D-Keine

The RiverNorth/DoubleLine Strategic Opportunity Fund (OPP) is a rather unique closed-end fund aka CEF that income-hungry investors can employ in their efforts to achieve their goals. The fund does very well in this respect, as it currently boasts a massive 14.36% yield, despite a recent distribution cut. Indeed, this yield is higher than just about any other closed-end fund that currently trades in the market.

Morningstar classifies the RiverNorth/DoubleLine Strategic Opportunity Fund as a taxable high-yield bond fund. As we will see in this article, this classification is perhaps not entirely accurate, but it is better than most other classifications that could be assigned to it. Here is how this fund’s yield compares to other closed-end funds that share the same classification:

|

Fund |

Current Yield |

|

RiverNorth/DoubleLine Strategic Opportunity Fund |

14.36% |

|

Allspring Income Opportunities Fund (EAD) |

9.35% |

|

Apollo Tactical Income Fund (AIF) |

11.11% |

|

BlackRock Corporate High Yield Fund (HYT) |

9.58% |

|

Neuberger Berman High Yield Strategies Fund (NHS) |

13.61% |

Clearly, we can see that the RiverNorth/DoubleLine Strategic Opportunity Fund compares pretty well to most of its peers in terms of yield. Eagle-eyed readers might also note that the yields of all of these funds, except for the Apollo Tactical Income Fund, have generally been increasing in recent weeks. This is due to the fact that long-term interest rates have been rising year-to-date as investors have lost their confidence that the Federal Reserve will rapidly reduce interest rates in 2024 and have been allowing bond yields to rise in accordance with this new belief.

Yesterday’s meeting of the Federal Open Market Committee is certainly not likely to change this belief, as policymakers actually increased their estimate of the long-term interest rate, suggesting that rates may be permanently higher going forward than we have become accustomed to over the past fifteen years.

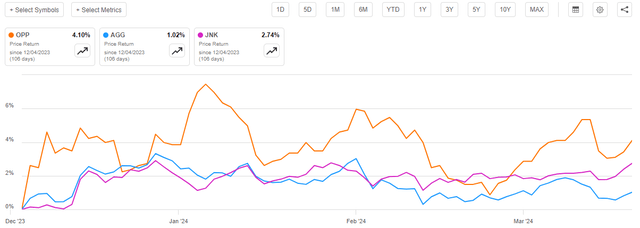

As regular readers can likely remember, we previously discussed the RiverNorth/DoubleLine Strategic Opportunity Fund in early December 2023. The market at that time was very different, as we were still in a very euphoric market as investors were rapidly purchasing bonds and other assets before the Federal Reserve reduced interest rates in 2024. Following the start of the new year, this euphoria wore off and investors have been allowing bond prices to fall as it seems increasingly unlikely that a rapid interest rate reduction will happen in the near future. As such, we might expect that the fund has not delivered the greatest performance in the market since the publication of that article. In fact, though, the fund has done very well as its share price is up 4.10% since that date, beating both the Bloomberg U.S. Aggregate Bond Index (AGG) and the Bloomberg High Yield Very Liquid Index (JNK):

Seeking Alpha

We do see though that the fund exhibited some considerable volatility in terms of share price performance in early January 2024. This may have been due to the fund cutting its distribution, which I also predicted would occur in my previous article. This action naturally caused the market to reprice the fund’s shares, which is natural because closed-end funds are at least partially priced based on their yields. It is similar to the way a master limited partnership will decline in price if it cuts its distribution, even if all of the fundamentals remain exactly the same.

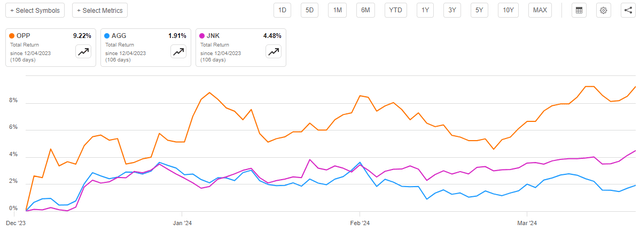

One interesting thing here though, is that investors in the RiverNorth/DoubleLine Strategic Opportunity Fund actually did much better over the period than the share price performance would suggest. This is because closed-end funds such as this one typically pay out most or all of their investment profits to the shareholders via distributions.

