Boarding1Now

Norwegian Air Shuttle (OTCPK:NWARF) is one of the companies I have a speculative buy rating on. The company is seeing its results improve after a much-needed change in mindset, opting for prudent growth rather than unbridled debt-laden growth. In this report, I will be discussing the company’s most recent report and update my rating on the stock if there’s need for it using a combination of fundamental analysis coupled with stock price modeling.

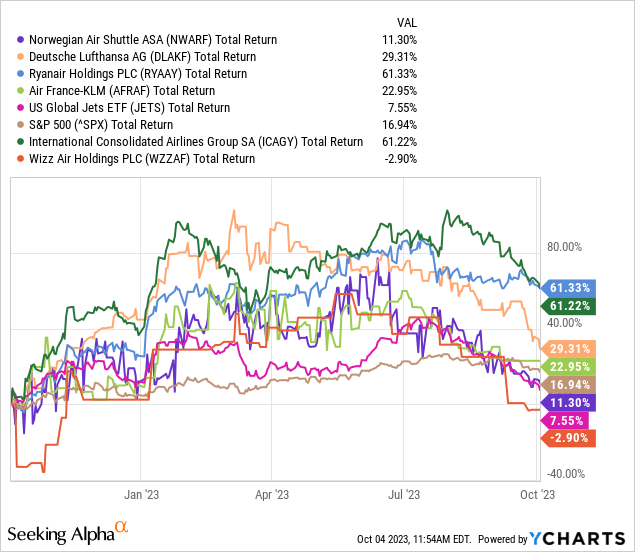

Norwegian Air Shuttle Stock Underperforms

While I do have a speculative buy rating on Norwegian Air Shuttle stock, the reality is that the stock has been underperforming its European peers, with Wizz Air (OTCPK:WZZAF) being the only airline performing worse. The company also underperforms the global markets but outperforms the U.S. Global Jets ETF (JETS), which in turn underperforms the global markets. So it does seem that airline stocks are under pressure and Norwegian Air Shuttle is collateral damage in that. That itself is not odd, when stocks sell-off, it is the higher-risk names that tend to decline faster in value and Norwegian is such a name given that it’s working on a turnaround.

Strong Q2 Earnings For Norwegian Air Shuttle

Norwegian Air Shuttle

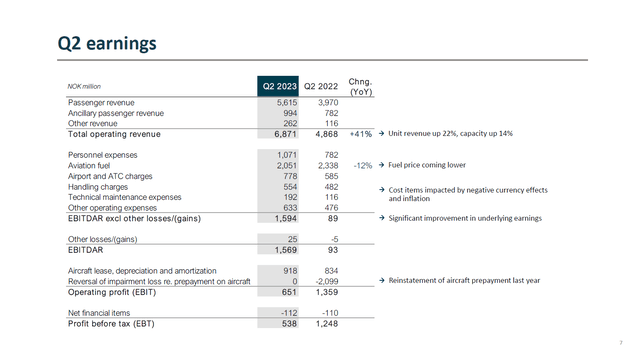

What’s somewhat interesting to note is that over a one-year period, the company’s stock gained “only” 11.3% while its results showed considerably better improvement. Indeed, pre-tax profit is down to NOK538 million from NOK1.25 billion, but we need to start unpacking the results from the top to see why that’s the case.

The first positive sign is that capacity was up 14% allowing the company to amortize costs over more seat miles. Coupled to that the unit revenues still showed strong growth of 22% driving revenues higher by 41%. Generally, the costs were higher year-on-year and in excess of the capacity growth. That, however, should not come as a major surprise as inflation is still providing a higher cost basis this year. The EBITDAR from Q2 2022 and Q2 2023 are actually night and day with a NOK1.57 billion EBITDAR this year compared to NOK89 million last year. The operating profit last year was positively impacted by a NOK2 billion reversal on previously announced impairments. Adjusting for that the operating profit and pre-tax profit would have been NOK2 billion lower last year showing an EBIT swing from a NOK740 million loss last year to a NOK651 million this year.

While the company is growing its capacity, the unit cost excluding fuel still climbed 11%. So, the better cost amortization that I see as a positive has not been there. The simple explanation is inflation and pressure from the currency exchange rate. However, it’s important to keep an eye on the growing unit revenue. Norwegian is managing its unit revenues quite well and is not adding so much capacity to the market that its unit costs are moving in a positive direction but its unit revenues are not.

Additional positives are that booked revenue for the September-December period is trending ahead of pre-pandemic levels, indicating that demand is still strong, and this somewhat reduces the chances of the company having to lower airfares as flight dates close in.

