MF3d/E+ via Getty Images

Investment Thesis

Okta (NASDAQ:OKTA) is heading into its Fiscal Q2 2024 at the end of August. While I remain bullish on Okta’s prospects, I’m becoming increasingly wary that Okta is starting to become a “show-me” story.

Here I describe some of the pluses and minuses of this investment.

Heading Into Fiscal Q2 2024, What to Think About

Okta specializes in identity and access management solutions. Okta provides cloud-based services to help businesses securely manage user identities and access to various applications, delivering enhancing security and user experience.

Okta’s Single Sign-On (“SSO”) product allows users to access multiple applications and services with just one set of login credentials, streamlining the authentication process and enhancing security.

As we head into Okta’s fiscal Q2 earnings on 30th August, the one consideration that I believe will carry its earnings results will be an uptick in its current remaining performance obligations (“cRPO”) and the pace that Okta will add new customers. Allow me to explain both.

As followers of my work will know, I’ve made this argument on previous occasions, and I’ll reiterate my point now, the customer adoption curve is in my opinion the single best indicator of the health of a business.

If we see when Okta reports its fiscal Q2 2024 results that its customer adoption curve has accelerated once again, this will be a positive indicator that the business is still thriving. The figure that I’m looking out towards is a +15% increase in total customers y/y.

Additionally, I have seen several recent earnings reports confirming this point of view. To illustrate, there’s still a lot of customer appetite for software companies that provide enterprises with a clear value proposition, in Okta’s case a comprehensive identity and access management platform that enables organizations to securely connect their users and manage applications. But customers are demanding more value than they were in the past two years.

Simply put, IT departments are requiring clear and high ROIs, before embracing “yet another” productivity software platform. To this end, we’ve seen companies mention on numerous occasions during the current earnings season that IT departments are embracing a wave of software consolidation and providing added scrutiny to the software adoption process. To put it simply, the time of easy money has gone and if a company isn’t seeing clear value, they are rethinking whether they truly need that software or whether an alternative option will suffice?

Next, we’ll discuss Okta’s cRPO.

Okta’s Guidance Needs to be Upwards Revised

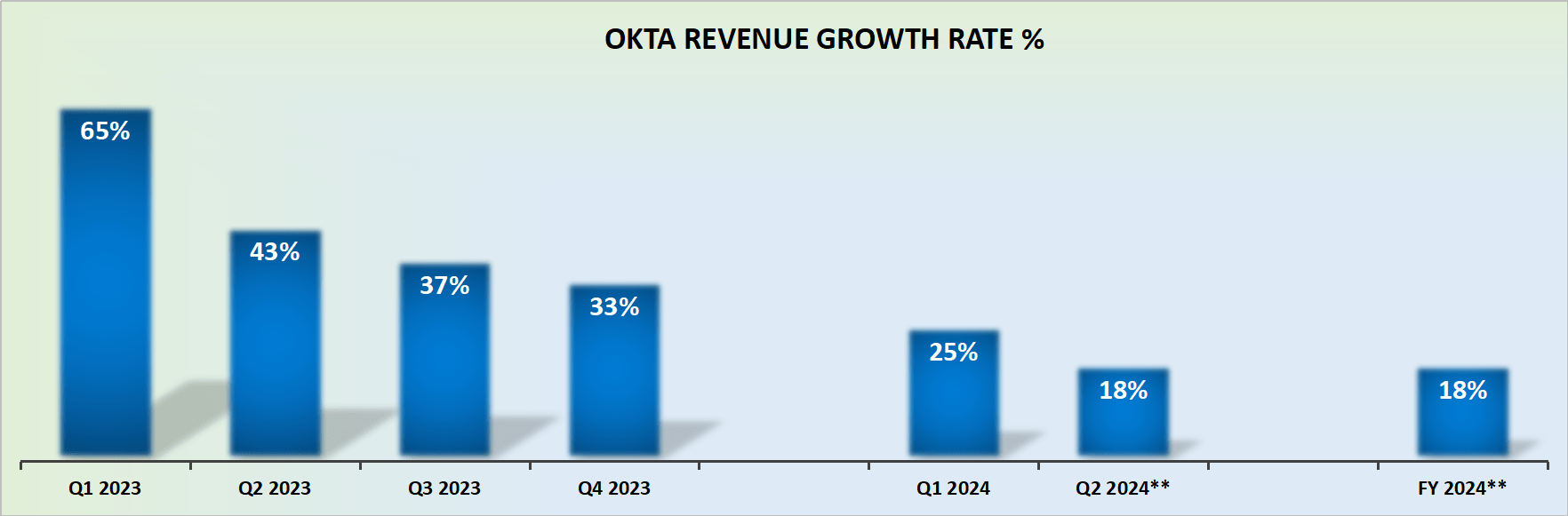

OKTA revenue growth rates

In fiscal Q1 2024, that is last quarter, we saw Okta’s cRPO decelerate from 25% in fiscal Q4 2023 down to 20% for Q1 2024.