The end result is that the size of the fund’s portfolio remains relatively stable over time and the investors get cash payments corresponding to the returns delivered by the portfolio. These cash distributions represent a real return to the fund’s investors and therefore result in investors in the fund actually doing much better than the share price performance alone would suggest. This also means that we need to incorporate the distributions that the fund pays to its investors in any analysis of its results. When we do this, we see that shareholders in this fund have actually gained 9.22% since the date that the previous article was published:

Seeking Alpha

Once again, we can see that this was substantially better than either of the bond indices managed to deliver over the period. This will undoubtedly appeal to any investor, regardless of their actual goals. After all, it is possible to avoid paying taxes on the distributions simply by holding your shares in some sort of tax-advantaged account.

As three months have passed since the time of our previous discussion on this fund, a great many things have changed. In particular, the fund cut its distribution and released its semi-annual report for the first half of the 2024 fiscal year. We will want to pay special attention to this report, as it should provide us with a great deal of insight into how well the fund navigated the volatile bond market conditions that existed during the second half of 2024.

About The Fund

According to the fund’s website, the RiverNorth/DoubleLine Strategic Opportunity Fund has the primary objective of providing its investors with a very high level of current income. This makes a great deal of sense for a fund that is managed by both RiverNorth and DoubleLine, as both companies are fairly well-known as bond managers. RiverNorth has also managed to earn a reputation for engaging in some alternative strategies such as closed-end fund arbitrage, similar to Saba Capital (another fund manager that has managed to earn a pretty good reputation among investors in this space). As I pointed out in a recent article,

As a rule, bonds provide all of their investment return in the form of direct payments to their investors. A bond investor purchases a newly issued bond at face value, collects a regular coupon payment from the issuer that corresponds to interest on the loan, and then receives the face value back when the bond matures. There are no net capital gains over the life of the bond because bonds have no inherent link to the growth and prosperity of the issuing company. Thus, the bond’s yield is the only source of net investment returns.

Considering this, it makes sense for a bond fund to focus on the generation of income as its primary objective. In fact, no other objective really makes sense because bonds cannot deliver capital gains over the long term. Any investor who purchases a bond when it is first issued and holds it until it matures will only get the coupon payments.

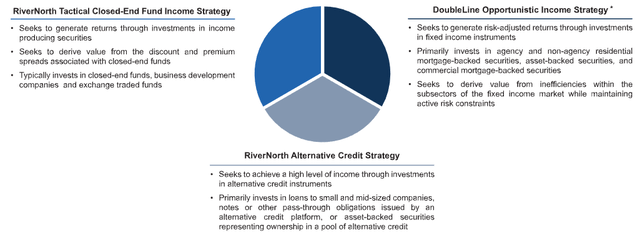

As noted in my previous article on this fund though, the RiverNorth/DoubleLine Strategic Opportunity Fund is not a pure bond fund. In fact, it invests its assets in three different buckets:

RiverNorth

The only one of these buckets that is akin to a traditional closed-end bond fund is the Opportunistic Income Strategy bucket. This segment of the fund is managed by DoubleLine Capital, which is generally considered to be one of the better bond fund managers around. As shown above, this segment of the fund invests mostly in various types of asset-backed securities such as residential and commercial mortgages, car loans, credit card receivables, and similar things.

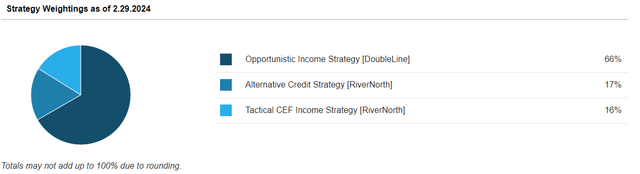

Despite the chart above, which was pulled from the fund’s website, making it appear as though about a third of the fund’s assets are invested in each bucket, this is not the case. In fact, as of right now, about 66% of the fund’s assets are invested in the Opportunistic Income Strategy segment:

RiverNorth

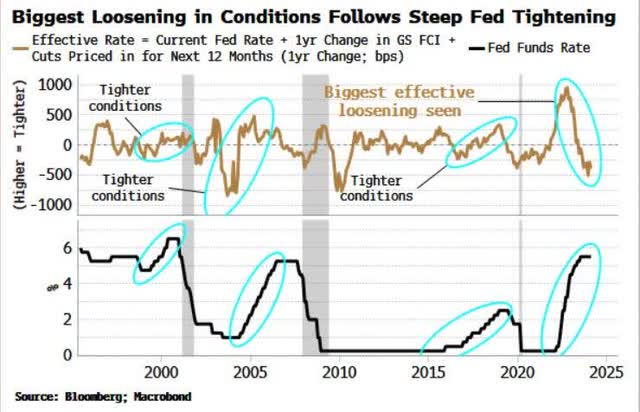

These allocations are slightly different than what we saw the last time that we looked at this fund. The last time that we discussed it, the most recent data available was as of October 31, 2023, and the fund had 64% of its assets invested in the Opportunistic Income Strategy segment and 18% of its assets invested in each of the other two segments. Thus, it appears that the fund slightly increased its allocation to traditional bonds at the expense of the other two asset classes. I will admit that I am not as confident about this move as the fund’s management, as there is still a chance that the Federal Reserve will not be able to cut interest rates in line with the current predictions. As Simon White, Bloomberg’s macro strategist, points out, financial conditions are currently looser than they were at the time that the Federal Reserve started raising the federal funds rate in March 2022:

