101cats

Oil-Dri Corporation of America (NYSE:ODC) does not seem to be observing a lot of competitors in the business-to-business segment, and offers products for the growing pet industry. Besides, the company continues to report international demand, mainly from Canada and other jurisdictions, and operating efficiency improvements. I believe that the stock could trade at more than its current price mark as soon as more investors carry out due diligence on the stock.

Oil-Dri Corporation of America

With all of its production destined for absorbent products, Oil-Dri Corporation is in charge of the design, manufacture, marketing, and commercialization.

Most of these products are made using hydrated aluminosilicate, and serve various purposes such as agricultural fertilizers as well as other derivatives of chemical products. Some of the brands through which the company introduces its products to the market are Cat’s Pride or Jonny Cat in the line of absorbent stones for cats, Agsorb or Verge for agricultural products, and Pure-Flo, Supreme, and Select in surface whitening products.

Source: Corporate Website

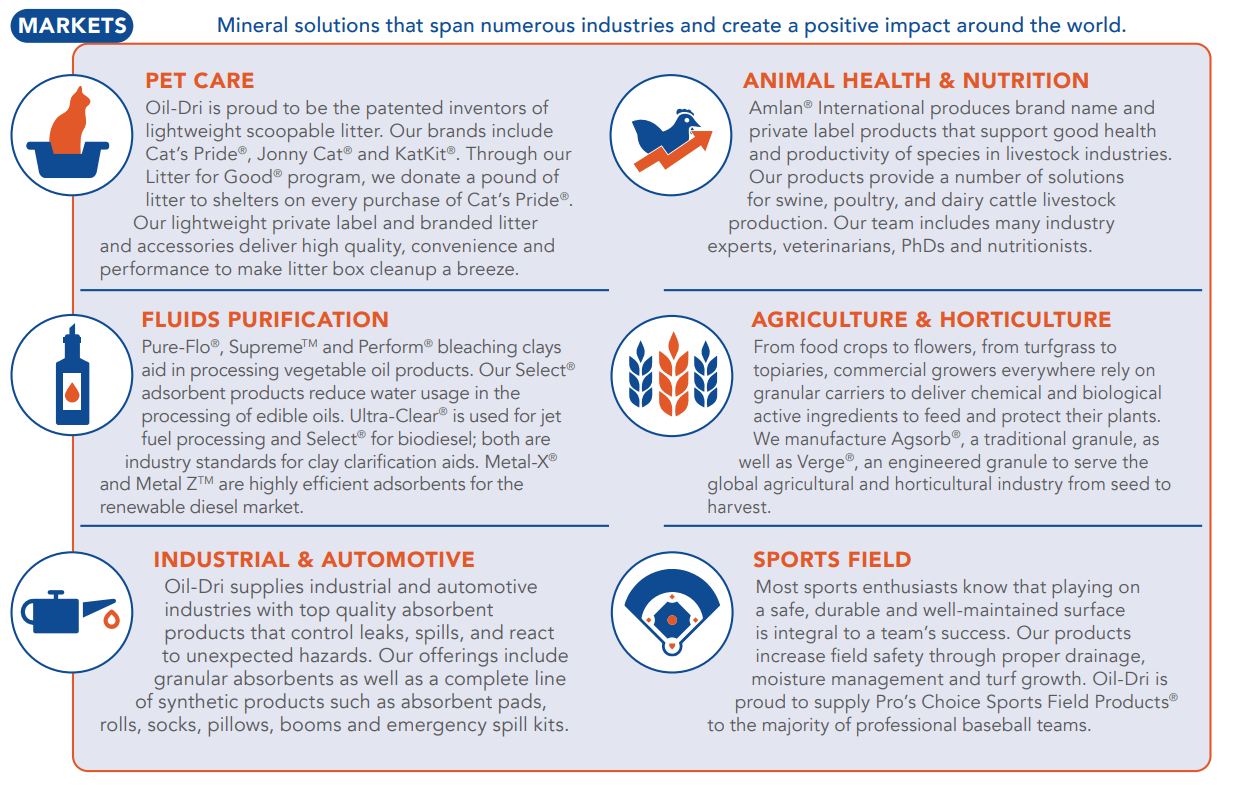

The mineral solutions offered by Oil-Dri Corporation serve many markets, but it is worth noting that most of the revenue comes from the pet care industry and activities related to fluid purification.

