Kevin Dietsch

Article Thesis

Palantir Technologies Inc. (NYSE:PLTR) reported its most recent Q1 quarterly results on Monday afternoon. The company saw PLTR shares soar following a better-than-expected result, although Palantir is still down over the last couple of years. Due to its massive potential over the coming years and decades, Palantir stock could be a speculative buy.

What Happened?

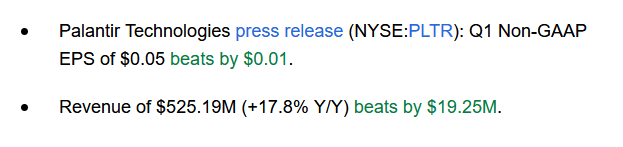

On Monday afternoon, following the close of the market, Palantir Technologies Inc. announced its most recent quarterly results. The headline numbers can be seen in the following screencap:

Seeking Alpha

Palantir Technologies grew its revenue by 18%, which was much stronger than expected. Revenue estimates were beaten by around 4%, which is quite a compelling feat. While one can argue that profits aren’t as important for a growth company relative to the top line performance, it’s still important to note that Palantir generated a small net profit — on an adjusted basis –which was better than expected. That being said, profits aren’t very high, but that is excusable for a growth company as long as underlying business growth remains convincing.

The market reacted very positively to Palantir’s earnings release, as shares jumped up by 28% at the time of writing. It can be expected that shares will remain volatile in both after-hours trading and throughout the coming days.

Palantir: Underlying Execution And Growth Potential

Palantir Technologies has made some investors unhappy, especially those that bought shares at the peak. But the underlying performance of the company has not been bad, as Palantir Technologies has continued to generate appealing sales growth while adding customers at a sizeable pace. Some bears have argued that Palantir’s reliance on government contracts was an issue, as this makes PLTR very dependent on a single customer. I don’t really agree with that thesis, as doing work for the government can be highly lucrative, proven by the track records of defense companies such as Lockheed Martin Corporation (LMT). Also, demand from the government isn’t really dependent on the strength of the economy, as the government spends money no matter what. But even those that subscribe to the thesis that reliance on government contracts is a bad thing don’t have to worry too much, as Palantir has also been expanding its non-government (or commercial) business at a hefty pace.

This trend continued during the most recent quarter, as Palantir’s commercial revenues were up by 15% year-over-year, largely driven by commercial U.S. revenues. Currency rate movements play a role here, as a strengthening U.S. Dollar had a negative impact on Palantir’s reported ex-U.S. commercial revenue growth rate.

Potentially even more importantly for Palantir’s long-term growth potential in the commercial space, Palantir’s customer count rose by 41% versus the previous year’s quarter. On a quarter-to-quarter basis, customer count growth was attractive as well, at 7%, which pencils out to an annualized growth rate of 31% [1.07^4].

Customers that start working with Palantir oftentimes do smaller projects at first. This helps the customer and PLTR in getting used to each other and establishing how and where PLTR can create value for the new customer, e.g., by improving data quality or lowering costs. When those first minor projects are successful, customers then follow up with larger projects in the future. A fast pace of adding new customers thus bodes well for Palantir’s long-term growth potential — as long as the company executes well and provides value for these new customers, revenues should see a sizeable long-term growth impact. While some might argue that commercial customers will be less eager to spend money on projects such as the ones they are doing with Palantir during uncertain times and ahead of a potential recession, that does not seem to be the case. A high rate of new customer additions suggests that commercial customers are, in fact, very willing to spend money on these projects. Since Palantir can help companies improve costs by making operations more efficient, this makes sense to me — improving the cost profile is attractive for commercial customers, potentially even more so before a potential recession, when cost-savings could be crucial to maintain margins.

Looking at Palantir’s government business, we see that revenues continued to grow as well, being up 20% year over year. This was, again, largely driven by U.S.-based growth, as U.S. government revenue rose by 22%, which was more than the international growth rate. Currency rate movements play a role here as well, but the U.S. government’s support for Ukraine during the ongoing war likely plays a role as well — Palantir is providing data such as targeting information for Ukrainian forces, for example.

While Palantir’s business growth has slowed down versus previous years, it still remains at a compelling level. Also, a growth slowdown over time has to be expected for all growth companies, as maintaining a very high growth rate becomes harder and harder the larger a company becomes.

Looking beyond the most recent quarter, we see that Palantir’s guidance is relatively in line with what the analyst community had estimated. The revenue guidance for the current year stands at $2.185 to $2.235 billion, which is equal to $2.21 billion at the midpoint of the guidance range. That’s relatively close to the $2.2 billion revenue consensus estimate for this year, although PLTR would be ahead of estimates when its results come close to the upper end of the guidance range. Guidance for the current quarter, Q2, is a little below estimates, but since the FY guidance is in line with estimates, Palantir seemingly sees H2 growth ahead of estimates. As long as overall growth this year is close to market expectations, I wouldn’t worry too much about the revenue distribution over individual quarters — revenues can be a bit lumpy for Palantir.

Importantly, Palantir also guides for something that many market participants and investors didn’t expect — GAAP profitability during every quarter of the current year. While adjusted net profits are one thing, being profitable on a GAAP basis is a much harder task for a growth company. Growth companies, especially from the tech space, oftentimes pay a lot of share-based compensation. That is generally excluded in adjusted earnings but has to be accounted for under GAAP. Palantir also has been issuing a lot of new shares in the past, although the dilution rate has improved drastically over time. With PLTR guiding for GAAP profits this year, the company seems to be planning to be profitable throughout the entire year — even with share-based compensation being fully accounted for. That deflates, I believe, a major bear talking point — bears have been worried about PLTR’s share issuance and the dilution it causes for a long time. Over the last year, Palantir’s share count rose by less than 4%, from 2.036 million to 2.108 million. I don’t see this as a dramatic dilution pace, especially since PLTR’s revenues are growing much faster — revenue per share thus continues to grow at a sizeable pace.

While Palantir has made a lot of progress in improving its profitability over the last year, the company still isn’t overly profitable. $500 million to $550 million in adjusted profits — the guidance range announced by management — translates into an earnings multiple of around 40. That’s not cheap, but might still be warranted in the long run — as long as Palantir continues to enjoy attractive business growth and as long as margins continue to improve. PLTR has seen its operating margin (GAAP) explode upwards by a hefty 1,000 base points over the last year. If further sizeable margin improvements occur over the coming years, e.g., due to operating leverage and positive scale effects, then Palantir’s valuation could eventually be significantly more attractive — but there is, of course, no guarantee that margins will continue to rise drastically.

Takeaway

Palantir Technologies Inc. has beaten Q1 estimates easily and the profit guidance for the current year looks appealing. The company’s growth potential is sizeable, although it should be noted that growth has slowed down to some extent over the last year.

While Palantir Technologies Inc. stock looks expensive today, it could grow into the current valuation if business growth remains healthy and if further margin improvements can be achieved.

Credit: Source link