HeliRy

Note:

I have covered Nordic American Tankers Limited (NYSE:NAT) previously, so investors should view this as an update to my earlier articles on the company.

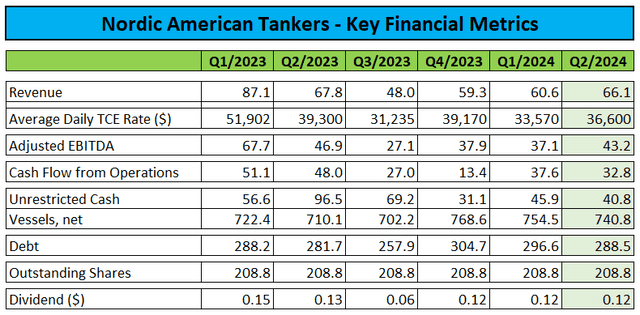

Last week, Suezmax tanker pure play Nordic American Tankers Limited or “NAT” reported Q2/2024 results ahead of consensus expectations and declared an unchanged quarterly cash dividend of $0.12 per common share:

Company Press Release / Regulatory Filings

The company generated $32.8 million in cash flow from operations and finished the quarter with unrestricted cash of $40.8 million and debt of $288.5 million.

As a result of NAT’s generous quarterly dividend payments, net debt is coming down only slowly, but with the company’s debt obligations representing just 20% of its asset value, there’s little reason for investors to be concerned.

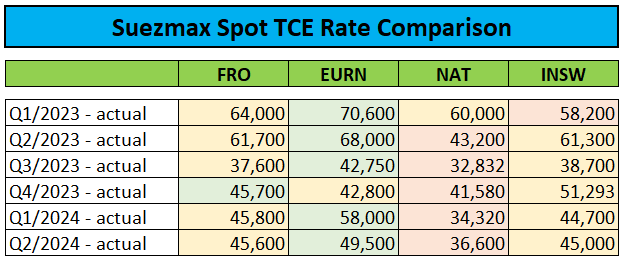

While results came in ahead of expectations, NAT’s average daily time charter equivalent (“TCE”) rate underperformed peers by a wide margin again:

Press Releases

However, it is important to note that 20% of the company’s fleet is currently working on lower-margin time charter contracts, with NAT not breaking out average spot and time charter rates.

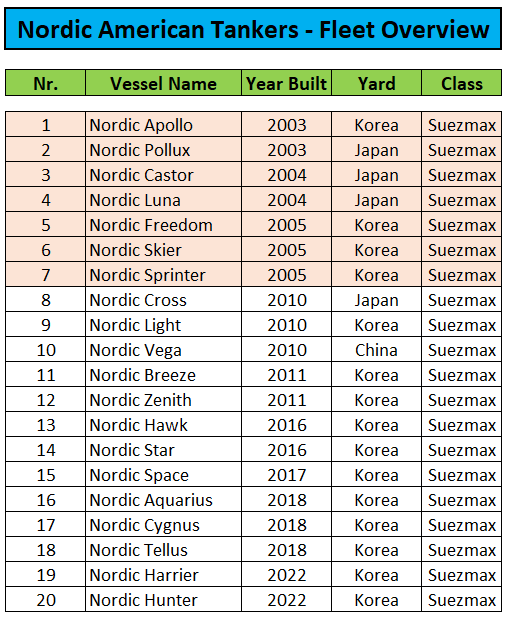

In addition, the company’s average fleet age of 12.8 years is above most of its peers. Moreover, NAT’s fleet is not equipped with exhaust gas cleaning systems or “scrubbers”.

But even when considering these factors, the company should be able to achieve average TCE rates much closer to its peers.

As the company does not hold quarterly conference calls, NAT’s level of underperformance is likely to remain a mystery for the time being.

