luismmolina

I have a strong affinity for cell technology tickers attempting to push limits in order to provide cutting-edge therapies to the market to address some of the worst diseases known to man. It wasn’t that long ago the FDA approved the first CAR-T therapy, which was Novartis’s (NVS) Kymriah (tisagenlecleucel) for acute lymphoblastic leukemia (ALL). Since then there have been a few more CAR-T therapies approved targeting lymphomas and myelomas. However, the development of cell therapies is just getting started as other firms attempt to employ other immune cells and improve upon the first-gen technology. Nkarta (NASDAQ:NKTX) is one of these players, which uses natural killer (NK) cells engineered with chimeric antigen receptors ((CARs)) and membrane-bound IL-15 to take on both autoimmune diseases and oncology. Although the company’s pipeline is still young, the company’s technology could make it a game-changer in the cell therapy arena that is still largely up for grabs. NKTX has experienced a notable decline in its share price from its peak in March and is finally trading at an attractive valuation ahead of some potent catalysts and a financial runway projected to extend into 2027.

I intend to provide a brief background on Nkarta and how their platform technology fits into the cell therapy setting. Then, I will discuss the company’s valuation and my bull thesis for NKTX. In addition, I will point out some downside risks that NKTX investors should consider when managing their position. Finally, I reveal my parameters for establishing a position in NKTX.

Background On Nkarta

Natural Killer (NK) cells are part of the body’s innate immune system and are categorized by their capacity to distinguish and eradicate threats, comprising infected or cancer cells. It is possible to engineer NK cells with CARs, which can enhance their ability to seek and destroy cells expressing specific markers found in cancer cells or pathogenic cells related to autoimmune conditions.

Nkarta’s NK cell therapies contain membrane-bound IL-15 cytokines, which are expected to boost their activity and durability without the need for additional cytokine support. Nkarta’s NK cells are expected to have a superior safety profile thanks to the decreased probability of creating cytokine release syndrome (CRS) and immune effector cell-associated neurotoxicity syndrome (ICANS), compared to contemporary cell therapies.

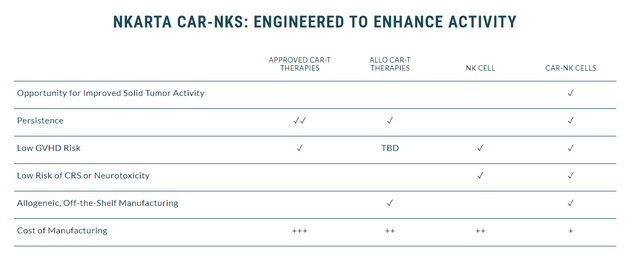

Nkarta CAR-NK Overview (Nkarta)

Another key advantage of Nkarata’s method is their off-the-shelf availability, unlocking the potential outpatient administration without the need for personalized cell manufacturing. Nkarta’s NK cells are considered off-the-shelf because they are derived from donors, meaning patients don’t have to undergo leukapheresis and can get a fully allogeneic treatment administered in an outpatient setting.

Nkarta is one of a handful of cell therapy outfits that are attempting to take on autoimmune diseases, which occur when one’s immune system incorrectly attacks healthy tissues. Contemporary treatment options often use immunosuppression to calm the overactive immune cells, which clearly can have significant side effects and fails to be a long-term solution. Nkarta’s NKX019 is targeting CD19 to selectively target and eliminate pathogenic B cells linked to lupus nephritis and rheumatoid arthritis. As a result, NKX019 has the prospects to yield drug-free remissions, and durable disease control devoid of constant immune suppression.

Nkarta’s oncology pipeline includes programs targeting both refractory hematologic malignancies and solid tumors. Preliminary data points to Nkarta’s CAR-NK therapies having the potential to overcome a tumor’s resistance mechanisms while also improving outcomes in relapsed or refractory cancers.

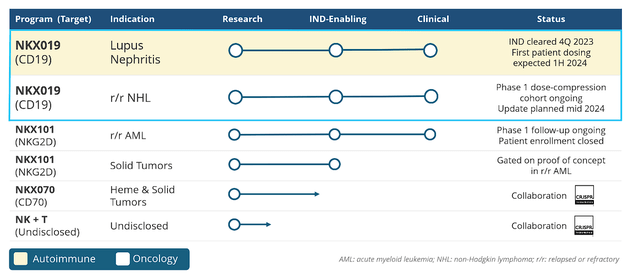

Nkarta Therapeutics Pipeline (Nkarta Therapeutics)

NKX019 is Nkarta’s leading asset in the pipeline, targeting B-cells in cancers and autoimmune disorders. Nkarta has aimed NKX019 at lupus nephritis, with the goal of eliminating disease-causing B-cells and inducing sustained remission. The company is dosing in the first half of 2024, with efficacy and safety data readout in the first half of 2024.