Zero Hedge/Reposted from Bloomberg

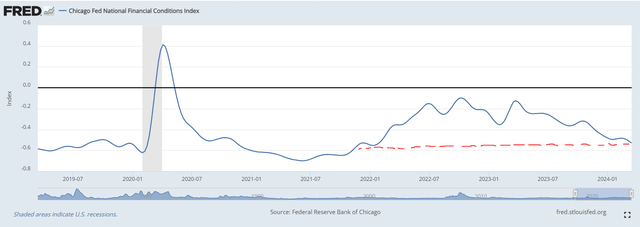

The Federal Reserve’s own data confirms this:

Federal Reserve Bank of St. Louis/Edits by Author

My horrible graphical talents aside, the Chicago Fed National Financial Conditions Index sits at -0.53056 right now. The last time that it was this low was in January of 2022. Thus, despite Chairman Powell’s claim that financial conditions are weighing on the economy, that does not appear to be the case. As I have pointed out in a few other recent articles, the month-over-month personal consumption expenditures data also appears to be trending upward. As such, it might be difficult for the Federal Reserve to actually execute its prediction of three 25-basis point interest rate cuts in 2024 unless it is willing to reignite inflation right before a presidential election.

This could suggest that bonds remain overpriced, as they will almost certainly decline a bit if the Federal Reserve fails to execute the current rate cut projections. That means that alternative credit, which is very frequently variable-rate, could be poised to outperform traditional bonds in 2024. As such, the fund might be better off with a smaller allocation to its Opportunistic Income Strategy Bucket, but it has apparently been increasing it.

Leverage

As is the case with most closed-end funds, the RiverNorth/DoubleLine Strategic Opportunity Fund employs leverage as a means of boosting the effective yield of its portfolio. I explained how this works in my previous article on this fund:

Basically, the fund is borrowing money and using that borrowed money to purchase fixed-income assets. As long as the purchased assets have a higher yield than the interest rate that the fund has to pay on the borrowed money, the strategy works pretty well to boost the effective yield of the portfolio. As this fund is capable of borrowing at institutional rates, which are significantly lower than retail rates, that will usually be the case.

Unfortunately, the use of debt in this fashion is a double-edged sword because leverage boosts both gains and losses. As such, we want to ensure that a fund is not employing too much leverage because that would expose us to too much risk. I do not usually like to see a fund’s leverage exceed a third as a percentage of its assets for this reason.

As of the time of writing, the RiverNorth/DoubleLine Strategic Opportunity Fund has leveraged assets comprising 35.50% of its portfolio. This is less than the 36.09% leverage that the fund had the last time that we discussed it, although admittedly this leverage decline is not as large as the ones that we have seen from some other bond-heavy closed-end funds.

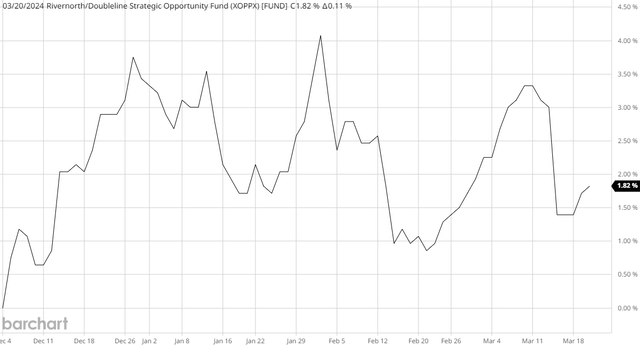

As has been the case with many other funds, the reason for this decline in overall leverage is that the fund’s portfolio has increased in size. As we can see here, the fund’s net asset value per share has gone up by 1.82% since the last time that we discussed it:

Barchart

Many readers will undoubtedly note that this is a substantially lower increase than the fund’s share price delivered over the same period. This could have some implications for the fund’s valuation, which we will discuss later in this article. The important takeaway for now is that the fund’s portfolio has gotten larger, mostly due to a combination of realized and unrealized gains that have not yet been paid out to the investors. The total outstanding amount of the fund’s borrowings remained the same over the period, so its debt now represents a smaller portion of a larger portfolio. This is nice to see as lower levels of leverage typically correlate to lower volatility, particularly in the case of a market correction.

