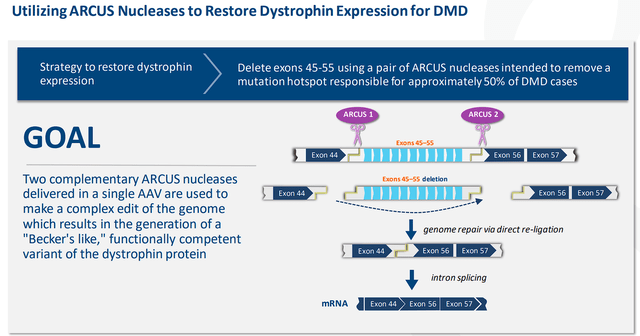

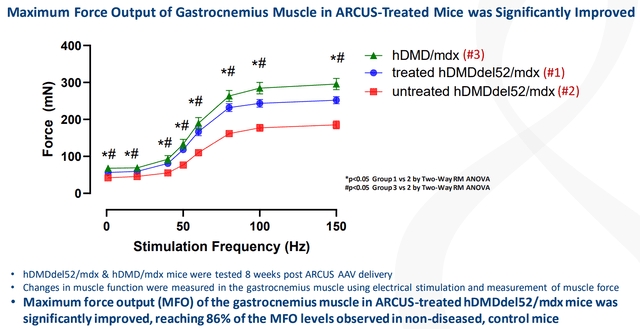

The company publicized that their edited dystrophin variation was tested in several tissue types associated with DMD, comprising skeletal muscle, the heart, and the diaphragm. Precision reported that the “maximum force output of the gastrocnemius muscle in ARCUS-treated animals was significantly improved compared to untreated mice, reaching 86% of the maximum force output levels observed in non-diseased, control animals.”

Precision Biosciences Max Force Output Treated Vs Untreated (Precision Biosciences) Precision Biosciences PBGENE-HBV Data (Precision Biosciences)

This does give Precision at least an in vivo proof of concept for their dual ARCUS nuclease approach for DMD. Indeed, this was just a mouse study, so we weren’t going to get performance numbers out of the heart and diaphragm. However, the fact the company has data that shows that there is a significant improvement in skeletal muscle, which should be enough to continue development.

I must stress that contemporary gene therapies attempt to stop or alleviate progression, but they are not cures. Precision’s program, if successful, could be a real cure for roughly 50% of DMD patients because it is excising the bad sequence and replacing it with a functional one. What is more, this gene editing therapy is expected to be a one-time administration, whereas contemporary gene therapies are expected to require repeat dosing down the line. Again, it is possible that Precision could offer a cure for a large percentage of DMD patients. Obviously, the success of the PBGENE-DMD would be a huge win for Precision as well as its partner, Eli Lilly (LLY). According to their agreement,

“Under the terms of the agreement, Precision will receive an upfront cash payment of $100 million, as well as an equity investment by Lilly of $35 million in Precision’s common stock. Precision is also eligible to receive up to $420 million in potential development and commercialization milestones per product, as well as tiered royalties ranging from the mid-single digits to low-teens on product sales should Lilly successfully commercialize a therapy from the collaboration. Precision will lead pre-clinical research and IND-enabling activities, with Lilly then assuming responsibility for clinical development and commercialization. Lilly will have the right to select up to three additional gene targets for this collaboration. Precision can co-fund clinical development of one product in exchange for an increased royalty rate on co-funded product sales.”

So, Precision should be seeing some cash from Eli Lilly if they can get the PBGENE-DMD program into the clinic and produce some positive clinical data.

PBGENE-HBV Update

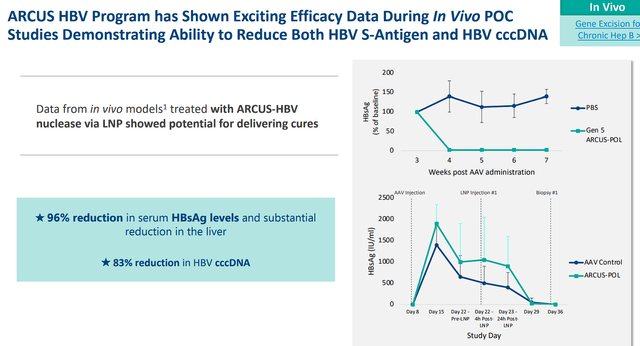

Precision recently presented encouraging preclinical data for PBGENE-HBV for chronic hepatitis B at the 2023 European Association for Study of the Liver “EASL” Congress.