Source: Fact Sheet

Considering that the pet care industry receives a significant portion of the products offered by Oil-Dri Corporation, revenue growth may be close to pet care industry growth or a bit larger.. According to experts, the pet care market grows at close to 5.1% CAGR.

The global pet care market size was valued at USD 150.67 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 5.1% from 2022 to 2030. Source: Pet Care Market Size, Share & Trends Analysis Report, 2030

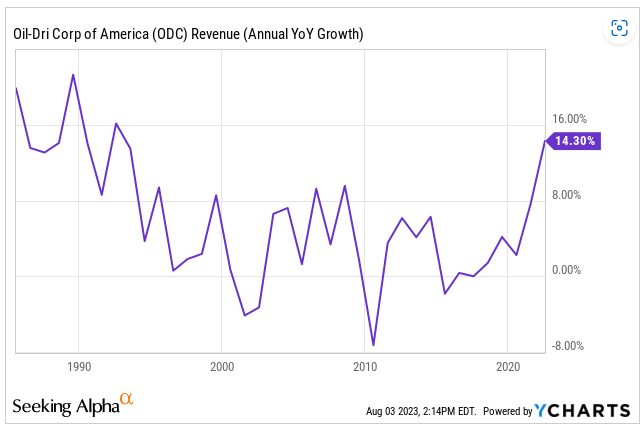

With that about the market, the fact that Oil-Dri Corporation of America is reporting sales growth of more than 4%-6% is beneficial. I used some of these figures in my DCF model, so have a look at the revenue growth chart below.

Source: Ycharts

In addition to its facilities and operating center in the United States, this company has a global position, operating through subsidiaries in Mexico, Canada, the United Kingdom, Switzerland, Indonesia, and China. In some of these countries, Oil-Dri has industries to manufacture the products, and in other countries, it has only distribution brands, such as Indonesia and China.

Regarding its clients, the company presents a concentration in some of the main clients, as has been the case of 16% and 18% in recent years represented by sales to Walmart (WMT). No other client represented more than 10% of the company’s revenues or sales in either of its two segments.

Oil-Dri’s operations are divided between retail or wholesale activities and business to business. Each of these comprises an operating segment. In fact, they are the company’s two reportable segments. In the first of these we find sales to supermarkets, veterinarians, warehouses, retail store franchises, digital sales channels, and direct customers, which include distributors of cleaning products for cars and industrial activities, users of sports products, and companies that offer environmental services. The business-to-business segment includes oil and fuel processors and refiners, manufacturers of animal products and agrochemicals, and distributors of veterinary products.

The variety of product applications allows Oil-Dri to have a large channel of different customers, position its products in different markets, and offer them to distributors and manufacturers, expanding its sales channels beyond those that are direct from the company. In addition, the marketing of its products reaches the entire world, through its own channels and those facilitated by wholesale distribution, such as its main client, Walmart.