The company is also pitting NKX019 against relapsed/refractory non-Hodgkin lymphoma (r/r NHL) and has already shown promising marks, with a large number of patients experiencing complete responses ((CRs)) at different doses. Furthermore, the company reported positive outcomes for patients who were previously treated with CAR-T therapy. Nkarta expects to report data in the middle of this year.

In addition to NKX019, the company has a number of other assets including two pipeline programs that are partnered with CRISPR Therapeutics (CRSP).

In terms of financials, Nkarta has strengthened their balance sheet by adding $240.1M from their recent offering. At the end of Q1, Nkarta had $450M in cash, cash equivalents, restricted cash, and investments in marketable securities, which encouraged them to project their cash runway going into “late” 2027.

Nkarta’s Thesis

My NKTX bull thesis is fixated on the company’s on-demand, off-the-shelf, fully allogeneic CAR-NK treatments that can be performed in an outpatient setting. This contrasts with the autologous CAR T-cell therapies, which require patients to undergo leukapheresis. Potentially marking Nkarta’s therapies as a more attractive option for patients, providers, and payers.

Additionally, Nkarta’s use of donor NK cells also prevents the possibility of replicative fading that might occur in cell line methods used by some of Nkarta’s potential competition.

Furthermore, the incorporation of membrane-bound IL-15 in CAR NK cells safeguards persistence and efficacy minus the need for supplementary cytokines. Nkarta’s therapies are less likely to produce the same level of severe side effects as CRS and ICANS associated with approved CAR-T therapies. As a result, Nkarta’s therapies could be an option for a broader range of patients who require a superior safety profile.

Another point to consider is that Nkarta’s pipeline includes not only leukemia and lymphomas but solid tumors as well as autoimmune diseases. These prospects could take on autoimmune diseases by eliminating pathogenic B cells, potentially offering long-term remission without ongoing immune suppression. Nkarta may be able to take on other autoimmune conditions such as myositis, sclerosis, RA, and numerous other diseases. So, we are looking at a plethora of indications in some of the biggest markets in healthcare.

Presume the company’s current pipeline programs are effective and make it the market. In that event, Nkarta should report exponential growth as their “off-the-shelf” CAR-NK cell therapies enter huge markets and possibly dislodge existing cell therapies that are not off-the-shelf and have to rely upon apheresis. Thanks to Nkarta’s allogeneic “off-the-shelf” technology, their products would have addressed a snag that can be a concern for patients, payers, and providers.

Another aspect to highlight is that Nkarta is targeting huge markets with their NK programs. NKX019 is targeting the lupus nephritis market, which is projected to hit $3.2B in 2030. Plus, NKX019 is looking to get into the global non-Hodgkin’s lymphoma market size, which is estimated to be $20B by 2036. Meanwhile, NKX101 is going after the global acute myeloid leukemia market which is projected to hit $6.8B by 2028, and the gargantuan global solid tumor market which is estimated to cross over the $532B mark by 2032. Considering these figures, it is not reckless to say that Nkarta might have the potential to produce a blockbuster therapy.

To recap, Nkarta offers CAR-NK technology that can produce therapies that improve ease of use with superior safety and efficacy to be used in a multitude of diseases in upsized markets. Backed with a strong cash position, Nkarta is positioned to capitalize on upcoming mid-year updates as pivotal catalysts that could determine the company’s future prospects.