In an AAV mouse model, Precision was able to use lipid nanoparticles enclosing mRNA that codes for an HBV-targeted ARCUS nuclease causing a 96% decrease in serum HBsAg. In HBV-infected primary human hepatocytes, the treatment produced a 90% decrease in cccDNA.

Precision Biosciences PBGENE-HBV Data (Precision Biosciences)

Therefore, the company has developed a potential functional cure by removing both the cccDNA and HBsAg. The company plans to submit an application for an IND for PBGENE-HBV.

PBGENE-PCSK9 Coming?

Back in February, the U.S. Patent and Trademark Office issued Precision a Notice of Allowance for the composition of matter claims for a PCSK9-specific ARCUS nuclease. So, it looks as if the company is taking aim at some cardiovascular indications for gene editing, including familial hypercholesterolemia. The company stated that they have performed some preclinical work using both gene deletion and insertion. I have yet to see an announcement about a potential PBGENE-PCSK9 program, but it would be an intriguing addition to the company pipeline and would definitely bring some attention to the ticker.

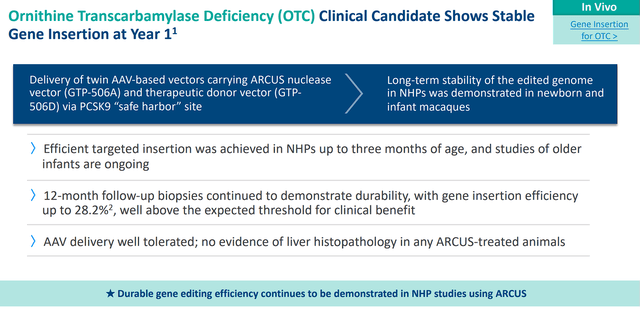

iECURE-OTC

iECURE-OTC has partnered with Precision for an ARCUS-mediated gene insertion program for ornithine transcarbamylase “OTC” deficiency. Non-human primate data showed durability at one-year post-dosing. iECURE is working on an IND submission for the second half of this year.

Precision Biosciences iECURE-OTC Data (Precision Biosciences)

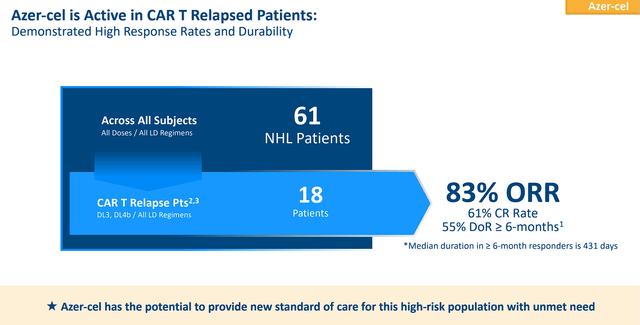

Cell Therapies

Precision is attempting to develop best-in-class, off-the-shelf, allogeneic CAR T therapies for a variety of cancer indications. The company updated investors on their allogeneic CAR T pipeline including new interim clinical data for its lead candidate, azercabtagene zapreleucel “azer-cel”, as a possible first-in-class allogeneic CD19 CAR T for relapsed DLBCL patients who have had a previous autologous CAR T therapy. At the end of May, Precision reported that they have seen 58% ORR with 41% CR, “across all doses and lymphodepletion regimen.” The relapsed autologous CAR T population had 83% ORR with 61% attaining CR. Furthermore, these patients had 55% ongoing durable responses for 6 months or greater.

