Pgiam/iStock via Getty Images

Introduction

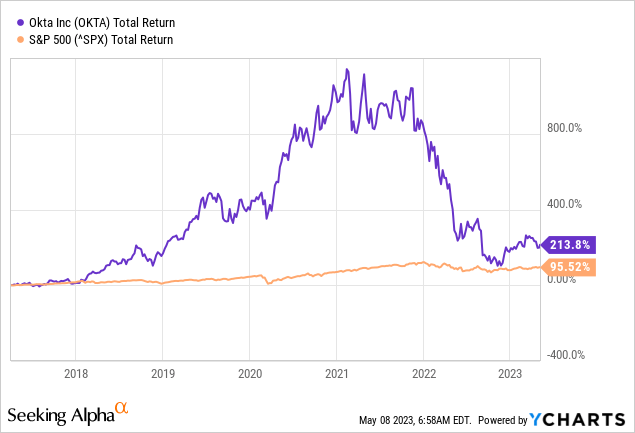

Okta (NASDAQ:OKTA) is one of the technology stocks whose price has risen sharply but has fallen sharply since mid-2021. It is one of many growth stocks in which I recognize the same pattern. Others include PayPal (PYPL), Shopify (SHOP) and Cloudflare (NET). These stocks are currently quite cheap.

Okta is a leader in the growing global Identity and Access Management (IAM) market. Revenue grew at an average CAGR of 37% from FY21 to FY24th, and already has some 17,600 customers. A nice customer gain is OpenAI (the company behind ChatGPT). Furthermore, quarterly earnings are strong and profitability has improved significantly.

Okta is the market leader, and the market is expanding steadily. Microsoft (MSFT) Azure Active Directory is another market leader. Okta is a good investment due to its attractive stock valuation, which is supported by strong growth numbers and solid growth projections.

Huge Room To Grow

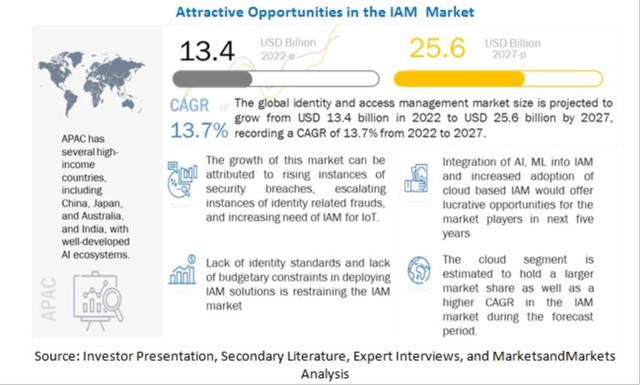

Attractive opportunities in the IAM Market (Markets and Markets analysis)

Okta is still a small player in the global Identity and Access Management [IAM] market with annual revenues of $1.86 billion. Markets and Markets estimates that the total addressable IAM market is $13.4 billion. Increased adoption of cloud-based applications and services, which in turn require secure identity and access management solutions, is expected to drive the global identity and access management market to a CAGR of 14.5% through 2025. These organizations operate primarily in banking, financial services and insurance, travel and hospitality, healthcare, retail and e-commerce. The total addressable market in which Okta operates is estimated to be as much as $80 billion. There is huge growth potential.

The presence of rules and regulations such as the GDPR Act, PCI-DSS, SOX and HIPAA Act are expected to be further updated by increased authentication requirements and security issues. The growth of business activities in the cloud requires more and more anti-identity theft and anti-fraud solutions, which may lead governments to introduce new laws that drive companies to action. Given Okta’s strong market position, I expect further growth in their Identity and Access Management market in the coming years.

For the future, there are opportunities in combining biometrics such as fingerprints, iris and face to integrate with blockchain technology to provide a fool-proof way to identify individuals and ensure the data is secure and validated. A company like Okta is vulnerable to cyber attacks, so the priority is to store identity data quickly, securely and efficiently by use of new technological advancements.

Fourth Quarter Fiscal 2023 Earnings

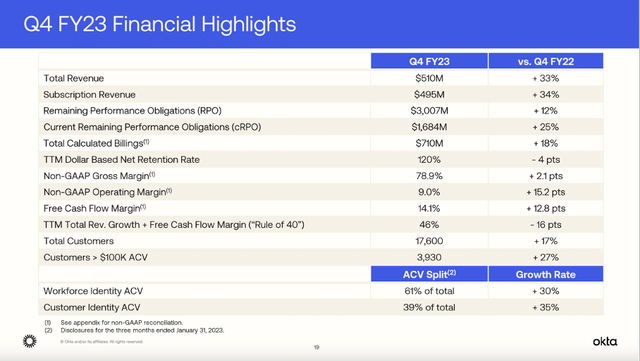

Q4 FY23 financial highlights (Okta’s investor presentation)

The most recent quarterly figures are from 4Q23 due to its broken book year. This was a strong quarter, as revenue increased 33% from the same period a year earlier. Free cash flow margin was strong at 14.1% versus 1.3% in the same period a year earlier. Okta is also entering a profitable period with positive cash flows partly due to strong customer growth of 17%. Okta has some prominent customers in its portfolio such as Sonos, Hewlett Packard Enterprise and MassMutual.