Attractive Valuation

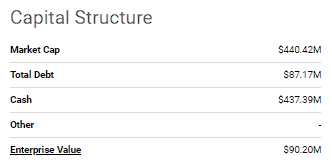

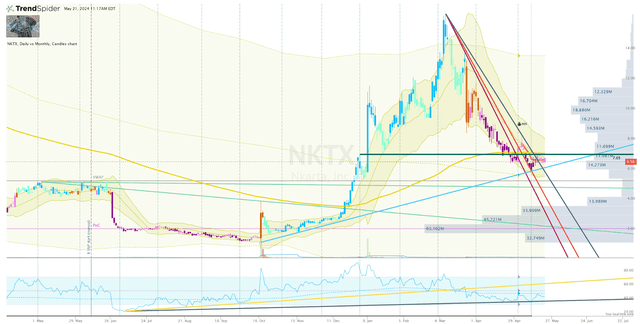

NKTX’s prominent decline in its share price from its peak in March has finally brought the ticker down to an attractive valuation ahead of some potent catalysts along with a solid cash position. In fact, NKTX’s enterprise value is roughly $90M with a cash runway expected to last into 2027. It is not common to see pre-commercial biotech tickers trading a price-to-book under 1x or trading close to its cash-per-share of ~$6.70.

NKTX Capital Structure (Seeking Alpha)

I find NKTX’s valuation attractive not solely because of its price-to-book or below cash value, but also due to some of the potent catalysts that are slated in 2026. Since the company presumably has the cash to get through those catalysts, it is possible that it could justify a higher valuation and limit the need for extensive dilution to get their pipeline through the FDA and onto the market. Looking at the company’s quarterly cash flow statements, it appears that their average cash burn is just under $30M per quarter since September 2021, so perhaps the company won’t require an upsized offering to fund their commercialization ramp-up and keep the lights on.

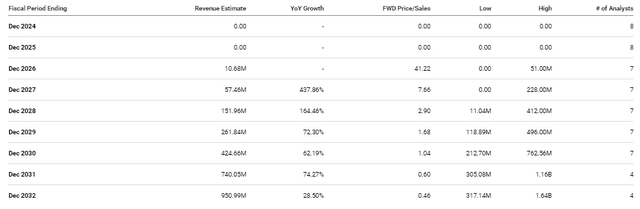

The Street expects Nkarta to start reporting meaningful revenue in 2027, so it is possible the company won’t have to rely on fundraising to finance operations. Furthermore, analysts predict that Nkarta will quickly establish a strong growth trajectory and will maintain it into the next decade.

Nkarta Revenue Estimates (Seeking Alpha)

Street analysts expect Nkarta to report around $424M in 2030, which would be roughly 1x forward price-to-sales, which is substantially under the industry’s average price-to-sales of 4x-5x. At that multiple, NKTX would be valued at around $24-$30 per share in 2030. Admittedly, the company will probably have to perform some form of dilutive funding between now and then, but those targets do illustrate NKTX’s current opportunity for a long-term investor.

Risk To Consider

As with all pre-commercial healthcare tickers, NKTX has the hallmark risks associated with biotech companies including clinical trial outcomes, cash burn, and market sentiment. In addition, Nkarta will have to deal with strong competition from other cell therapy companies attempting to produce unique off-the-shelf NK cell therapies including ImmunityBio (IBRX) and Fate Therapeutics (FATE). At the moment, it would appear that ImmunityBio might have a shot at getting their M-ceNK programs across the finish line first. Although Nkarta’s CAR-NK approach differs from their competition, it is possible that their approach is seen as inferior or has a niche opportunity compared to their peers. Furthermore, it is possible that Nkarta gets their products all the way through the FDA and another cell therapy technology is hitting the clinic and has already produced superior data to the company’s product.

Another notable risk is payer support for Nkarta’s cell therapies. Cell therapies are known for having hefty price tags upwards to $1M, which is a major concern for insurers who are always looking for bang for their buck. Indeed, some cell therapies have the potential to be curative in certain indications, but I have to believe payers are going to be apprehensive unless the data supports the price tag. It is possible that Nkarta’s therapies are a clinical success, but a commercial failure.

Considering these points above, I am giving NKTX a conviction level of 2 out of 5 which will be considered a speculative ticker for my “Bio Boom” portfolio.

My Plan

I am currently stalking NKTX for a potential entry point before the company reports NHL data from NXX019 in the middle of this year. I am keeping an eye on the uptrend ray coming from the October 2023 low, which has provided support several times. Another bounce off that uptrend ray should provide me with enough conviction that the bulls are still present.

NKTX Daily Chart (Trendspider)

However, if the share price fails to hold above the uptrend ray, I will look to the $5 area for a potential bounce for an entry.

If the NHL data is positive, I will consider adding to the position once the volatility has subsided. Admittedly, I don’t expect NKTX to be a large holding, however, I believe it could be a great trading vessel over the next several years as the company moves their programs through the clinic and attempts to get them through the FDA.

Credit: Source link