Precision Biosciences Azer-Cel Data In CAR T Relapsed Patients (Precision Biosciences)

In terms of safety signals, the company reported that there was no grade 3 or greater CRS, ICANS, or GvHD in this cohort. So, azer-cel is still holding up high response rates with a satisfactory safety profile in r/r NHL patients.” The company stated that they were scheduled for a face-to-face with the FDA “to discuss the next steps for azer-cel in the CAR T relapsed setting” in June, so we should be hearing an update on that in the near term. Hopefully, Precision will get the green light to go after relapsed CAR T population because is expected that roughly 60%-65% of all patients treat with autologous CAR T relapse. Precision might be the only option for those patients and would be a lucrative opportunity.

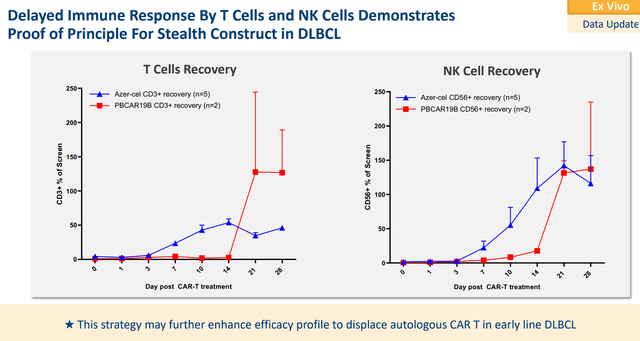

Precision also gave us our first glimpse into clinical data from the PBCAR19B stealth cell for r/r NHL, with a primary focus on DLBCL. PBCAR19B has an “immune cloaking” to improve CAR T proliferation and persistence by avoiding immune rejection. The Phase I data showed that PBCAR19B produced a 71% ORR and 43% CR rate. In the DLBCL group, it produced an 80% ORR and 60% CR.

Precision Biosciences PBCAR19B T Cells and NK Cells Data (Precision Biosciences)

In terms of safety, Precision reported no grade 3 or greater CRS, ICANS, or GvHD. The company is waiting for additional durability data and is seeking potential partners to attempt PBCAR19B in earlier lines for DLBCL.

Financial and Valuation Update

Precision’s Q1 earnings revealed that they finished the quarter with about $158M in cash and cash equivalents, which along with operational receipts, is expected to be adequate to fund Precision “through the Q1 of 2025.” The ticker’s market cap is only about $73M and the company only has around $26.6M in debt, so DTIL is trading with a -$58.59M enterprise value.

I would also stress that the company should receive milestone payments over the upcoming years, which should provide Precision with a respectable income. In fact, Precision’s total revenues for Q1 were $8.8M, thanks to a Novartis payment. Indeed, $8.8M is not a massive infusion of funds for a cell and gene editing biotech. However, the Street expects Precision to pull in nearly $30M this year and around $42M in 2025, which would be a forward price-to-sales of roughly 1.75x.

DTIL Annual Revenue Estimates (Seeking Alpha)

The industry’s average price-to-sales is about 4x-5x, so DTIL is trading at a discount just on expected milestone payments. When you add in the potential revenue from their therapies, you are looking at potentially coming close to $500M by the end of the decade, which would be 0.15x. One might be suspicious that Precision will be reporting this level of growth in the coming years, but remember, they have the potential to have several first-in-class and best-in-class therapies as well as partnered programs with Novartis and Eli Lilly. So, I think it is safe to say that those revenue estimates are not absurd if the company is able to get these therapies on the market and supported by insurance.

Considering these points in addition to the company’s current cash position, near-term milestone revenue, and projected growth… I think it is safe to say that DTIL is trading at a significant discount at this point in time.