However, we can still see that the fund’s leverage remains a bit above the one-third level that we ordinarily prefer. This is true, but a fixed-income fund can usually carry a higher level of leverage than an equity fund because the assets in general are less volatile. While the RiverNorth/DoubleLine Strategic Opportunity Fund is not a pure fixed-income fund, we have already seen that most of its assets are in bonds and alternative credit securities, so it is pretty close to one. The fund’s leverage is also not much above the one-third level that we would prefer so overall the leverage is probably okay right now. We should not need to worry too much about it.

Distribution Analysis

As mentioned earlier in this article, the primary objective of the RiverNorth/DoubleLine Strategic Opportunity Fund is to provide its investors with a very high level of current income. In pursuit of this objective, the fund invests its assets into a portfolio consisting of closed-end funds, bonds, and alternative credit securities. All of these assets deliver a substantial percentage of their total returns to their owners in the form of direct payments. In this case, it is the fund that receives these payments, which it pools together and combines with any capital gains that it manages to realize by exploiting changes in the prices of the assets in the portfolio.

This fund even takes things a step further by borrowing money, which allows it to collect payments from more securities than it could afford simply by relying on its own assets alone. As the purchased assets will frequently have a higher yield than the interest rate that the fund has to pay on the borrowed money, it is able to pocket the difference and thus boost the effective yield that it receives from the assets. The fund then pays out all of this money to its investors, net of its expenses. We might expect that this would allow the fund’s shares to boast a very high yield.

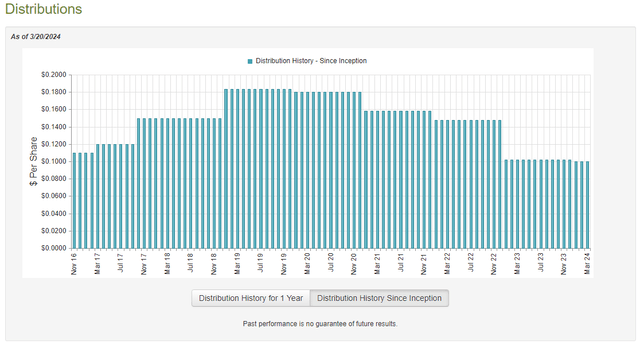

This is indeed the case, as the RiverNorth/DoubleLine Strategic Opportunity Fund pays a monthly distribution of $0.1003 per share ($1.2036 per share annually), which gives it a 14.36% yield at the current price. As we saw in the introduction, this yield is considerably higher than that of most other funds that are currently trading in the markets and thus might prove very attractive to income-focused investors. Unfortunately, this fund has not been particularly consistent with respect to its distributions over its history. As we can see here, the fund’s distribution has been steadily declining since 2019:

CEF Connect

The latest distribution cut came in January of this year, although it was a very small cut as the monthly distribution went from $0.1021 per share to $0.1003 per share. This is still a large enough cut to have a noticeable effect on your income if you own a substantial number of shares, however. It is also not what we want to see in an inflationary environment, as inflation is constantly reducing the number of goods and services that we can purchase with the distribution that the fund pays out. The Federal Reserve said yesterday that inflation is likely to remain “higher for longer,” so the last thing that we really want is a distribution cut that amplifies the loss of purchasing power that comes with inflation.

However, as I pointed out in my previous article on this fund, it probably did need to cut the distribution as it was struggling to maintain it at the previous level. As such, we should probably have a look at the fund’s finances to see how likely it is that the distribution will be sustainable at this new level.

Fortunately, we have a very recent document that we can use for the purposes of our analysis. As of the time of writing, the most recent financial report for the RiverNorth/DoubleLine Strategic Opportunity Fund corresponds to the six-month period that ended on December 31, 2023. This is a much newer report than the one that we had available to us the last time that we discussed this fund, which is quite nice to see.

The second half of 2023 was plagued with volatility in the bond markets, as bonds took a beating over the summer as long-term interest rates rose dramatically due to the market’s realization the Federal Reserve would not be reducing its benchmark rate anytime soon. The central bank actually raised the federal funds rate in July 2023, which also probably had an adverse impact on the market. This all changed in the final two months of the year, as investors started buying up bonds to lock in a high yield prior to the Federal Reserve cutting interest rates in 2024. These two disparate market environments may have caused this fund to either take some capital losses or book some profits. The latest financial report should give us a good idea of how well it navigated the conditions that existed.