Solid Balance Sheet With A Small Amount Of Debt

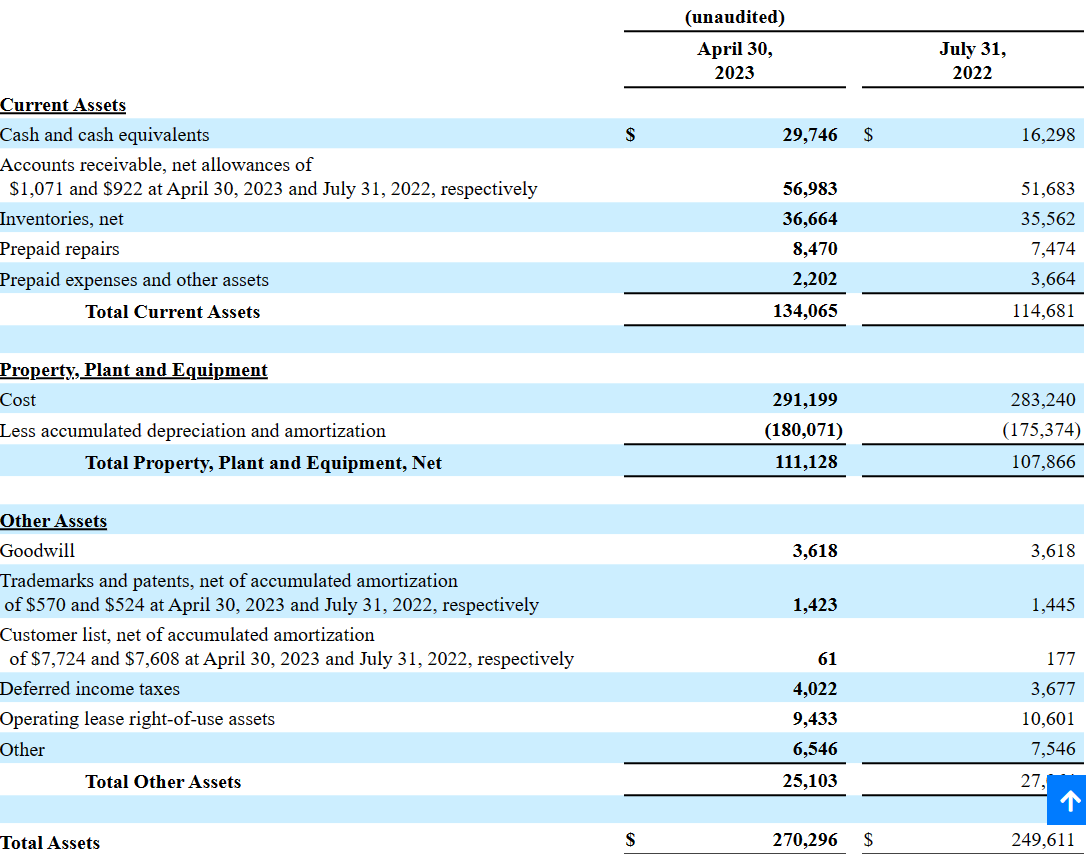

As of April 30, 2023, the company reported cash and cash equivalents worth $29 million, accounts receivable close to $56 million, inventories of $36 million, and total current assets worth $134 million. Total current assets are more than 2x the total amount of current liabilities, so I think that liquidity does not seem an issue here.

Long term assets include property, plant, and equipment worth $111 million, goodwill of close to $3 million, trademarks and patents of $1 million, and operating lease right-of-use assets worth $9 million. Total assets stand at more than $270 million, much more than 2x the total amount of current liabilities. In sum, I believe that the balance sheet stands in good shape.