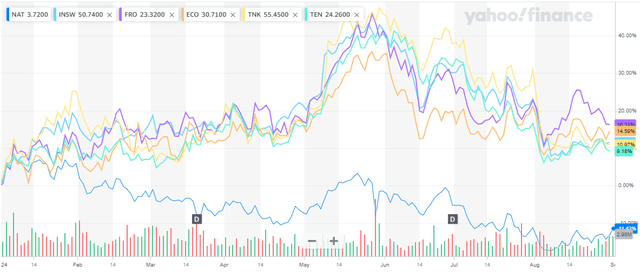

At least in my opinion, the issue is likely the main reason behind the stock’s noticeable underperformance year-to-date:

Yahoo Finance

While Nordic American Tankers’ operating performance leaves much to be desired, the company remains committed to shareholder capital returns. Since the beginning of 2023, NAT has declared almost $150 million in quarterly cash dividends.

At prevailing share prices, annualized dividend yield calculates to 13%.

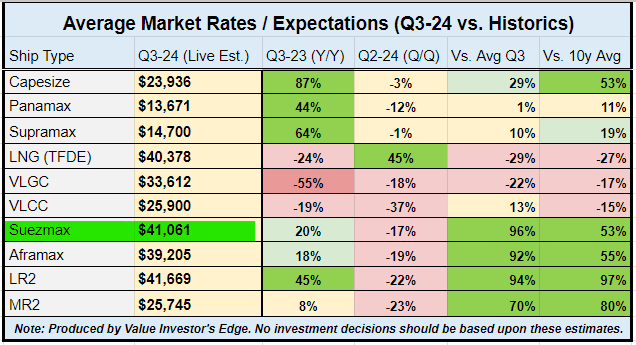

That said, tanker charter rates have shown some weakness in recent weeks which I would mostly attribute to seasonal patterns.

Should the company’s average daily TCE rate continue to underperform peers by a wide margin, investors would be well-served to prepare for a sequential reduction in the quarterly dividend.

However, rates remain at healthy levels relative to last year and particularly historical patterns:

Value Investor’s Edge

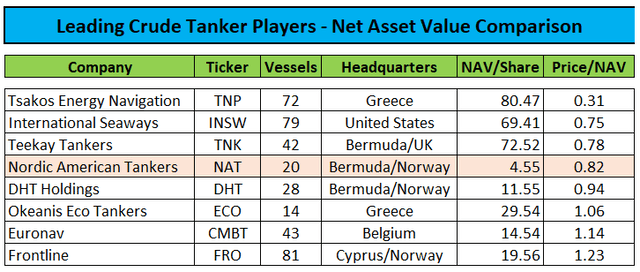

Valuation-wise, Nordic American Tankers is currently trading at an approximately 18% discount to estimated net asset value (“NAV”).

Value Investor’s Edge

However, with more diversified peer International Seaways (INSW) offering a similar dividend yield and trading at an even larger discount, it’s difficult to make an argument for Nordic American Tankers’ stock.

At least in my opinion, the company should consider divesting some or even all of its older vessels for estimated proceeds of up to $250 million:

Company Press Releases / Regulatory Filings

A sale of all vessels built between 2003 and 2005 would result in Nordic American tankers moving from a net debt to a net cash position.

In addition, the company would save a decent amount of cash on otherwise required near-term special periodic surveys.

However, with daily operating expenses of around $9,000 per vessel, even these old Suezmax tankers are still generating healthy cash flows for NAT.

Bottom Line

While Nordic American Tankers outperformed muted expectations in the second quarter, the company continued to underperform peers by a wide margin.

With Q3 likely to be a seasonally weaker quarter, investors need to prepare for a sequential reduction in the quarterly cash dividend.

While the weak year-to-date share price performance has resulted in the company trading at a sizeable discount to net asset value, larger and more diversified peer International Seaways is trading at an even higher discount despite a considerably better operating performance.

With Nordic American Tankers’ operational underperformance unlikely to reverse anytime soon and a sequential dividend cut in the cards, I continue to see little reason to open or add to existing positions.

However, the company’s generous approach to shareholder capital returns still makes the stock a “Hold“.

Credit: Source link