For the six-month period, the RiverNorth/DoubleLine Strategic Opportunity Fund received $12,126,666 in interest along with $1,598,820 in dividends from the assets in its portfolio. When we combine this with a small amount of income from other sources, we get a total investment income of $13,734,438 for the period. The fund paid its expenses out of this amount, which left it with $11,325,710 available for shareholders.

This was, unfortunately, not nearly enough to cover the $14,042,153 that the fund actually paid out during the period. At first glance, this is quite concerning as we would ordinarily prefer a debt-focused fund such as this to be able to fully cover its distributions out of net investment income. The fund obviously failed in that task.

However, there are other methods through which the fund can obtain the money that it requires to cover the distribution. For example, it might be able to earn capital gains by selling securities that go up in price. The fund also might receive some return of capital distributions from the closed-end funds that it includes in one of the RiverNorth-managed segments of its portfolio. Realized capital gains and received return of capital distributions are not considered to be investment income for tax or accounting purposes, but they clearly do represent money coming into the fund that can be paid out to investors.

The fund, however, had somewhat mixed results at earning money via these alternative methods. It did report net realized losses totaling $14,094,515 but these were offset by $20,213,202 net unrealized gains during the period. Overall, the fund’s net assets increased by $634,708 after accounting for all inflows and outflows during the period.

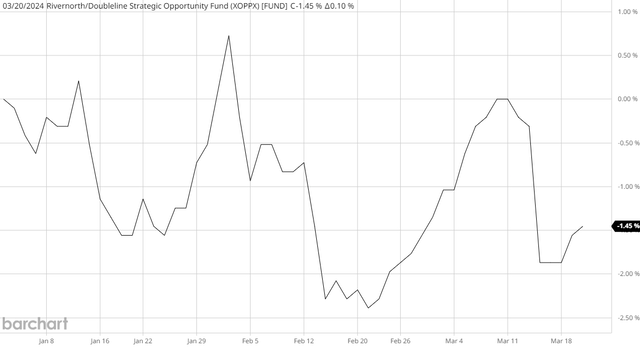

Thus, the RiverNorth/DoubleLine Strategic Opportunity Fund did manage to cover its distribution during the second half of 2023, albeit barely. The biggest concern here is that the fund was only able to cover it because the incredibly bullish market in the final two months of 2023 drove up asset prices enough to give the fund sufficient unrealized capital gains to offset the amount that it pays out in excess of net investment income. This is concerning because unrealized gains can be quickly erased by a market correction. This appears to have been the case year-to-date, as we can see here:

Barchart

This chart shows the fund’s net asset value year-to-date. As we can see here, it has declined by 1.45% since the start of the year, which was also the opening date of the final half of the fiscal year. Thus, it appears that the fund has failed to cover its distribution so far this year, even after the distribution cut. This could certainly be concerning, as it may require the fund to cut its distribution again if the bond market fails to deliver sufficient gains to offset the losses that it has suffered so far as well as all of the remaining distributions to be paid out. That is a tall order, and it does lend some support to our overall thesis here that the fund should probably be allocating more money to the two non-fixed-income buckets as they are less sensitive to interest rates.

Valuation

As of March 20, 2024 (the most recent date for which data is currently available), the RiverNorth/DoubleLine Strategic Opportunity Fund has a net asset value of $9.49 per share but the shares currently trade at $8.42 each. This gives the fund’s shares an 11.28% discount on net asset value at the current share price. This is nowhere near as attractive as the 13.26% discount that the shares have had on average over the past month. However, a double-digit discount is a pretty good entry point for any closed-end fund, so the current price seems acceptable if you want to add this fund to your portfolio.

Conclusion

In conclusion, the RiverNorth/DoubleLine Strategic Opportunity Fund benefited from the incredibly strong expectations of interest rate cuts that dominated the bond market in the final two months of the year. These expectations allowed the fund to earn sufficient unrealized gains to cover its distribution. However, it was still forced to cut the payment and it has failed to cover even this lower distribution year-to-date. While the Federal Reserve did reiterate its expectations for rate cuts later this year, there are still reasons to doubt that prediction as inflation continues to remain high and financial conditions remain incredibly loose.

All we have to do is look at the gold market to realize that few people believe that the Federal Reserve is going to be able to both reduce rates and keep inflation under control. As such, there could still be considerable risks here, and as the majority of this fund is invested in interest-rate sensitive securities, now might not be the best time to buy the RiverNorth/DoubleLine Strategic Opportunity Fund.

Credit: Source link