kodda

Back in May, in a bullish write-up on Plains All American (NASDAQ:PAA), I said that it was one of the cheapest stocks in the midstream sector and that it had a lot of potential growth in front of it. Since then, the stock has generated a return of about 14%, outpacing the nearly 7% gain in the S&P. With the company reporting its Q2 results earlier this month, let’s check in on the name.

Company Profile

As a refresher, PAA is a liquids focused midstream operator. Its crude segment accounts for over 80% of its EBITDA, with the Permian representing about 60% of the segment’s EBITDA. Its assets consist of gathering, intra-basin, and long-haul pipelines, as well as associated storage assets, located throughout the Permian Basin, Eagle Ford, Mid-Continent, Gulf Coast, Rocky Mountains, and Canada.

Its pipelines generate revenue through the use of tariffs, pipeline capacity agreements, and other transport fee, while its storage assets use a combination of monthly to multi-year agreements, throughput and loading and unloading fees, as well as fees from condensation processing services.

PAA’s NGL segment includes 4 natural gas processing plants and 8 fractionation plants, mostly located in western Canada. Approximately 60% of the segment’s EBITDA comes from fracs spreads and marketing, with 40% from fees. It typically hedges between 65-90% of volumes.

Q2 Results

For the most-recent quarter, PAA reported adjusted EBITDA attributable to PPA of $587 million, which was a decline of -3% from a year ago.

Crude Oil segment adjusted EBITDA came in at $529 million, a 7% increase from $494 million a year ago. Throughput volumes in its Crude Oil segment rose 13% to 8,392 Mb/d. The Permian led the way, with volumes increasing 16% to 6,304 Mb/d. The company credited the solid Crude Oil Segment results to higher tariff volumes, better tariff rates, and its increased ownership in Cactus II.

NGL segment adjusted EBITDA, meanwhile, fell -48% from $120 million to $62 million. The company said the decline was due to decreased volumes as a result of planned turnarounds, the absence of weather outage benefits, and the sale of KFS.

Implied distributable cash flow (DCF) available to common unitholders came in at $371 million, a -7% decline. On a per unit basis, it was 54 cents, down from 57 cents a year ago.

PAA paid a distribution of 26.75 cents in the quarter. It had a coverage ratio of 1.98x and excess DCF of $184 million.

The company ended the quarter to $7.1 billion in net debt, a reduction of $1 billion from a year ago. Its leverage stood at 3.2x.

Overall, it was a solid quarter, as PAA continues to benefit from increased Permian production flowing through its underutilized pipelines in the area. The NGL segment is more variable and was expected to see a reduction in EBITDA due to lower frac spreads. The $1 billion reduction in debt and 3.2x quarter-end leverage, meanwhile, speaks to the improvements that the company has undergone over the past year.

2023 Outlook

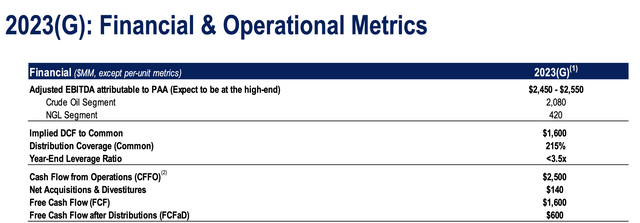

Looking ahead, PAA said it now expects 2023 adjusted EBITDA to be at the high-end of its previous guidance of $2.45-2.55 billion.

FinBox

The Crude Oil segment is projected to contribute around $2.08 billion in 2023 adjusted EBITDA, with total volumes of 8,520 Mb/d, including 6,500 Mb/d from the Permian.

The NGL segment is expected to produce around $420 million in EBITDA, down from $518 million in 2022. About 80% of the segment’s volumes are hedged for 2023.

It is looking for free cash of approximately $1.6 billion, and FCF after distributions of $600 million. It plans to spend $325 million in growth capex and $195 million in maintenance capex for the year. It projected leverage to be under 3.5x at year-end. It forecasts a coverage ratio of 2.15x.

After the quarter, the company acquired a 43% interest in the OMOG JV for $145 million. PAA said the acquisition further aligns its interests with those of E&P Diamondback (FANG) in the Permian. It noted its guidance update, however, was more from improved performance and not from 5 months of this bolt-on deal.

It also announced a new $200 million NGL project in Canada, which it said will generate unlevered returns above its hurdle rate. It noted that it has entered into commercial agreements associated with the project that will increase its weighted average contract length for it Fort Sak facility to 10 years.

On its Q2 earnings call, CFO Al Swanson said:

“As a result of business performance in both our crude oil and NGL segments year-to-date, and the partial benefit of the OMOG acquisition, we now expect to be at the high end of our full year adjusted EBITDA guidance of $2.45 billion to $2.55 billion. We continue to expect year-over-year growth in our crude oil segment, driven by Permian tariff volume increases. For the NGL segment, we remain highly hedged and do not expect a material impact from the lower frac spreads or Canadian wildfires. Shifting to capital allocation, as illustrated on Slide 8, we remain committed to: one, significant returns of capital to our equity holders, two, continued capital discipline; and three, reducing debt and increasing financial flexibility.”

With underutilized pipes in the Permian, PAA remains well positioned from continued production growth in the most important oil basin in the U.S. Given the bolt-on acquisition, guidance appears it also could be conservative.

Valuation

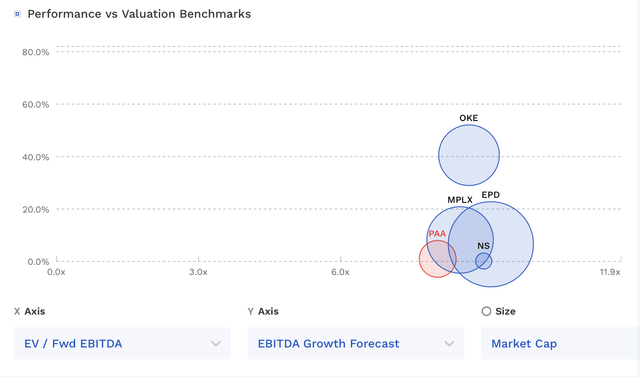

PAA currently trades at 8x the 2023 EBITDA consensus of $2.56 billion, and 7.8x the 2024 EBITDA consensus of $2.62 billion.

It trades around 9.8x its core Crude segment ’23 EBITDA of approximately $2.1 billion.

On an FCF basis, the stock has an FCF yield of 12% based on a 2023 FCF forecast of $1.3 billion. For some reason the company includes assets sales when it discusses free cash flow, but I leave that out of the calculation. The stock yields about 7%.

PAA trades at one of the cheaper valuations among its midstream peers.

PAA Valuation Vs Peers (FinBox)

Conclusion

PAA continues to demonstrate the benefits it receives from its ties to the best oil basin in the U.S. While the company made a mistake overbuilding its Permian capacity in the past, it is nicely set to benefit from this going forward as it has a lot of growth opportunities with minimal capex spend, as its underutilized pipes get filled and tariff rates move higher as overall Permian utilization improves.

With a great balance sheet and high coverage ratio around 2x, the company has plenty of room to continue to ramp up its distribution level over the next few years. At the same time, the stock remains among the cheapest in the midstream space, even after a solid performance since my original write-up.

I continue to rate the stock a “Buy” with a $17 target price.

Credit: Source link