Downside Risks To Consider

Like all early-stage biotechs, DTIL has a few notable risks that investors should consider when managing a DTIL position. Primarily, Precision has some serious competition that has established platforms as well as next-gen technology developing impressive programs. The cell therapy space is currently dominated by some of the biggest names in Healthcare such as Bristol Myers Squib (BMY) and Roche (OTCQX:RHHBY). However, there are plenty of smaller firms that are similar to Precision, who are testing new approaches to cell therapy and expanding the list of target indications. Precision’s gene therapy pipeline is also dealing with contemporary gene therapies and developing next-gen platforms. Sarepta Therapeutics (SRPT) is the leader in DMD with several approved gene therapy products as well as some advanced tech programs in the pipeline. Sarepta is not only the clear leader, they are embedded commercially, which will require Precision to have outstanding clinical data as well as undeniable cost benefits for them to quickly gain market share. Although DMD has dominated the attention of gene therapy efforts thus far, there are numerous other gene therapy and gene editing programs in development that are targeting a wide range of indications. As a result, I expect some of these indications to be a land grab as companies race to be first to market, with some claiming orphan drug benefits. So, Precision will have to move quickly, or they better prove their therapies are without a doubt superior to the competition.

Moreover, big pharma has the ability to simply acquire new tech that could match or outperform Precision in the clinic or on the market, which could blemish the market’s outlook on the company’s potential.

Second, Precision continues to report losses, which will most likely prevent the ticker from achieving and premium valuation this early in their development. Indeed, the company has enough cash to make it to 2025 and they have the potential to receive some milestone payments to extend that runway… but, the company is still miles away from the finish line. It is likely the market is going to wait for mature data and some financial guidance before they allow DTIL to go on an extended move higher.

Another risk to consider is the fact DTIL is trading below the $1 per share minimum threshold to be in compliance with NASDAQ listing requirements. Failure to get the share price to close above $1 for 10 consecutive trading days will result in delisting from NASDAQ and relegation to OTC trading. Typically, a company will have to perform a reverse split to get the share price to close above $1 for 10 consecutive trading days to regain compliance to maintain their listing on NASDAQ. Or, the company can report a positive update to trigger some buying activity to get the share price to close above $1 per share for 10 consecutive trading days. Either way, some investors tend to wait for the company to regain compliance, or perform the reverse split before committing funds to DTIL. So, DTIL investors will probably have to wait for a reverse split or potent catalyst before the ticker regains some positive momentum. Until then, investors need to accept DTIL will remain in the doldrums.

Finally, Precision is going to have to manage the possibility that they will have regulatory setbacks and disappointing data. The company did report subpar durability data for azer-cel, which appears to have weighed down the share price and diminished the program’s expectations. The company could continue to experience these setbacks including the potential for a clinical hold from the FDA, which is notably common in cell and gene editing programs. Clearly, this would be a major setback for the company and stock. As a result, investors should anticipate the market to be apprehensive until one of the company’s programs has made it to a late stage of development and is close to approval.

Considering these points above, I still have DTIL’s conviction level at 2 out of 5 and will remain in the Compounding Healthcare “Bio Boom” speculative portfolio.

My Plan

As I mentioned in my previous article, “I don’t anticipate making DTIL a principal component of the Bio Boom Portfolio”, and I am sticking with that notion at this point in time. Indeed, I believe Precision has some promising technology and the ticker is trading at an attractive valuation. However, the company is still too early in its development for me to amass a hefty position. My goal is still to trade the ticker in order to book some profits on a snapback, or potential mean reversion that will drive DTIL to my Sell Targets, and hopefully shift my position into a “house money” state for a long-term investment. This will allow me to have exposure to DTIL’s positive aspects, but the initial investment will be extracted with only profits remaining on the table.

For now, I am sticking to small additions as long as DTIL continues to remain bearish on the Go-No-Go indicator and is trading under my Buy Target 2 of $0.78.

DTIL Daily Chart (TrendSpider)

DTIL Daily Chart Enhanced View (TrendSpider)

Once I see the Go-No-Go turn bullish and the share price breaks through one of the Algo downtrend rays, I will increase my sizing and will subsequently set some sell orders around my sell targets in order to derisk the position and book some profits in a very speculative ticker.

If the company decides to perform a reverse split, I will cease my accumulation of DTIL and will reevaluate once the reverse split is complete.

I must stress that investors must be mindful that DTIL is a speculative ticker with significant risks at the moment. It is conceivable an investor could lose the bulk or the entirety of their investment.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Credit: Source link