Norwegian Adjusted Debt Rises

Norwegian Air Shuttle

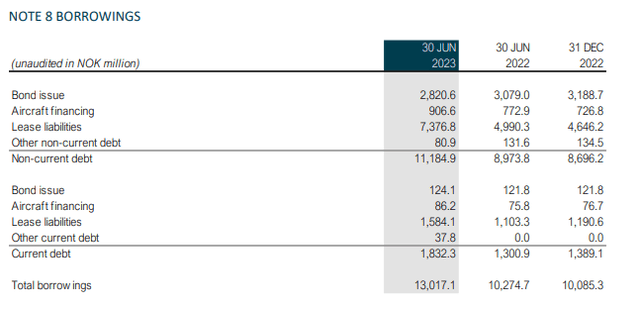

What hurt Norwegian in the past was growing without creating value and compounding the debt for that growth. With that in mind, what I would like to see is debt reduction. The reality is that I’m not seeing that debt decreasing. In fact, it increased from NOK10.1 billion at the start of the year to NOK13.0 billion. Is that a problem? No, not really. If we exclude the aircraft financing and lease liabilities, the latter is required to be added to debt per accounting rules, we get to a debt of NOK3.06 billion which is NOK381.6 million lower compared to the start of the year. Meanwhile, the cash and cash equivalents grew to NOK9.349 billion compared to NOK7.759 billion.

The net debt position is NOK3.67 billion compared to NOK2.33 billion at the start of the year. With the airline growing again, it’s not odd that the debt is growing since the airline operates an asset-light model meaning most airplanes are leased, giving the airline a higher lease liability. However, a positive is that the company has been able to cut $4 million to $5 million from the purchase prices of the 80 airplanes that it expects Boeing to deliver, which provides a considerable saving.

Furthermore, excluding lease liabilities, the debt is NOK4.1 billion and the company would be in an adjusted net cash position of NOK5.3 billion compared to an adjusted net cash position of NOK3.5 billion at the start of the year. So, the company is not adding to debt excessively without efficiently deploying the proceeds of issued debt.

Norwegian Air Shuttle Positions For The Future, Stock Has Upside

Norwegian Air Shuttle is still successfully executing its turnaround plan, and even though the company will not be able to realize its unit cost targets due to inflation and currency pressures, I believe the results and forward bookings are good.

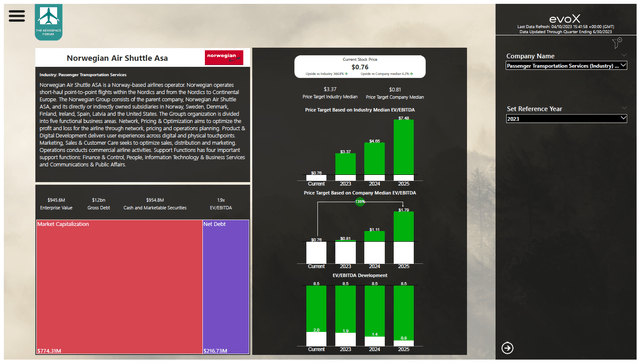

However, the big question is whether the company’s stock has any upside from current price levels. In order to assess this, I have added the balance sheet figures and expectations into my stock valuation model.

NWARF stock price valuation using evoX Financial Analytics (The Aerospace Forum)

The expected improvement in the results is rather clear. Even when we don’t allow any multiple expansion to account for any risk as discussed below, Norwegian Air Shuttle stock is slightly undervalued with 2023 earnings in mind has a 46% upside for 2024 and a 136% upside for 2025. So, there most definitely is an upside for the stock, but management needs to continue executing a prudent path and not fall back to bad habits of the past.

The Risks For Norwegian Air Shuttle

I do see positives for the company and its stock price. It should be kept in mind that with the turnaround that Norwegian Air Shuttle is executing, the company also is considered more high risk and prone to significant decline if demand softens. Furthermore, its stock price is below $1.00 which does open up opportunities for speculative buying, but it also can cause volatility in the stock price which coupled to the relatively low volumes could render investors unable to buy and sell at desired prices.

Conclusion: Norwegian Air Shuttle Stock, Not The Best, Still Good

My conclusion actually remains unchanged from previous quarters, and that’s from a stock price performance perspective: Norwegian Air Shuttle is not the best, and it’s extremely sensitive to the off-peak quarters. The positives are discounts on future airplane deliveries as well as a strong Q3 expected and Q4 bookings running ahead of the pre-pandemic curve. Also, from a fundamental point, there’s a significant upside, which warrants my buy rating. However, investors also should be informed on the risks associated to Norwegian. As the company is still executing a turnaround, volatility in the market hits the low-cost carrier harder than others.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Credit: Source link