Given that Okta’s revenue growth rates at the time were up 25% y/y, which is higher than its cRPO figure, this would lead one to conclude that Okta recognized revenues at a pace that is not consistent, and was higher, than the amount of bookings it has received.

There’s nothing wrong with this. But it could mean that Okta will in the coming quarters see its revenue growth rates decelerating into the mid-teens, unless Okta’s cRPO figure or its customer bookings figure increased.

Consequently, this is my contention, for now, I have a buy rating on this stock. But Okta needs to find a way to reaccelerate and grow its cRPO, otherwise, this would inform me (and the investment community) that this is no longer a rapidly growing company. And it would affect its valuation, which we’ll discuss next.

Okta’s Valuation – Still Priced as a Growth Stock

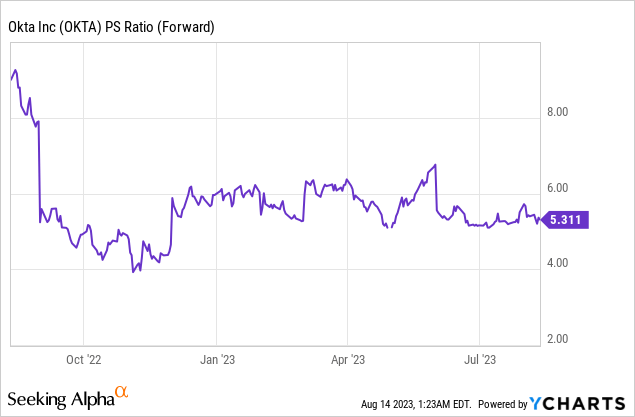

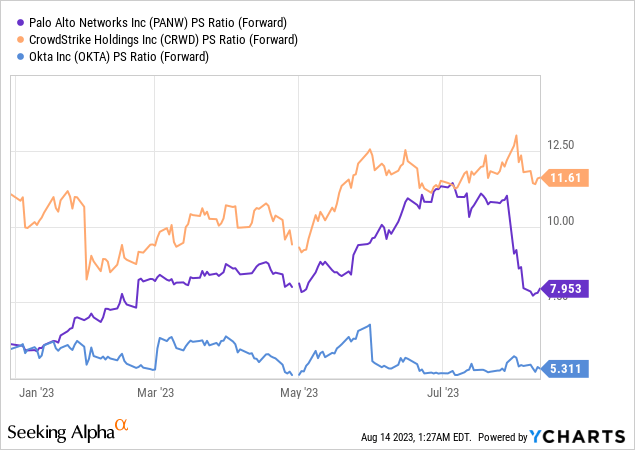

Okta’s valuation got crushed in the bear market, but since the October lows its multiple has expanded slightly from 4x to 5x. And it has kept this expansion, even while its revenue growth rates have clearly continued to slow down. Why?

Because investors continue to believe that Okta has what it takes to reaccelerate its revenue growth rates. However, investors will only continue to hold that vision for so long. After a while, Okta will become a “show-me” story.

And indeed, the argument could be made that Okta is already a “show-me” story, given that, unlike many other SaaS businesses which have re-rated higher in the past few months, Okta’s valuation has remained relatively static since the start of 2023.

Accordingly, by the time Okta reports its fiscal Q2 2024 results, it will be halfway through its fiscal year. Meaning that if Okta does not upwards revise its full-year 2024 revenue guidance, this will put a lot of pressure on the multiple that investors will be willing to pay for Okta.

After all, Okta would be assuredly on the deceleration path, and its underlying profitability would become increasingly in focus. And I’m not convinced that paying more than 50x next year’s EPS is all that attractive, for a business with revenue growth rates below 25% CAGR.

The Bottom Line

Heading into Okta’s Fiscal Q2 2024 earnings, I maintain a bullish outlook but am growing cautious as the stock’s performance has been under pressure.

As I analyze the pluses and minuses of this investment, I’m focusing on the customer adoption curve and the pace of new customer additions, with a keen eye on a potential +15% increase in total customers y/y.

The recent trend in software consolidation and heightened scrutiny in IT departments demand clear value propositions, posing a challenge for Okta to reaccelerate and grow its remaining performance obligations (cRPO).

While Okta’s valuation has slightly expanded, its continued ability to reaccelerate revenue growth will be crucial to maintaining investor confidence.

Credit: Source link