OpenAI (the company behind ChatGPT) was a big winner from the Customer Identity Cloud. Okta’s Customer Identity Cloud is a self-service authentication solution that OpenAI’s developers used to strengthen the company’s Customer Identity requirements.

Cloud and hybrid IT, digital transformation projects and the adoption of Zero Trust security will continue to drive revenue. The importance of identity has increased significantly as organizations seek an increasingly efficient and secure workforce identities stored in the cloud.

For the first next quarter, expectations look good with revenue growth of 23% year over year to $510 at midpoint and non-GAAP earnings per share of $0.12. For the full fiscal year, it expects 17% revenue growth and $0.77 non-GAAP earnings per share with a non-GAAP free cash flow margin of about 10%.

Risks And Competitors

Okta’s has several competitors, the largest of which is Microsoft’s Azure Active Directory (Azure AD). Azure AD poses a significant threat to Okta because Azure AD is integrated into the Microsoft 365 ecosystem. This means businesses only have to work with one platform to access the entire Microsoft and Azure ecosystem. Okta has an advantage and offers a wider range of third-party protocols than Azure AD. Azure AD only offers support for protocols such as SAML, OAuth and OpenID Connect. Comparing features, Okta provides better user management capabilities. Okta also offers a good layer of protection against unwanted attacks through fingerprint and facial recognition. Still, Okta may win out over the competition because of its strong cross platform functionality and narrow focus on IAM.

I expect the integration of artificial intelligence into Microsoft’s 365 suite to threaten Okta’s future. Microsoft recently took a significant stake in ChatGPT and is integrated into Azure OpenAI services. This allows developers to integrate custom AI-driven experiences into their own applications. The total package offered by Microsoft poses a danger to Okta, as organizations may be more likely to choose an artificial intelligence-based platform (such as Azure) than one without or still in development.

Valuation

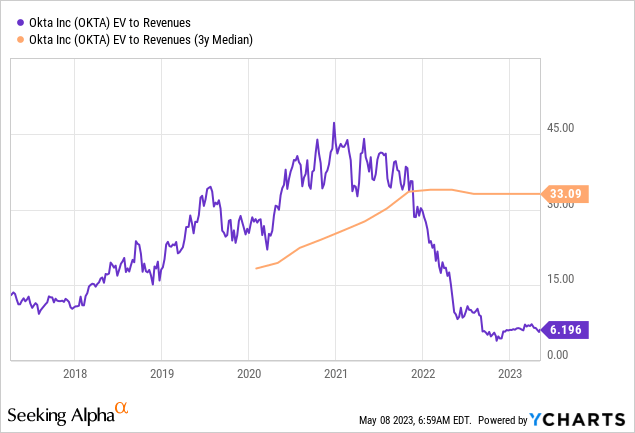

The enterprise value to revenue ratio takes cash and debt into the valuation and compares them to revenue. This is ideal for a growth company like Okta because in the growth phase, profits are not yet made.

We see in the YCharts chart below that the EV/Revenue ratio is historically low. So investors seem significantly pessimistic about the future, which is unique given Okta’s strong market position in the AIM market.

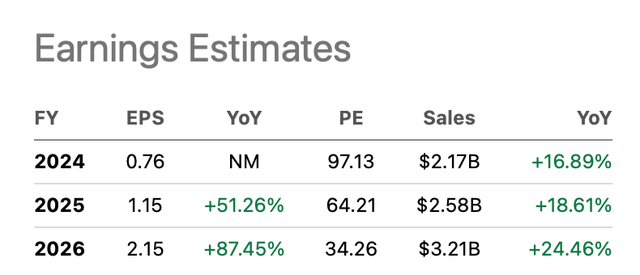

Looking at the forward PE ratio, we see an expensive valuation, but it is characterized by strong growth in earnings and revenue. Earnings are expected to grow strongly and the projected PE ratio for 2026 is 34. Okta is attractively valued, provided it can meet expectations and maintain its growth for the upcoming years.

Okta’s earnings estimates (OKTA ticker page on Seeking Alpha)

Conclusion

Okta operates in a fast-growing market with a total addressable market of up to $80 billion. Okta, along with Microsoft’s Azure Active Directory, is the market leader in the TAM, which is projected to grow strongly. The use of cloud applications that require increasingly secure levels of identification underlies this strong growth. The presence of stricter regulations around authentication requirements and security issues will also serve as a growth catalyst. This is evidenced by Okta’s strong numbers and outlook. Last quarter was a strong quarter with revenue growth of 33% year-over-year. Free cash flow margin was also high at 14.1%. For fiscal 2024, Okta expects about 17% revenue growth with a non-GAAP free cash flow margin of about 10%. Although Okta holds a commanding market share, I anticipate fierce competition from Microsoft’s Azure Active Directory. Through Microsoft’s investment in OpenAI’s ChatGPT, Microsoft now offers a total package integrating artificial intelligence into their 365 suite. This allows organizations to work more efficiently, but I do expect Okta to come up with similar AI solutions. Looking at the stock’s valuation, the picture looks very attractive and it is trading at a historically low valuation. However, the forward PE ratio for 2026 is high at 34, but that is characterized by solid growth expectations. Okta’s strong market position in a growing market and the historically low valuation make Okta’s stock worth buying.

Credit: Source link