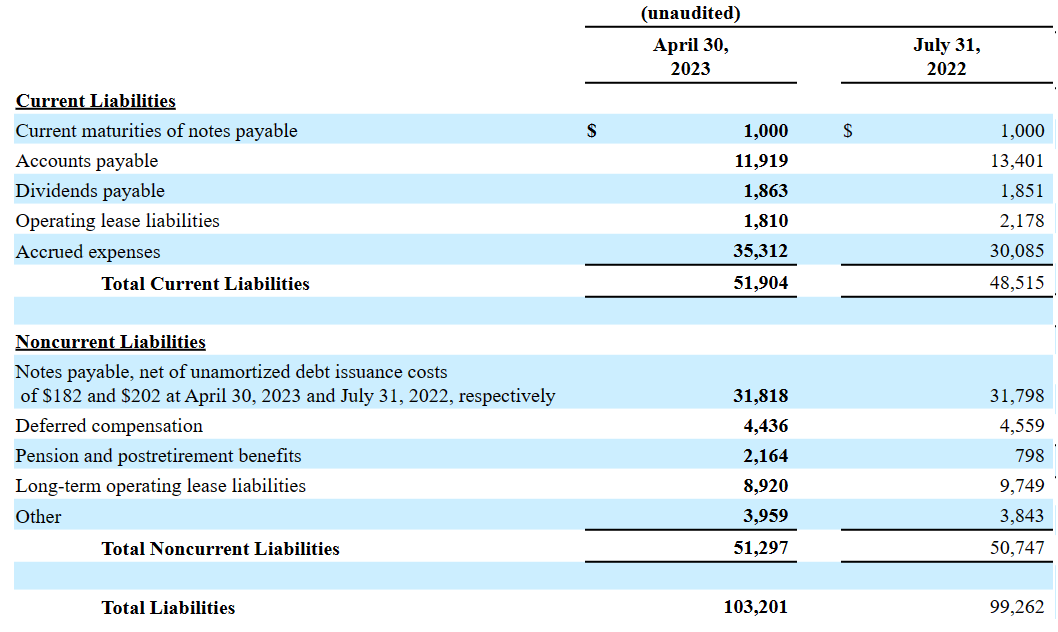

Source: 10-Q

With regard to the list of liabilities, I would remark current maturities of notes payable close to $1 million, accounts payable worth $11 million, accrued expenses worth $35 million, and total current liabilities of $51 million.

Oil-Dri also reported notes payable of close to $31 million, pension and postretirement benefits close to $2 million, and total liabilities of about $103 million.

Source: 10-Q

DCF Model: Successful Price Increases, Further Optimization Of Equipment, Reduction In Labor, Manufacturing, and Freight Constraints Could Imply Undervaluation

At this point, I think that Oil-Dri is focused on maintaining its position in the markets in which it participates and having organic growth through the sales channels in which it currently maintains active operations. With that, I believe that further successful price increases as we saw in the last quarter will most likely bring net sales growth and perhaps FCF growth.

Net sales increased for both our R&W and B2B products groups, primarily due to price increases implemented across both product groups and to a lesser extent due to volume growth in our B2B products group. Source: 10-Q

It is also worth noting that Oil-Dri Corporation of America appears to be increasing the number of employees and obtaining a superior level of optimization, which may bring further FCF margin increases. In this regard, I think that investors may want to have a look at the following lines from a recent quarterly report.

During the first nine months of fiscal year 2023, we have been able to reduce our backlog of orders by $4.2 million, a 64% decrease from July 31, 2022. This was accomplished by increasing personnel, expanding production shifts, optimizing equipment, and utilizing alternative modes of transportation. In order to meet the increase in customer demand, we continue to implement strategies to further reduce labor, manufacturing and freight constraints. Source: 10-Q

Under my financial model, I assumed that the company’s ability to create efficient distribution and marketing channels together with the infrastructure that allows it to acquire raw materials will also most likely improve profitability.

In my view, the effective strategy of licenses and patents by which Oil-Dri has positioned its brands in the veterinary sales markets, industrial chemical products, and sports products allow it to maintain sustained activity both nationally and internationally. As it appears to be working great, I would be expecting the same strategy to work in the future.

I would also expect further increases in net sales coming from new jurisdictions and existing jurisdictions outside the United States. I am pretty sure that new regions will most likely expect to show as much demand as in Canada and many other countries. In this regard, it is worth noting that the company noted 24% 9M/9M in Canada and also growth in other regions.

All of our foreign operations, with the exception of our subsidiaries in China and Indonesia, experienced an increase in net sales during the first nine months of fiscal year 2023 compared to fiscal year 2022. Total net sales of our subsidiary in Canada during this period increased by $2.0 million, or 24%, compared to the same period in fiscal year 2022 driven by higher private label cat litter net sales. Source: 10-Q

