Carolina Rudah

There’s exactly one reason that drew me to write on the Danish pharmaceuticals company Novo Nordisk (NVO) (OTCPK:NONOF) today. And that’s Ozempic. As it happens, there has been such a steady stream of its mention in my news and podcast feeds, my curiosity was piqued. I’d even go so far as to say that its popularity might have come second only to updates on the all important general elections being held in various parts of the world this year.

The point is, that a medical treatment becoming a regular feature in pop culture conversation says something. Something about the size of the problem (no pun intended) it addresses. In my article on Eli Lilly (LLY) (see section on ‘Winning in the Diabetes market’ of the link), I had mentioned the extent of challenge that weight and associated lifestyle diseases represent. And these closely correlate with Ozempic’s effect as well.

But being newsworthy is not the same as being a good investment. So here I take a closer look at Novo Nordisk to assess whether there’s an upside to the stock or not.

Advantage Ozempic and Wegovy

Technically, Ozempic is a diabetes medication, which regulates blood sugar. But “weight loss is a common side effect” as University of California, Davis [UC Davis] points out. UC Davis also notes that “It is not approved for weight loss, but some physicians prescribe it to be used for weight loss”. Novo Nordisk’s weight management drug is actually Wegovy, which has the same active ingredient, semaglutide.

Ozempic leads sales

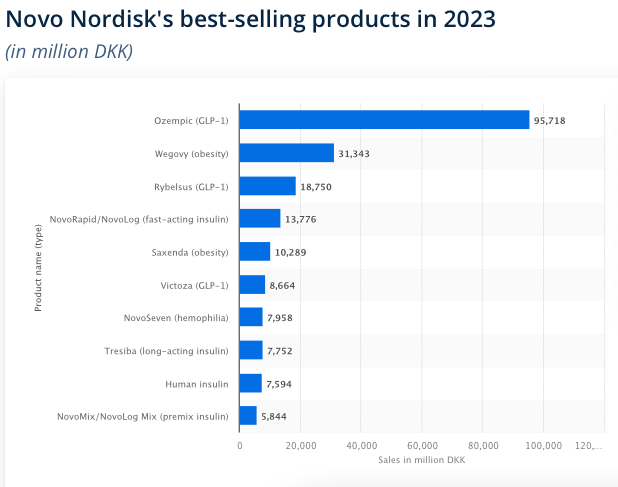

But Ozempic stands out as the company’s leading treatment (see chart below), bringing in 41% of its revenues in 2023, with Wegovy bringing in another 13.5%. The weight management and diabetes segment all together is its mainstay contributing to 93% of the sales last year.

Source: Statista

Diabetes and obesity care show above average growth

Clearly, the focus segment is doing very well for Novo Nordisk, which saw a 22% sales growth at market exchange rates [MER] and 24% at constant exchange rates [CER] in DKK terms in the first quarter (Q1 2024). The Diabetes and Obesity care segment saw slightly higher growth of 25% at MER and 27% at CER, pulling up overall growth. The latest numbers follow the already robust 36% CER increase in 2023, with 42% growth for Diabetes and Obesity care.

Further expansion seen

Moreover, the growth is expected only to continue as Wegovy was recently approved by China. This is a particular positive considering that China is the biggest pharmaceuticals market in the world after the US.

So far, Novo Nordisk has only limited exposure to it, with it having a less than 7% share in its sales as of 2023. Wegovy might be just the recipe for greater inroads into the market, going by the fact that 1.4 billion people in China are either overweight or obese. The treatment has also been approved in the US for people at with or at risk of cardiovascular disease due to weight management challenges.

Positive full year outlook

In line with the continued boom in its focus market, it’s little wonder that Novo Nordisk’s full year outlook is not just positive, but was also upgraded (see graphic below). At the midpoint of the new guidance range, sales are expected to increase by 23%, which isn’t very different from that seen in Q1 2024.

The company’s operating profits are also seen growing at a fast clip, with 26% increase seen at the midpoint of the guidance range, which is lower than the 30% CER rise seen in Q1 2024. However, it may well come in at the top end of the range, in line with the last quarter.

Assuming however, that the operating profit does come in at the midpoint of the range and the ratio of net profit to operating profit remains at ~80%, the same as in Q1 2024, the net profit would come to DKK 103.1 billion. This is also a healthy growth of 23.2% YoY.

Source: Novo Nordisk

Rising challenges

However, while all appears to be going very well for Novo Nordisk, challenges are visible too. Here are three of them:

#1. Health risks: While there are good reviews available for both the Ozempic and Wegovy, they have also come under fire recently. Some 7-9% of users of these treatments are seen as at risk of nothing short of blindness. To be fair, some risk exists even for alternate medications. But it’s a comparatively far lower rate of 0.8-1.8%.

#2. Prices in the US: The company, along with Eli Lilly, has also come under fire for charging “unconscionably high prices” in the US by none other than President Biden. In an opinion article for USA Today earlier this week, he points out that if prescribed by a doctor, “… the prices of Ozempic and Wegovy can be up to six times higher than prices in Canada, Germany, Denmark and other major countries.”.

The upshot of the article for Novo Nordisk is essentially that its margins could be set for a decline in the US, which isn’t trivial either. The US is the biggest market for Novo Nordisk, with a 63% contribution to sales as of 2023. It’s also worth adding that the company’s EBIT margin at 44.1% in 2023 was significantly ahead of its biggest peers by market capitalisation. Even Eli Lilly, which comes next, for example, had a far lower margin of 31.6% during the year.

#3. Rising competition: Finally, the success of its treatments and the big market for weight management is set to increase competition as well. Last month, the Swiss pharmaceutical stock Roche Holding AG (OTCQX:RHHBY) made gains on positive results from its weight management treatment’s clinical trials. Also, after a disappointment last year on its obesity treatment’s side effects, Pfizer (PFE) is now testing three new drugs too. While these treatments will take their time to come to market, the fact is that Novo Nordisk’s sales growth may well slow down over time as a result.

Steep market multiples

With a price rise of 40% year-to-date [YTD}, Novo Nordisk’s market multiples aren’t looking attractive right now. Based on the estimate for net income made earlier, the forward GAAP price-to-earnings (P/E) ratio comes to 41.5x. This is not just substantially higher than the average of 27.1x for the healthcare sector but also the stock’s own five-year average of 30.5x.

However, the forward ratio is for the year 2024. Since we are midway through, it’s also worthwhile to look at the ratio for 2025. This is improved, at 32.7x, as per the average of analysts’ estimates on Seeking Alpha, but not enough to make it attractive.

What next?

Unless the company upgrades its earnings outlook again, for now, it’s hard to make a Buy case for Novo Nordisk. Even if it does make an upgrade, the gap between the company’s past average and current forward P/E is so big, it might still indicate overvaluation.

In any case, it remains to be seen whether another revision even happens, after President Biden has been critical of its prices, which could impact margins going forward. Whether or not it happens is debatable as the US goes to elections later this year, but it’s worth bearing in mind. Rising competition over time among weight management products can be another drag on the company.

That said, though, for now it looks very good fundamentally. Specifically, Ozempic is hugely popular even as its side effects are becoming increasingly known. It’s a big contributor to Novo Nordisk’s sales, which are expected to continue being healthy going forward into the year and for now its margins look strong too. It’s a pity, really, for investors who’d like to buy the stock. But it’s worth watching and buying on significant dips. I’m going with a Hold on Novo Nordisk.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Credit: Source link