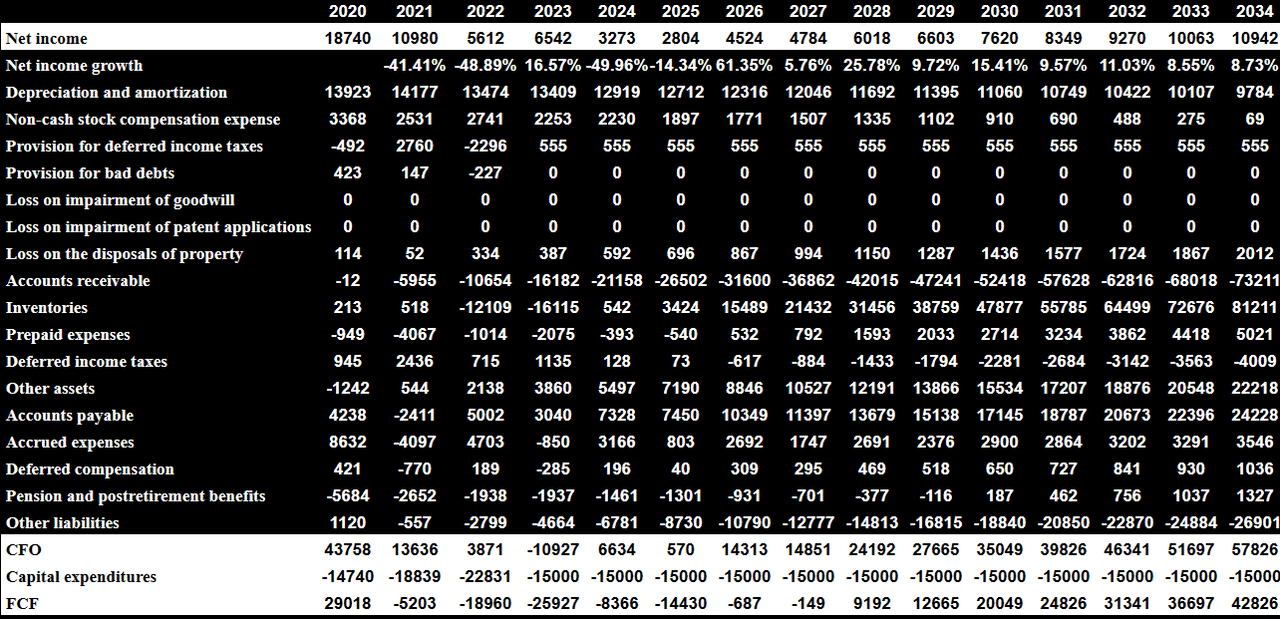

My DCF model includes 2034 net income close to $10.55 million, net income growth about 8%, and depreciation and amortization worth $9.05 million. Besides, with changes in accounts receivable of about -$74.55 million, changes in inventories close to $81.05 million, changes in prepaid expenses worth $5 million, and changes in accounts payable close to $24 million, I also assumed changes in accrued expenses of about $3.05 million.

With changes in deferred compensation of $1.55 million and changes in pension and postretirement benefits close to $1 million, 2034 CFO would be close to $57.55 million. Now, if we subtract 2034 capital expenditures of -$15.55 million, 2034 FCF would be $42.5 million.

Source: My DCF Model

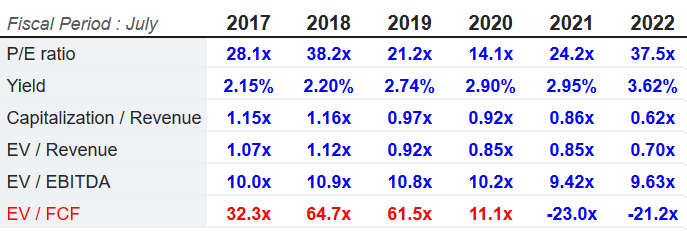

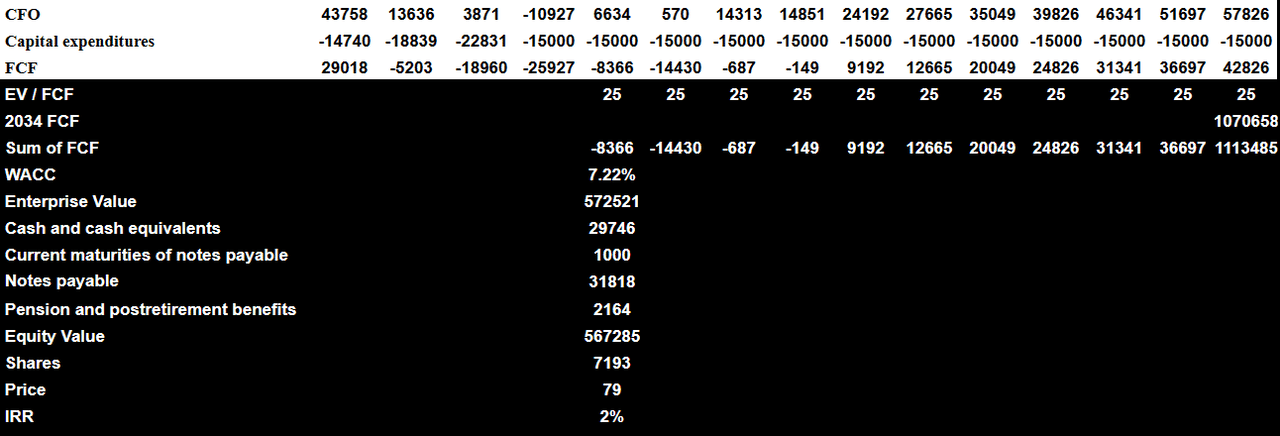

If we assume EV/FCF about 25x, which is conservative considering previous EV/FCF valuations, and a WACC of 7.22%, the implied enterprise value would be close to $572 million.

Source: Market Screener

If we also include cash and cash equivalents of close to $29 million, and subtract current maturities of notes payable of $1 million, notes payable close to $31 million, and pension and postretirement benefits worth $2 million, the implied equity value would be $567 million. Finally, the fair price would be $79 per share with an IRR of 2%.

Source: My DCF Model

Competitors

The analysis of the competition for this company is complex as the diversity of its products is intended for different markets that present other logics among themselves. In any case, the evaluation of the competition regarding its retail and wholesale segment is highly influenced by brand recognition and marketing strategies related to products, such as absorbent stones for cats or sports products. In this sense, there are other companies with similar manufacturing and product lines, mainly in the industrial and sports area. Most of them have greater financial resources than Oil-Dri. The company declares that it has six main competitors in this competitive market, and the accessible portion of it has decreased in the last year.

On the other hand, competition from the business-to-business segment also exists in a consolidated market, where customers are limited and so are sellers. Competition is primarily given by both national and multinational manufacturers. To a lesser extent, competition is also given by regional manufacturers, although due to communication strategies and the ability to reach their customers, these do not mean real competition for Oil-Dri.

Risks

Oil-Dri is a company that has presented volatile financial results in recent years, generating uncertainty regarding its forecasts or at least the difficulty of carrying them out. In the context of intense competition in which the operations of its two segments participate, a large part of the company’s success in the future involves introducing new products to the market, generating value transformations in existing ones, or generating communication strategies that nurture the recognition.

Another risk factor for this company is the concentration of its customers, who at any time may have a change in their inventory or cease commercial relations with the company. In a lesser order and also in general terms, the company depends on the supply of clay, and any disruption in this sense can generate complications in the productive circuit.

In addition, we can name the risks to which the company is exposed in its international activity, conditioned by regional trade legislation, the effectiveness of its distribution and logistics chain, variations in fuel and transportation prices and tariffs, and the ability to maintain relationships with distributors in markets, mainly Asian and Middle Eastern.

Conclusion

Oil-Dri Corporation enjoys a beneficial position in the business-to-business segment, in which sellers are limited. Besides, the company sells a lot in the pet industry, which is expected to grow significantly in the coming years. In my view, with new quarterly reports indicating international demand, further increase in the price of products, and operating efficiency, Oil-Dri Corporation of America would most likely receive further demand for the stock. Under conservative assumptions of FCF growth and FCF margin improvement, the company appears undervalued.

Credit: Source link